Press release

Digital Money Transfer and Remittances Market Research Insights with Opportunities, Segmentation, and Forecast to 2031 - PayPal/Xoom, TransferWise, WorldRemit.

DataM Intelligence has released a new research report on the Digital Money Transfer and Remittances market. The report provides a detailed analysis of current and emerging trends, offering insights into the market dynamics. It utilizes Porter's Five Forces model to assess key factors such as supplier and customer relationships, risks from various agents, competitive intensity, and opportunities for new entrants. The study also includes research data from various companies, analyzing factors like benefits, gross margins, and strategic decisions in the global market. The report is enriched with tables, charts, and infographics for a clear presentation of the findings.The Digital Money Transfer and Remittances Market is valued at at a high CAGR during the forecast period (2024-2031).

Get a Free Sample Research PDF - https://datamintelligence.com/download-sample/digital-money-transfer-and-remittances-market

Digital money transfer and remittances refer to the process of sending funds electronically across borders, often to support family members or for business purposes. These services provide a faster, more convenient alternative to traditional methods like bank drafts or money orders. The rise of smartphones, fintech platforms, and blockchain technology has significantly boosted the adoption of digital remittances. Companies like PayPal, Western Union, and Wise have streamlined the process, offering lower fees and real-time transfers. This market is particularly crucial for developing countries, where remittances often contribute to household incomes. Security, speed, and ease of access remain key drivers of the sector's growth.

List of the Key Players in the Digital Money Transfer and Remittances Market:

Western Union (WU), Ria Financial Services, PayPal/Xoom, TransferWise, WorldRemit, MoneyGram, Remitly, Azimo.

Key Developments:

In October 2018, Azimo, a prominent European digital money transfer service, expanded its operations across Europe to support its rapid growth. The company established a new office in Amsterdam, positioning it as a strategic base to increase its share in the global cross-border payments market. This Amsterdam office is set to expand as Azimo's business in Europe continues to scale.

Research Process:

Both primary and secondary data sources have been used in the global Digital Money Transfer and Remittances Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Segment Covered in the Digital Money Transfer and Remittances Market:

By Product Type: Domestic Money Transfer, International Money Transfer.

By Channel: Banks, Money Transfer Operators, Online Platforms, Others.

By Application: Consumer, Enterprise.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/digital-money-transfer-and-remittances-market

Regional Analysis:

➣ North America (US, Canada, Mexico)

➣ Europe (Germany, Russia, UK, France, Italy, Spain, Rest of Europe)

➣ Asia-Pacific (China, India, Japan, Australia, Rest of Asia Pacific)

➣ South America (Brazil, Argentina, Rest of South America)

➣ Middle East and Africa

**The full version of the report includes an in-depth analysis of emerging players and startups, which will provide valuable insights into the evolving market landscape and key strategies being adopted**

Chapter Outline:

⏩ Market Overview: It contains five chapters, as well as information about the research scope, major manufacturers covered, market segments, Digital Money Transfer and Remittances market segments, study objectives, and years considered.

⏩ Market Landscape: The competition in the Global Digital Money Transfer and Remittances Market is evaluated here in terms of value, turnover, revenues, and market share by organization, as well as market rate, competitive landscape, and recent developments, transaction, growth, sale, and market shares of top companies.

⏩ Companies Profiles: The global Digital Money Transfer and Remittances market's leading players are studied based on sales, main products, gross profit margin, revenue, price, and growth production.

⏩ Market Outlook by Region: The report goes through gross margin, sales, income, supply, market share, CAGR, and market size by region in this segment. North America, Europe, Asia Pacific, Middle East & Africa, and South America are among the regions and countries studied in depth in this study.

⏩ Market Segments: It contains the deep research study which interprets how different end-user/application/type segments contribute to the Digital Money Transfer and Remittances Market.

⏩ Market Forecast: Production Side: In this part of the report, the authors have focused on production and production value forecast, key producers forecast, and production and production value forecast by type.

⏩ Research Findings: This section of the report showcases the findings and analysis of the report.

⏩ Conclusion: This portion of the report is the last section of the report where the conclusion of the research study is provided.

Have any Query? Talk to our Expert @ https://www.datamintelligence.com/enquiry/digital-money-transfer-and-remittances-market

The Research Report Offers Answers To The Following Questions:

☛ What is the expected growth rate of the global market for the forecast period?

