Press release

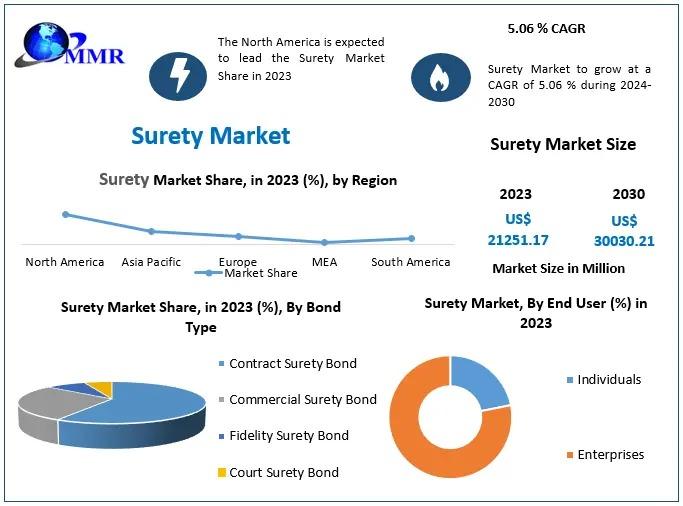

Surety Market to Soar to USD 30030.21 Million by 2030 with a 5.06 percentage CAGR

The 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 21251.17 Million in 2023 and the total Surety Market revenue is expected to grow at a CAGR of 5.06 % from 2024 to 2030, reaching nearly USD 30030.21 Million.𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The surety market serves as a critical financial mechanism wherein a surety, typically a bonding company, guarantees the obligations of a principal to a third party, known as the obligee. This arrangement is vital for ensuring that contractual commitments are met, especially in large-scale infrastructure projects, where financial guarantees are often mandatory. The market's growth is significantly influenced by increasing government spending on infrastructure and the corresponding demand for surety bonds, which facilitate project completion and secure financial transactions. North America dominates this market due to its well-established construction sector and stringent regulatory frameworks, while Europe and the Asia-Pacific regions are also witnessing growth, driven by emerging construction activities and government initiatives.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐎𝐮𝐫 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/request-sample/185094/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭:

The growth of the surety market is primarily driven by heightened government infrastructure spending, which serves as a significant catalyst for increased demand for surety bonds. Initiatives such as the substantial infrastructure investment plans in the United States and India demonstrate the government's commitment to improving public assets, thereby necessitating financial guarantees for various construction projects. With billions allocated for the modernization of infrastructure, the reliance on surety bonds to ensure project completion and financial responsibility is more critical than ever. These bonds provide reassurance to project owners and stakeholders that contractual obligations will be fulfilled, thus fostering a conducive environment for investment and growth.

Additionally, the changing regulatory landscape plays a pivotal role in the expansion of the surety market. Regulatory bodies, particularly in the U.S., have introduced measures such as increasing contract limits for the Surety Bond Guarantee Program, allowing small businesses greater access to significant federal contracts. This shift not only empowers small enterprises to secure more substantial projects but also enhances competition within the industry. As businesses increasingly recognize the value of surety bonds in mitigating financial risks and ensuring compliance with contractual obligations, the market is expected to experience robust growth fueled by these regulatory advancements.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

Technological innovation is reshaping the surety market landscape, as firms adopt advanced digital tools to streamline bond processing and enhance operational efficiency. The integration of technologies like blockchain and artificial intelligence is transforming traditional practices, making the issuance and management of surety bonds more transparent and secure. For instance, the adoption of electronic signature technologies facilitates quicker approvals and reduces the cumbersome paperwork typically associated with bond issuance. As firms increasingly embrace these advancements, they not only improve their service offerings but also attract new businesses to the surety market, fostering a culture of innovation and efficiency.

