Press release

Lithium Carbonate Prices, Demand, News, Chart and Forecast

𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐏𝐫𝐢𝐜𝐞𝐬 𝐈𝐧 𝐔𝐒𝐀• 𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬: 18225 USD/MT (Lithium Carbonate Battery Grade)

By the quarter ending December 2023, the latest prices for lithium carbonate battery grade DDP USGC settled at 18,225 USD/MT.

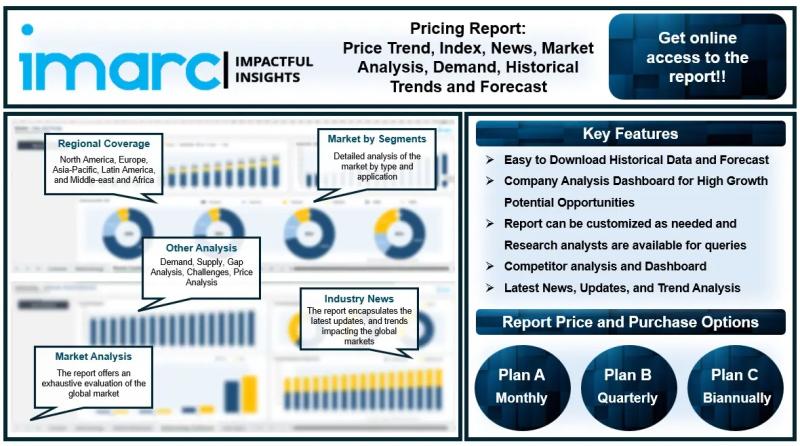

The latest report by IMARC Group, titled " 𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭 𝟐𝟎𝟐𝟒: 𝐏𝐫𝐢𝐜𝐞 𝐓𝐫𝐞𝐧𝐝, 𝐂𝐡𝐚𝐫𝐭, 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐍𝐞𝐰𝐬, 𝐃𝐞𝐦𝐚𝐧𝐝, 𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐚𝐧𝐝 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐃𝐚𝐭𝐚," provides a thorough examination of 𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐏𝐫𝐢𝐜𝐞𝐬. This report delves into the price of lithium carbonate globally, presenting a detailed analysis, along with informative price chart. Through comprehensive price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the demand, analyzing how it impacts market dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this report an invaluable resource for industry stakeholders.

𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐏𝐫𝐢𝐜𝐞𝐬 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

• 𝐉𝐚𝐩𝐚𝐧: 17060 USD/MT

• 𝐁𝐞𝐥𝐠𝐢𝐮𝐦: 18010 USD/MT

• 𝐂𝐡𝐢𝐥𝐞: 16710 USD/MT

𝗥𝗲𝗽𝗼𝗿𝘁 𝗢𝗳𝗳𝗲𝗿𝗶𝗻𝗴:

• 𝗠𝗼𝗻𝘁𝗵𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

• 𝗤𝘂𝗮𝗿𝘁𝗲𝗿𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

• 𝗕𝗶𝗮𝗻𝗻𝘂𝗮𝗹𝗹𝘆 𝗨𝗽𝗱𝗮𝘁𝗲𝘀: Annual Subscription

𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗙𝗼𝗿 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗖𝗼𝗽𝘆 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁: https://www.imarcgroup.com/lithium-carbonate-pricing-report/requestsample

𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐏𝐫𝐢𝐜𝐞 𝐓𝐫𝐞𝐧𝐝- 𝐋𝐚𝐬𝐭 𝐐𝐮𝐚𝐫𝐭𝐞𝐫

The lithium carbonate market is primarily driven by the surging demand for lithium-ion batteries, which are critical components in the growing electric vehicle (EV) sector and renewable energy storage systems. As global awareness of climate change intensifies, governments and consumers increasingly prioritize sustainable transportation solutions, leading to substantial investments in electric mobility.

This trend is further supported by various policy initiatives and incentives to reduce carbon emissions and promote clean energy technologies. Additionally, the proliferation of portable electronics, such as smartphones and laptops, continues to bolster the demand for high-capacity batteries, further driving the need for lithium carbonate.

The increasing adoption of energy storage solutions for solar and wind power systems also contributes significantly to market growth, as lithium-ion batteries are essential for storing energy generated from renewable sources. Besides this, advancements in lithium extraction technologies, including more sustainable methods, enhance supply chain efficiencies and expand production capacities, which is essential to meet the escalating global demand.

