Press release

Takaful Insurance Market Opportunities: Growth Prospects and Projections to 2030

The 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 33.50 Bn. in 2023 and the total Takaful Insurance Market revenue is expected to grow by 15.1% from 2024 to 2030, reaching nearly USD 120.2 Bn.𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The Takaful insurance market, also known as Islamic insurance, is experiencing steady growth worldwide as more individuals and businesses seek financial solutions that align with Islamic principles. In Takaful insurance, policyholders contribute to a shared pool to safeguard one another against risks and damages. This cooperative approach not only reflects the collective responsibility in Islamic values but also offers alternatives for individuals who prefer ethical and Sharia-compliant insurance products. The policies cover a wide range of needs, from life and health to general insurance, such as education savings and retirement planning. Notably, the market is poised for growth in Muslim-majority regions, where conventional insurance options may be limited or unsuitable due to religious considerations.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/213737/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

The Takaful insurance market is driven by a growing demand for Islamic financial services and products, especially in countries with large Muslim populations. Awareness of Takaful insurance is rising, prompting both individuals and businesses to explore its benefits and the ethical approach it offers compared to conventional insurance. Many regions, including Southeast Asia and the Middle East, are seeing an uptick in Takaful insurance policies as understanding of its principles becomes more widespread. This heightened awareness, combined with a growing preference for Sharia-compliant financial products, has significantly contributed to the market's expansion.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬

Digital transformation and the adoption of online sales channels are also transforming the Takaful landscape. As insurers embrace technology, they can offer policies directly through digital platforms, allowing customers to compare products and make purchases without intermediaries. This shift toward online platforms and digital engagement enables Takaful providers to reach a wider audience and meet the evolving expectations of tech-savvy consumers. Overall, the integration of digital tools with Takaful operations is modernizing the industry and setting the stage for sustained growth.

One of the main trends in the Takaful insurance market is the rise in ethical and socially responsible financial choices, with many consumers seeking options that align with their values. Takaful insurance appeals strongly to those who prefer financial solutions that support cooperative risk-sharing and adhere to Islamic ethical principles. In regions with high Muslim populations, Takaful is seeing higher penetration rates than conventional insurance, highlighting a shift towards value-based, ethical investments. This trend is further supported by the development of micro-Takaful products designed for low-income individuals and customized coverage for specific sectors, reflecting the market's responsiveness to consumer demand.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/213737

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬

The demand for Takaful insurance presents significant opportunities, as consumers are increasingly conscious of ethical and socially responsible finance. For many, Takaful's appeal lies in its adherence to Islamic values, which encourages socially responsible investments and cooperative risk-sharing. This ethical approach resonates with a growing number of businesses and individuals, particularly in regions where conventional insurance may be considered incompatible with Islamic law. Additionally, the potential for product development and customization offers new growth avenues, such as creating micro-Takaful products or hybrid Takaful options that combine insurance with investment elements, opening doors for insurers to meet diverse client needs.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭?

The Middle East & Africa region is the dominant market for Takaful insurance, driven largely by Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, Qatar, Kuwait, and Bahrain. These countries have developed supportive environments for Islamic finance, which has facilitated the adoption of Takaful insurance. With a robust financial infrastructure in place, the Middle East has established itself as a key player in the Takaful market, attracting both regional and international insurers. This region's established banking systems and strong emphasis on Islamic finance principles contribute to its position as a market leader.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/213737/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

by Type

Family

General

by Distribution Channel

Agents & Brokers

Direct Response

Banks

Others

by Application

Personal

Commercial

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. Abu Dhabi National Takaful Co. [Abu Dhabi, United Arab Emirates]

2. Allianz

3. AMAN Insurance

4. Islamic Insurance

5. Prudential BSN Takaful Berhad

6. Qatar Islamic Insurance [Doha, Qatar]

7. SALAMA Islamic Arab Insurance Company

8. Syarikat Takaful Brunei Darussalam

9. Takaful International

10. Zurich Malaysia

11. HSBC Insurance

12. AIG Prudential

13. Tokio Marine

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬

Past Market Size and Competitive Landscape

LED Video Walls Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

LED Video Walls Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦ Water Polo Ball Market https://www.maximizemarketresearch.com/market-report/water-polo-ball-market/148532/

♦ Global Beryllium Oxide Market https://www.maximizemarketresearch.com/market-report/global-beryllium-oxide-market/21062/

