Press release

Pension Administration Software Market to Reach $13 Billion by 2032 at 11.4% CAGR | Key Innovators: Sagitec, Zellis, Equiniti, Congruent Solutions, Inc., PensionSoft Corporation and More

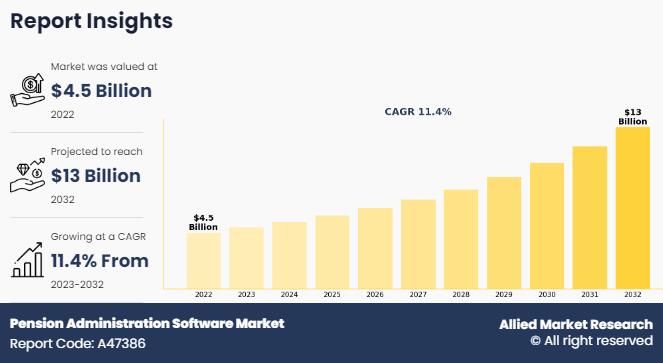

Allied Market Research published a report, titled, "Pension Administration Software Market by Component (Solution and Services), Deployment Mode (On-Premise and Cloud), Type (Public Pension and Private Pension), End User (Employers, Pension Plan Administrators, Government Agencies, and Others), and Pension Fund Size (Less Than $500 Million, $500 Million To $1 Billion, $1 Billion To $5 Billion, $5 Billion To $10 Billion, and $10 Billion and Above): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the pension administration software market was valued at $4.5 billion in 2022, and is estimated to reach $13 billion by 2032, growing at a CAGR of 11.4% from 2023 to 2032.Request Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A47386

Drivers, Restraints, and Opportunities-

The pension administration software market is expected to witness notable growth owing to modern customer experience, in which pension administration software helps to reduce processing time, efficiency, and cost effectiveness. Moreover, technological advancements in the field of administration and integration of mobile technology in pension administration software are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, technological limitations of the aged people and high implementation costs limit the growth of the pension administration software market.

The solution segment to maintain its leadership status throughout the forecast period

By component, the solution segment accounted for more than three-fifths of the global pension administration software market share in 2022 and is expected to remain dominant during the forecast period, owing to communication with participants, such as by sending out statements and alerts on plan modifications, which can enhance member satisfaction and communication. However, the services segment is expected to witness the highest CAGR of 13.1% in the upcoming years, owing to increase in the adoption of digital technologies across various industries and availability of desired information from anywhere at any time. Moreover, pension administration services help organizations in threat detection and risk management, which drives the growth of the market.

Buy This Report (260 Pages PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/44a6MJn

The on-premise segment to maintain its leadership status throughout the forecast period

By deployment mode, the on-premise segment accounted for more than half of the global pension administration software market share in 2022 and is expected to dominate by 2032, owing to increase in the need to secure critical data from cyberattacks and monitor the influx of data within the organization. However, the cloud segment is expected to witness the highest growth of 12.8%, owing to being employed by many organizations to safeguard the level of security and compliance of their public and private cloud architecture.

The public pension segment to maintain its leadership status throughout the forecast period

By type, the public pension segment accounted for nearly two-thirds of the pension administration software market share in 2022 and is expected to dominate by 2032, owing to increasing demand for pension administration software from small and medium-sized businesses (SMBs) due to the growing awareness of the benefits of using such software. Moreover, the increasing use of cloud-based pension administration software has made it more affordable and easier to use than traditional on-premises software. However, the private pension segment would also display the fastest CAGR of 13.6% throughout the forecast period, owing to the rise in demand for pension administration software with customized models, and changes in consumer preferences toward pension plans. Moreover, the unexpected social and financial disruption caused by the pandemic has forced individuals and businesses across the world to rely on technology and IT services such as SaaS for documentation, wide-ranging set of account-centric business operations, repayment modes such as standing instructions, cash, and electronic payments, and to follow social distance, and others.

The employers segment to maintain its leadership status throughout the forecast period

By end user, the employers segment accounted for more than two-fifths of the global pension administration software market share in 2022 and is expected to rule the boost by 2032, owing to more automation of the pension administration process, including things such as contribution tracking and benefit calculations. In addition, many employers are providing employees with access to their own pension information through self-service portals, allowing them to make changes or updates to their accounts. However, the pension plan administrators segment is expected to display the fastest CAGR of 17.5% throughout the forecast period, owing to increase in demand for transparency and accountability from plan administrators. Pension administration software can help administrators to provide this by making it easier to track and report plan activities.

Get Customized Reports with your Requirements: https://www.alliedmarketresearch.com/request-for-customization/A47386

The $1 billion to $5 billion segment to maintain its leadership status throughout the forecast period

By pension fund size, the $1 billion to $5 billion segment accounted for more than one-third of the global pension administration software market share in 2022 and is expected to remain dominant by 2032, owing to the increasing demand for integrated pension administration and financial management software suites. Pension funds in this category seek comprehensive solutions that streamline operations, improve efficiency, and enable better decision-making processes. In addition, there is a growing emphasis on data security and compliance features to protect sensitive member information and adhere to regulatory requirements. However, the $500 million to $1 billion segment is expected to display the fastest CAGR of 15.4% throughout the forecast period, owing to growth in demand for solutions offering advanced analytics and reporting functionalities to help administrators gain deeper insights into fund performance and member trends. Companies such as SunGard and Sapiens have developed comprehensive software suites tailored to medium-sized pension funds' needs, providing a range of features and scalability options.

