Press release

Motor Insurance Market Set to Surge to USD 1,630.0 Billion by 2032 at a 7.4% CAGR | IMARC Group

𝐆𝐥𝐨𝐛𝐚𝐥 𝐌𝐨𝐭𝐨𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲: 𝐊𝐞𝐲 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧 𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

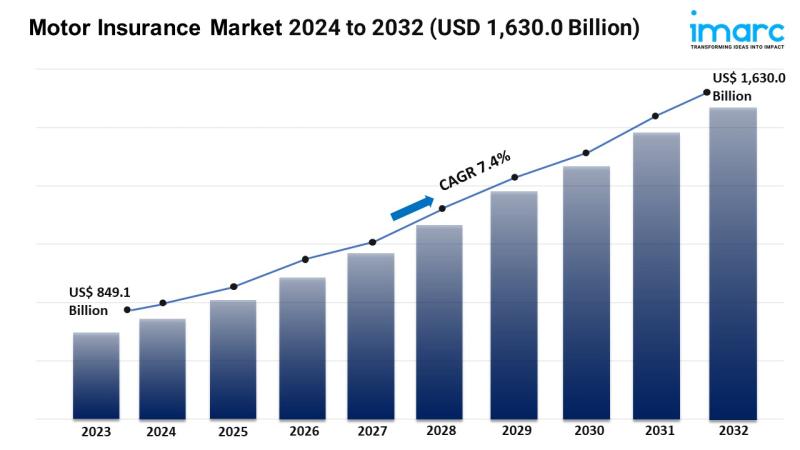

● The global motor insurance market size reached USD 849.1 Billion in 2023.

● The market is expected to reach USD 1,630.0 Billion by 2032, exhibiting a growth rate (CAGR) of 7.4% during 2024-2032.

● North America leads the market, accounting for the largest motor insurance market share.

● Liability insurance accounts for the majority of the market share in the policy type segment as it provides essential protection for vehicle owners.

● On the basis of premium type, the market has been bifurcated into personal insurance premiums and commercial insurance premiums.

● Insurance agents/brokers hold the largest share in the motor insurance industry.

● The rising vehicle ownership is a primary driver of the motor insurance market.

● Increasing regulatory requirements and technological advancements are reshaping the motor insurance market.

𝐆𝐫𝐚𝐛 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/motor-insurance-market/requestsample

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

● 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠 𝐕𝐞𝐡𝐢𝐜𝐥𝐞 𝐎𝐰𝐧𝐞𝐫𝐬𝐡𝐢𝐩:

The rising trend of vehicle ownership is one of the primary drivers of the motor insurance market. As more individuals in both developed and emerging economies acquire vehicles, the need for insurance coverage becomes imperative. This is particularly noticeable in rapidly urbanizing areas where inflating income levels of individuals enable more consumers to purchase cars or motorcycles. With vehicle ownership comes the responsibility of ensuring financial protection against potential risks, such as accidents, theft, or damage. In line with this, the growing need for insurance on account of the increasing frequency of road traffic incidents is offering a favorable market outlook. Insurers offer a variety of products tailored to different customer segments, enhancing market competition.

● 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬:

Regulatory requirements play a crucial role in shaping the motor insurance market. Governing authorities of various countries are enacting laws mandating vehicle owners to obtain a minimum level of insurance coverage, such as third-party liability insurance. This legal obligation ensures that drivers have financial protection against claims resulting from accidents involving other parties, promoting accountability and safety on the roads. The enforcement of these regulations is leading to a consistent flow of policy sales. In addition, as governing agencies continue to emphasize road safety and consumer protection, they may introduce stricter regulations or expand coverage requirements, further driving demand for motor insurance. Insurers must adapt to these regulatory changes, creating new products or enhancing existing ones to comply with legal standards.

● 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬:

Innovations are revolutionizing the motor insurance market by enhancing user experiences and creating new product offerings. Advancements, such as telematics devices, allow insurers to monitor driving behavior in real time, enabling the development of usage-based insurance (UBI) policies. These policies reward safe driving habits with lower premiums, appealing to cost-conscious consumers and promoting safer driving practices. Furthermore, the utilization of mobile applications simplifies the purchasing process, allowing individuals to compare policies, submit claims, and access support services seamlessly. Artificial intelligence (AI) and machine learning (ML) are also improving underwriting processes, helping insurers assess risks more accurately and set competitive premiums. Additionally, digital channels enhance user engagement, making it easier for insurers to communicate with clients and provide personalized services.

𝐁𝐮𝐲 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/checkout?id=6150&method=502

𝐌𝐨𝐭𝐨𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐏𝐨𝐥𝐢𝐜𝐲 𝐓𝐲𝐩𝐞:

● Liability Insurance

● Comprehensive Coverage

● Collision Coverage

● Personal Injury Protection

Liability insurance account for the majority of shares as it provides essential protection for vehicle owners.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐓𝐲𝐩𝐞:

● Personal Insurance Premiums

● Commercial Insurance Premiums

On the basis of premium type, the market has been bifurcated into personal insurance premiums and commercial insurance premiums.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥:

● Insurance Agents/Brokers

● Direct Response

● Banks

● Others

Insurance agents/brokers represent the majority of shares due to their ability to serve as trusted intermediaries between consumers and insurance companies.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position owing to a large market for motor insurance driven by high vehicle ownership rates.

𝐀𝐬𝐤 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐟𝐨𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/request?type=report&id=6150&flag=C

𝐓𝐨𝐩 𝐌𝐨𝐭𝐨𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬:

The motor insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

● American International Group Inc.

● Assicurazioni Generali S.p.A.

● AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.)

● Bajaj Allianz General Insurance Company Limited

● China Ping An Insurance Co. Ltd.

● Government Employees Insurance Company (Berkshire Hathaway Inc.)

● Reliance General Insurance Company Limited (Reliance Capital Limited )

● State Farm Mutual Automobile Insurance Company

● The Hanover Insurance Group Inc. (Opus Investment Management)

● The Progressive Corporation

● Universal Sompo General Insurance Company Limited

● Zurich Insurance Group Ltd.

𝐈𝐟 𝐲𝐨𝐮 𝐫𝐞𝐪𝐮𝐢𝐫𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐨𝐯𝐞𝐫𝐞𝐝 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐎𝐭𝐡𝐞𝐫 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐁𝐲 𝐈𝐌𝐀𝐑𝐂 𝐆𝐫𝐨𝐮𝐩:

𝐀𝐦𝐦𝐮𝐧𝐢𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.einpresswire.com/article/723020256/ammunition-market-size-to-hit-us-34-6-billion-by-2032-grow-cagr-by-3-62

𝐞𝐕𝐓𝐎𝐋 𝐀𝐢𝐫𝐜𝐫𝐚𝐟𝐭 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.einpresswire.com/article/723021854/evtol-aircraft-market-to-grow-worth-usd-35-1-billion-by-2032-exhibiting-cagr-of-11-87

𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.einnews.com/pr_news/722649599/supply-chain-analytics-market-to-hit-us-30-6-billion-at-15-5-cagr-by-2032-imarc-group

𝐏𝐨𝐮𝐥𝐭𝐫𝐲 𝐅𝐞𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.einpresswire.com/article/720886026/poultry-feed-market-size-to-hit-us-289-0-billion-by-2032-with-a-3-5-cagr

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Motor Insurance Market Set to Surge to USD 1,630.0 Billion by 2032 at a 7.4% CAGR | IMARC Group here

News-ID: 3698352 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…