Press release

Aircraft Leasing Market Competitor Analysis By Regions (2024-2032)

The global aircraft leasing market is poised for strong growth, with an anticipated market size of USD 312.2 billion by 2032, expanding at a compound annual growth rate (CAGR) of 8.20% between 2024 and 2032. Aircraft leasing has become a cornerstone of the global aviation industry, allowing airlines to access the latest aircraft technology and expand their fleets without the massive upfront capital expenditure that comes with buying aircraft outright. This flexible financing model enables airlines to meet fluctuating demand, manage their fleets efficiently, and mitigate risks associated with aircraft ownership. As the aviation industry recovers from the disruptions caused by the COVID-19 pandemic, the demand for both short-term and long-term aircraft leasing solutions is growing rapidly. In this blog, we will analyze the competitive landscape of the aircraft leasing market, examine key drivers fueling its growth, explore the challenges it faces, assess regional dynamics, and highlight future prospects for the sector.Access Full Report Now: https://www.marketresearchfuture.com/reports/aircraft-leasing-market-4247

Competitive Landscape

The aircraft leasing market is highly competitive, with a mix of established leasing companies, airlines, and financial institutions actively participating in the space. Some of the largest and most well-known players in the market include AerCap, GECAS (General Electric Capital Aviation Services), Avolon, SMBC Aviation Capital, BOC Aviation, Air Lease Corporation, and Hong Kong Aircraft Engineering Company (HAECO). These companies dominate the global leasing market, controlling a significant share of the leased aircraft portfolio worldwide. In fact, AerCap and GECAS alone account for nearly half of the global aircraft leasing fleet, reflecting their strong market presence and expansive portfolios.

Leasing companies generally provide two types of leasing options operating leases and finance leases. Operating leases are short-term in nature and allow airlines to lease aircraft for a specific period without the option to buy, while finance leases are long-term and allow airlines to purchase the aircraft at the end of the lease term. The increasing preference for operating leases, especially among low-cost carriers (LCCs) and regional airlines, has further strengthened the leasing market as it provides the flexibility required to adapt to changing market conditions.

A key characteristic of the competitive landscape is the growing consolidation within the aircraft leasing industry. Larger players like AerCap have expanded their portfolios through mergers and acquisitions, such as its merger with GECAS in 2021, forming one of the largest aircraft leasing companies globally. This consolidation allows leasing firms to achieve economies of scale, enhance operational efficiency, and expand their customer base. At the same time, smaller leasing companies and boutique firms are also playing an increasingly important role by offering specialized services, such as leasing older aircraft or catering to niche markets like freighters and regional jets.

As airlines and leasing companies face growing competition, innovation in leasing models is becoming a significant differentiator. In particular, flexible leasing contracts, including options for aircraft swaps, early return clauses, and customized terms, are becoming increasingly popular. This flexibility allows airlines to respond more effectively to changing market dynamics, such as shifts in passenger demand, regulatory changes, or economic downturns. The introduction of digital platforms that provide data-driven insights into fleet management and lease performance is also transforming the leasing market, offering more transparency, efficiency, and cost savings.

Key Players

AerCap (Ireland), Air Lease Corporation (US), BOC Aviation (Singapore), GECAS (US), BBAM LLC (Australia), CIT Commercial Air (US), Aviation Capital Group (US), Boeing Capital Corporation (US), SAAB Aircraft Leasing (Sweden), International Lease Finance Corporation (US)

Market Drivers

Several key drivers are propelling the growth of the aircraft leasing market, making it an attractive option for airlines and lessors alike. Below are some of the most influential factors driving this expansion.

Growing Demand for Air Travel

The recovery of the global aviation industry post-pandemic is a primary driver for the aircraft leasing market. As international travel resumes, airlines are scaling up their operations to meet increasing passenger demand. Leasing companies offer airlines the flexibility to quickly expand their fleets and access the latest aircraft technology without committing to large upfront investments. This is especially critical for airlines looking to capitalize on growing demand in emerging markets, where air traffic is expected to surge in the coming years.

Fleet Modernization and Fuel Efficiency

Airlines around the world are focused on fleet modernization to reduce operating costs and increase fuel efficiency. New-generation aircraft such as the Airbus A320neo and Boeing 737 MAX offer significant advantages in terms of fuel efficiency, lower maintenance costs, and reduced emissions. Aircraft leasing allows airlines to tap into these newer, more efficient aircraft without having to purchase them outright. Leasing also gives airlines the ability to operate younger fleets, which not only reduces operating costs but also enhances their competitive edge.

