Press release

Steel Price Trend: A Comprehensive Analysis

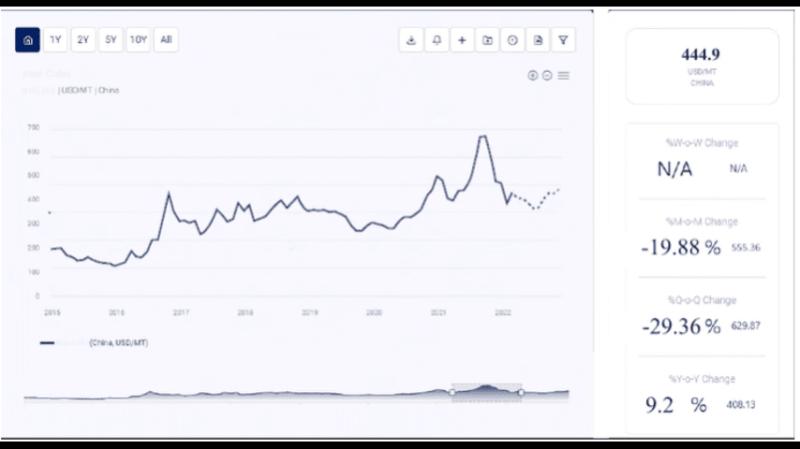

Steel is one of the most widely used materials in the world due to its strength, durability, and versatility. It plays a fundamental role in industries such as construction, automotive, infrastructure, and machinery manufacturing. Given its significance in the global economy, steel price trends reflect broader economic conditions and are influenced by a variety of factors, including supply and demand dynamics, energy costs, trade policies, and geopolitical events.Steel Price Trend:- https://shorturl.at/iY2zo

This article provides an in-depth analysis of historical trends, recent developments, and future projections for steel prices. Understanding these trends is crucial for businesses, investors, and policymakers as they navigate the complexities of the steel market.

Historical Trends in Steel Prices

2000s: Rising Demand and Economic Growth

In the early 2000s, steel prices experienced a steady increase, driven by rapid economic expansion, particularly in emerging markets like China. As China began large-scale urbanization and infrastructure projects, demand for steel soared. Steel prices peaked around 2008, reaching nearly $1,200 per ton as the global economy thrived and construction activity surged.

The financial crisis of 2008, however, led to a significant decline in steel prices as economic growth stalled, and industrial activity slowed worldwide. Prices dropped by more than 50% in a short period, highlighting the close link between steel demand and global economic conditions. This marked the beginning of a volatile period for the steel market.

Enquire For Regular Prices: https://shorturl.at/R1D7P

2010-2015: Market Volatility and Excess Capacity

From 2010 to 2015, steel prices experienced volatility due to varying economic conditions, changing demand, and excess production capacity. During this period, China continued to dominate global steel production, leading to an oversupply in the market. Global steel capacity increased significantly, leading to price pressures as supply exceeded demand.

In 2014, the European Union and the United States accused China of dumping steel at below-market prices, further disrupting the market. Trade tensions and tariffs were introduced, adding to the volatility. By 2015, steel prices had dropped to around $400 per ton, reflecting both the supply glut and slowing demand from traditional steel-consuming industries.

2016-2019: Stabilization and Gradual Recovery

Between 2016 and 2019, steel prices gradually recovered as global demand for steel rebounded, particularly from the construction and automotive sectors. Chinese steel production began to slow, partly due to government efforts to curb pollution and reduce overcapacity. China's decision to cut production in certain regions helped stabilize the global steel market, leading to higher prices.

In 2018, the United States imposed tariffs on imported steel, sparking trade tensions and adding to price volatility. The tariffs temporarily increased U.S. steel prices due to reduced imports, while global prices remained relatively stable. However, by 2019, trade tensions eased, and steel prices stabilized around $500-$600 per ton, as the market adjusted to new trade policies.

