Press release

Surety Market Report, Size, Share, Growth, Trends, Industry Analysis, Forecast to 2033

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!The new report published by The Business Research Company, titled Surety Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the surety market size has grown strongly in recent years. It will grow from $18.38 billion in 2023 to $19.62 billion in 2024 at a compound annual growth rate (CAGR) of 6.8%. The surety market size is expected to see strong growth in the next few years. It will grow to $25.6 billion in 2028 at a compound annual growth rate (CAGR) of 6.9%.

Download Free Sample Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=18747&type=smp

What Is Driving The Growth Of The Global Surety Market?

Growth Of Digital Payment Services Driving Expansion In The Surety Market

The growing use of digital payment services is expected to propel the growth of the surety market going forward. Digital payment refers to the services that involve using electronic channels and mobile devices to facilitate monetary transactions online. Higher smartphone usage, better internet access, advanced security measures, and user convenience drive digital payment. Surety helps by providing a financial guarantee that ensures the performance and reliability of service providers, protecting users from potential losses due to fraud, service disruptions, or non-compliance with contractual obligations. For instance, in February 2023, according to the Ministry of Electronics & IT, an India-based ministry, total number of digital transactions was valued at 8,840 crore ($1.056 billion) in 2021-2022, reaching 9,192 crore ($1.097 billion) till December 2022. Therefore, the growing use of digital payment services drives the surety market.

What Is The Key Trend In The Global Surety Market?

ICICI Lombard Launches Surety Insurance To Enhance Financial Security And Risk Management

Major companies operating in the surety market are developing surety insurance to enhance financial security and meet the growing demand for risk management solutions. Surety insurance, also known as surety bonds provides a financial guarantee that obligations will be fulfilled, offering protection and confidence to parties involved in various transactions and contracts. For instance, in July 2024, ICICI Lombard, an India-based insurance company, launched surety insurance, offering financial guarantees to ensure contractors meet their obligations. This product frees up banking lines and supports larger projects by providing both conditional and unconditional options, advanced risk management, and improved financial flexibility. Its introduction is significant in the surety insurance market, addressing the growing infrastructure sector's demand for effective risk mitigation and helping businesses secure larger, high-value contracts.

How Is The Global Surety Market Segmented?

The surety market covered in this report is segmented -

1) By Bond Type: Contract Surety Bond, Commercial Surety Bond, Fidelity Surety Bond, Court Surety Bond

2) By Application: Government Agencies, Enterprise

3) By End User: Businesses, Contractors, Construction Organizations, Government Agencies, Suppliers, Service Providers And Individuals

You Can Pre-Book The Global Market Report Of Your Requirement For A Swift Delivery And Also Get An Exclusive Discount On This Report, Checkout Link:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18747

How Is The Competitive Landscape Of The Global Surety Market?

Major companies operating in the surety market are Berkshire Hathaway Specialty Insurance Company, Nationwide Financial General Agency Inc., Liberty Mutual Group, Zurich Insurance Group Ltd, Chubb Limited, The Travelers Indemnity Company, The Hartford Financial Services Group Inc., Marsh & McLennan Companies Inc, Intact Financial Corporation, QBE Insurance Group Limited, Aon plc, Everest Group Ltd, CNA Financial Corporation, Markel Corporation, Arch Capital Group Ltd, AssuredPartners Inc., Old Republic International Corporation, American Financial Group Inc., AmTrust Financial Services Inc., The Hanover Insurance Group Inc., Crum & Forster Insurance, Starr International Company Inc., Tokio Marine Holdings Inc., Allianz Trade , Aspen Insurance Holdings Limited, IAT Insurance Group Inc., EverQuote Inc., J.S. Held LLC, Prime Insurance Company Limited, American Surety Company

Contents Of The Global Surety Market

1. Executive Summary

2. Surety Market Report Structure

3. Surety Market Trends And Strategies

4. Surety Market - Macro Economic Scenario

5. Surety Market Size And Growth

…..

