Press release

Federal Reserve Cuts Rates: Is It Time to Celebrate?

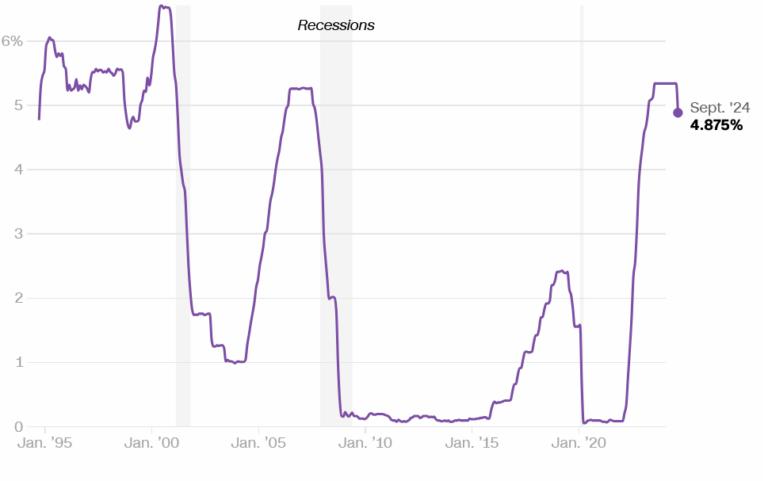

Image: https://www.abnewswire.com/uploads/edbdd9398bcf2ea79fbaa7fb0d532412.pngThe stock market went crazy after the half point cut by the federal reserve? Should you rejoice like the stock market? Take a look at the chart above showing all the recessions in the last 30 or so years. Do you notice a trend? What is the chart telling us about our probability of a recession this cycle? What happens to mortgage rates and in turn real estate prices?

What can we learn from the chart on past recessions?

The stock market is partying like never before touching on historic highs. Essentially the stock market is "believing" the fed that all is well and peachy in the economy and that is why they are cutting rates. This narrative is a bit naive and I am surprised the markets are buying this explanation. Unfortunately history is showing a much different story.

Based on the chart above, every single time in the last 30 years when the federal reserve cut rates a recession followed. There has not been a single case where this did not occur (I'm factoring out Covid in 2019 as that was an anomaly/one time event) but yet even with this history, the market is predicting something entirely opposite.

Will the federal reserve prevail in preventing a recession?

Although we have some new fancy terms like "recalibration", I have yet to see a compelling argument as to why this economy is radically different than the last 30 years.

Unfortunately based on the data, I am 100% in the camp that we will have a recession. What the federal reserve and federal government has done is merely goose the economy to delay the recession.

At the end of the day employment is declining and more companies are tightening, consumers are finally running out of the Covid cash, and delinquencies are exceeding pre 2019 levels.

At the same time, the federal reserve did a huge rate cut to ensure full employment which ironically has raised mortgage rates [https://www.fairviewlending.com/fed-cuts-rates-why-are-mortgage-rates-rising/] and also many shorter term rates. In essence the market euphoria is blunting the effects of rate cuts and actually doing the opposite by making everything more expensive.

What does the chart above mean for mortgage rates?

Over the next 4-6 months mortgage rates will trade around where they have been for the year. Mid next year rates should decline a little closer to 5.5%-6% range when the economy really starts to slow. Unfortunately, the huge federal deficit is going to keep rates considerably higher than they were before covid and rates around 6% are going to be the new norm for mortgages for the foreseeable future.

What should you do regarding interest rates?

Full disclosure: I'm not a mortgage broker as I am a private lender so if you are looking for advice on your mortgage consult another professional. With that said, I think rates will fall about 3/4 % from where they are today sometime next year so personally if I were looking to refinance, I would wait for rates to drop.

How will real estate prices be impacted?

For the next 4-6 months, I don't see any huge changes. The federal reserve and federal government will continue to prop up the economy through stimulus which will keep house prices give or take 5% either way. The real change comes next year when there is an economic reset and the market comes to grips that interest rates are never returning to the 3-4% range.

Summary

I would caution everyone not to buy into the market Euphoria. History shows in the chart above that over the last 30 years there is a 100% probability of an economic reset. Although Covid definitely changed the economy it did not change physics where everything that goes up must eventually come down. We are not in a new normal. The economy is slowly falling back into old patterns with unemployment starting to pick up, defaults increasing, and banks becoming increasingly tighter on their underwriting. All these factors add up to one answer, an economic reset.

Although the reset might not happen like past recessions due to huge government stimulus and a federal reserve aggressively trying to get ahead of the cure it will ultimately happen. Government spending and stimulus will ultimately run out and the economy will correct like it always has. This means that eventually there will be a real estate reset and also an opportunity for lower rates (just not as low as pre Covid).

Fairview is a hard money lender [https://www.fairviewlending.com/hard-money-lending-101/] specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending [https://www.fairviewlending.com/hard-money-lending-101/] through our free Hard Money Guide [https://www.fairviewlending.com/hard-money-lending-101/]. To get started on a loan all we need is our simple one page application [https://www.fairviewlending.com/hard-money-loan-programs/hard-money-loan-application/] (no upfront fees or other games).

