Press release

Business Loans Market Growing with a Healthy CAGR of 3.61 % by 2032

The business loans market, valued at USD 431.81 billion in 2022, is poised for a steady expansion, projected to reach USD 615.34 billion by 2032. This anticipated growth, with a compound annual growth rate (CAGR) of 3.61% from 2024 to 2032, reflects the increasing demand for flexible financial solutions that support businesses of all sizes. As small, medium, and large enterprises seek capital to drive growth, modernize operations, or weather economic fluctuations, the role of business loans as a critical financing tool continues to grow. Let's explore the drivers behind this growth and the evolving trends shaping the future of the business loans market.Key Companies in the Business Loans Market Include:

Credit Suisse, Citigroup, Wells Fargo, Royal Bank of Canada, Deutsche Bank, Barclays, JPMorgan Chase, Morgan Stanley, BNP Paribas, UBS, Santander, Goldman Sachs, Mitsubishi UFJ Financial Group, HSBC, Bank of America

Get a FREE Sample Report PDF Here:

https://www.marketresearchfuture.com/sample_request/23967

Overview of Business Loans

Business loans provide essential financing for enterprises, allowing them to invest in expansion, manage cash flow, and address operational needs. This type of financing is offered through a variety of structures, such as:

Term Loans - Fixed or variable-rate loans that provide capital for a defined period, ideal for long-term projects or large investments.

Working Capital Loans - Loans intended to cover day-to-day expenses and maintain cash flow during low-revenue periods.

Equipment Financing - Loans or leases specifically for purchasing machinery or other business equipment.

Line of Credit - Flexible, revolving credit that businesses can draw upon as needed, commonly used for short-term operational needs.

From traditional banks to alternative online lenders, a range of financial institutions offer business loans, enabling companies to find solutions that fit their unique financial needs.

Key Drivers of Growth in the Business Loans Market

Increasing Small and Medium Enterprises (SMEs) Demand

SMEs are a major driver of the business loans market as they often require external financing to manage cash flow, upgrade infrastructure, and drive expansion. As SMEs account for a large share of employment and economic activity worldwide, their growing demand for financing significantly supports the market's expansion.

Rising Investments in Digital Transformation

Businesses across industries are investing in digital transformation to enhance efficiency, customer experience, and competitive positioning. Business loans are a primary financing option for companies looking to adopt advanced technology, automate operations, and improve cybersecurity measures.

Supportive Government Policies and Economic Stimulus Programs

Various governments have introduced loan programs and guarantees to support businesses, especially SMEs. This financial support provides businesses with increased access to capital at more favorable rates, stimulating demand for business loans.

Economic Fluctuations and Inflation Pressures

In an environment of rising inflation and economic uncertainty, businesses face higher operating costs and unpredictable revenue streams. Many companies turn to business loans to maintain stability, cover expenses, and safeguard against market volatility.

Growing Alternative Lending Options

Non-bank lenders, such as fintech firms, are expanding their presence in the business loans market by offering quick, flexible financing options. These lenders use digital platforms and data-driven risk assessments, making it easier for small businesses to access credit.

Emerging Trends in the Business Loans Market

Adoption of Digital Lending Platforms

Digital platforms streamline the loan application process, making it faster and more accessible. With advancements in AI and machine learning, lenders can assess credit risk more accurately, process applications swiftly, and deliver funds to businesses with minimal delay. Digital lending platforms are expected to be a major trend as more businesses prefer convenient, digital solutions.

Expansion of Peer-to-Peer (P2P) Lending and Crowdfunding

P2P lending and crowdfunding provide alternative financing avenues, especially for startups and small businesses that may struggle with traditional loan requirements. These platforms allow businesses to connect directly with individual or institutional investors, broadening access to capital and driving market diversification.

Rise of ESG-Centered Financing

Environmental, social, and governance (ESG) factors are becoming increasingly important in financing decisions. Lenders are starting to offer favorable loan terms to businesses that adhere to sustainable practices or contribute to social welfare, promoting ESG-aligned growth in the business loans market.

Flexible Repayment and Interest Models

Lenders are introducing innovative repayment structures, such as income-based repayments or seasonal payment options, to better suit business cash flow patterns. Interest rate models are also evolving, with options like step-up and step-down rates, offering businesses more flexibility and affordability.

