Press release

Global Diamond-based Semiconductors Market Research Report 2024

The "Global Diamond-based Semiconductors Market" Size was estimated at USD 55 Million in 2024 and is projected to reach USD 120.7 Million by 2030, exhibiting a CAGR of 14.0% during the forecast period.Diamond is known to have the highest potential performance (limit) of semiconductor device materials. Due to its inherent characteristics, diamond is called "limit wideband gap semiconductor material".

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/258330/global-diamondbased-semiconductors-market-2024-24

The distinct qualities of diamond materials, which provide notable benefits over conventional semiconductor materials like silicon and gallium nitride, are the main drivers of the worldwide diamond-based semiconductors industry's rise to prominence within the larger semiconductor market. Diamond is a popular choice for high-power and high-frequency electrical applications because of its remarkable thermal conductivity, broad bandgap, and high breakdown voltage. These characteristics make it possible for diamond-based semiconductors to function well in harsh settings where dependability and performance are crucial, including those found in the automotive, aircraft, and defence industries.

Chemical vapour deposition (CVD) and other recent developments in synthetic diamond growth processes have greatly lowered production costs and enhanced the quality of diamond materials, making it easier to incorporate them into electronic systems. These developments have created new opportunities for diamond-based semiconductors in a number of fields, such as optoelectronics, radio frequency (RF) devices, and power electronics. Industries are looking more closely at how diamond-based semiconductors might increase device efficiency, decrease size, and improve thermal management as the need for high-performance electronics and energy-efficient devices grows.

Segmental Analysis

Microwave Plasma Chemical Vapor Deposition (MPCVD) to hold the highest market share: By Type

Hot Filament Chemical Vapor Deposition (HFCVD), Microwave Plasma Chemical Vapor Deposition (MPCVD), Plasma Jet Chemical Vapor Deposition, Others.

The largest market share in the global diamond-based semiconductors industry is held by microwave plasma chemical vapour deposition, or MPCVD. Because of its superior uniformity and control over the deposition process, this method is preferred for producing high-quality diamond films. By creating a high-energy environment using microwave plasma, MPCVD devices enable the creation of high-purity and high-performance diamond materials and allow for the deposition of diamond at lower temperatures. Applications in a variety of fields, such as electronics, optics, and advanced materials, where diamond's excellent thermal conductivity, broad bandgap, and chemical stability are essential, are driving the need for MPCVD. Further supporting MPCVD's market domination is the growing use of diamond-based semiconductors in high-power and high-frequency electronic devices such RF amplifiers and high-temperature sensors.

While Hot Filament Chemical Vapor Deposition (HFCVD) is also a significant method for diamond growth, particularly for applications requiring lower cost and simplicity, it tends to produce films with lower quality compared to MPCVD, which limits its market share. Plasma Jet Chemical Vapor Deposition and other methods are used for specific applications but represent a smaller portion of the overall market due to their niche capabilities and limitations in comparison to the more widely adopted MPCVD technology. Thus, MPCVD remains the leader in the diamond-based semiconductors market, driven by its superior performance and versatility in various applications.

Water Foundry to hold the highest market share: By Type

In terms of Application the global market has been segmented as Wafer Foundry, Integrated Circuit Device Manufacturer.

In contrast to Integrated Circuit Device Manufacturers, Wafer Foundries have the largest market share in the semiconductor industry. Specialised establishments known as wafer foundries produce semiconductor wafers for a range of customers, including integrated circuit (IC) design firms without their own fabrication operations (fabs). Since many businesses are outsourcing their production to specialised foundries as a result of the growing complexity and expense of semiconductor manufacture, the foundry model has become increasingly popular. By providing cutting-edge manufacturing techniques and technologies that facilitate the creation of a broad variety of semiconductor devices, major companies in the wafer foundry market, including Taiwan Semiconductor Manufacturing Company (TSMC), Global Foundries, and Samsung Foundry, control the market. The demand for wafer foundries has increased due to the development of technologies like 5G, IoT, AI, and automotive electronics, which offer the scale and flexibility required to satisfy the market's quickly changing demands.

However, although they are equally important participants in the semiconductor ecosystem, integrated circuit device manufacturers usually concentrate on creating and producing particular semiconductor devices (such memory chips, microprocessors, and application-specific ICs). Wafer foundries, on the other hand, have a greater market share overall since many of these firms depend on them for their production requirements. Wafer foundries are projected to maintain their leading position in the semiconductor business as a result of the trend towards outsourcing semiconductor manufacture to foundries.