☛ What are the key driving factors that are responsible to shape the fate of the Digital Money Transfer and Remittances market during the forecast period?

☛ What will be the overall size of the market during the analysis period?

☛ What are the prominent market trends which influence the development of the Digital Money Transfer and Remittances market across various regions?

☛ Who are the key market players and the market strategies that have helped them to secure the leading position in the global market?

☛ What are the challenges and threats that are likely to act as a barrier to the growth of the Digital Money Transfer and Remittances market?

☛ What are the major opportunities that the companies can get to attain success in the world?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Money Transfer and Remittances Market Research Insights with Opportunities, Segmentation, and Forecast to 2031 - PayPal/Xoom, TransferWise, WorldRemit. here

News-ID: 3694218 • Views: …

More Releases from DataM Intelligence 4market Research LLP

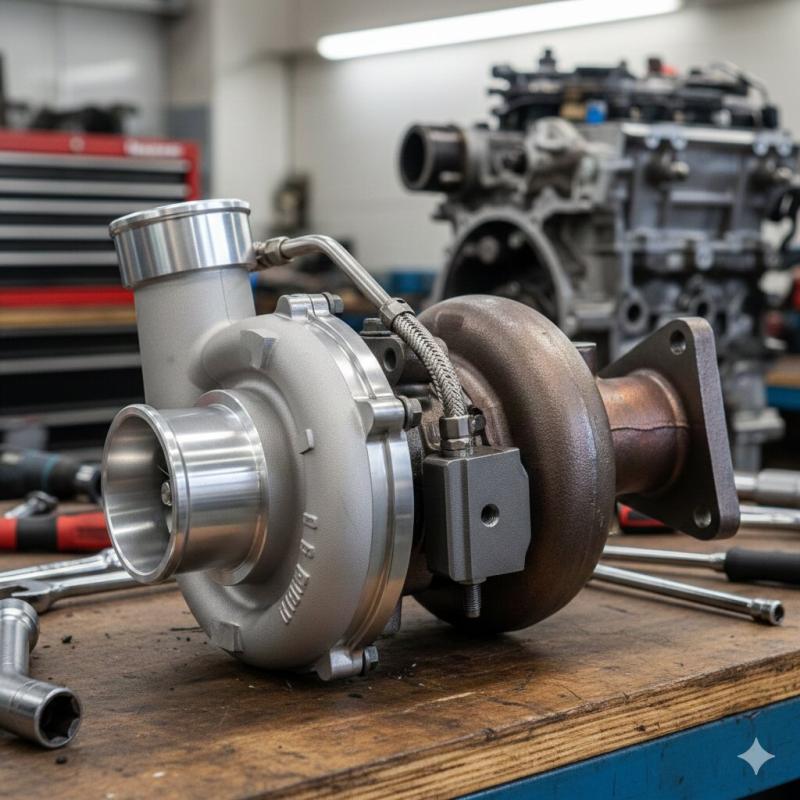

Automotive Turbocharger Market to Reach USD 16.5 Billion by 2030 at 10.3% CAGR, …

The Automotive turbocharger market reached USD 13.5 billion in 2022 and is expected to reach USD 16.5 billion by 2030, growing with a CAGR of 10.3% from 2023 to 2030. as vehicle manufacturers increasingly adopt turbocharging technology to enhance engine efficiency, performance, and emissions compliance.

Growth is supported by rising demand across key vehicle segments including passenger cars, commercial vehicles, and light-duty trucks, driven by stringent fuel economy and regulatory…

