Press release

Cryptocurrency Market Expected to Hit US$ 119.8 Billion by 2031

IntroductionThe cryptocurrency market has transformed the global financial landscape over the past decade, disrupting traditional banking and payments systems and introducing new forms of decentralized assets. Driven by technological advancements, investor interest, and increasing applications, cryptocurrencies are becoming more integral to both individual and institutional portfolios. This report provides an in-depth analysis of the cryptocurrency market, exploring its growth drivers, challenges, technological trends, and regional dynamics, as well as the outlook for the future.

Cryptocurrencies are digital or virtual assets designed to function as a medium of exchange and are based on decentralized networks secured by blockchain technology. Their unique properties, including transparency, decentralization, and accessibility, have propelled their adoption across sectors such as finance, healthcare, real estate, and supply chain. With advancements in blockchain and increased acceptance among investors, the cryptocurrency market is poised for significant growth.

Market Projections and Forecast

According to the latest market study published by Persistence Market Research, the global cryptocurrency market is projected to increase from US$ 51.67 billion in 2024 to US$ 119.8 billion by the end of 2031. The market is expected to secure a compound annual growth rate (CAGR) of 12.80% during the forecast period from 2024 to 2031.

This rapid expansion is fueled by factors such as the growing popularity of decentralized finance (DeFi), increased demand for blockchain-based applications, and institutional investments in digital assets. Additionally, innovations in blockchain technology, such as improved scalability and security, are expected to attract further interest from traditional financial institutions, thereby boosting market growth.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/16741

Market Dynamics

Drivers of Market Growth

Decentralized Finance (DeFi): The rise of DeFi applications has contributed significantly to the expansion of the cryptocurrency market. DeFi offers financial services on decentralized platforms, enabling users to lend, borrow, and trade assets without intermediaries, thus enhancing accessibility and efficiency in financial transactions.

Institutional Adoption of Cryptocurrencies: The growing adoption of cryptocurrencies by institutional investors has legitimized digital assets in the financial markets. Firms like Tesla, MicroStrategy, and Square have invested in Bitcoin and other digital assets, providing further credibility to the cryptocurrency market.

Blockchain Technology Advancements: Continuous improvements in blockchain technology, such as increased scalability, security, and interoperability, have accelerated the development of new cryptocurrency applications. Blockchain innovations are helping to address issues like transaction speed and network congestion, making cryptocurrencies more viable for daily transactions.

Increased Awareness and Adoption: With more individuals becoming aware of cryptocurrencies, the demand for digital assets as a hedge against inflation and economic instability has risen. Cryptocurrencies offer an alternative investment vehicle, appealing to a growing number of investors looking for diversification and protection against currency depreciation.

Challenges in the Market

Despite its rapid growth, the cryptocurrency market faces several challenges:

Regulatory Uncertainty: One of the primary challenges is the lack of a standardized regulatory framework for cryptocurrencies. Different countries have varying approaches to regulation, creating uncertainty for businesses and investors alike.

Volatility in Market Prices: Cryptocurrencies are highly volatile, with price fluctuations often driven by speculation and market sentiment. This volatility can deter potential investors who seek stable returns, impacting market growth.

Security Concerns and Cyber Threats: Cybersecurity remains a critical issue in the cryptocurrency market, with several exchanges and platforms experiencing hacks and data breaches. Security concerns continue to pose a risk for investors and hinder broader adoption of digital assets.

Market Trends and Technological Innovations

The cryptocurrency market is witnessing various trends and technological advancements that are shaping its development:

Rise of Stablecoins: Stablecoins, which are digital currencies pegged to fiat currencies like the US dollar, are becoming increasingly popular as they offer the stability of traditional currencies while retaining the benefits of cryptocurrencies. Stablecoins are widely used in DeFi platforms, enabling seamless transactions and reducing the impact of market volatility.

Growth of NFTs (Non-Fungible Tokens): NFTs have gained significant attention in recent years, especially in the art, gaming, and entertainment industries. NFTs offer unique digital ownership and are based on blockchain technology, allowing for new avenues of investment and engagement in the cryptocurrency space.

Integration of AI and Blockchain: Artificial Intelligence (AI) is being integrated with blockchain technology to enhance decision-making, data analysis, and predictive modeling within the cryptocurrency market. AI-driven analytics help in managing large datasets, improving transparency, and optimizing trading strategies.

Focus on Green and Sustainable Blockchain Solutions: The energy-intensive nature of cryptocurrency mining has sparked interest in sustainable blockchain solutions. Many cryptocurrency projects are exploring eco-friendly mining methods, with a focus on renewable energy sources to minimize the environmental impact.