27. Surety Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore The Report Store To Make A Direct Purchase Of The Report: https://www.thebusinessresearchcompany.com/report/surety-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market Report, Size, Share, Growth, Trends, Industry Analysis, Forecast to 2033 here

News-ID: 3688447 • Views: …

More Releases from The Business research company

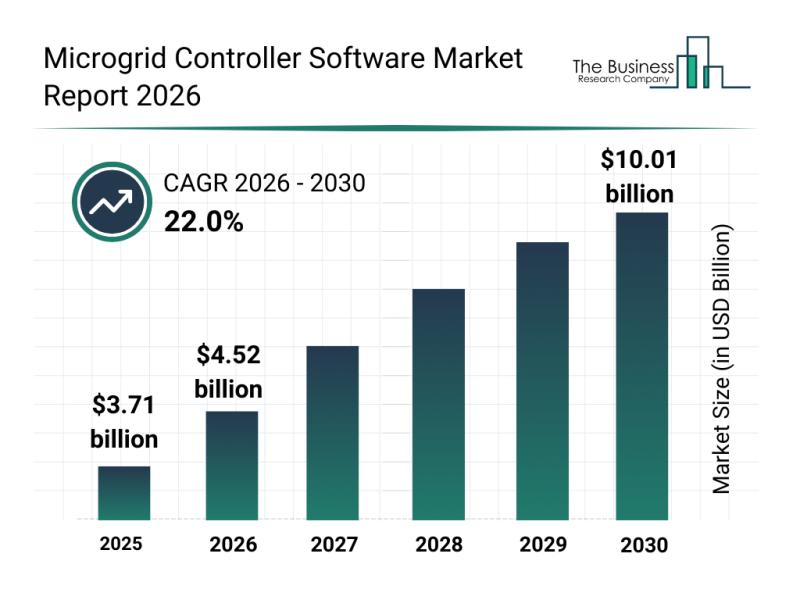

Emerging Growth Factors Boosting the Expansion of the Microgrid Controller Softw …

The microgrid controller software market is poised for remarkable expansion as the energy landscape shifts toward smarter, more efficient systems. With technological advancements and growing demand for decentralized energy management, this sector is set to play a crucial role in the future of power distribution and sustainability. Let's explore the market's size projections, leading players, emerging trends, and key segments shaping its trajectory.

Forecasted Market Size and Growth in the Microgrid…

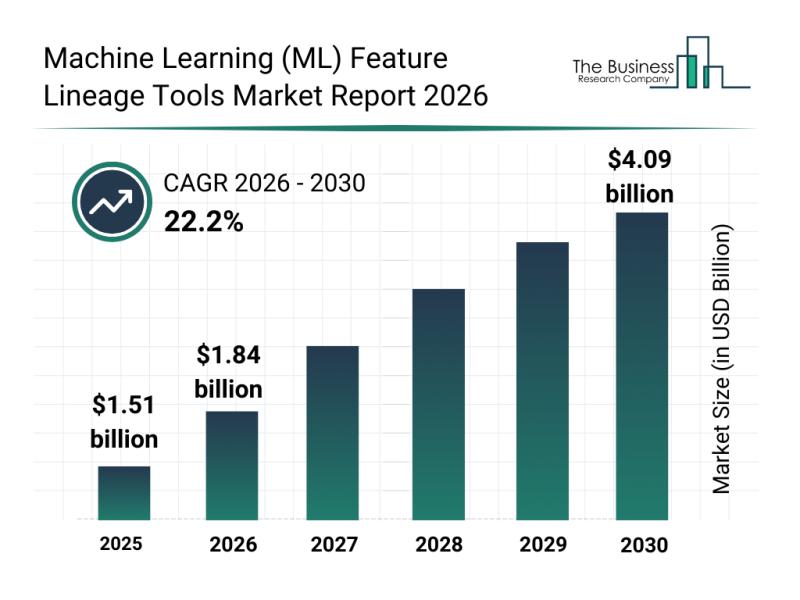

Analysis of Market Segments and Major Growth Areas in the Machine Learning (ML) …

The machine learning feature lineage tools market is poised for remarkable expansion as organizations increasingly prioritize transparency and efficiency in AI workflows. With the growing importance of tracking feature data throughout the ML lifecycle, this sector is gaining traction globally. Let's explore the anticipated market size, key drivers, major players, emerging trends, and segmentation details shaping this dynamic industry.

Projected Market Size and Growth Outlook for the Machine Learning Feature Lineage…