𝐋𝐢𝐭𝐡𝐢𝐮𝐦 𝐂𝐚𝐫𝐛𝐨𝐧𝐚𝐭𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

In the second quarter of 2024, the North American lithium carbonate market experienced a notable price increase, primarily due to a complex interplay of supply and demand dynamics. Elevated freight charges across major maritime trade routes significantly raised shipping costs, compounded by an unexpected surge in ocean freight demand from Asia, driven by restocking efforts in Europe and the acceleration of peak season demand among North American importers.

This situation strained the container market, further exacerbated by logistical challenges, including capacity constraints and port congestion. Meanwhile, in Europe, lithium carbonate prices experienced upward pressure due to moderate-to-high supply levels and substantial inventory among manufacturers. Belgium saw pronounced price increases resulting from high product availability and sluggish consumption rates, with rising production costs linked to higher spodumene prices.

Conversely, the Asia-Pacific region faced a significant downturn in lithium carbonate prices, largely due to an oversupplied market from cheaper imports, weakened demand from battery manufacturers, and subdued interest in electric vehicles. This bearish trend was particularly evident in Japan, reflecting broader challenges within the market. In South America, particularly Chile, lithium carbonate prices experienced a marginal decline amid weak consumer demand and oversupply issues, with major producers maintaining consistent production levels despite overall bearish market conditions influenced by sluggish EV sales and economic challenges.

𝐒𝐩𝐞𝐚𝐤 𝐓𝐨 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 : https://www.imarcgroup.com/request?type=report&id=22524&flag=C

• 𝗔𝘀𝗶𝗮 𝗣𝗮𝗰𝗶𝗳𝗶𝗰: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

• 𝗘𝘂𝗿𝗼𝗽𝗲: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

• 𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: United States and Canada

• 𝗟𝗮𝘁𝗶𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

• 𝗠𝗶𝗱𝗱𝗹𝗲 𝗘𝗮𝘀𝘁 & 𝗔𝗳𝗿𝗶𝗰𝗮: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

𝗡𝗼𝘁𝗲: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝘂𝘀:

𝗜𝗠𝗔𝗥𝗖 𝗚𝗿𝗼𝘂𝗽

134 N 4th St. Brooklyn, NY 11249, USA

𝗘𝗺𝗮𝗶𝗹: sales@imarcgroup.com

𝗧𝗲𝗹 𝗡𝗼:(𝗗) +91 120 433 0800

𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀: +1-631-791-1145

𝗔𝗯𝗼𝘂𝘁 𝗨𝘀:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Carbonate Prices, Demand, News, Chart and Forecast here

News-ID: 3686101 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Lithium

Lithium Compounds Market To Witness Massive Growth | Competitive Outlook Albemar …

Lithium compounds market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses the market to account 20.04 billion by 2027 growing with the CAGR of 20.90% in the above-mentioned forecast period. Huge investments in infrastructure developments is a vital factor driving the growth of lithium compounds market swiftly.

The Lithium Compounds Market research report assesses the ongoing as well as future…

Lithium Compounds Market 2020-2025 Global Analysis & Opportunity Assessment | Li …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Analysis & Industry Outlook 2019-2025| Livent Corporati …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Scenario & Industry Outlook 2019-2025| Livent Corporati …

The global lithium compound market size is projected to reach over USD 9 billion by 2025.The report on lithium compound market is aimed to equip report readers with versatile understanding on diverse marketing opportunities that are rampantly available across regional hubs. A thorough assessment and evaluation of these factors are likely to influence incremental growth prospects in the lithium compound market.

Request sample copy of this report at: https://www.adroitmarketresearch.com/contacts/request-sample/1445

Additionally, in this…

Lithium Fluoride Market players Jiangxu Ganfeng Lithium, Harshil Fluoride Brivo …

The developing in the glass, optics and electronic and electrical industries has initiated a high demand for Lithium and related compounds. Lithium and lithium based compounds are one the key substances that have dynamic usage, either as a feedstock or as product. One of the most commercially important compound is Lithium fluoride. Lithium fluoride is an odorless, crystalline lithium salt manufactured by the reaction of lithium hydroxide with hydrogen fluoride.…

Lithium Hydroxide Market | Key Players are FMC Corporation, Sociedad Quimica Min …

Lithium Hydroxide (LiOH) is an inorganic compound that is insoluble in water and partially soluble in ethanol. It is commercially available as a monohydrate (LiOH.H2O) and in anhydrous form, both of which are strong bases. On the basis of purity level, it is also available in battery grade and technical grade. Lithium hydroxide is manufactured by means of a metathesis reaction between calcium hydroxide and lithium carbonate and it finds…