Press release

New York Real Estate Attorney Natalia Sishodia Releases Insightful Article on Avoiding NYC Transfer Tax

New York real estate attorney Natalia Sishodia (https://sishodia.com/how-to-avoid-the-nyc-transfer-tax/) of Sishodia PLLC provides valuable insights into the often complex topic of transfer taxes in New York City. With the sale of a property, transfer taxes are a significant consideration for both buyers and sellers, and Natalia Sishodia emphasizes the importance of understanding and addressing this tax to minimize financial burdens.Transfer taxes in New York City can become a costly aspect of real estate transactions, especially for high-value properties. Natalia Sishodia, a seasoned New York real estate attorney, outlines various strategies that property owners can employ to mitigate these taxes and ensure compliance with local regulations. The NYC Real Property Transfer Tax (RPTT) applies to most sales, conveying significant financial obligations for sellers. Sishodia explains that although the tax is often unavoidable, there are methods to legally minimize its impact.

Natalia Sishodia highlights that individuals and entities engaged in property transactions must be aware of the intricacies of the tax code. The New York real estate attorney stresses that even minor misunderstandings can lead to costly penalties or missed opportunities for tax savings. By being proactive and seeking professional legal advice, parties can further ensure that they are fully compliant with tax regulations while potentially reducing their financial obligations.

"Real estate in New York City involves a number of taxes and fees that can add up, but the NYC Transfer Tax is one that often surprises sellers. It's critical to know what's applicable to your sale and to plan accordingly," says New York real estate attorney Natalia Sishodia. Sishodia's guidance can be valuable for property owners, especially those dealing with higher-priced real estate, seeking ways to maximize their returns in a competitive market.

Among the methods discussed by Sishodia to avoid or reduce transfer taxes is the use of exemptions that apply in certain situations. One such exemption involves transfers between spouses, which typically are not subject to the NYC Transfer Tax. Additionally, Sishodia mentions that if a property is sold for less than $25,000, the transaction is also exempt from the RPTT. These exemptions, while beneficial, require strict adherence to guidelines to ensure eligibility.

Furthermore, Natalia Sishodia discusses the benefits of planning a sale strategically, such as structuring the transaction through a legal entity like a limited liability company (LLC). This approach may provide flexibility in managing tax liabilities and can be particularly advantageous in certain high-value transactions. As a New York real estate attorney, Sishodia advises that each situation be evaluated on a case-by-case basis to determine the most effective tax strategies.

While the NYC Transfer Tax is a well-established aspect of real estate transactions, the New York real estate attorney points out that many sellers are still unaware of its potential impact. Sishodia's goal is to equip property owners with the knowledge they need to make informed decisions. Through the detailed explanation, the New York real estate attorney hopes to reduce the anxiety often associated with real estate taxes and help clients approach their transactions with confidence.

As Natalia Sishodia underscores, one of the most effective ways to avoid unnecessary tax burdens is by consulting with a knowledgeable New York real estate attorney early in the process. Whether through utilizing exemptions, strategically structuring the sale, or exploring other options, professional guidance can be instrumental in achieving the best possible financial outcomes.

New York City's competitive real estate market requires sellers and buyers alike to be vigilant in their financial planning. With transfer taxes representing a significant portion of transaction costs, the guidance of a real estate attorney such as Natalia Sishodia can make a substantial difference. By staying informed and taking the appropriate steps, property owners can mitigate the impact of taxes on their sales and optimize their returns.

Property owners looking to sell or transfer real estate in New York City should seek professional advice early in the process. Working with an experienced real estate attorney such as Natalia Sishodia can help ensure that the transaction is completed smoothly, legally, and with the least financial burden possible. By understanding the available exemptions and structuring deals wisely, sellers can avoid unnecessary costs and protect their investments.

About Sishodia PLLC:

Sishodia PLLC is a New York-based law firm that can provide comprehensive legal services in real estate transactions, estate planning, and tax law. Led by New York real estate attorney Natalia Sishodia, the firm is committed to offering personalized legal solutions to individuals and businesses involved in property transactions. Sishodia PLLC prides itself on delivering high-quality legal counsel tailored to the unique needs of New York's real estate market.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=vtn6E93Sr10

GMB: https://www.google.com/maps?cid=12450537318741950980

Email and website

Email: natalia@sishodialaw.com

Website: https://sishodia.com/

Media Contact

Company Name: Sishodia PLLC

Contact Person: Natalia A. Sishodia

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-york-real-estate-attorney-natalia-sishodia-releases-insightful-article-on-avoiding-nyc-transfer-tax]

Phone: (833) 616-4646

Address:600 3rd Ave 2nd floor

City: New York

State: New York 10016

Country: United States

Website: https://sishodia.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New York Real Estate Attorney Natalia Sishodia Releases Insightful Article on Avoiding NYC Transfer Tax here

News-ID: 3685618 • Views: …

More Releases from ABNewswire

SEO Agency Dubai: How Data-Driven Search Strategies Are Shaping Digital Growth

Explore how a data-driven SEO agency in Dubai helps businesses grow online through advanced search strategies, analytics, and performance-based SEO. Visit us today!