Media Contact

Company Name: Fairview Lending

Contact Person: Glen Weinberg

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=federal-reserve-cuts-rates-is-it-time-to-celebrate]

Phone: +1 (404) 846-4718

Country: United States

Website: http://www.fairviewlending.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Federal Reserve Cuts Rates: Is It Time to Celebrate? here

News-ID: 3724116 • Views: …

More Releases from ABNewswire

Artallin Redefines Original Hand-Painted Oil Paintings Online: The Best Alternat …

NEW YORK - Feb. 26, 2026 - For homeowners and interior designers searching for original hand-painted oil paintings online, the market has long been dominated by mass-produced prints or inaccessible gallery prices. Today, Artallin officially launches its new Direct-to-Consumer (DTC) platform in the United States, offering a trusted space to buy art directly from independent artists. Positioned as the ultimate real oil painting on canvas, not print solution, Artallin [https://artallin.com/]…

The Veekys RGBIC Frunk Light Pro is the First Must-Have Mod for the Tesla Model …

As the refreshed 2025 Tesla Model Y (project "Juniper") hits the streets, early adopters are already hunting for ways to personalize their new rides. While Tesla has undoubtedly refined the vehicle's interior aesthetics, one glaring omission remains: the front trunk (frunk) is still notoriously dark at night.

Enter Veekys [https://veekys.com/], a premium EV accessory brand that has quickly become a favorite among Tesla enthusiasts. Their latest release-the Frunk Light Pro for…

Pest Brothers, Inc. Shares Top Pest Prevention Tips for Homestead, FL Homes

Pest Brothers, Inc. offers practical tips to help prevent pests in Homestead, FL. From sealing entry points to proper waste management, these proactive strategies help homeowners protect their homes from common infestations and avoid costly damage.

Homestead, FL - Homeowners prepare for the warmer months, and the company offers expert advice to help prevent issues from invading homes. With years of experience in pest control, lawn care, and termite management, they…

Terminator Pest Control Helps Cambria Homeowners Identify Early Signs of Pest In …

Terminator Pest Control educates Cambria homeowners on recognizing the first signs of pest infestations. By acting early, they help prevent serious damage and reduce long-term pest control costs. Their expert team provides advice and tailored solutions for each unique situation.

Cambria, WI - Terminator Pest Control, a family-owned and trusted provider of management services, is helping homeowners identify early signs of infestations and take proactive steps to prevent costly damage. With…

More Releases for Covid

COVID-19 Diagnostics Market Analysis and Forecast to 2033: COVID-19 and Post-COV …

The COVID-19 diagnostics market is projected to reach a size of US$ 79.41 billion in 2023, with a robust compound annual growth rate (CAGR) of 7.87% from 2023 to 2033. This growth is primarily driven by technological advancements in diagnostic tools and methodologies, enabling faster and more accurate detection of the virus. However, the market faces several challenges, including the perception of high costs, along with concerns regarding test accuracy…

Unveiling the Global Remdesivir (COVID-19) Market: Size, Share & COVID-19 Impact …

𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧:

Remdesivir, an antiviral medication, gained significant attention during the COVID-19 pandemic as a potential treatment for the novel coronavirus. In this blog, we delve into the dynamics of the global Remdesivir (COVID-19) market, analyzing its size, share, and the impact of the COVID-19 pandemic on its trajectory. Additionally, we explore the market based on resin type, application, technology, end-use industry, and regional forecasts spanning from…

Biosimilar Monoclonal Antibody Market|Covid Impact & Post Covid Analysis, Busine …

Global Biosimilar Monoclonal Antibody Market Research Report 2020 is a historical overview and in-depth study on the current & future market of the Biosimilar Monoclonal Antibody industry. The report represents a basic overview of the market status, competitor segment with a basic introduction of key vendors, top regions, product types and end industries. This report gives a historical overview of the market trends, growth, revenue, capacity, cost structure, and…

COVID-19 Imparts Positive Impact on Covid-19 Treatment Market | 2020-2027

The Covid-19 treatment market is projected to grow due to increasing cases worldwide requiring short- and long-term respiratory support and multiple partnerships for the development of treatments with clinical trials underway. However, governments all over the world are now responding to the threat of COVID-19 with all the essential measures such as social distancing, nationwide lockdown, travel restrictions, and large-scale quarantines that are anticipated to impact the businesses and consumer…

Industrial AI Computers Market 2020 - Pre-COVID-19 and Post-COVID-19 Comparison

Industrial AI Computers Industry 2020 Market Research Report" A new report added by DeepResearchReports.com to its research database. Industrial AI Computers Market is segmented by Regions/Countries. All the key market aspects that influence the Industrial AI Computers market currently and will have an impact on it have been assessed and propounded in the Industrial AI Computers market research status and development trends reviewed in the new report.

Download Free PDF Sample…

Patient Handling Equipment Market 2020 - Pre-COVID-19 and Post-COVID-19 Comparis …

Patients Handling Equipment Industry 2020 Market Research Report" A new report added by DeepResearchReports.com to its research database. Patients Handling Equipment Market is segmented by Regions/Countries. All the key market aspects that influence the Patients Handling Equipment market currently and will have an impact on it have been assessed and propounded in the Patients Handling Equipment market research status and development trends reviewed in the new report.

Download Free PDF Sample…