Press release

Global Equipment Finance Services Market Outlook and Key Insights for 2024

The Business Research Company recently released a comprehensive report on the Global Equipment Finance Services Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=16676&type=smp

According to The Business Research Company's, The equipment finance services market size has grown rapidly in recent years. It will grow from $1,200.45 billion in 2023 to $1,333.83 billion in 2024 at a compound annual growth rate (CAGR) of 11.1%. The growth in the historic period can be attributed to economic growth and stability influencing capital investments, regulatory changes impacting lease accounting and tax policies, increased globalization leading to expanded equipment needs, industry-specific demands for specialized equipment solutions, and shifts in customer preferences towards leasing over purchasing.

The equipment finance services market size is expected to see rapid growth in the next few years. It will grow to $2,039.99 billion in 2028 at a compound annual growth rate (CAGR) of 11.2%. The growth in the forecast period can be attributed to growth in demand for flexible financing options tailored to customer needs, expansion of equipment leasing in emerging markets, rising environmental and sustainability considerations influencing equipment choices, a shift towards sustainable and eco-friendly equipment options, and the and the impact of geopolitical factors on global supply chains and equipment demand. Major trends in the forecast period include the integration of embedded insurance solutions, enhanced data analytics, the expansion of industry-specific solutions, and digital transformation.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/equipment-finance-services-global-market-report

Market Drivers and Trends:

The growth in the construction industry is expected to propel the growth of the equipment finance services market going forward. The construction industry encompasses the activities involved in building, repairing, and renovating structures. The construction industry is experiencing growth due to increasing urbanization, infrastructure development, and rising demand for residential and commercial properties. The use of equipment finance services in the construction industry supports growth by enabling companies to acquire advanced machinery and technology, improving efficiency and project scalability without substantial upfront capital expenditure. For instance, in February 2023, according to the Office for National Statistics, a UK-based statistics authority, annual construction output increased by 5.6% in 2022 compared with 2021, which follows a record increase in 2021 of 12.8%. Therefore, growth in the construction industry will drive the growth of the equipment finance services market.

Major companies operating in the equipment finance services market are focusing on multiple strategic areas to enhance their market position and meet evolving customer demands related to embedded coverage solutions to improve customer relationship management and streamline operational efficiencies. Embedded coverage solutions in equipment finance refer to integrated insurance or protection plans included within the financing agreement, providing automatic coverage for the financed equipment against risks such as damage, theft, or loss. For instance, in August 2023, Great American Insurance Group, a US-based provider of insurance solutions, introduced an embedded coverage solution for equipment finance companies utilizing Salesforce. This cutting-edge technology seamlessly integrates insurance solutions into the leasing process. This system makes insurance solutions available at any stage in the lease workflow, delivering the following advantages, immediate quoting and enrollment, decreased data entry using metadata, and flexible support for various workflows.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Siemens AG, TD Bank N.A., U.S. Bancorp, Truist Financial Corporation, The PNC Financial Services Group Inc., Mitsubishi HC Capital Inc., Fifth Third Bank, Regions Financial Corporation, Huntington Bancshares Incorporated, KeyBank National Association, First-Citizens Bank & Trust Company, Macquarie Group Limited, CIT Group Inc., DLL Group, GreatAmerica Financial Services Corporation, Balboa Capital Corporation, OnDeck Capital Inc., Hitachi Capital America Corp., Crest Capital LLC, Keystone Equipment Finance Corp., Smarter Finance USA LLC

Equipment Finance Services Market 2024 Key Insights:

• The equipment finance services market size is expected to see rapid growth in the next few years. It will grow to $2,039.99 billion in 2028 at a compound annual growth rate (CAGR) of 11.2%.