Blockchain for Enhanced Security and Efficiency

Blockchain technology is expected to play a growing role in business lending by enhancing the security, speed, and transparency of transactions. Smart contracts powered by blockchain can automate loan agreements, reducing paperwork and ensuring compliance with contractual terms.

Know More about the Business Loans Market Report:

https://www.marketresearchfuture.com/reports/business-loans-market-23967

Challenges Facing the Business Loans Market

Despite its growth potential, the business loans market encounters several challenges:

Stringent Credit Requirements

Many traditional lenders maintain strict credit requirements, which can limit access to loans for SMEs with limited credit history or collateral. This creates a gap in financing availability, particularly for new or high-risk businesses.

Economic Uncertainty and Market Volatility

Economic downturns, inflation, and interest rate fluctuations can impact businesses' ability to borrow and repay loans. Lenders face the challenge of balancing risk management with lending accessibility, particularly in volatile markets.

Increasing Competition from Fintech Lenders

Traditional banks face competition from fintech firms, which offer faster loan processing and less restrictive qualification criteria. To remain competitive, banks may need to invest in digital transformation and streamline their lending processes.

Rising Regulatory Scrutiny

Financial regulations are becoming stricter, especially in areas like data privacy and cybersecurity. Compliance costs can be high, especially for non-bank lenders, and regulatory complexity can impact lending operations and loan product innovation.

Future Outlook for the Business Loans Market

The business loans market is set to expand steadily through 2032, driven by the increasing financing needs of SMEs, continued digital transformation, and the growing availability of alternative lending options. Traditional banks and fintech firms alike are anticipated to invest in digital solutions, advanced risk assessment models, and customer-centric loan products to meet evolving business needs.

As the demand for capital continues, particularly in emerging markets and among small businesses, lenders will have opportunities to diversify offerings and cater to underserved sectors. The integration of technology in the lending process is expected to streamline application, approval, and repayment processes, making business loans more accessible and efficient.

In particular, sustainable finance is expected to rise, with lenders prioritizing businesses that align with ESG principles. This focus on ESG financing will not only support green and socially responsible businesses but also help lenders differentiate themselves in a competitive market.

Top Trending Research Report:

Electronic Gadget Insurance Market https://www.marketresearchfuture.com/reports/electronic-gadget-insurance-market-24132

Equity Indexed Life Insurance Market https://www.marketresearchfuture.com/reports/equity-indexed-life-insurance-market-24126

Group Life Insurance Market https://www.marketresearchfuture.com/reports/group-life-insurance-market-24012

Claims Processing Software Market https://www.marketresearchfuture.com/reports/claims-processing-software-market-24167

Insurance Third Party Administration Market https://www.marketresearchfuture.com/reports/insurance-third-party-administration-market-24033

Agriculture Equipment Finance Market https://www.marketresearchfuture.com/reports/agriculture-equipment-finance-market-24331

Auto Finance Market https://www.marketresearchfuture.com/reports/auto-finance-market-24350

Custody Services Market https://www.marketresearchfuture.com/reports/custody-services-market-24371

Embedded Finance Market https://www.marketresearchfuture.com/reports/embedded-finance-market-24421

Online Investment Platform Market https://www.marketresearchfuture.com/reports/online-investment-platform-market-24433

Factoring Services Market https://www.marketresearchfuture.com/reports/factoring-services-market-24451

About Us

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact:

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Loans Market Growing with a Healthy CAGR of 3.61 % by 2032 here

News-ID: 3721056 • Views: …

More Releases from Market Research Future (MRFR)

Organic Hair Color Market Accelerates at 11.51% CAGR, Driven by Clean Beauty Dem …

The Organic Hair Color Market is witnessing robust growth as consumers increasingly shift toward clean-label, plant-based, and chemical-free personal care solutions. Concerns over the long-term effects of synthetic chemicals such as ammonia, parabens, and PPD have significantly influenced purchasing decisions, positioning organic hair color products as a safer and more sustainable alternative. In 2024, the market was valued at USD 2,357.3 million and is projected to reach USD 7,815.43 million…

Mascara Market Accelerates at 6.09% CAGR, Driven by Clean Beauty Demand Through …