Flexible Financing Options

Aircraft leasing offers airlines an alternative financing model that is more flexible than traditional aircraft purchases. This is particularly appealing in a post-pandemic world where airlines are seeking ways to manage their balance sheets and maintain financial liquidity. Leasing enables airlines to preserve capital while still expanding their fleets and meeting demand. The ability to adjust lease terms or swap out aircraft based on market conditions is a huge advantage for carriers navigating volatile and uncertain markets.

Increasing Adoption of Low-Cost Carriers (LCCs)

The rise of low-cost carriers (LCCs) has been a major contributor to the growth of the aircraft leasing market. LCCs typically operate under a more flexible model that allows them to scale their fleets rapidly in response to market fluctuations. Leasing aircraft gives these carriers the ability to grow quickly, especially in regions where air travel demand is expanding. As LCCs continue to grow and expand into new markets, their demand for leased aircraft will continue to drive market growth.

Globalization of Aviation

The increasing globalization of the aviation industry, particularly in emerging markets in Asia-Pacific, Latin America, and Africa, is fueling the demand for aircraft leasing. Airlines in these regions are adopting modern aircraft to serve growing populations and increased business and tourism travel. For many airlines, leasing is a more feasible option than outright purchase, particularly in emerging markets where access to capital may be limited. As these regions continue to grow, the demand for aircraft leasing will rise significantly.

Market Challenges

Despite the promising growth prospects, the aircraft leasing market faces several challenges that could impact its expansion. Below are some of the key challenges the industry must navigate.

Volatile Fuel Prices

Fuel costs are one of the largest operating expenses for airlines, and fluctuations in fuel prices can have a significant impact on the financial health of both airlines and leasing companies. While the market for fuel-efficient aircraft is growing, higher fuel prices could reduce the profitability of airlines and, in turn, decrease their ability to lease new aircraft. In addition, rising fuel prices can lead to a slowdown in air travel demand, affecting both leasing and aviation-related services.

Regulatory and Compliance Risks

The global aviation industry is heavily regulated, with safety, environmental, and operational standards varying across different regions. Leasing companies must navigate a complex regulatory landscape, ensuring that their aircraft meet the necessary compliance standards for each market. Changes in regulations, such as stricter environmental standards for emissions, could also impact the demand for older aircraft and pose challenges for leasing companies that own or manage such fleets. These evolving regulations can also influence the residual value of leased aircraft, impacting the overall profitability of leasing companies.

Currency Fluctuations

Aircraft leasing transactions are often denominated in U.S. dollars, while airlines operate in a variety of currencies across the globe. Currency fluctuations between the U.S. dollar and other currencies can introduce volatility and risk for leasing companies, particularly those with portfolios spread across multiple regions. Companies that operate in multiple currencies must implement effective risk management strategies to mitigate the impact of currency fluctuations on their leasing contracts.

Competition from Alternative Financing Models

While aircraft leasing is a widely accepted model, other financing alternatives, such as sale and leaseback arrangements, could challenge the traditional leasing model. In a sale and leaseback agreement, airlines sell their owned aircraft to a leasing company and immediately lease them back, thereby unlocking capital without giving up operational control of the aircraft. The increasing use of sale and leaseback transactions could potentially reduce demand for traditional leasing models, especially as airlines look for more flexible options to manage their fleets.

Regional Insights

The aircraft leasing market is influenced by regional dynamics, with different growth rates and trends observed across various geographic regions. Here's a breakdown of the regional landscape

North America North America remains a key market for aircraft leasing, driven by the presence of major global leasing firms and a large number of airlines operating in the region. The U.S. market is particularly strong, with many leasing companies based in the country. As the U.S. aviation industry continues its recovery post-pandemic, demand for leased aircraft is expected to remain high.

Europe Europe is another significant market for aircraft leasing, with leasing firms such as AerCap and Avolon playing a dominant role. The region's established aviation infrastructure and increasing demand for low-cost carriers in both Western and Eastern Europe are contributing to the growth of aircraft leasing.

Asia-Pacific The Asia-Pacific region is expected to witness the highest growth in the aircraft leasing market due to rapid urbanization, increasing air travel demand, and the growing number of airlines in countries like China, India, and Japan. As emerging markets expand their fleets, the demand for aircraft leasing services is expected to grow significantly.

Middle East and Africa The Middle East, with its major aviation hubs such as Dubai and Doha, is a growing market for aircraft leasing. Airlines like Emirates and Qatar Airways have large fleets, and the region's strategic position as a global transit hub increases the demand for modern aircraft.