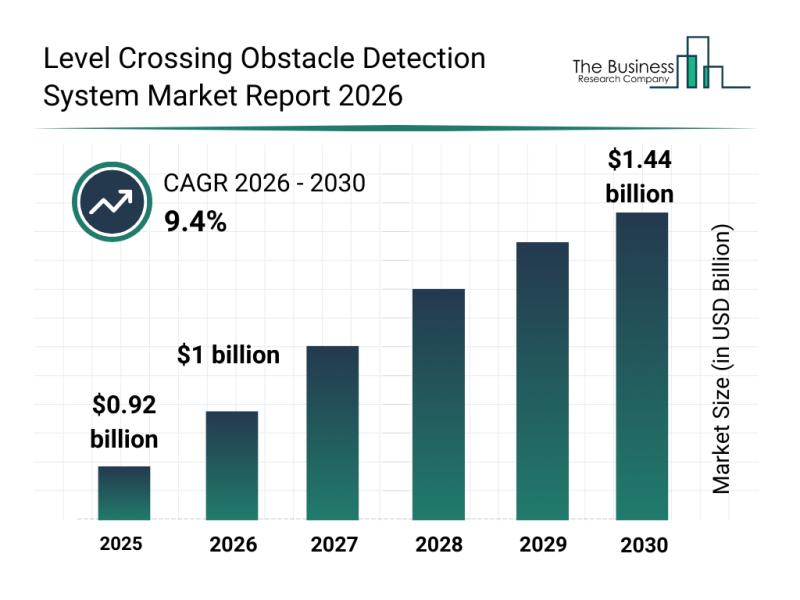

Key Trends and Emerging Changes Shaping the Level Crossing Obstacle Detection Sy …

The level crossing obstacle detection system market is set for significant expansion as rail networks modernize and safety demands intensify. Advances in technology and growing investments in smart infrastructure are expected to drive this sector forward over the coming years. Below is an in-depth examination of the market's anticipated growth, key players, emerging trends, and detailed segment analysis.

Level Crossing Obstacle Detection System Market Size and Growth Outlook

Forecasts indicate…

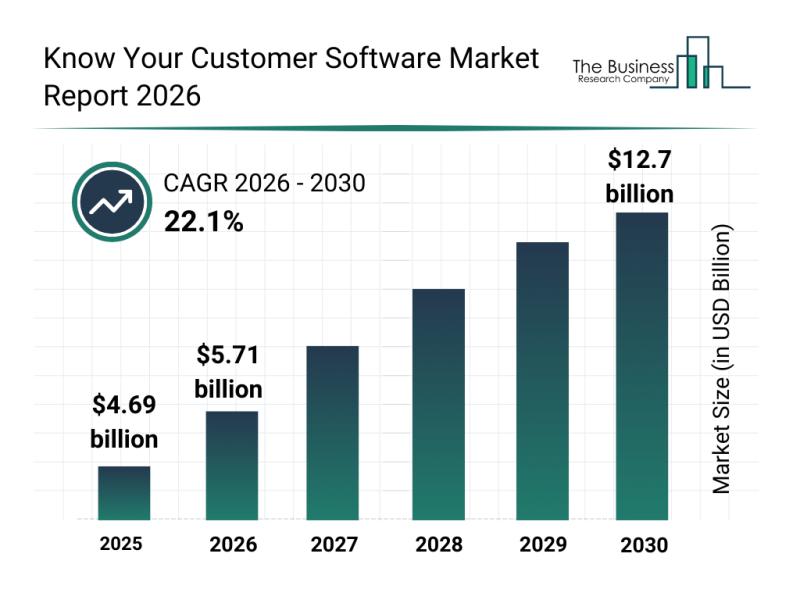

Emerging Sub-Segments Transforming the Know Your Customer Software Market Landsc …

The know your customer (KYC) software market is rapidly progressing, driven by evolving regulatory demands and technological innovations. As organizations increasingly prioritize secure and efficient customer verification processes, this sector is slated for remarkable growth, shaping the future of financial compliance and risk management. Let's explore the market's valuation outlook, leading players, emerging trends, and key segments that define this expanding industry.

Projected Market Size and Growth Trajectory of the Know…

More Releases for Surety

Surety Bonds Without Private Equity Pressure

As private equity continues to reshape the insurance and surety landscape, White Lion Bonding & Insurance Services is reaffirming its commitment to surety bonds and performance bonds, including site improvement bonds, grading bonds, and utilities bonding, delivered through a founder-led, relationship-driven approach. This focus on surety bonds for site improvements, grading, and utilities has guided the firm from its earliest days to its growth as a nationally respected surety brokerage.

Founded…

Surety Market Size to Reach USD 33146.14 Million by 2032 | Global Surety Bonds I …

The global Surety Market was valued at USD 23462.34 Million in 2025 and is projected to grow at a CAGR of 5.06% from 2025 to 2032, reaching USD 33,146.14 Million by 2032, according to Maximize Market Research.

Market Overview

The Surety Market plays a critical role in global financial risk management by providing guarantees that contractual obligations will be met. In this arrangement, a surety assures an obligee (project owner or client)…

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…