Press release

Stock Trading & Investing Apps Market Grows Amid Fintech Boom - Global Forecast 2024

"The Business Research Company recently released a comprehensive report on the Global Stock Trading And Investing Applications Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The stock trading and investing applications market size has grown exponentially in recent years. It will grow from $44.05 billion in 2023 to $52.89 billion in 2024 at a compound annual growth rate (CAGR) of 20.1%. The growth in the historic period can be attributed to growth in the alternative investment options, increased changing investor behaviors, increased accessibility to financial markets, growth in demand for high-speed internet connectivity, increased role of retail investors.

The stock trading and investing applications market size is expected to see exponential growth in the next few years. It will grow to $111.56 billion in 2028 at a compound annual growth rate (CAGR) of 20.5%. The growth in the forecast period can be attributed to rise in the self-directed investors, rising of digital platforms, increasing awareness of security measures, rising digital stock trading and investing, rising use of smartphones. Major trends in the forecast period include technological advancements, mobile trading and apps, integration of artificial intelligence and automation, integration of augmented reality (AR) and virtual reality (VR), pre-IPO share trading.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/stock-trading-and-investing-applications-global-market-report

Market Drivers and Trends:

The rising use of the internet and social media platforms is expected to propel the growth of the stock trading and investing applications market going forward. An internet platform refers to a digital service or website that provides users with various functionalities, services, and content accessible over the Internet. A social media platform is an online service or program that enables users to create, share, and interact with content while also connecting with others in virtual communities. The Internet provides quick access to extensive information about stocks, markets, and investment methods. Social media platforms make it easier to build online trading and investment communities. These communities allow users to share their experiences, discuss investment ideas, and seek advice, building a sense of camaraderie and boosting involvement in trading activities. For instance, in February 2023, according to Meltwater, a Netherlands-based software company, internet users in the UK climbed by 224 thousand (+0.3%) between 2022 and 2023. There were 66.11 million internet users in the UK overall. In addition, in the UK, there are 35 million LinkedIn members and 28.75 million Instagram users. Between 2022 and 2023, LinkedIn's potential ad reach in the UK climbed by 2.9%. Therefore, the rising use of the internet and social media platforms is driving the growth of the stock trading and investing applications market.

Major companies operating in the stock trading and investing applications market are focused on developing advanced solutions, such as mobile trading platforms, to gain a competitive edge in the market. Mobile trading platforms are applications that enable users to trade stocks, options, futures, currencies, bonds, and other financial instruments on mobile devices, such as smartphones and tablets. For instance, in May 2023, Geojit Financial Services, an India-based investment services company, launched FLIP, its newest mobile trading platform designed to provide traders and investors with a versatile and comprehensive trading experience powered by a variety of cutting-edge features. It enables users to trade equity, IPOs, bonds, futures, options, commodities, and currencies. It also includes next-generation features, including portfolio insights, technical and fundamental research, advanced charting (TradingView), and a dashboard summary of transactions and investments. Geojit FLIP seeks to empower clients to invest and trade smarter and more successfully by offering a seamless and safe trading environment with fast execution and a wide range of innovative features.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=14807&type=smp

Major Key Players of the Market:

Morgan Stanley, Fidelity Investments, Charles Schwab Corporation, Merrill Edge, Ameriprise Financial Inc, Ally Financial Inc, Vanguard Group Inc, Interactive Brokers LLC, E-Trade Financial Corporation, Social Finance Inc, Robinhood Markets Inc, Plus500 Ltd, eToro Ltd, TradeStation Group Inc, M1 Finance, Stash Financial Inc, Betterment, Wealthfront Inc, Acorns Grow Incorporated, Charles Stanley Direct, Zerodha Broking Ltd, Angel One Limited, Webull Corporation, Saxo Bank

Stock Trading And Investing Applications Market 2024 Key Insights:

• The stock trading and investing applications market size is expected to see exponential growth in the next few years. It will grow to $111.56 billion in 2028 at a compound annual growth rate (CAGR) of 20.5%.

• Impact Of Rise Of Digital Platforms On The Stock Trading And Investing Applications Market

• Advanced Mobile Trading Platform Transforming The Stock Trading And Investing Applications Market

• North America was the largest region in the stock trading and investing applications market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=14807&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Stock Trading & Investing Apps Market Grows Amid Fintech Boom - Global Forecast 2024 here

