Press release

Wealth Management Platform Market to Drive Rapid Growth with Top Prominent Players and High Future CAGR by 2024-2031 - SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc.

The Wealth Management Platform Market study by DataM Intelligence offer an in-depth analysis of the market, presenting insightful observations, statistics, historical data, and industry-validated market insights. The report delves into the competitive positioning of key companies, examining factors such as product offerings, pricing strategies, financial health, product portfolios, growth initiatives, and geographical reach.Download a Free sample PDF (Use Corporate email ID to Get Higher Priority) at: - https://datamintelligence.com/download-sample/wealth-management-platform-market

What is the projected growth rate (CAGR) of the Global Wealth Management Platform market from 2024 to 2031, and what is the market value expected to change by 2031?

The Global Wealth Management Platform Market is expected to reach at a high CAGR during the forecast period 2024-2031.

A Wealth Management Platform is a digital tool or system designed to provide a comprehensive suite of services for managing personal or institutional wealth. These platforms integrate various functions such as financial planning, investment management, portfolio tracking, risk assessment, tax optimization, retirement planning, and estate planning. Wealth management platforms typically aim to streamline the wealth management process by offering access to advanced analytics, market insights, personalized recommendations, and reporting tools.

Key Developments:

❁ In December 2019, Fiserv, Inc., a global provider of financial services technology solutions, and Motive Partners, a private equity firm specializing in technology-enabled financial services, reached an agreement for Motive Partners-led investors to purchase up to 60% of Fiserv's Investment Services business. This transaction marked a strategic shift for Fiserv, allowing it to focus more on its core business while partnering with Motive Partners to grow and innovate in the investment services space.

List of the Key Players in the Wealth Management Platform Market:

SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc., Profile Software, Broadridge Financial Solutions, Inc., InvestEdge, Inc., Temenos Group AG, InvestCloud, Inc., SEI Investments Company, and Comarch SA.

Research Process:

Both primary and secondary data sources have been used in the global Wealth Management Platform Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Segment Covered in the Wealth Management Platform Market:

By Advisory Model: Human Advisory, Robo advisory, Hybrid.

By Business Function: Financial advice management, Portfolio, accounting, and trading management, Performance management, Risk and compliance management, Reporting, Others.

By Deployment Model: Cloud, On-premises.

By End-User: Banks, Investment management firms, Trading and exchange firms, Brokerage firms, Others.

Regional Breakout:

The global Wealth Management Platform Market report focuses on six major regions: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa.

✫ North America (U.S., Canada, Mexico)

✫ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

✫ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

✫ South America (Colombia, Brazil, Argentina, Rest of South America)

✫ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Get Year End Discounts on Premium Report:- https://www.datamintelligence.com/buy-now-page?report=wealth-management-platform-market

This Report Unveils:

✔ Go to Market Strategy- A roadmap to successfully product launch or service in the target market.

✔ Gain a clear picture of the market's health and growth trajectory through neutral analysis.

✔ Deep Market Insights delve into development trends, competitor landscape, supply and demand dynamics, brand share & pricing analysis year-over-year growth patterns, and key players' performance.

✔ Upon request, we can provide customized reports focusing on specific regions or countries, offering a granular view of their markets.

✔ Identify high-potential niche segments and regions poised for significant expansion.

✔ Analysis of Market Size (historical and forecast) Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) to understand the market's overall size and your achievable market share.

✔ Gain a comprehensive understanding of the competitive landscape, including market share distribution, key players (innovators, startups, laggards, and pioneers), and their respective strengths and weaknesses.

**The full version of the report includes an in-depth analysis of emerging players and startups, which will provide valuable insights into the evolving market landscape and key strategies being adopted**

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of Wealth Management Platform manufacturers competitive landscape, revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product revenue, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Revenue of Wealth Management Platform in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the Wealth Management Platform market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the Wealth Management Platform market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Get Customization in the report as per your requirements:- https://datamintelligence.com/customize/wealth-management-platform-market

Frequently Asked Questions

☞ What is the expected growth rate of the global Wealth Management Platform market for the forecast period?

☞ What are the key driving factors that are responsible to shape the fate of the Wealth Management Platform market during the forecast period?

☞ What will be the overall size of the market during the analysis period?

☞ What are the prominent market trends which influence the development of the Wealth Management Platform market across various regions?

☞ Who are the key market players and the market strategies that have helped them to secure the leading position in the global market?

☞ What are the challenges and threats that are likely to act as a barrier to the growth of the Wealth Management Platform market?

☞ What are the major opportunities that the companies can get to attain success in the world?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Platform Market to Drive Rapid Growth with Top Prominent Players and High Future CAGR by 2024-2031 - SS&C Technologies, Inc., Fidelity National Information Services, Fiserv, Inc. here