2020: Pandemic-Induced Price Fluctuations

The COVID-19 pandemic in 2020 introduced significant volatility into the steel market. Lockdowns and reduced industrial activity led to a sharp drop in demand for steel, causing prices to decline in the first half of the year. However, as countries began to reopen and implement economic stimulus measures, steel demand quickly rebounded, particularly in construction and infrastructure projects.

Additionally, pandemic-related disruptions to supply chains, including labor shortages and logistical challenges, led to constrained supply. By the end of 2020, steel prices began to rise again as production lagged behind demand, particularly in regions experiencing strong economic recoveries, such as China and the United States.

Current Steel Price Trends (2021-Present)

2021: Record Highs and Supply Constraints

In 2021, steel prices reached record highs, driven by strong global demand, supply constraints, and rising raw material costs. Key factors contributing to this price surge included:

Economic Recovery: As countries implemented stimulus measures to rebuild their economies post-pandemic, demand for steel surged, particularly in construction, infrastructure, and manufacturing sectors.

Raw Material Costs: Prices for key steel-making inputs, such as iron ore and coking coal, rose significantly due to high demand and supply disruptions. This increase in raw material costs added to steel production expenses, pushing steel prices higher.

Supply Chain Disruptions: Global supply chains continued to experience disruptions due to pandemic-related challenges, labor shortages, and logistical bottlenecks. Steel production was also affected by these issues, leading to tight supply.

Environmental Regulations in China: China, the world's largest steel producer, introduced stricter environmental regulations, leading to production cuts in some regions to reduce emissions. This created further supply constraints in the global steel market.

By mid-2021, steel prices had peaked at over $1,800 per ton in some markets, driven by the convergence of high demand and limited supply.

2022: Market Volatility Amid Geopolitical Tensions

In 2022, steel prices remained volatile due to various macroeconomic and geopolitical factors. Russia's invasion of Ukraine in early 2022 had a notable impact on the steel market, as both countries are significant exporters of raw materials used in steel production, such as iron ore and coking coal. Supply disruptions from the conflict, combined with sanctions on Russia, led to higher raw material costs and additional price volatility in the steel market.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Procurement Resource is a premier market research firm dedicated to delivering in-depth insights and analysis on the procurement and production costs of a wide range of commodities and products. Backed by a team of experienced industry professionals, Procurement Resource provides detailed reports that encompass every aspect of the supply chain-from sourcing raw materials to final product manufacturing. Their services are tailored to help businesses enhance their procurement strategies, minimize costs, and improve overall efficiency. With robust market intelligence and proprietary cost models, Procurement Resource empowers clients to make well-informed decisions, remain competitive, and foster sustainable growth in today's dynamic market environment.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steel Price Trend: A Comprehensive Analysis here

News-ID: 3682360 • Views: …

More Releases from Procurement Resource

Cocoa Butter Price Trend: Market Drivers, Supply Dynamics, and Global Outlook fo …

The Cocoa Butter Price Trend has become a strategic point of attention for confectionery manufacturers, personal care brands, food processors, commodity traders, and procurement leaders across global supply chains. As cocoa butter remains one of the most essential raw materials in chocolate production and a core ingredient in cosmetics, pharmaceuticals, and nutraceuticals, fluctuations in its price directly influence cost structures, profit margins, and retail pricing strategies across multiple industries.

Inquire for…

Dichloromethane Price Trend Analysis Report By Procurement Resource

Dichloromethane (DCM), also known as methylene chloride, is a volatile, colorless liquid primarily used as a solvent in various industrial processes. It plays a critical role in paint stripping, pharmaceuticals, adhesives, and metal cleaning. With increasing demand and changing dynamics across global supply chains, the Dichloromethane price trend has become a key point of interest for stakeholders across industries.