♦ Global E-waste to Precious Metal Market https://www.maximizemarketresearch.com/market-report/global-e-waste-to-precious-metal-market/104860/

♦ Global Magnesium Fluoride Market https://www.maximizemarketresearch.com/market-report/global-magnesium-fluoride-market/91363/

♦ Solar Water Purifier Market https://www.maximizemarketresearch.com/market-report/solar-water-purifier-market/67028/

♦ Lansoprazole Market https://www.maximizemarketresearch.com/market-report/lansoprazole-market/74123/

♦ Semi-autonomous & Autonomous Bus Market https://www.maximizemarketresearch.com/market-report/semi-autonomous-autonomous-bus-market/152506/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market Opportunities: Growth Prospects and Projections to 2030 here

News-ID: 3731965 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

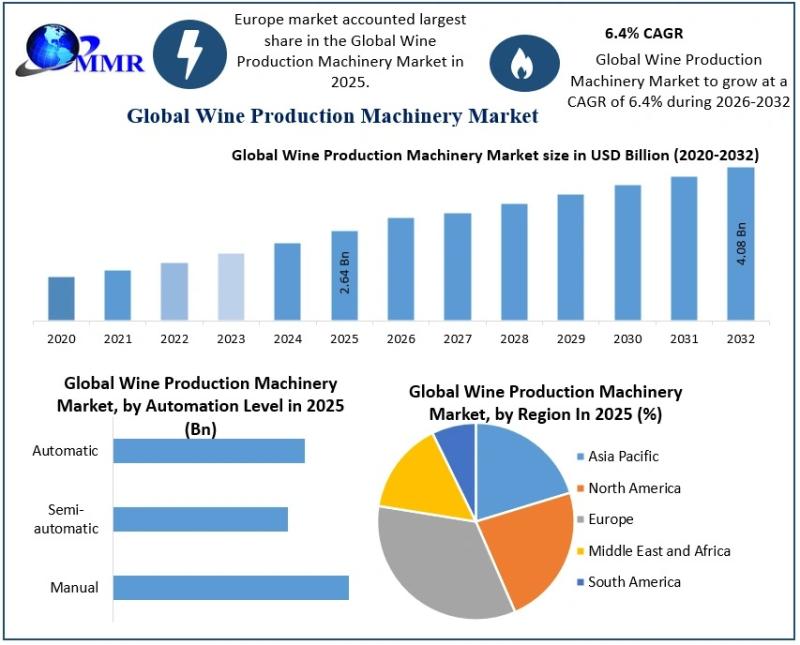

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

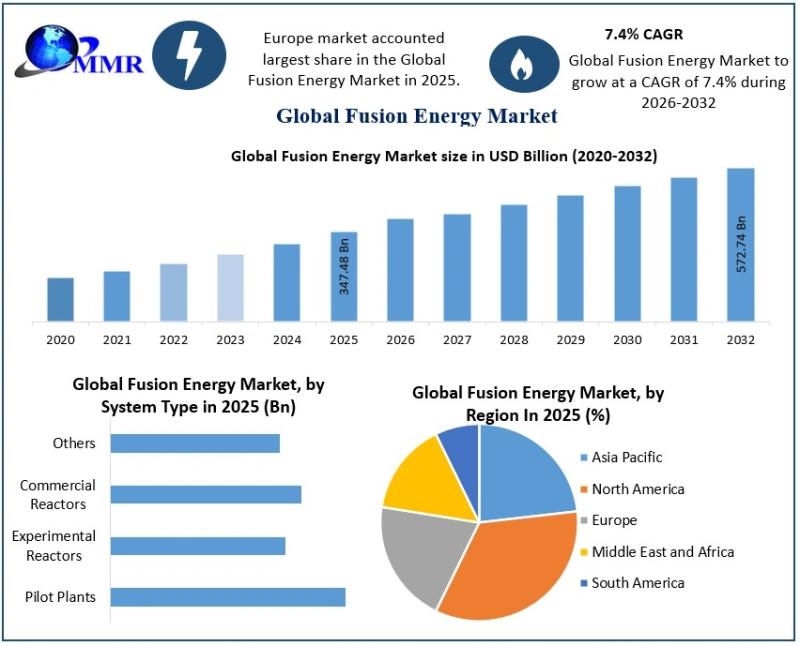

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…