Press release

Trade Finance Market Size, Share, Trends, Industry Analysis & Forecast Report 2024-2032

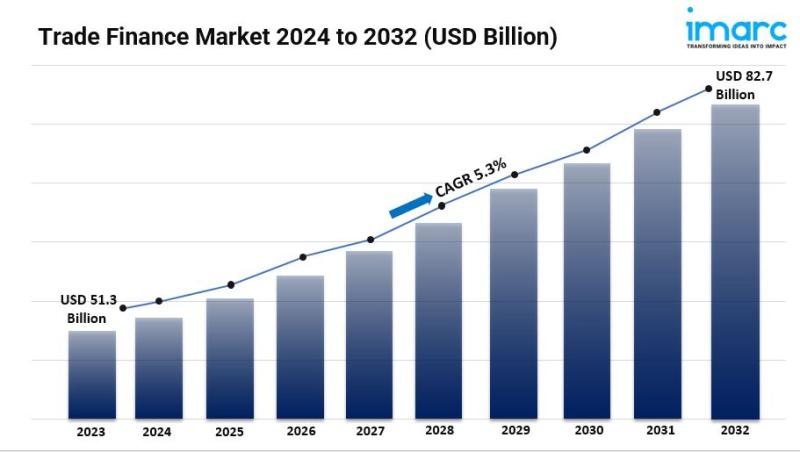

Summary:• The global trade finance market size reached USD 51.3 Billion in 2023.

• The market is expected to reach USD 82.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

• North America leads the market, accounting for the largest trade finance market share owing to its strong international trade activities and advanced financial infrastructure.

• Supply chain finance accounts for the majority of the market share in the finance type segment as it offers flexible financing solutions.

• Letters of credit holds the largest share in the offering industry because they provide a secure mechanism for international trade.

• Banks remain a dominant segment in the market due to their established global networks.

• Large enterprises represent the leading end-user segment as they engage in higher volumes of international trade.

• The rapid globalization and expanding trade activities across the globe is a primary driver of the trade finance market.

• Technological advancements and the implementation of supportive government policies are reshaping the trade finance market.

Request to Get the Sample Report: https://www.imarcgroup.com/trade-finance-market/requestsample

Industry Trends and Drivers:

Globalization and Expanding Trade Volumes:

The growth of global trade has been a key driver of the trade finance market, as companies need reliable financial tools to support cross-border transactions. The expansion of international trade routes and free trade agreements has boosted global trade volumes, prompting businesses to seek trade finance solutions like letters of credit, trade credit insurance, and payment guarantees.

As more countries integrate into the global economy, especially emerging markets, the need for financial instruments that mitigate risks and facilitate transactions becomes increasingly important. Additionally, the rise of e-commerce and digital trade has amplified the demand for trade finance by simplifying international trade for small and medium-sized enterprises (SMEs). These businesses, often lacking the creditworthiness of larger corporations, require trade finance to secure working capital and ensure payments in international markets.

Government Support and Regulatory Improvements:

Government initiatives and regulatory reforms are key factors driving the growth of the trade finance market. Governments worldwide recognize the importance of trade finance in promoting international commerce and economic growth, especially for SMEs that often struggle to access traditional financing. As a result, many governments are implementing policies to improve access to trade finance, providing financial guarantees, and partnering with private sector institutions to support exporters and importers.

Trade agreements reduce trade barriers, fostering a more favorable environment for global trade and increasing the demand for trade finance. Furthermore, regulatory improvements in areas such as anti-money laundering (AML) and know-your-customer (KYC) compliance are making the trade finance market more secure, encouraging more institutions to offer trade finance services.

Technological Advancements:

Technological innovation is revolutionizing the trade finance market, making it more efficient and accessible. Blockchain technology has introduced significant improvements in transaction transparency and fraud prevention by creating immutable digital records of trade transactions. This innovation reduces the risk of fraud and streamlines complex trade processes, such as documentation and payment verification. Digital platforms, using artificial intelligence and automation, are helping to optimize trade finance workflows by reducing manual processing time and errors.

For example, smart contracts on blockchain networks automatically execute trade agreements once pre-defined conditions are met, eliminating the need for intermediaries and reducing costs. Additionally, artificial intelligence (AI)-driven risk assessment tools are providing more accurate and quicker credit evaluations, enhancing the ability of banks to offer financing to a broader range of clients, including SMEs.