News-ID: 3691234 • Views: …

More Releases from The Business Research Company

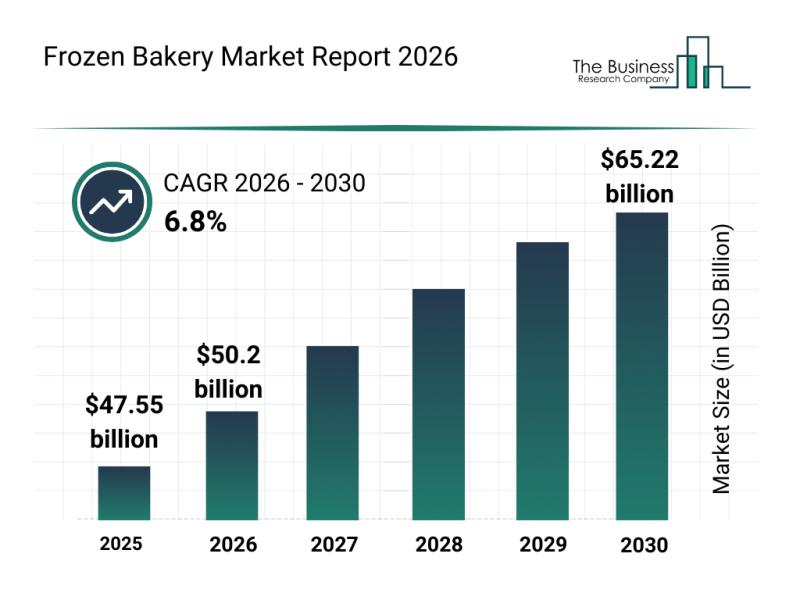

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fr …

The frozen bakery market is poised for impressive expansion over the coming years, driven by evolving consumer lifestyles and shifting preferences. As convenience and quality become increasingly important, this sector is adapting with innovative offerings and enhanced distribution methods. Let's explore the market size projections, key players, notable trends, and the main segments shaping the future of frozen bakery products.

Forecasted Growth and Size of the Frozen Bakery Market

The…

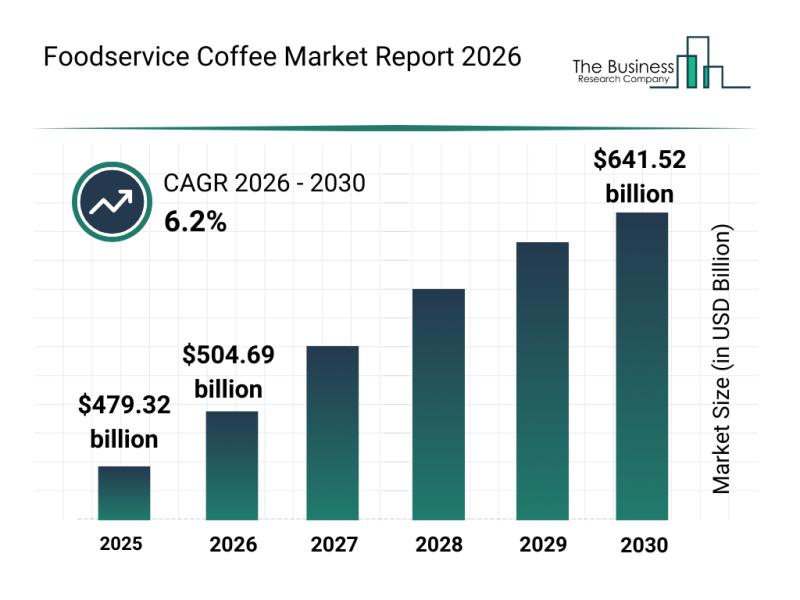

Key Players and Competitive Dynamics in the Foodservice Coffee Market

The foodservice coffee sector is poised for impressive expansion over the coming years, driven by evolving consumer preferences and technological advancements. As coffee culture continues to flourish globally, this market is adapting rapidly to meet new demands. Let's explore the current market size, influential players, and emerging trends shaping the future of foodservice coffee.

Forecasted Market Size and Growth Trajectory of the Foodservice Coffee Market

The foodservice coffee market is…

Emerging Sub-Segments Transforming the Food Safety Testing Market Landscape

The food safety testing industry is poised for significant expansion as global demand for safer food products intensifies. With advancements in technology and stricter regulatory standards, this market is evolving rapidly to meet the needs of manufacturers, regulators, and consumers alike. Let's explore the market's projected growth, key players, emerging trends, and detailed segment breakdowns shaping its future.

Projected Expansion and Market Size of Food Safety Testing by 2030

The…

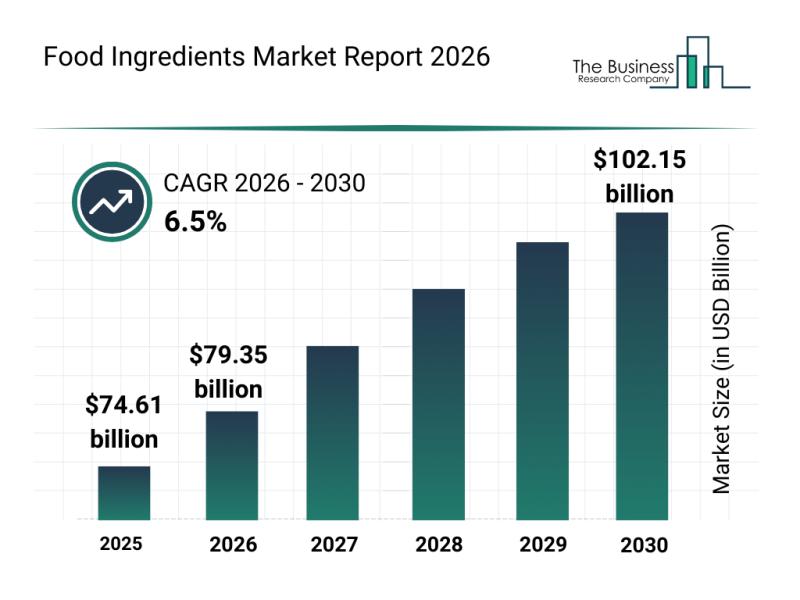

Emerging Growth Patterns Driving Expansion in the Food Ingredients Market

The food ingredients sector is on track for significant expansion in the coming years, driven by evolving consumer preferences and advancements in food technology. As the demand for healthier, sustainable, and personalized food options increases, this market is poised to experience noteworthy growth and innovation. Let's delve into the market's projected size, key players, prevailing trends, and segmentation insights shaping its future.

Anticipated Growth and Market Size of the Food Ingredients…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…