News-ID: 3730960 • Views: …

More Releases from DataM Intelligence 4market Research LLP

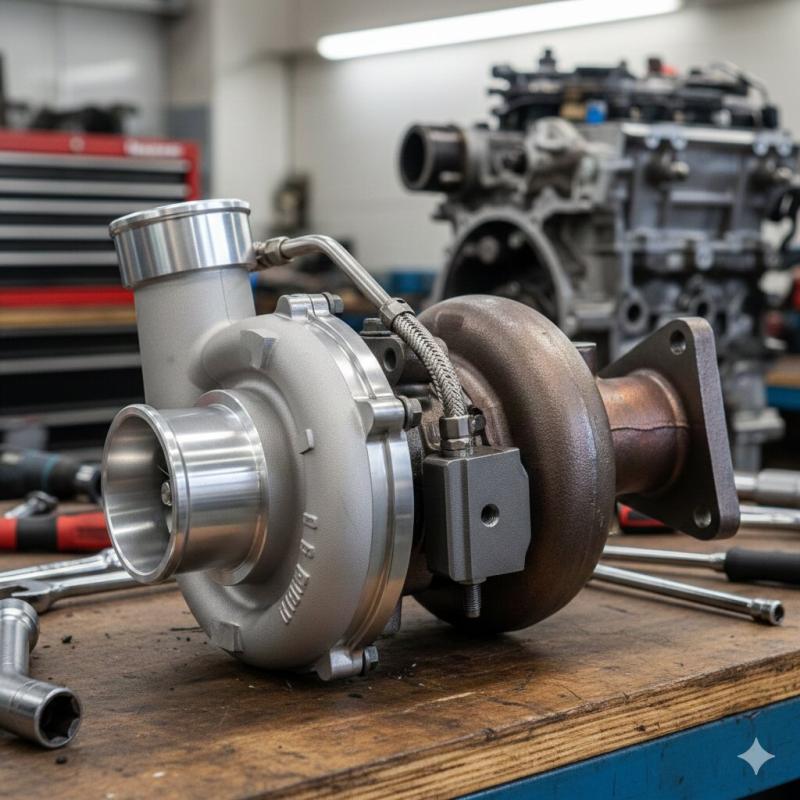

Automotive Turbocharger Market to Reach USD 16.5 Billion by 2030 at 10.3% CAGR, …

The Automotive turbocharger market reached USD 13.5 billion in 2022 and is expected to reach USD 16.5 billion by 2030, growing with a CAGR of 10.3% from 2023 to 2030. as vehicle manufacturers increasingly adopt turbocharging technology to enhance engine efficiency, performance, and emissions compliance.

Growth is supported by rising demand across key vehicle segments including passenger cars, commercial vehicles, and light-duty trucks, driven by stringent fuel economy and regulatory…

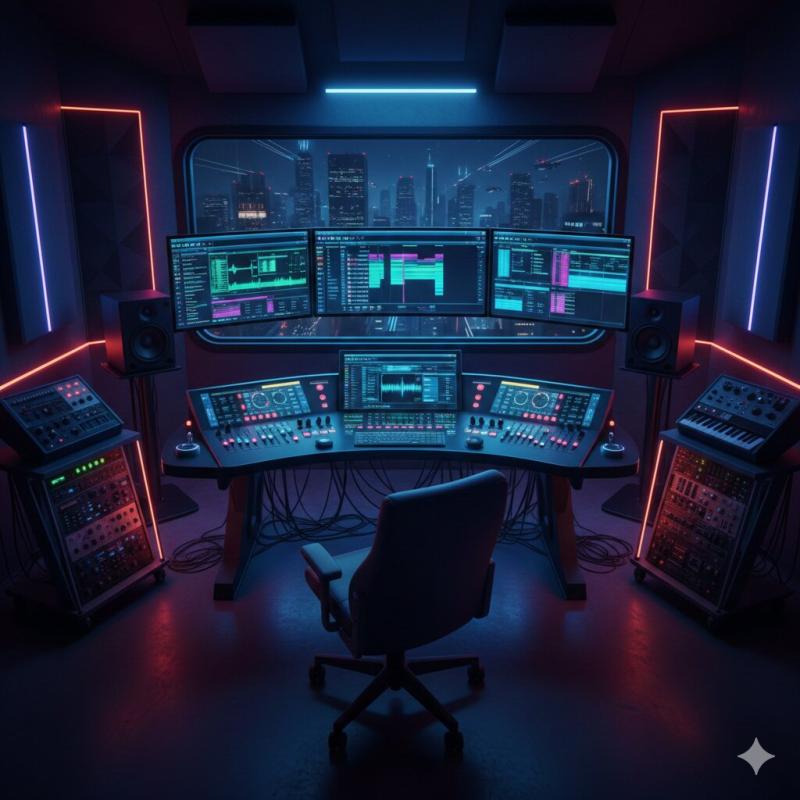

Digital Audio Workstation Market to Reach US$ 7.3 Billion by 2029 at 16.1% CAGR, …

The Digital Audio Workstation (DAW) Market reached approximately US$ 3.3 billion in 2024 and is expected to grow to around US$ 7.3 billion by 2029, expanding at a CAGR of about 16.1% from 2025 to 2029 as demand for advanced music production, sound design, and audio editing solutions continues to rise across professional and consumer segments.

Growth is supported by increasing adoption across key application areas such as music production, post-production,…

Fracture Fixation Products Market to Reach US$ 16.34 Billion by 2031 at 7.8% CAG …

The Global Fracture Fixation Products Market reached US$ 9.1 billion in 2023 and is expected to reach US$ 16.34 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031 as orthopedic care providers and surgical centers increasingly adopt advanced fixation solutions to improve patient outcomes and reduce recovery time.

Growth is supported by rising demand across key product segments such as plates & screws, intramedullary nails, external…

LNG Storage Tank Market to Reach USD 6.7 Billion by 2030 Driven by Rising LNG In …

The LNG Storage Tank Market reached USD 4.5 billion in 2022 and is expected to reach USD 6.7 billion by 2030, growing at a CAGR of 5.5% during the forecast period 2024-2031.

Growth is driven by increasing global demand for liquefied natural gas (LNG) as a cleaner alternative to conventional fossil fuels, particularly in power generation, industrial applications, and transportation. Rising investments in LNG infrastructure, including terminals, regasification facilities, and storage…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…