𝐓𝐡𝐞 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐜𝐚𝐧 𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/inquiry-before-buying/185094/

𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

The surety market is ripe with opportunities, particularly in the context of increasing infrastructure projects globally. Governments are prioritizing infrastructure development as a means of stimulating economic growth, which translates into a higher demand for surety bonds to ensure these projects are executed successfully. In emerging markets, such as India, recent initiatives like the introduction of Surety Insurance Bonds illustrate how financial instruments can facilitate the completion of vital infrastructure projects while boosting contractors' capacities. As countries seek to enhance their economic landscapes through infrastructure investment, the surety market will likely expand to meet these growing needs.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭?

The surety market's regional dynamics reveal significant variations in growth and demand across different areas. North America remains the largest market, accounting for over half of the global share, propelled by a robust construction industry and stringent regulatory requirements. The prevalence of significant infrastructure projects necessitates the use of surety bonds, ensuring compliance and financial accountability in contractual agreements. Well-established surety providers and a favorable regulatory environment further enhance the market's attractiveness in this region, making it a leader in the surety landscape.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐮𝐥𝐥 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 @https://www.maximizemarketresearch.com/request-sample/185094/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭:

by Bond Type

Contract Surety Bond

Commercial Surety Bond

Fidelity Surety Bond

Court Surety Bond

by End-User

Individuals

Enterprises

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. AoN (United Kingdom)

2. Arch Insurance Group (Bermuda)

3. Berkshire Hathaway Specialty Insurance (U.S)

4. Chubb Limited (Switzerland)

5. CNA Financial Corporation(U.S)

6. Everest Re Group, Ltd.(Bermuda)

7. IAT Insurance Group (U.S)

8. Intact US insurance (NY)

9. Liberty Mutual Insurance Group (U.S)

10. Markel Corporation (U.S)

11. Marsh McLennan (NY)

12. Nationwide Mutual Insurance Company (Ohio)

13. Old Republic Surety Company (U.S)

14. QBE Insurance Group Limited (NY)

15. The Hanover Insurance Group (U.S)

16. The Hartford Financial Services Group, Inc (U.S)

17. The Travelers Companies, Inc. (U.S)

18. Tokio Marine HCC (U.S)

19. XL Catlin (Bermuda)

20. Zurich Insurance Group (Switzerland)

𝐅𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐢𝐬𝐢𝐭 :https://www.maximizemarketresearch.com/market-report/surety-market/185094/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

Past Market Size and Competitive Landscape

Surety Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Surety Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐅𝐨𝐫 𝐚𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐫𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐭𝐨𝐩𝐢𝐜𝐬, 𝐯𝐢𝐬𝐢𝐭 𝐨𝐮𝐫 𝐰𝐞𝐛𝐬𝐢𝐭𝐞:

♦ Global Aloe Vera Extract Market https://www.maximizemarketresearch.com/market-report/global-aloe-vera-extract-market/24071/

♦ Industrial Gas Turbine Market https://www.maximizemarketresearch.com/market-report/industrial-gas-turbine-market/164195/

♦ Global Alopecia Therapeutics Market https://www.maximizemarketresearch.com/market-report/global-alopecia-therapeutics-market/99807/

♦ Global Commercial Satellite Launch Service Market https://www.maximizemarketresearch.com/market-report/commercial-satellite-launch-service-market/11777/

♦ Global Ovarian Cancer Drugs Market https://www.maximizemarketresearch.com/market-report/global-ovarian-cancer-drugs-market/23883/

♦ Global Waterproofing Membranes Market https://www.maximizemarketresearch.com/market-report/global-waterproofing-membranes-market/31412/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market to Soar to USD 30030.21 Million by 2030 with a 5.06 percentage CAGR here