Regional Overview

The regional landscape of the semiconductor market, particularly focusing on wafer foundries and integrated circuit device manufacturers, is diverse and influenced by various factors, including technological advancements, manufacturing capabilities, and government policies.

Due to the existence of top wafer foundries like Samsung Foundry in South Korea and Taiwan Semiconductor Manufacturing Company (TSMC) in Taiwan, respectively, Asia-Pacific dominates the semiconductor business and holds a sizable proportion. By utilising cutting-edge technologies and strong supply chains, these nations have become world leaders in the production of semiconductors. The region's leadership in the industry is further supported by significant investments in expanding fabrication facilities and a strong emphasis on research and development. Furthermore, nations like China and Japan are advancing semiconductor design and production significantly, which is contributing to the Asia-Pacific market's overall growth.

The existence of significant integrated circuit device makers like Intel, NVIDIA, and Qualcomm makes North America another crucial region. With large investments in semiconductor research and development, the United States boasts a robust innovation environment that has advanced chip design and technology. It is also anticipated that the recent push to onshore semiconductor manufacturing capabilities in the United States will strengthen domestic foundries and lessen reliance on international supply chains. Through attempts to increase domestic production capabilities and decrease dependency on external suppliers, Europe is progressively expanding its footprint in the semiconductor market. Nations like the Netherlands, France, and Germany are concentrating on creating cutting-edge semiconductor technology and encouraging partnerships between businesses and academic institutions.

Although they are still smaller markets, Latin America and the Middle East and Africa are gradually expanding in the semiconductor sector. Due to growing local demand for electronics and initiatives to create innovation centres, several nations are starting to invest in their capacity to manufacture semiconductors.

Competitive Analysis

Element Six

Morgan Technical Ceramics

Sumitomo Electric

Advanced Diamond Technologies

NeoCoat

AKHAN Semiconductor

Other key Players

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/258330/global-diamondbased-semiconductors-market-2024-24

The diamond-based semiconductor market is characterized by intense competition among various players, including manufacturers of diamond materials, deposition equipment providers, and research institutions. Key players in the market include Element Six, Advanced Diamond Technologies, etc. each leveraging unique technologies and applications to differentiate themselves. The competition is further intensified by the emergence of new players and startups that are innovating in diamond synthesis and processing techniques, such as Microwave Plasma Chemical Vapor Deposition (MPCVD) and Hot Filament Chemical Vapor Deposition (HFCVD). These technologies are crucial for producing high-quality diamond films, and companies that can offer cost-effective solutions while maintaining high quality are likely to gain a competitive advantage.

Recent Development

February 17th, 2022, AKHAN Semiconductor (AKHAN), a technology company specializing in lab-grown electronics-grade diamond materials today announced that it has raised $20 million of committed capital led by strategic financial partners. In addition to the funding round, AKHAN also announced the hiring of Craig Mitchell as Chief Executive Officer and John Thode as COO/President. The highly skilled and distinguished executives, with decades of leadership experience in technology and supply chain development, manufacturing operations and intellectual property licensing, will be essential to AKHAN as it brings its breakthrough Miraj Diamond® Technology to market.

John Crane announced the acquisition of Advanced Diamond Technologies. The company has finalized its purchase of the Industrial Division of Advanced Diamond Technologies (ADT)."John Crane's acquisition of the Industrial Division of ADT underscores our commitment to technology as a key driver of strategic growth," said Jean Vernet, President and CEO of John Crane.

Industry Dynamics

Industry Driver

Increasing Demand for High-Performance Electronic Devices

The growing need for high-performance electronic devices across a range of industries, including telecommunications, defence, automotive, and industry, is a major factor propelling the market for diamond-based semiconductors. Because of their remarkable thermal conductivity, broad bandgap, and high breakdown voltage, diamond semiconductors are perfect for high-frequency and high-power applications where conventional semiconductor materials like silicon and gallium nitride would not work as well. Diamond-based semiconductors provide benefits like better heat dissipation, less energy waste, and higher performance in harsh conditions as industries shift towards miniaturisation and the requirement for more dependable and efficient components. As a result, there is increasing interest in using diamond technology in sensors, RF devices, and high-power electronics, especially in applications like 5G telecommunications, electric cars, and high-temperature settings.