Request Free Sample Report: https://www.marketresearchfuture.com/sample_request/4247

Future Prospects

Looking ahead, the aircraft leasing market is expected to continue its growth trajectory, driven by increasing air travel demand, the adoption of modern fleets, and the need for flexible financing options. Innovations in digital platforms and the integration of data analytics will further improve the efficiency of leasing transactions and fleet management. Additionally, the rise of electric and hybrid aircraft could create new opportunities for leasing companies to diversify their portfolios.

As the industry faces challenges such as regulatory changes, volatile fuel prices, and economic uncertainties, leasing companies will need to adapt to new market conditions while maintaining flexibility and operational efficiency. With its solid growth prospects and continued relevance in the evolving aviation landscape, the aircraft leasing market is poised to play a critical role in shaping the future of global air transport.

Key Questions Answered in this Report

What are the challenges to market growth?

Who are the key vendors in this market space?

What will the market size be in 2024-2032 and what will the growth rate be?

What are the key market trends? What is driving this market?

What are the market opportunities and threats faced by the key vendors?

What are the strengths and weaknesses of the key vendors?

Table of Content

Chapter I: Industry Overview

Section II: Scoping, Methodology And Market Structure

Section III: Qualitative Analysis

Section IV: Quantitative Analysis

Section V: Competitive Analysis …

More Finding

Airport Stands Equipment Market: https://www.marketresearchfuture.com/reports/airport-stands-equipment-market-29096

Airship Market: https://www.marketresearchfuture.com/reports/airship-market-29068

Anti-Submarine Rocket Launch System Market: https://www.marketresearchfuture.com/reports/anti-submarine-rocket-launch-system-market-29027

Cbrne Defense Market: https://www.marketresearchfuture.com/reports/cbrne-defense-market-28998

Commercial Aircraft Mro Market: https://www.marketresearchfuture.com/reports/commercial-aircraft-mro-market-28997

Commercial Aircraft Nextgen Avionic Market: https://www.marketresearchfuture.com/reports/commercial-aircraft-nextgen-avionic-market-28995

Commercial Aircraft Video Surveillance System Market: https://www.marketresearchfuture.com/reports/commercial-aircraft-video-surveillance-system-market-28989

Commercial Aviation Aircraft Seating Market: https://www.marketresearchfuture.com/reports/commercial-aviation-aircraft-seating-market-28983

Contact us:

Industry Research Future (part of Wants tats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

Email: sales@Industryresearchfuture.com

About US

At Industry Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Industry Research & Consulting Services. MRFR team have supreme objective to provide the optimum quality Industry research and intelligence services to our clients. Our Industry research studies by products, services, technologies, applications, end users, and Industry players for global, regional, and country level Industry segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions. To stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aircraft Leasing Market Competitor Analysis By Regions (2024-2032) here

News-ID: 3729856 • Views: …

More Releases from MRFR ( Market Research Future Report)

Commercial Aircraft Engine Market Size to Reach USD 237.64 Billion by 2035, Grow …

The Commercial Aircraft Engine Market is set for dynamic expansion over the next decade, powered by rapid growth in global air travel demand, ongoing fleet modernization, and technological leaps toward fuel efficiency and sustainability. Commercial aircraft engines - typically turbofan and turboprop powerplants - are central to airline operations, influencing fuel consumption, operating costs, and environmental compliance. According to Market Research Future (MRFR), the market was valued at about USD…

Aircraft Turbine Engine Market Size to Reach USD 75.89 Billion by 2035, Growing …

The Aircraft Turbine Engine Market is entering a sustained growth phase driven by rising global air travel, fleet modernization efforts, and advances in engine technologies that prioritize fuel efficiency and emissions reduction. Turbine engines - including turbofan, turbojet, turboprop, and turboshaft types - are essential propulsion systems for commercial, business, and military aircraft. According to Market Research Future (MRFR), the market was valued at approximately USD 43.58 billion in 2024…