Cryptocurrency Market Segmentation

By Component

Hardware

Mining Rigs

Wallets

Other Hardware Components

Software

Wallets

Exchanges

Payment Platforms

By Application

Payments

Trading and Investments

Smart Contracts

Decentralized Applications (DApps)

By Industry

Banking and Financial Services

Healthcare

Supply Chain and Logistics

Retail

Real Estate

Others

Regional Analysis

The cryptocurrency market exhibits growth patterns that vary by region, influenced by factors such as regulatory frameworks, technological adoption, and market demand.

North America

North America leads the cryptocurrency market, with the United States and Canada at the forefront. The region's established financial infrastructure, combined with a strong appetite for technological innovation, has enabled widespread cryptocurrency adoption. In addition, regulatory support and increased investment from institutional investors have bolstered market growth.

Europe

Europe is a major player in the cryptocurrency market, with countries like the United Kingdom, Germany, and Switzerland driving adoption. Europe's supportive regulatory environment, coupled with the growing popularity of DeFi and blockchain applications, has positioned the region as a key contributor to market expansion.

Asia-Pacific

Asia-Pacific is expected to witness rapid growth in the cryptocurrency market, driven by increasing investments in digital assets and government initiatives to explore blockchain technology. Countries like China, Japan, and South Korea are leading cryptocurrency adoption in the region, with a strong focus on technological advancements and digital payments.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa regions are emerging markets for cryptocurrencies, with growing adoption in countries such as Brazil, Argentina, and the UAE. The need for alternative financial solutions and the rise of remittance payments have propelled cryptocurrency adoption in these regions.

Key Companies Profiled in the Report

Coinbase

Binance

Ripple Labs

Bitmain Technologies Ltd.

Kraken

Bitfinex

Huobi

Ethereum Foundation

Circle Internet Financial Ltd.

Chainalysis

Gemini Trust Company, LLC

OKEx

TRON Foundation

eToro

Litecoin Foundation

Future Outlook

The cryptocurrency market is poised for robust growth, with advancements in blockchain technology and increasing acceptance across sectors. The rise of DeFi and NFTs, along with the integration of AI in cryptocurrency applications, will drive market expansion. Moreover, the focus on sustainability and eco-friendly blockchain practices is expected to address environmental concerns, making cryptocurrencies more attractive to environmentally-conscious investors.

The future of the cryptocurrency market will likely be shaped by the development of comprehensive regulatory frameworks that foster innovation while addressing security and privacy concerns. As global adoption of digital assets increases, cryptocurrencies are expected to play a crucial role in reshaping financial ecosystems and driving financial inclusion worldwide.

Conclusion

The cryptocurrency market is on an accelerated growth trajectory, driven by decentralized finance, technological advancements, and growing institutional interest. Although regulatory uncertainties and security issues present challenges, the market's potential for innovation and disruption remains significant.

With the integration of AI, the rise of stablecoins, and sustainable blockchain practices, the cryptocurrency market is well-positioned for expansion, providing investors and businesses with new opportunities in the digital economy. As cryptocurrencies continue to gain mainstream acceptance, they are expected to revolutionize the financial landscape, offering secure, transparent, and efficient solutions for individuals and institutions alike.

Explore the Latest Trending "Exclusive Article" @

Explore the Latest Trending "Exclusive Article" @

• https://www.linkedin.com/pulse/nuclear-powered-naval-vessels-market-emerging-technologies-ahfgf/

• https://www.linkedin.com/pulse/photo-printing-merchandise-market-emerging-technologies-jwvof/

• https://www.linkedin.com/pulse/live-streaming-market-trends-transforming-digital-ruxwf/

• https://www.linkedin.com/pulse/organic-pigments-market-exploring-biodegradable-qwnqf/

• https://www.linkedin.com/pulse/vacuum-insulation-panel-market-trends-shaping-azk0f

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency Market Expected to Hit US$ 119.8 Billion by 2031 here