The push for advanced materials that can handle the increasing demands of modern electronic systems is driving investment and research in diamond-based semiconductor technologies, further propelling market growth. As the performance requirements for electronic devices continue to rise, the unique properties of diamond semiconductors are positioned to play a crucial role in meeting these challenges, making them a key driver in the market.

Industry Restraint

Higher Cost of Production

The high cost of production is a major barrier to the market for semiconductors based on diamond. Diamond semiconductor manufacturing requires advanced equipment and exact control over deposition conditions, especially when using Chemical Vapour Deposition (CVD) techniques like Hot Filament Chemical Vapour Deposition (HFCVD) and Microwave Plasma Chemical Vapour Deposition (MPCVD). This leads to high operating and capital costs, which can restrict production scalability and raise the cost of diamond-based devices relative to more conventional semiconductor materials like silicon or gallium nitride. Furthermore, it might be difficult to produce high-quality diamond wafers with the required qualities, which can result in variations in the performance and quality of the final product. Potential clients may be turned off by these elements, especially in areas where cost competitiveness is essential and prices are high.

Additionally, the market's expansion is impeded by prospective end users' poor knowledge and comprehension of diamond semiconductor technology, which can impede adoption rates. Companies must overcome major obstacles to increase the use of diamond-based semiconductors in a variety of applications, including high production costs and difficulties with market education.

Industry Trend

Increasing focus on Research and development

The increasing emphasis on research and development (R&D) to improve the performance and scalability of diamond semiconductor technologies is a notable trend in the market for diamond-based semiconductors. Significant investments are being made to investigate cutting-edge production techniques, such as sophisticated Chemical Vapour Deposition (CVD) procedures, that enhance the quality and yield of diamond wafers, in response to the growing demand for high-performance electronic devices.

In order to produce composite structures that capitalise on the advantages of each element, researchers and businesses are also looking into hybrid techniques that combine diamond with other materials like gallium nitride or silicon carbide. For high-power and high-frequency applications, this movement seeks to create devices with better efficiency, higher breakdown voltages, and better thermal management. Additionally, there is an increasing interest in the potential use of diamond semiconductors in emerging technologies, such as quantum computing, high-temperature electronics, and photonic applications. The unique properties of diamond, such as its wide bandgap and ability to operate effectively in harsh environments, position it as a promising candidate for these advanced applications.

Moreover, collaborations between academia, research institutions, and industry players are becoming more prevalent, driving innovation and accelerating the commercialization of diamond-based semiconductor technologies. As these trends continue to evolve, the diamond-based semiconductor market is likely to see advancements that enhance its applicability and performance across various sectors, further propelling its growth.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Types, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market's competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

Attributes

Details

Segments

By Type

Hot Filament Chemical Vapor Deposition (HFCVD)

Microwave Plasma Chemical Vapor Deposition (MPCVD)

Plasma Jet Chemical Vapor Deposition

Others

By Application

Wafer Foundry

Integrated Circuit Device Manufacturer

Region Covered

Key Market Players

Report Coverage

Chapter Outline

Chapter 1 mainly introduces the statistical scope of the report, market division standards, and market research methods.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the Diamond-based Semiconductors Market and its likely evolution in the short to mid-term, and long term.

Chapter 3 makes a detailed analysis of the Market's Competitive Landscape of the market and provides the market share, capacity, output, price, latest development plan, merger, and acquisition information of the main manufacturers in the market.

Chapter 4 is the analysis of the whole market industrial chain, including the upstream and downstream of the industry, as well as Porter's five forces analysis.

Chapter 5 introduces the latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 6 provides the analysis of various market segments according to product types, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 7 provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 8 provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 9 introduces the basic situation of the main companies in the market in detail, including product sales revenue, sales volume, price, gross profit margin, market share, product introduction, recent development, etc.

Chapter 10 provides a quantitative analysis of the market size and development potential of each region in the next five years.

Chapter 11 provides a quantitative analysis of the market size and development potential of each market segment (product type and application) in the next five years.