Buy Report: https://www.imarcgroup.com/checkout?id=2031&method=502

Trade Finance Market Report Segmentation:

Breakup By Finance Type:

• Structured Trade Finance

• Supply Chain Finance

• Traditional Trade Finance

Supply chain finance accounts for the majority of shares because it offers flexible financing solutions that improve liquidity for both buyers and suppliers, making it highly attractive for businesses managing complex global supply chains.

Breakup By Offering:

• Letters of Credit

• Bill of Lading

• Export Factoring

• Insurance

• Others

Letters of credit represent the majority of shares as they provide a secure mechanism for international trade, ensuring payment protection for exporters and trust for importers.

Breakup By Service Provider:

• Banks

• Trade Finance Houses

Banks hold the majority of shares due to their established global networks, risk mitigation expertise, and ability to offer diverse financial products for trade transactions.

Breakup By End-User:

• Small and Medium Sized Enterprises (SMEs)

• Large Enterprises

Large enterprises a clear dominance because they engage in higher volumes of international trade, requiring significant financial backing to manage cross-border transactions and mitigate risks.

Breakup By Region:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

North America holds the leading position owing to its strong international trade activities, advanced financial infrastructure, and high adoption of trade finance solutions by large corporations.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Top Trade Finance Market Leaders: The trade finance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

• Asian Development Bank

• Banco Santander SA

• Bank of America Corp.

• BNP Paribas SA

• Citigroup Inc.

• Crédit Agricole Group

• Euler Hermes

• Goldman Sachs Group Inc.

• HSBC Holdings Plc

• JPMorgan Chase & Co.

• Mitsubishi Ufj Financial Group Inc.

• Morgan Stanley

• Royal Bank of Scotland

• Standard Chartered Bank

• Wells Fargo & Co.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Size, Share, Trends, Industry Analysis & Forecast Report 2024-2032 here

News-ID: 3692608 • Views: …

More Releases from IMARC Group

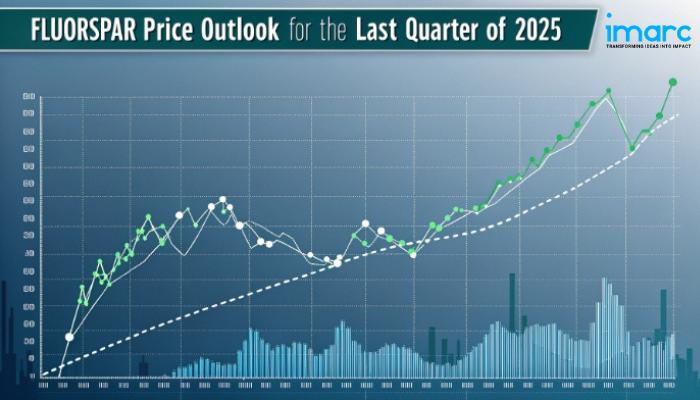

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

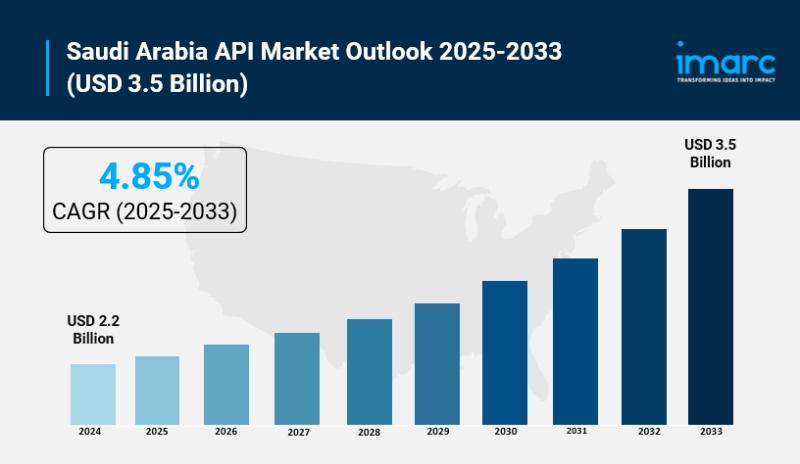

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

France Real Estate Market to Reach USD 330.75 Billion by 2033 CAGR, 3.42% 2025-2 …

Market Overview

The France real estate market size reached USD 236.29 Billion in 2024 and is projected to reach USD 330.75 Billion by 2033, growing at a CAGR of 3.42% during the forecast period of 2025-2033. The market reflects cautious optimism influenced by evolving buyer expectations, government renovation schemes promoting energy efficiency, and an interest shift towards secondary cities and rural areas due to remote work trends. Improved mortgage conditions, sustainability,…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…