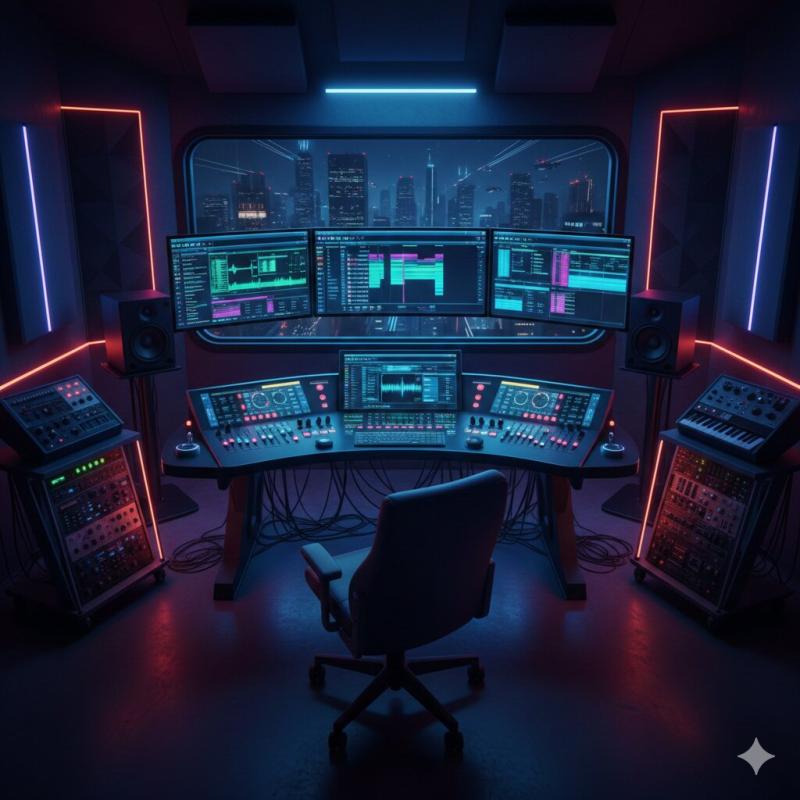

Digital Audio Workstation Market to Reach US$ 7.3 Billion by 2029 at 16.1% CAGR, …

The Digital Audio Workstation (DAW) Market reached approximately US$ 3.3 billion in 2024 and is expected to grow to around US$ 7.3 billion by 2029, expanding at a CAGR of about 16.1% from 2025 to 2029 as demand for advanced music production, sound design, and audio editing solutions continues to rise across professional and consumer segments.

Growth is supported by increasing adoption across key application areas such as music production, post-production,…

Fracture Fixation Products Market to Reach US$ 16.34 Billion by 2031 at 7.8% CAG …

The Global Fracture Fixation Products Market reached US$ 9.1 billion in 2023 and is expected to reach US$ 16.34 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031 as orthopedic care providers and surgical centers increasingly adopt advanced fixation solutions to improve patient outcomes and reduce recovery time.

Growth is supported by rising demand across key product segments such as plates & screws, intramedullary nails, external…

LNG Storage Tank Market to Reach USD 6.7 Billion by 2030 Driven by Rising LNG In …

The LNG Storage Tank Market reached USD 4.5 billion in 2022 and is expected to reach USD 6.7 billion by 2030, growing at a CAGR of 5.5% during the forecast period 2024-2031.

Growth is driven by increasing global demand for liquefied natural gas (LNG) as a cleaner alternative to conventional fossil fuels, particularly in power generation, industrial applications, and transportation. Rising investments in LNG infrastructure, including terminals, regasification facilities, and storage…

More Releases for Money

Miracle Money Magnets Review: Reprogram Your Money Vibration for Lasting Wealth

Miracle Money Magnets is a mindset transformation program created by Croix Sather that focuses on raising your personal money vibration to attract financial abundance effortlessly. The course teaches how subconscious beliefs, emotional resistance, and daily language patterns create blocks that repel wealth, and provides simple steps to reset them for consistent money flow. Priced accessibly at an introductory $7, it promises to shift users from financial struggle to prosperity by…

Just Between Friends Can Help Save Money & Make Money

Image: https://www.getnews.info/uploads/314b3c2c783a4157e147efd33935356f.jpg

Kids are expensive. Just Between Friends can help you save money and make money.

At Just Between Friends, we understand that children grow fast, which can quickly become expensive for parents.

That's why we host a community event twice a year, where families can sell the things their children no longer use and buy what they need at 50-90% below retail.

Discover a sense of Pride and Purpose when participating at Just…

The Money Wave Reviews (Controversial Or Fake 2023) The Money Wave Price Legitim …

Self-improvement and wealth promotion the The Money Wave has come to light as an innovative concept drawing the attention of thousands around the world. This revolutionary approach, grounded in the latest neuroscience research and antiquated wisdom, will unlock the potential hidden within our brains and allow our brains to generate prosperity and wealth effortlessly. It was developed in the lab of the Dr. Thomas Summers, a top neuroscientist who is…

Mobile Money Market to Witness Huge Growth by 2029 | Orange Money, Epress Union, …

The Latest research study released by HTF MI "Global Mobile Money Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are MTN…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…