Chapter 12 is the main points and conclusions of the report.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/258330/global-diamondbased-semiconductors-market-2024-24

Table of content

Table of Contents

1 Research Methodology and Statistical Scope

1.1 Market Definition and Statistical Scope of Diamond-based Semiconductors

1.2 Key Market Segments

1.2.1 Diamond-based Semiconductors Segment by Type

1.2.2 Diamond-based Semiconductors Segment by Application

1.3 Methodology & Sources of Information

1.3.1 Research Methodology

1.3.2 Research Process

1.3.3 Market Breakdown and Data Triangulation

1.3.4 Base Year

1.3.5 Report Assumptions & Caveats

2 Diamond-based Semiconductors Market Overview

2.1 Global Market Overview

2.1.1 Global Diamond-based Semiconductors Market Size (M USD) Estimates and Forecasts (2019-2030)

2.1.2 Global Diamond-based Semiconductors Sales Estimates and Forecasts (2019-2030)

2.2 Market Segment Executive Summary

2.3 Global Market Size by Region

3 Diamond-based Semiconductors Market Competitive Landscape

3.1 Global Diamond-based Semiconductors Sales by Manufacturers (2019-2024)

3.2 Global Diamond-based Semiconductors Revenue Market Share by Manufacturers (2019-2024)

3.3 Diamond-based Semiconductors Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.4 Global Diamond-based Semiconductors Average Price by Manufacturers (2019-2024)

3.5 Manufacturers Diamond-based Semiconductors Sales Sites, Area Served, Product Type

3.6 Diamond-based Semiconductors Market Competitive Situation and Trends

3.6.1 Diamond-based Semiconductors Market Concentration Rate

3.6.2 Global 5 and 10 Largest Diamond-based Semiconductors Players Market Share by Revenue

3.6.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, India 411014

International: +1(332) 2424 294

Asia: +91 9169162030

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, India 411014

International: +1(332) 2424 294

Asia: +91 9169162030

We Expertise in Chemical industry segment to deliver a quality Market research services and providing a platform to the suppliers and buyers to meet their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Diamond-based Semiconductors Market Research Report 2024 here

News-ID: 3696048 • Views: …

More Releases from 24chemicalresearch

Molded Fiber Pulp Packaging for Food market 2026-2034: Pathways to Innovation & …

Global Molded Fiber Pulp Packaging for Food market demonstrates robust expansion, valued at USD 2.25 billionin 2026 with projections indicating growth to USD 3.80 billion by 2034, reflecting a 6.0% CAGR. This sustainable packaging solution gains traction as food manufacturers and retailers prioritize eco-friendly alternatives to plastic, driven by regulatory pressures and shifting consumer preferences.

Molded fiber pulp packaging, manufactured from recycled paperboard or agricultural byproducts, offers superior biodegradability and cushioning…

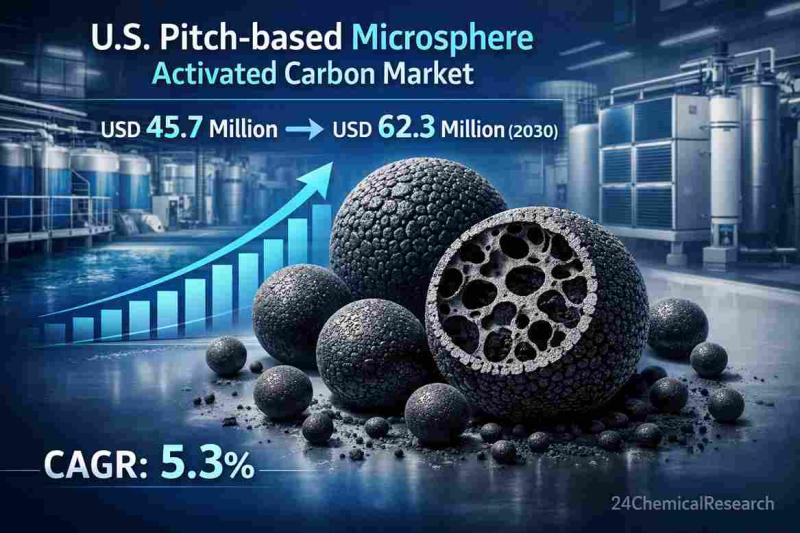

Is the global Pitch-based Microsphere Activated Carbon market growing rapidly an …

The United States Pitch-based Microsphere Activated Carbon market was valued at USD 45.7million in 2026 and is projected to reach USD 62.3 million by 2032, growing at a CAGR of 5.3 % during the forecast period. This specialized adsorbent material - featuring spherical particles with controlled pore structures - continues gaining traction across high-performance purification applications where standard granular activated carbon falls short.

