Press release

Insurance Rating Software Market Getting Back To Stellar Growth Ahead: EZLynx, Fineos, Vertafore

HTF MI introduces new research on Insurance Rating Software covering the micro level of analysis by competitors and key business segments (2024-2030). The Insurance Rating Software explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled in the study are EZLynx (United States), Fineos (Ireland), Applied Systems, Inc (United States), Earnix (Israel), Insurance Technologies Corporation (United States), Vertafore, Inc. (United States), CGI Inc. (Canada), tigerlab GmbH (Switzerland), West Point Insurance (United States), Solartis (United States), OneShield (United States), Duck Creek Technologies (United States), Policy Administration Solutions (United States), Bytesforce (Singapore), Jarus Technologies (United States).Get Free Sample Report + All Related Graphs & Charts @ https://www.htfmarketintelligence.com/sample-report/global-insurance-rating-software-market?utm_source=Alefiya_OpenPR&utm_id=Alefiya

On the off chance that you are engaged with the industry or expect to be, at that point this investigation will give you a complete perspective. It's crucial you stay up with the latest sectioned by Applications [Private Insurance Companies, Government Insurance Companies, Insurance Brokers and Agencies], Product Types [Cloud-Based, On-Premises] and some significant parts of the business.

Definition:

The Insurance Rating Software Market refers to the industry that develops and provides software solutions designed to help insurance companies calculate premiums and assess risks for various insurance policies. These software platforms automate the rating process by analyzing factors such as policyholder data, risk variables, and regulatory requirements to generate accurate and consistent insurance quotes. They are used in multiple types of insurance, including auto, health, life, and property insurance. The market is driven by the need for efficiency, compliance, and customization in the insurance industry, as well as advancements in data analytics and AI integration.

Market Trends:

AI and machine learning enhance risk prediction and pricing flexibility in insurance rating software.

Cloud-based and API-based solutions improve scalability, integration, and efficiency, with growing interest in blockchain for data security.

Market Drivers:

Complex insurance products and personalized policies drive adoption of insurance rating software.

Regulatory demands for transparency and competition push insurers toward automated and data-driven solutions.

Market Opportunities:

Usage-based insurance models and integration with InsurTech innovations offer growth opportunities.

Expanding into emerging markets and catering to small and mid-sized insurers presents further potential for advanced rating technologies.

Buy the Full Research report of Insurance Rating Software Market @ https://www.htfmarketintelligence.com/buy-now?format=1&report=12983?utm_source=Alefiya_OpenPR&utm_id=Alefiya

Insurance Rating Software Market by Key Players: EZLynx (United States), Fineos (Ireland), Applied Systems, Inc (United States), Earnix (Israel), Insurance Technologies Corporation (United States), Vertafore, Inc. (United States), CGI Inc. (Canada), tigerlab GmbH (Switzerland), West Point Insurance (United States), Solartis (United States), OneShield (United States), Duck Creek Technologies (United States), Policy Administration Solutions (United States), Bytesforce (Singapore), Jarus Technologies (United States)

Which market aspects are illuminated in the report?

Executive Summary: It covers a summary of the most vital studies, the Insurance Rating Software market increasing rate, modest circumstances, market trends, drivers and problems as well as macroscopic pointers.

Study Analysis: Covers major companies, vital market segments, and the scope of the products offered in the Insurance Rating Software market, the years measured, and the study points.

Company Profile: Each Firm well-defined in this segment is screened based on a product's, value, SWOT analysis, ability, and other significant features.

Manufacture by region: This Insurance Rating Software report offers data on imports and exports, sales, production, and key companies in all studied regional markets

Insurance Rating Software Market by Geographical Analysis:

• APAC (Japan, China, South Korea, Australia, India, and the Rest of APAC; the Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Avail Limited Period Offer /Discount on Immediate purchase @ https://www.htfmarketintelligence.com/request-discount/global-insurance-rating-software-market?utm_source=Alefiya_OpenPR&utm_id=Alefiya

The study is a source of reliable data on Market segments and sub-segments, Market trends and dynamics Supply and demand Market size Current trends/opportunities/challenges Competitive landscape Technological innovations Value chain, and investor analysis.

Interpretative Tools in the Market: The report integrates the entirely examined and evaluated information of the prominent players and their position in the market by methods for various descriptive tools. The methodical tools including SWOT analysis, Porter's five forces analysis, and investment return examination were used while breaking down the development of the key players performing in the market.

Key Growths in the Market: This section of the report incorporates the essential enhancements of the marker that contains assertions, coordinated efforts, R&D, new item dispatch, joint ventures, and associations of leading participants working in the market.

Key Points in the Market: The key features of this Insurance Rating Software market report includes production, production rate, revenue, price, cost, market share, capacity, capacity utilization rate, import/export, supply/demand, and gross margin. Key market dynamics plus market segments and sub-segments are covered.

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Browse for Full Report at @ https://www.htfmarketintelligence.com/report/global-insurance-rating-software-market

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Australia or Southeast Asia.

Contact Us:

Nidhi Bhavsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Rating Software Market Getting Back To Stellar Growth Ahead: EZLynx, Fineos, Vertafore here

News-ID: 3700917 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

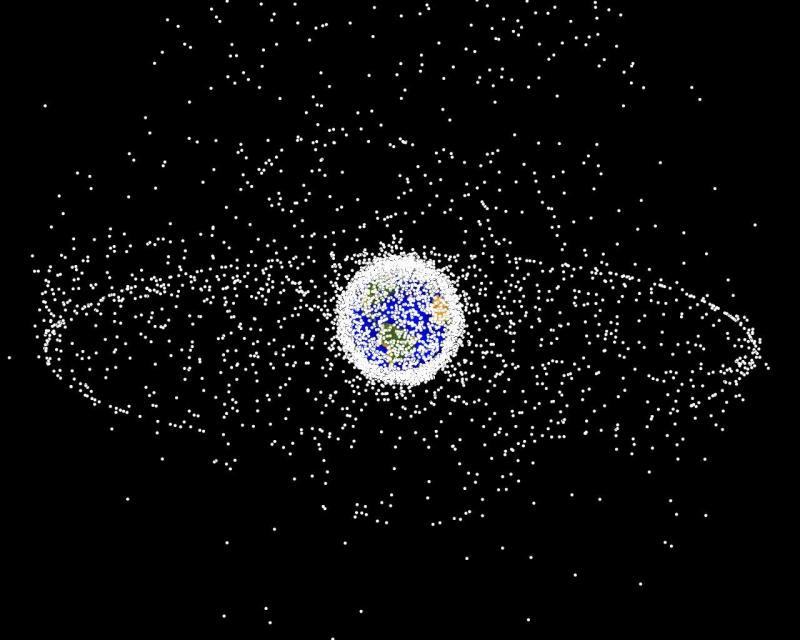

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…