The global Mascara Market is witnessing sustained growth as beauty routines evolve and consumers increasingly prioritize eye makeup as a core cosmetic category. Mascara, once considered a basic enhancement product, has transformed into a highly innovative segment driven by formulation advancements, branding, and changing consumer expectations. In 2024, the Mascara Market was valued at USD 8.65 billion and is expected to reach USD 9.17 billion in 2025, highlighting steady short-term…

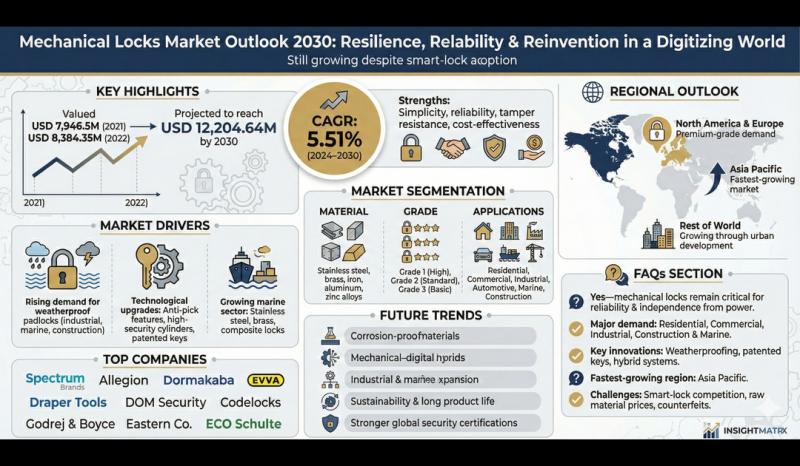

Mechanical Locks Market Driven by Rising Security Needs, Set to Grow at 3.5% CAG …

The Mechanical Locks Market continues to hold a vital position in the global security ecosystem, supported by its reliability, cost-effectiveness, and widespread adoption across residential, commercial, and industrial sectors. In 2024, the market was valued at USD 8,720.0 million and is expected to reach USD 12,900.0 million by 2035, expanding at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2035. Despite the emergence of electronic and digital…

Can Fashion, Eye Protection, and Innovation Drive the Sunglasses Market at a 6.1 …

The Global Sunglasses Market is evolving from a seasonal accessory category into a year-round consumer essential driven by fashion consciousness, eye health awareness, and technological innovation. Sunglasses today are no longer limited to UV protection; they represent lifestyle choices, brand identity, and performance enhancement. With rising disposable incomes and increasing outdoor and travel activities, demand continues to expand across both developed and emerging economies.

In 2024, the Sunglasses Market reached a…

More Releases for Loans

Beehive Loans Expands Access to Transparent Online Payday Loans across Utah

Beehive Loans, a trusted local financial provider, has expanded its services to offer broader access to online payday loans across Utah. With an emphasis on clear terms, fast approvals, and no credit check options, Beehive Loans continues its mission to provide responsible short-term financial assistance to individuals throughout the state.

Residents in Salt Lake City, Ogden, Provo, West Jordan and other major Utah cities can now benefit from streamlined applications, same-day…

Online Payday Loans Texas & USA | Online Installment Loans for Bad Credit | Loom …

https://www.loomloans.com

Loom Loans: Your Gateway to Financial Flexibility Across the United States

Have you been searching for $255 payday loans online same day, online payday loans Texas, or maybe even online installment loans for bad credit? Look no further; Loom Loans can help! Understanding that time is often of the essence when it comes to financial needs, our service specializes in linking applicants to available loans, allowing you to find the right…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Online Loans at GoodCheddar Make Comparing Loans Easier in Canada

GoodCheddar offers a personal finance solution that is about helping consumers find the answers they need when it comes to personal loans. Expanding its reach in the consumer marketplace, GoodCheddar.com aims to lower the barriers of borrowing by making options more accessible to Canadians.

When a consumer needs a personal loan, it can be a big financial decision. GoodCheddar empowers consumers in their decisions and helps them make smart financial…

Loans Now Website Educates Consumers on Bad Credit Loans

JACKSONVILLE, FL – MAY 6, 2019–Bad credit can make people feel hopeless when they face issues out of their control like car crashes and medical emergencies. Personal loan provider Loans Now educates consumers so that they can get the help they need.

Loans Now’s website serves as an extensive resource meant to inform potential borrowers about how to borrow money responsibly. Its representatives work with borrowers to find the loan that’s…