Dichloromethane Price Trend Analysis Report: https://www.procurementresource.com/resource-center/dichloromethane-price-trends

This article explores a comprehensive overview of…

Ammonium Nitrate Production Cost Analysis

Ammonium nitrate is a widely used inorganic chemical compound with significant applications in fertilizers, explosives, mining, construction, and industrial blasting. Due to its high nitrogen content and strong oxidizing properties, ammonium nitrate plays a crucial role in global agriculture and industrial development. Understanding the ammonium nitrate production cost structure is essential for manufacturers, investors, and procurement professionals operating in fertilizer and chemical markets.

Request a Free Sample:- https://www.procurementresource.com/production-cost-report-store/ammonium-nitrate/request-sample

This article provides a…

Naphthalene Sulfonic Acid Price Trend: Cost Drivers, Supply Dynamics, and Global …

The Naphthalene Sulfonic Acid Price Trend has become an increasingly important indicator for manufacturers, procurement teams, and industrial planners operating across construction chemicals, textiles, dyes, agrochemicals, and specialty chemical segments. As a key intermediate used in the production of concrete admixtures, dispersants, dye intermediates, and surfactants, fluctuations in naphthalene sulfonic acid pricing have a direct impact on downstream cost structures and profit margins.

Inquire for Latest Market Prices :- https://www.procurementresource.com/resource-center/naphthalene-sulfonic-acid-price-trends/pricerequest

In 2025,…

More Releases for China

China fund establishment, China fund management,china investment management

Pandacu China is a leading financial institution that specializes in providing fund establishment and management services for domestic and international investors looking to invest in China. The company was founded in 2015 by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the investment industry.

https://boomingfaucet.com/

China Fund Establishment Consultation

E-mail:nolan@pandacuads.com

Investing in China can be a complex and challenging process, and…

China Finance Advisor, China Debt Finance Corporation,China Investment Corporati …

Investment bank is a financial institution that helps companies and governments raise capital by underwriting and issuing securities, and also provides advice on mergers and acquisitions, strategic investments, and other financial matters. Investment banks typically have a team of professionals with expertise in various areas such as corporate finance, securities underwriting, sales and trading, and market research.

http://pandacuads.com/

China Investment Corporation

Email:nolan@pandacuads.com

Some of the main services provided by investment banks include:

Underwriting: Investment banks…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

china construction company,china engineering company,china major bridge engineer …

List of Top 500 Chinese Construction Enterprises

ranking

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Company Name

province

1

China State Construction Corporation Limited

Beijing

2

China Railway Corporation Limited

Beijing

3

China Railway Construction Corporation Limited

Beijing

4

Shanghai Weimengsi Construction Engineering Co., Ltd.

Shanghai

5

China Communications Construction Group Co., Ltd.

Beijing

6

China Power Construction Corporation Limited

Beijing

7

China Energy Construction Group Co., Ltd.

Beijing

8

Shanghai Construction Engineering Group Co., Ltd.

Shanghai

9

Jiangsu Zhongnan Construction Industry Group Co., Ltd.

Jiangsu

10

China Gezhouba Group Co., Ltd.

Hubei

11

China National Chemical Engineering Co., Ltd.

Beijing

12

Sinoma Group Co., Ltd.

Beijing

13

Guangxi Construction Engineering Group Co., Ltd.

Guangxi

14

Shanghai Urban…

Forehead Thermometer Market Analysis (2019- 2025)| Microlife (China), Radiant (C …

This research study is one of the most detailed and accurate ones that solely focus on the global Forehead Thermometer market. It sheds light on critical factors that impact the growth of the global Forehead Thermometer market on several fronts. Market participants can use the report to gain a sound understanding of the competitive landscape and strategies adopted by leading players of the global Forehead Thermometer market. The authors of…

Global Color Steel Tile Market 2017 - South China, East China, Southwest China, …

Color Steel Tile Market Research Report

A market study based on the " Color Steel Tile Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Color Steel Tile Market 2017’. The research report analyses the historical as well as present performance of the worldwide Color Steel Tile industry, and makes predictions on the future status of Color Steel Tile market on the basis…