Dubai's digital economy is moving fast, and visibility has become a decisive factor in growth. Businesses competing in saturated markets can no longer rely solely on paid ads. They need organic authority, credibility, and long-term discoverability. This is where an SEO agency Dubai [https://www.google.com/search?SEO+agency+Dubai&kgmid=/g/11v3f6wqbl] businesses trust becomes essential,…

The Life and Loves of an Artist Illuminates the Remarkable Journey Behind a Life …

Authors Paul and Gail King present The Life and Loves of an Artist. This sweeping biographical narrative traces the extraordinary story of a family whose lives were intertwined with art, resilience, and history.

Rooted in meticulous research and personal reflection, the book offers a moving portrait of two generations shaped by both hardship and inspiration.

Purpose of the Book

What started as an attempt to remember family memories became a vivid journey of…

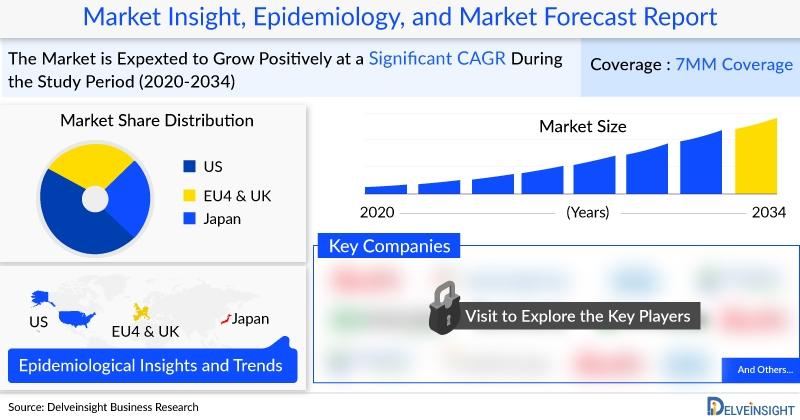

Alzheimer's Disease Market in the 7MM is projected to reach USD 34 Billion by 20 …

Key players operating in the Alzheimer's disease market include Eisai, Biogen, Changchun Huayang High-tech Co. Ltd., Hoffmann-La Roche, vTv Therapeutics, AZTherapies, Cerecin, Neurotrope, Lyndra, AC Immune, INmune Bio, Cassava Sciences, EIP Pharma, Neuraly, AB Science, Cortexyme, Anavex Life Sciences, Athira Pharma, Time Therapeutics, Prilenia Therapeutics, Denali Therapeutics Inc., Stemedica Cell Technologies, Inc., along with several other emerging and established companies.

The Alzheimer's disease market was valued at approximately USD 3,610 million…

Glaucoma Market Forecast 2034: USD 4,073 Million Market Size, 30+ Companies, and …

Major Glaucoma players include Allergan (AbbVie), Sun Pharma Advanced Research Company Limited, Santen Pharmaceutical Co., Ltd., Alcon, D. Western Therapeutics Institute (DWTI), Kowa Ltd., Senju Pharmaceuticals, Otsuka Pharmaceuticals, Bausch and Lomb, Novartis, Merck & Co., Aerie Pharmaceuticals, Nicox Ophthalmics, Sylentis, Envisia Therapeutics, Ocuphire Pharma, TearClear, Peregrine Ophthalmic, and others.

The Glaucoma Market across the seven major markets (7MM) - the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom,…

More Releases for Sishodia

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

NYC Condo Attorney Natalia Sishodia Provides Insights on Manhattan Real Estate T …

NYC condo attorney [https://sishodia.com/manhattan-condo-real-estate-attorney/] Natalia Sishodia discusses key aspects of Manhattan real estate transactions, helping buyers and sellers navigate purchasing or selling a condominium in the city. With the competitive nature of the real estate market, having an understanding of legal requirements and potential challenges is essential. Sishodia PLLC provides guidance on contract negotiations, due diligence, and closing processes for those involved in condo transactions.

As an NYC condo attorney, Natalia…

Manhattan Deed Transfer Lawyer Natalia Sishodia Releases Insightful Article on P …

Manhattan deed transfer lawyer Natalia Sishodia (https://sishodia.com/manhattan-deed-transfer-lawyer/), of Sishodia PLLC, highlights the essential role of deed transfers in real estate transactions. A deed, which serves as the official document transferring property ownership from one party to another, is foundational in establishing clear and lawful property rights. Handling these transfers properly is critical to avoiding costly disputes or legal challenges.

A deed transfer is not just about signing paperwork. As Manhattan deed…

New York Estate Probate Lawyer Natalia Sishodia Explains the Probate Sale Proces …

Probate sales play an important role in settling estates after the death of a loved one. According to New York estate probate lawyer Natalia Sishodia (https://sishodia.com/what-is-a-probate-sale/) of Sishodia PLLC, a probate sale involves selling property under court supervision to meet the financial obligations of the deceased, such as debts and taxes, before distributing any remaining assets to beneficiaries. This legal process ensures that everything is conducted fairly, especially when real…

New York Estate Probate Lawyer Natalia Sishodia Explains the NY Estate Probate P …

New York estate probate lawyer Natalia Sishodia (https://sishodia.com/new-york-estate-probate-lawyer/) releases a new article explaining the NY estate probate process. The lawyer mentions that the probate process refers to the transfer of property from a person to their heirs. Going through the probate process can be lengthy and complicated, especially after losing a loved one.

"A Will or a Last Will and Testament is a written document detailing what a person wants to…