Press release

Market Size, Opportunities, and Growth Strategies in the Finance Cloud Industry

The Business Research Company recently released a comprehensive report on the Global Finance Cloud Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The finance cloud market size has grown rapidly in recent years. It will grow from $61.29 billion in 2023 to $72.12 billion in 2024 at a compound annual growth rate (CAGR) of 17.7%. The growth in the historic period can be attributed to legacy system challenges, cost efficiency, scalability requirements, data security concerns, globalization trends.

The finance cloud market size is expected to see rapid growth in the next few years. It will grow to $137.16 billion in 2028 at a compound annual growth rate (CAGR) of 17.4%. The growth in the forecast period can be attributed to regulatory changes, enhanced user experience, rising cybersecurity threats, data analytics and business intelligence, mobile access and flexibility. Major trends in the forecast period include innovative technologies integration, technology advancements, collaborative work environments, hybrid cloud adoption, interconnected ecosystems.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/finance-cloud-global-market-report

Market Drivers and Trends:

The rising digital transformation is expected to propel the growth of the finance cloud market going forward. Digital transformation refers to the process of leveraging digital technologies to fundamentally change or improve business operations, strategies, and customer experiences. Digital transformation continuously innovate and bring new services, and solutions to market for personalized, user-friendly interactions that enhance customer satisfaction. The finance cloud is utilized in digital transformation to enable organizations to modernize IT infrastructure, enhance customer experiences, leverage data-driven insights, automate processes, manage risk, and ensure compliance. For instance, in November 2022, according to the Mind the Tech Gap survey conducted among approximately 2,700 executives in 13 countries by Boston Consulting Group (BCG), a US-based management consulting firm, up to 60% of enterprises intend to boost their investments in digital transformation by 2023, despite a declining global economy. Therefore, the rising digital transformation is driving the growth of the process orchestration market.

Major companies operating in the finance cloud market are concentrating on technological innovations and advancements, such as financial services cloud, to help enterprises accelerate business value and innovation in the cloud. Financial services cloud typically refers to a cloud-based platform or solution designed specifically for the financial services industry, and this is designed to help small and medium-sized financial services enterprises accelerate cloud adoption and development. For instance, in April 2022, Infosys Technologies Private Limited, an India-based global consulting and IT services company, launched cobalt financial services cloud, which offers security and regulatory compliance built into the platform, financial services-specific assets and use cases, the capability to rapidly deliver cloud-native business platforms, and low-code apps for use by business and citizen developers, among others. It benefits services, assets, and frameworks to accelerate enterprise cloud adoption and the development of cloud-native platforms and applications. Additionally, these features are aimed at helping financial services firms unleash the power of cloud-driven transformation and accelerate business value and innovation in the cloud.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=14374&type=smp

Major Key Players of the Market:

Microsoft Corporation, International Business Machine Corporation, Oracle Corporation, SAP SE, Salesforce Inc., Fiserv Inc., Intuit Inc., Fidelity Information Services Global, Dassault Systèmes SE, Wolters Kluwer NV, Broadridge Financial Solutions Inc., SS&C Technologies Holdings Inc., Workday Inc., Morgan Stanley Capital International Inc., SAGE Group plc, FactSet Research Systems Inc., ACI Worldwide Inc., TIBCO Software Inc., Alteryx Inc., Temenos Group AG, Ellucian Company L.P., BlackLine Inc., Q2 Holdings Inc., Bottomline Technologies Inc., nCino Inc.

Finance Cloud Market 2024 Key Insights:

• The finance cloud market size is expected to grow to $137.16 billion in 2028 at a compound annual growth rate (CAGR) of 17.4%.

• Impact Of Digital Transformation On The Growth Of The Finance Cloud Market

• Cobalt Financial Services Cloud Acts As A Breakthrough In Finance Technology

• North America was the largest region in the finance cloud market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=14374&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Market Size, Opportunities, and Growth Strategies in the Finance Cloud Industry here

News-ID: 3698392 • Views: …

More Releases from The Business research company

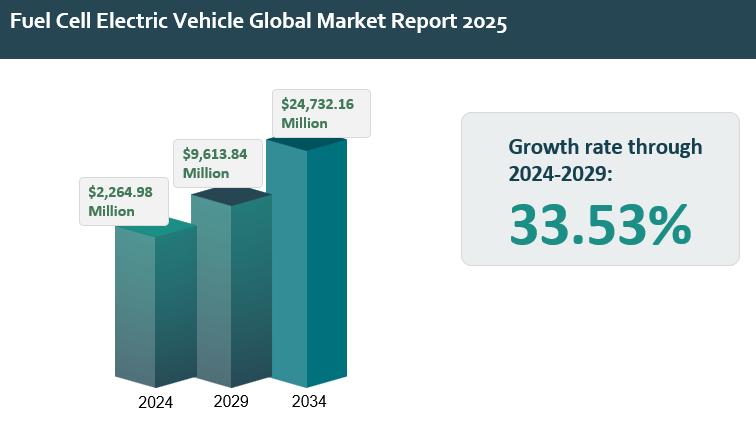

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

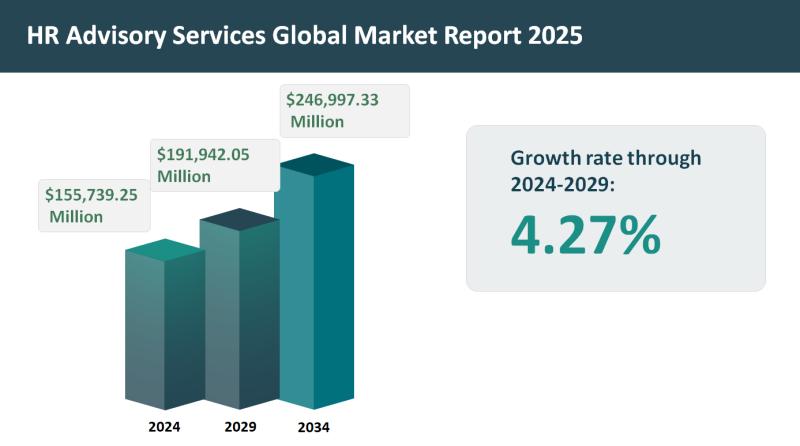

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…