Press release

Payment Card Skimming Market Report 2024 - Payment Card Skimming Market Demand And Trends

"The Business Research Company recently released a comprehensive report on the Global Payment Card Skimming Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=16760&type=smp

According to The Business Research Company's, The payment card skimming market size has grown rapidly in recent years. It will grow from $3.16 billion in 2023 to $3.56 billion in 2024 at a compound annual growth rate (CAGR) of 12.4%. The growth in the historic period can be attributed to increased adoption of payment cards and electronic transactions, the proliferation of ATMs and point-of-sale (POS) terminals, limited awareness and education about skimming risks, regulatory pressures and compliance requirements, and economic factors affecting consumer spending behavior.

The payment card skimming market size is expected to see rapid growth in the next few years. It will grow to $5.71 billion in 2028 at a compound annual growth rate (CAGR) of 12.6%. The growth in the forecast period can be attributed to a rise in contactless payment adoption, reducing physical card exposure, a shift towards mobile and digital wallet payments, regulatory enhancements and mandates for stronger payment security, consumer demand for seamless and secure payment experiences, global expansion of electronic payment systems, and digital economies. Major trends in the forecast period include increased focus on prevention technologies, integration of artificial intelligence, integration of machine learning, adoption of blockchain technology, and advancements in security technologies.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/payment-card-skimming-global-market-report

Market Drivers and Trends:

The increasing incidents of automated teller machine (ATM) fraud are expected to propel the growth of the payment card skimming market going forward. An automated teller machine (ATM) is a specialized computerized device that enables individuals to perform various banking transactions without human intervention or visiting a physical bank branch. With advancements in technology and the widespread use of ATMs for banking transactions, there has been a significant rise in ATM fraud. Payment card skimming measures protect against fraud and unauthorized access, ensuring the safe operation of automated teller machines (ATMs) and safeguarding users' financial information. These measures include PIN authentication, encryption, surveillance and physical security features. For instance, in April 2022, according to the Federal Bureau of Investigation, a US-based law enforcement agency, there were 254 thefts from ATMs in 2021, an increase of 10% from 229 in 2020. Therefore, the increasing incidents of automated teller machine (ATM) financial fraud will drive the growth of the payment card skimming market.

Major companies operating in the payment card skimming market are integrating artificial intelligence, such as generative AI technology, to enhance detection capabilities and bolster security measures for card transactions. Generative AI technology is utilized in skimming prevention by identifying patterns and anomalies in transaction data to detect and mitigate fraudulent activities proactively. For instance, in May 2024, Mastercard Inc., a US-based payment card services corporation, launched a new technology that rapidly scans transaction data from billions of cards and millions of merchants, surpassing previous processing speeds. This system employs Mastercard's generative AI-based predictive technology to detect and alert on emerging fraud patterns, effectively doubling the detection rate of compromised cards, significantly reducing false positives by up to 200% during fraud detection on potentially compromised cards, and accelerating the identification of merchants at risk from or compromised by fraudsters by 300%.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

Fiserv Inc., NCR Voyix Corporation, Zebra Technologies Corporation, Fortinet Inc., Diebold Nixdorf Incorporated, IDEMIA Identity & Security USA LLC, Check Point Software Technologies Ltd., Trend Micro Incorporated, Axis Communications AB, ACI Worldwide Inc., Fair Isaac Corporation (FICO), Ingenico Group SA, CyberArk Software Ltd., Verifone Systems Inc., McAfee LLC, Trustwave Holdings Inc., SAI360 Inc., MagTek Inc., Matrix IFS Ltd., Bluefin Payment Systems LLC, Sesame Software LLC, ComplianceForge LLC, Rivial Data Security LLC, C2C SmartCompliance LLC, Riskskill Inc.

Payment Card Skimming Market 2024 Key Insights:

• The payment card skimming market size is expected to see rapid growth in the next few years. It will grow to $5.71 billion in 2028 at a compound annual growth rate (CAGR) of 12.6%.