News-ID: 3709983 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

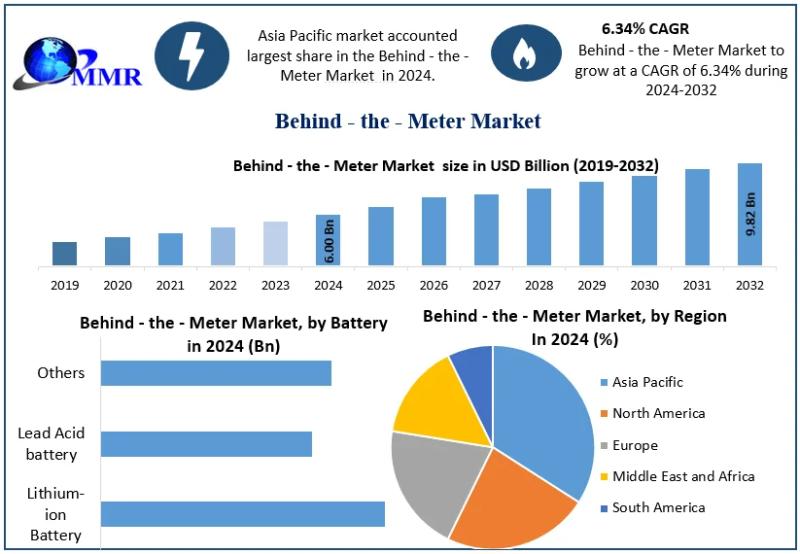

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

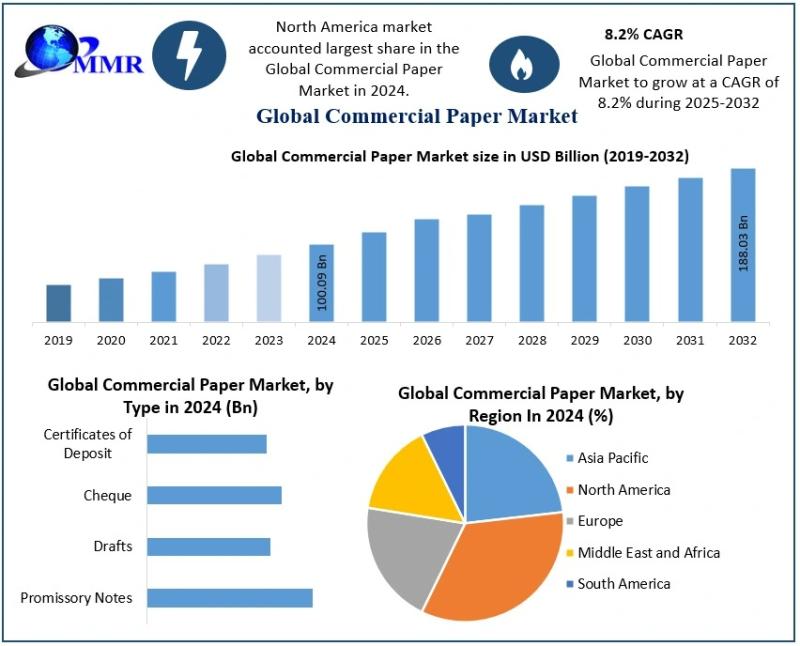

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

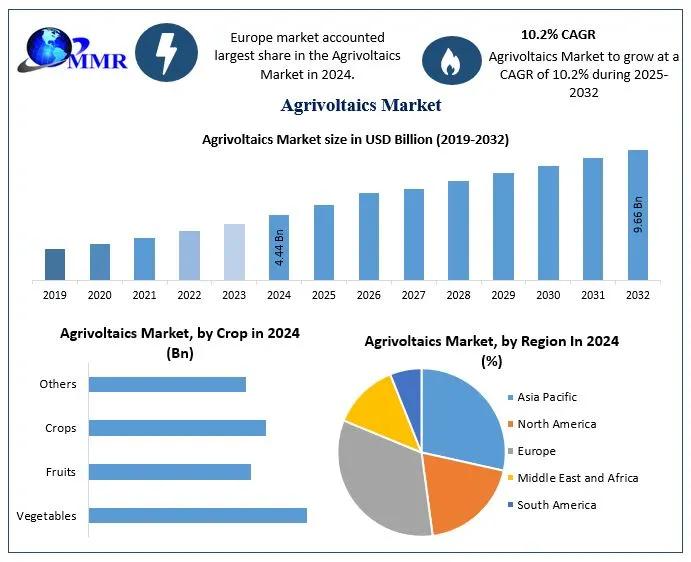

Agrivoltaics Market to Reach USD 9.66 Billion by 2032: Unlocking Dual-Use Land f …