North America garnered the major share in 2022

Region-wise, the pension administration software market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to fund management and investment management that are increasing in the U.S. for which customers demand a robust pension settlement procedure. Therefore, companies in this region are adopting pension administration software to do the work fast and efficiently. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the use of pension administration software in the banking and financial institution industry for better decisions, better customer experiences, and significant cost savings. Furthermore, as a result of the coronavirus disease (COVID-19) outbreak, financial institutions all over the world are increasingly turning to digital/automation channels to provide pension- related services and deal with pandemic challenges.

Leading Market Players-

Capita Plc.

Civica

Congruent Solutions, Inc.

Pensionsoft Corporation, LLC

Sagitec Solutions

WTW

Equiniti

Levi, Ray and Shoup Inc.

Tatvasoft Software Development Company

Zellis

The report analyzes these key players in the global pension administration software market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, developments, and product portfolios of every market player..

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A47386

Key Benefits For Stakeholders

This report provides a quantitative analysis of the pension administration software market segments, current trends, estimations, and dynamics of the pension administration software market analysis from 2022 to 2032 to identify the prevailing pension administration software market opportunities.

The pension administration software market forecast research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the pension administration software market growth assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the pension administration software market opportunity.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the pension administration software market outlook.

The report includes the analysis of the regional as well as global pension administration software market trends, key players, market segments, application areas, and retirement administration strategies.

Key Market Segments

Component

Solution

Services

Deployment Mode

On-Premises

Cloud

Type

Public Pension

Private Pension

End User

Pension Plan Administrators

Government Agencies

Others

Employers

Pension Fund Size

Less Than $500 Million

$500 Million To $1 Billion

$1 Billion To $5 Billion

$5 Billion To $10 Billion

$10 Billion and Above

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia-Pacific

China

Japan

India

Australia

South Korea

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Usage-Based Insurance Market https://www.alliedmarketresearch.com/usage-based-insurance-market

Cross-border Payments Market https://www.alliedmarketresearch.com/cross-border-payments-market-A288119

Digital Gift Cards Market https://www.alliedmarketresearch.com/digital-gift-cards-market-A09990

E-commerce Market https://www.alliedmarketresearch.com/e-commerce-market-A107885

Surety Market https://www.alliedmarketresearch.com/surety-market-A31385

Management Consulting Services Market https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Gift Cards Market https://www.alliedmarketresearch.com/gift-cards-market

US Life Insurance Market https://www.alliedmarketresearch.com/us-life-insurance-market-A324608

US Premium Finance Market https://www.alliedmarketresearch.com/u-s-premium-finance-market-A305149

India E-commerce Market https://www.alliedmarketresearch.com/india-e-commerce-market-A126917

Contact Us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://steemit.com/@monikak

https://www.quora.com/profile/Monika-Kawade-2

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pension Administration Software Market to Reach $13 Billion by 2032 at 11.4% CAGR | Key Innovators: Sagitec, Zellis, Equiniti, Congruent Solutions, Inc., PensionSoft Corporation and More here

News-ID: 3687961 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Pension

Pension Funds Market Reworking Long Term Growth |AT&T Corporate Pension Fund, 11 …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

The basic pension or Rürup pension - neglected old-age provision

Compared to other forms of pension provision, such as statutory pension insurance or the private Riester pension, the Rürup pension or basic pension is much less well known to the public. This special form of pension provision offers great opportunities to additionally strengthen purchasing power in old age. The topic of old-age provision and securing the statutory pension level via a statutory equity pension is on everyone's lips, although a…

Pension Fund Market Is Booming Worldwide : Blue Sky Group, NatWest Group Pension …

Advance Market Analytics published a new research publication on "Global Pension Fund Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Pension Fund market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Pension Funds Market to Eyewitness Massive Growth by 2030:AT&T Corporate Pension …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

Pension Fund Market Booming Segments; Investors Seeking Growth| IBM, NatWest, BT …

AMA Research started a new business research with title Pension Fund Market Study Forecast till 2027 . This Pension Fund market report brings data for the estimated year 2021 and forecasted till 2027 in terms of both, value (US$ MN) and volume (MT). The report also consists of detailed assessment macroeconomic factors, and a market outlook of the Pension Fund market. The study is conducted by applying both top-down and…

Pension Administration Software Market 2022 Rising Pension Schemes In The Public …

According to Precision Business Insights (PBI), the latest report, the pension administration software market is expected to have a significant CAGR over the forecast period. The primary driver of the expansion of the global Pension Administration Software market is rising public pension schemes as required by the majorly old age population, and many private companies offer pension schemes with individuals' requirements.

View the detailed report description here - https://precisionbusinessinsights.com/market-reports/pension-administration-software-market/

…