• Rising ATM Fraud Incidents Fueling Growth In ATM Security Market

• Innovations In Fraud Detection With Generative AI

• North America was the largest region in the payment card skimming market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=16760&type=smp

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ"

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Card Skimming Market Report 2024 - Payment Card Skimming Market Demand And Trends here

News-ID: 3719018 • Views: …

More Releases from The Business research company

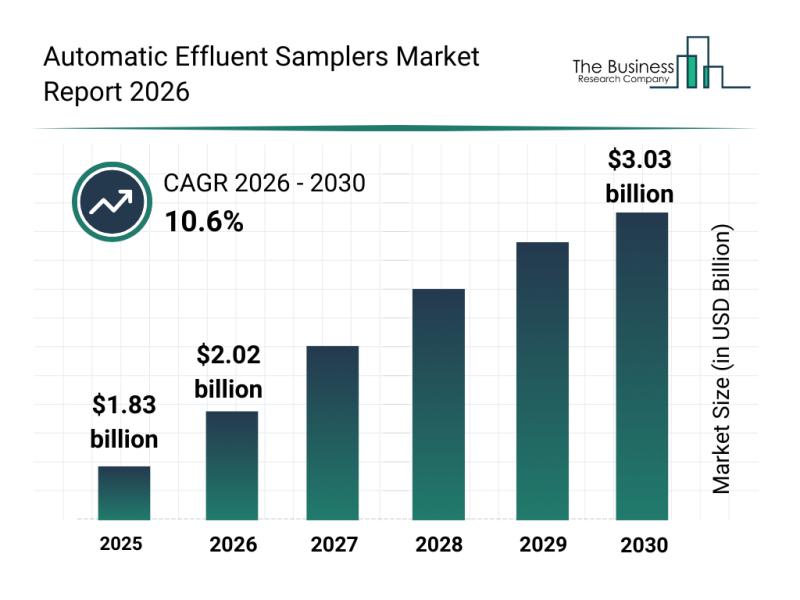

Leading Companies Solidify Their Presence in the Automatic Effluent Samplers Mar …

The automatic effluent samplers market is gaining significant momentum as environmental monitoring and water quality management take center stage worldwide. With technological advancements and increasing regulatory demands, this industry is poised for substantial growth and innovation over the coming years. Let's explore the market size projections, key players, emerging trends, and segment analysis shaping the future of this sector.

Projected Market Size and Growth of the Automatic Effluent Samplers Market

The…

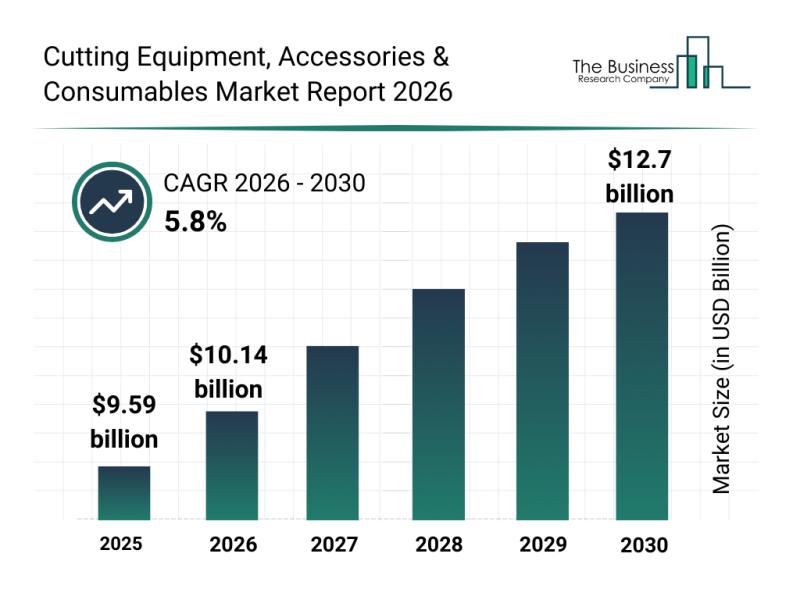

Future Perspectives: Key Trends Shaping the Cutting Equipment, Accessories, and …

The cutting equipment, accessories, and consumables industry is set for notable expansion in the coming years, driven by advancements in manufacturing technologies and increasing demand for precision and efficiency. This sector is evolving rapidly as automation and innovative cutting methods gain prominence across various industrial applications. Let's explore the current market outlook, key players, emerging trends, and major segments shaping this dynamic field.