• Impact Of Construction Industry Growth On Equipment Finance Services

• Integrating Salesforce For Enhanced Efficiency And Customer Engagement In Equipment Finance Services

• North America was the largest region in the equipment finance services market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=16676&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Equipment Finance Services Market Outlook and Key Insights for 2024 here

News-ID: 3715295 • Views: …

More Releases from The Business research company

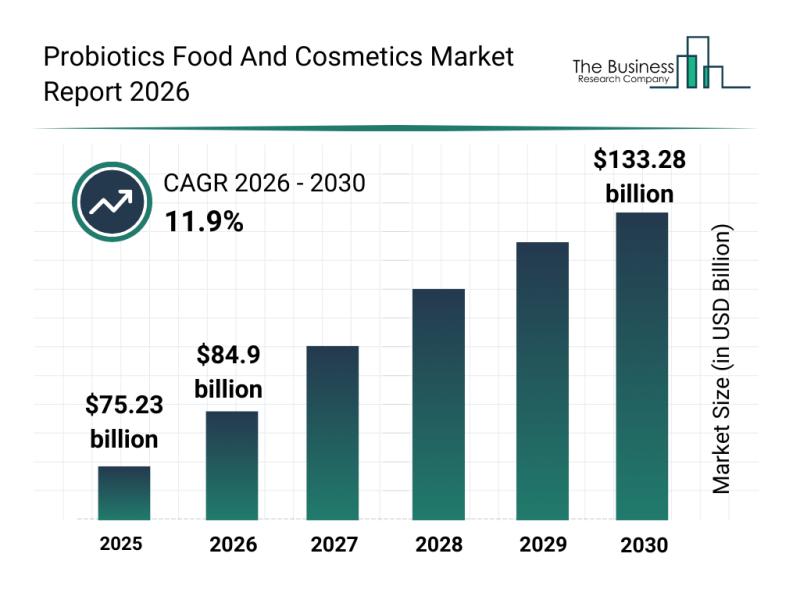

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

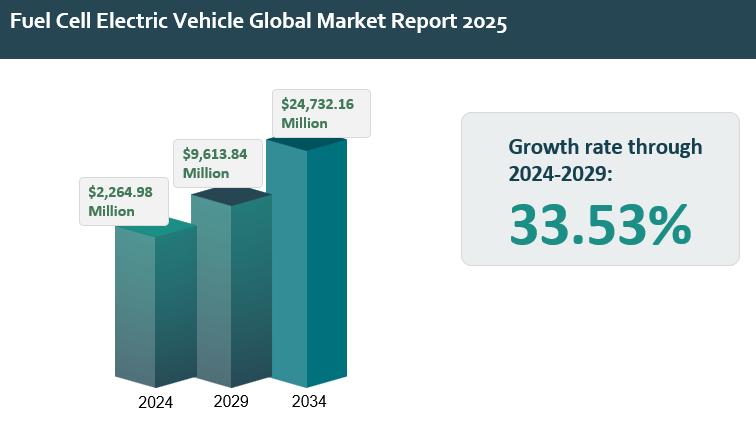

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

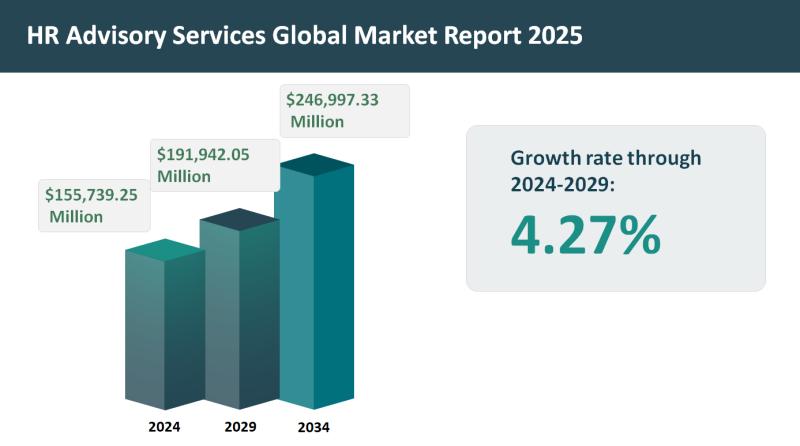

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…