News-ID: 3717636 • Views: …

More Releases from Persistence Market Research

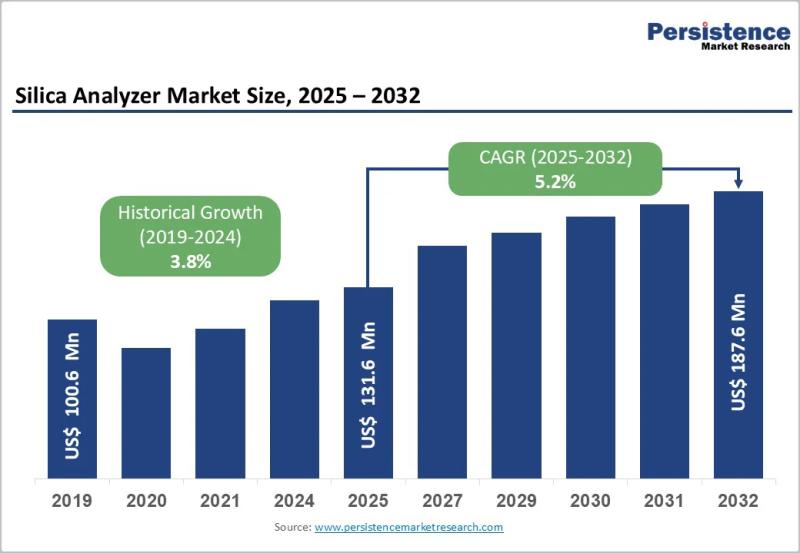

Silica Analyzer Market Size to Reach US$187.6 Million by 2032 - Persistence Mark …

The silica analyzer market plays a critical role in industrial water quality monitoring, particularly in sectors where high purity water is essential for operational efficiency and equipment longevity. Silica analyzers are specialized instruments used to detect and measure silica concentrations in water and steam cycles, preventing scale formation and corrosion in boilers, turbines, and cooling systems. Industries such as power generation, oil and gas, pharmaceuticals, semiconductors, and chemical processing rely…

Soybean Derivatives Market to Hit $390.8B by 2033, Growing at 4.5% CAGR

The global soybean derivatives market is poised for sustained expansion, driven by growing demand across food, feed, and industrial applications. The market is projected to be valued at US$ 288.1 billion in 2026 and is expected to reach US$ 390.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.5% during the forecast period from 2026 to 2033. This growth underscores the continued significance of soybean derivatives as…

Europe Electric Vehicle Market to Reach US$ 571.9 Bn by 2033 as Tesla, Volkswage …

The Europe electric vehicle market is witnessing unprecedented growth, driven by increasing consumer awareness, government policies promoting sustainability, and rapid advancements in electric mobility technologies. As countries across Europe adopt stricter emission regulations and incentivize the adoption of electric vehicles (EVs), manufacturers are accelerating their transition from conventional vehicles to electric alternatives. This shift is not only redefining the automotive industry but is also shaping the region's energy, transportation, and…

Nutmeg Butter Market to Reach $57.6M by 2033, Driven by Rising Demand in Food

The global nutmeg butter market is witnessing significant growth, driven by rising demand from the cosmetic, pharmaceutical, and food industries. The market is estimated to be valued at US$ 39.1 million in 2026 and is projected to reach US$ 57.6 million by 2033, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2033.

The growth of the nutmeg butter market is largely attributed to…

More Releases for DeFi

IO DeFi User Base Surpasses 3 Million as Structured DeFi Participation Gains Glo …

IO DeFi has reached a significant milestone as its global user base surpasses 3 million accounts, reflecting growing interest in structured and simplified participation within the decentralized finance sector.

The expansion highlights a broader shift in how users engage with DeFi. As the ecosystem matures, participants are increasingly prioritizing stability, clarity, and reduced operational complexity over constant manual involvement.

A Milestone Reflecting Changing User Preferences

User growth in decentralized finance is no longer…

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Building Defi Staking Platform with PerfectionGeeks Technologies

With each investment-related research you undertake, whether in mutual funds, stocks or gold, you will likely find legal advice to make money by investing correctly.

Today, with one out of 10 investors investing their money into cryptocurrency, the old saying about holding assets over the long term extends to crypto-related investors. Many ways to look at it, more so considering the volatility of crypto that is frequently traded and bought, which…

DeFi (Decentralized Finance) Tool Market Still Has Room to Grow | MetaMask, Dapp …

The latest research study released by Stratagem Market Insights on the "DeFi (Decentralized Finance) Tool Market" with 100+ pages of analysis on business strategy taken up by emerging industry players, geographical scope, market segments, product landscape and price, and cost structure. It also assists in market segmentation according to the industry's latest and upcoming trends to the bottom-most level, topographical markets, and key advancement from both market and technology-aligned perspectives.…

Banking the Banked: Why Defi

“Bank the unbanked! Banking for the people! Upend the dominant paradigm!” Decentralized finance, or DeFi, is touted as the next big revolution in the world of banking and markets, just like Bitcoin was supposed to be the next big revolution in the world of currency. Oh, wait, one Bitcoin is currently worth over USD 10k, so maybe it isn’t going to replace the dollar, but it’s certainly been a revolution.…