Projected Expansion and Market Size in Cutting Equipment,…

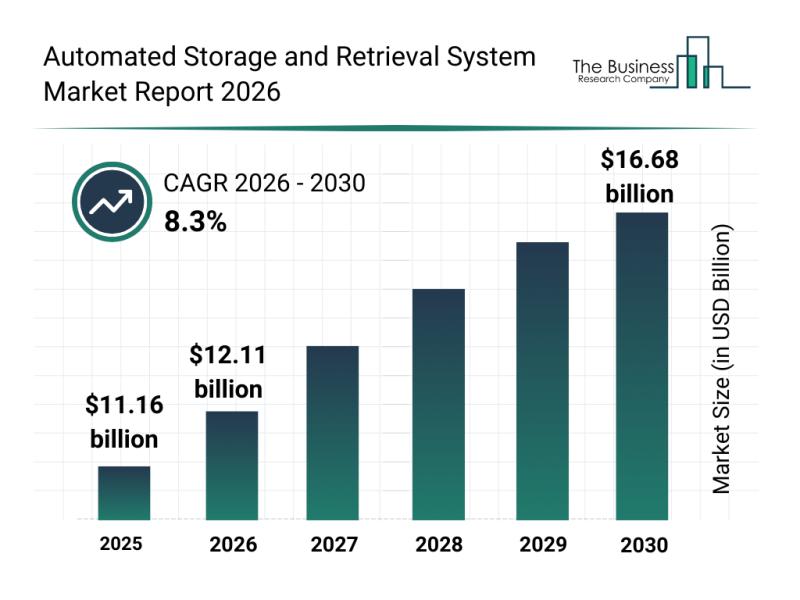

Emerging Growth Trends Driving Expansion in the Automated Storage and Retrieval …

The automated storage and retrieval system market is positioned for substantial growth as industries increasingly seek smarter and more efficient warehousing solutions. With the rise of e-commerce and data-driven logistics, this sector is rapidly evolving to meet the demands of modern supply chains. Let's explore the current market outlook, key players, emerging trends, and the main segments shaping this industry's future.

Projected Market Size and Growth Trajectory in the Automated Storage…

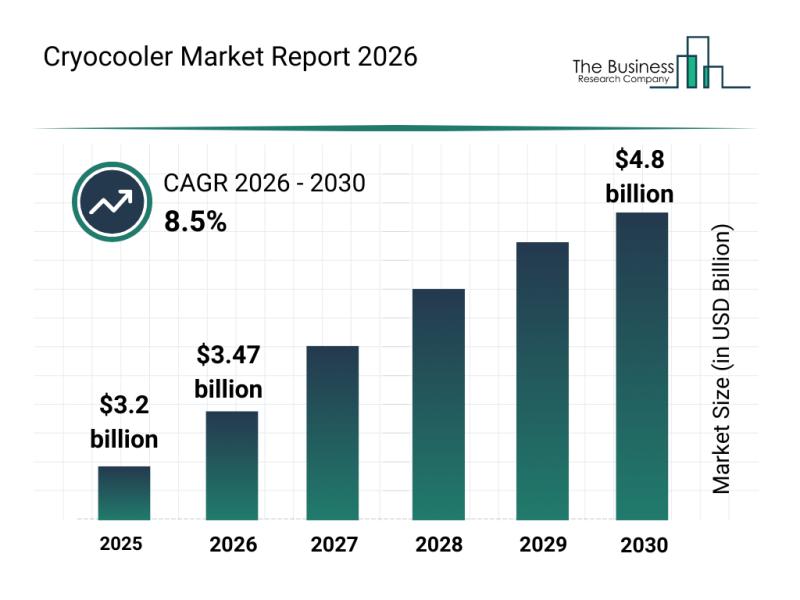

In-Depth Examination of Segments, Industry Trends, and Key Players in the Cryoco …

The cryocooler market is poised for significant expansion over the coming years, driven by advancements in various high-tech sectors and growing demand for specialized cooling solutions. This analysis explores the market's anticipated growth, leading players, emerging trends, and the key segments shaping its future trajectory.

Projected Growth and Market Size of the Cryocooler Industry

The cryocooler market is expected to reach a valuation of $4.8 billion by 2030, growing at a…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…