The Global Agrivoltaics Market size was valued at USD 4.44 Billion in 2024 and is anticipated to reach nearly USD 9.66 Billion by 2032, growing at a CAGR of 10.2 % from 2025 to 2032, driven by rising demand for renewable energy solutions and sustainable agriculture practices.

Market Overview

Agrivoltaics - also called "dual-use farming" - integrates photovoltaic (PV) solar power systems with agricultural land, enabling simultaneous cultivation and energy generation on…

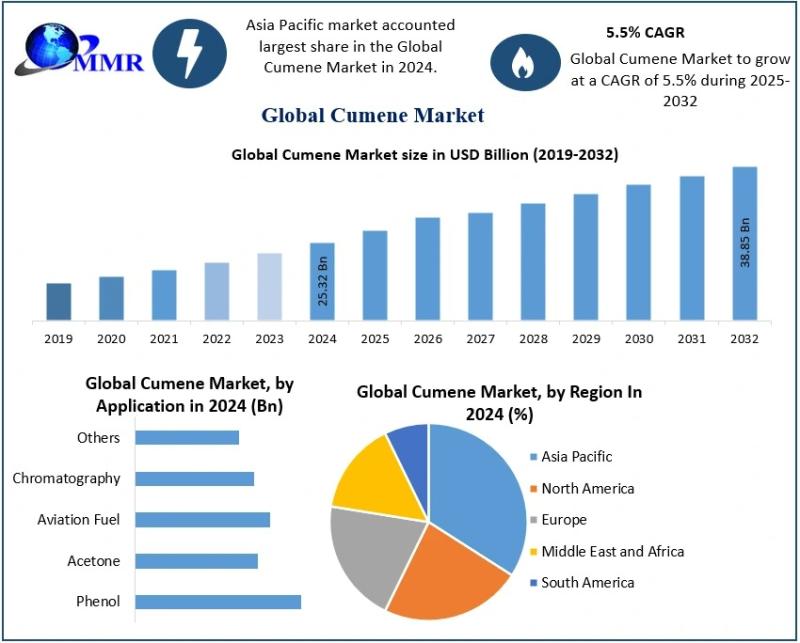

Cumene Market Outlook 2032: Asia-Pacific Emerges as the Fastest-Growing Region a …

The Cumene Market size was valued at USD 25.32 Billion in 2024 and the total Cumene revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 38.85 Billion.

The Cumene Market is witnessing consistent expansion as rising demand from downstream chemical industries strengthens its global footprint. Cumene, also known as isopropylbenzene, is a critical aromatic hydrocarbon primarily used in the production of phenol and…

More Releases for Surety

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market Opportunities and Forecast Assessment till 2027

According to a recent research study added to the document repository of ResearchMoz, the Global Surety Market is likely to garner the valuation of XX Mn/Bn at the end of forecast period 2021–2027. Further, the assessment report notes that the market for Surety will expand at extensive CAGR of XX% throughout assessment period.

Surety Market: Overview

Growth avenues, drivers, restraints, demand–supply ratio, and challenges are some of the key factors presented in the new…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…

Contract surety bond holding nearly half of the surety market share

The global surety market at US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% during the forecast period 2019 – 2027, to account to US$ 28.77 Bn by 2027.

The Surety market penetration rates in North America region is higher than any other markets across the globe. This is attributed to most of U.S. State governments’ laws that mandate surety bonds. Both the U.S. and…