Pitch-based microsphere activated carbon demonstrates superior performance in…

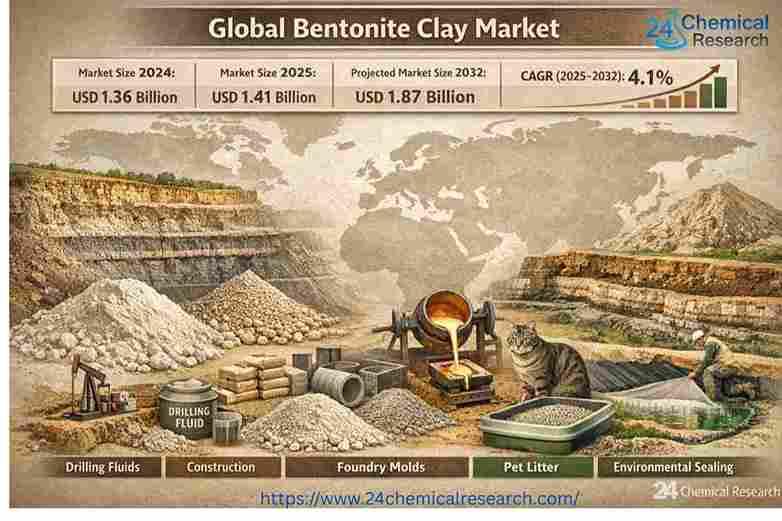

Global Bentonite Clay Market Poised for Steady Growth, Projected to Reach USD 1. …

Driven by construction boom and environmental applications, the versatile mineral market exhibits resilience and innovation amid challenges.

Global bentonite clay market, valued at USD 1.36 billion in 2024, is on a trajectory of consistent expansion, according to the latest comprehensive analysis by 24chemicalresearch. The market is projected to grow at aCAGR of 4.1%, reaching an estimated USD 1.41 billion in 2025 and USD 1.87 billion by 2032.

This growth underscores the enduring…

Global Ammonium Bicarbonate Market Report 2025-2032: Industry Size, Share & Stra …

Global Ammonium Bicarbonate Market continues to demonstrate stable demand across multiple industries, with its valuation reaching USD 1.23 billion in 2023. According to the latest industry analysis, the market is projected to decline to USD 800 million by 2029, exhibiting a CAGR of -6.90% during the forecast period. This contraction is attributed to regulatory shifts in Western markets, while Asia-Pacific continues to dominate consumption due to strong agricultural and food…

More Releases for Diamond

Industrial Diamond Market Hits New High | Major Giants Sandvik, Zhongnan Diamond …

HTF MI just released the Global Industrial Diamond Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Industrial Diamond Market are:

De Beers Group, Element Six,…

Diamond Wire Rope Market 2023: Companies Revenue Analysis- Diamond WireTec, Asah …

The Diamond Wire Rope market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with…

Synthetic Diamond Market Seeking Excellent Growth | New Diamond Technology, Appl …

Advance Market Analytics published a new research publication on "Synthetic Diamond Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Synthetic Diamond market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Jewelry Diamond Market is Booming Worldwide | Zhongnan Diamond, Jinqu Chaoying D …

Latest launched research document on Global Jewelry Diamond Market study of 115 Pages provides detailed analysis with presentable graphs, charts and tables. The Research Study presents a complete assessment of the Market and highlights future trend, growth factors & drivers, leaders opinions, facts, and primary validated market data. The research study provides estimates for Global Jewelry Diamond Forecast till 2026*.

How to reach that market place and its associated audience with…

Synthetic Diamond Market | Key Players - Include Element Six (E6), Applied Diamo …

As per the current market trends and the promising nature of the Global Synthetic Diamond Market, it can be estimated that the future holds positive outcomes. In order to provide a deep insight about the concerned market, Market Research Reports Search Engine would be publishing a resourceful analysis that will enclose knowledge about the regional market size, revenue and opportunity status. Readers will be offered the privilege to decode various…

Global Industrial Diamond Sales Market 2017 - Advanced Diamond Solutions, Applie …

The Industrial Diamond Sales market research report distils the most essential aspects of the market and presents them in the form of a comprehensive and cohesive document. The findings of this report have been obtained via a balanced mix of both primary and secondary research. Interviews of C-level executives in the Industrial Diamond Sales market form a chunk of the qualitative analysis contained in this report.

Download Sample Report @…