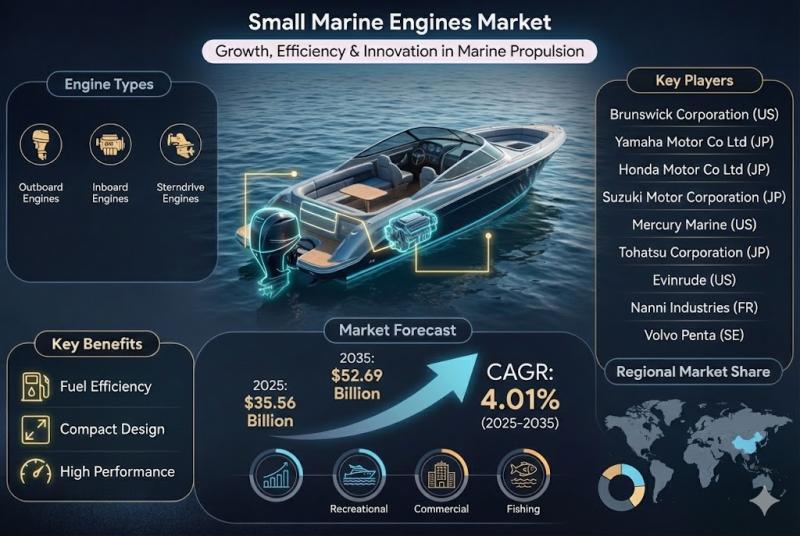

Small Marine Engines Market Size to Reach USD 52.69 Billion by 2035, Growing at …

The global Small Marine Engines Market is positioned for steady growth as demand rises for propulsion systems in recreational boats, support vessels, coastal craft, and other small-to-medium watercraft. According to Market Research Future, the small marine engines market was estimated at USD 34.19 billion in 2024 and is projected to grow to approximately USD 35.56 billion in 2025. Over the forecast period from 2025 to 2035, the market is expected…

Aviation Engine MRO Market Size to Reach USD 73.58 Billion by 2035, Growing at a …

The Aviation Engine Maintenance, Repair, and Overhaul (MRO) Market is a critical backbone of the global aviation industry, ensuring that aircraft engines - among the most complex and costly components - remain safe, efficient, and airworthy throughout their service life. As air traffic continues to rebalance and grow globally, the demand for engine MRO services has surged, driven by fleet expansions, aging aircraft, and the high operational costs associated with…

More Releases for Air

Thermoelectric Assemblies Market, By Type (Air to Air, Direct to Air, Liquid to …

The thermoelectric assemblies market is expected to witness market growth at a rate of 8.25% in the forecast period of 2021 to 2028. Data Bridge Market Research report on thermoelectric assemblies market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the application of thermoelectric assemblies in the food and beverage industry…

Air Ambulance Market 2019 Global Analysis By Key Players – EMA Global , Native …

WiseGuyReports.Com Publish a New Market Research Report On –“ Air Ambulance Market 2019 Global Analysis By Key Players – EMA Global , Native American Air Ambulance, Air Medical Group, REVA Air Ambulance, PHI Air Medical ”.

Air Ambulance Industry 2019

Description:-

Air Ambulance is also known as helicopter emergency medical service, it refers to the aircraft specially adapted for carrying patients with critical condition and serious injury after permanent professional medical…

Air Ambulance Services Market 2019 AMR PHI Air Medical Scandinavian Air Ambulanc …

Air medical services is a comprehensive term covering the use of air transportation, airplane or helicopter, to move patients to and from healthcare facilities and accident scenes. Personnel provide comprehensive prehospital and emergency and critical care to all types of patients during aeromedical evacuation or rescue operations aboard helicopter and propeller aircraft or jet aircraft.

Request a Sample of this Report @ http://www.orbisresearch.com/contacts/request-sample/2398576 …

Air Ambulance Services Market 2026: Air Methods Corporation, Deccan Charters, Sc …

Coherent Market Insights has announced the addition of the “Air Ambulance Services Market Size Status and Forecast 2026”, The report classifies the global Air Ambulance Services Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

Publisher’s Air Ambulance Services market research report provides the newest industry data and industry future trends, allowing you to identify the products and…

Air Ambulance Services Market Growth, & Key Business Strategies by Leading Indus …

Coherent Market Insights has announced the addition of the “Air Ambulance Services Market Size Status and Forecast 2026”, The report classifies the global Air Ambulance Services Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

This report studies the global Air Ambulance Services Speaker market, analyzes and researches the Air Ambulance Services Speaker development status and forecast in…

Air Ambulance Services Market Analysis Report, Regional Outlook with Key Players …

Coherent Market Insights has announced the addition of the “Air Ambulance Services Market Size Status and Forecast 2026”, The report classifies the global Air Ambulance Services Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

This report studies the global Air Ambulance ServicesSpeaker market, analyzes and researches the Air Ambulance Services Speaker development status and forecast in North…