Press release

Global N-Propyl Acetate Market Research Report 2024

The Global "N-Propyl Acetate Market" Size was estimated at USD 196.49 million in 2024 and is projected to reach USD 272.47 million by 2030, exhibiting a CAGR of 5.60% during the forecast period.Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/260759/global-npropyl-acetate-market-2024-691

The market for N-propyl acetate is defined by its diverse applications in a range of industries, such as paints and coatings, adhesives, cosmetics, and pharmaceuticals. N-propyl acetate is used as a solvent because of its high rate of evaporation, low toxicity, and capacity to dissolve a variety of compounds. This makes it perfect for use in formulations that call for quick drying durations and little residue. The market has been supported by the rising demand for low-VOC (volatile organic compound) and environmentally friendly products as manufacturers look more and more for sustainable options.

Furthermore, improvements in production methods along with the rise of end-use industries, especially in emerging nations, are anticipated to propel market expansion. The industry's major companies are concentrating on capacity increases, strategic alliances, and innovations to improve product quality and satisfy changing consumer demands. However, fluctuations in raw material prices and stringent regulatory frameworks may pose challenges to market players in the near future.

Segmental Analysis

N-Proply Acetate 99.5% holds the highest market share: By Type

In terms of type, the global N-Propyl Acetate industry has been segmented as N-Propyl Acetate 99.5%, N-Propyl Acetate 99.0%.

N-Propyl Acetate with a purity of 99.5% holds the highest market share primarily due to its superior quality and performance characteristics. This high-purity variant is widely preferred in applications where solvent effectiveness and minimal impurities are crucial. This grade is preferred in industries like paints and coatings because a cleaner finish and increased durability areas where ideal film formation and drying rates are critical. High-purity solvent are also necessary for the pharmaceutical and cosmetic industries in order to meet strict regulations and guarantee product safety. The market for market for N-Propyl Acetate 99.5% has grown dramatically due to the strong demand for premium solvents in certain uses.

On the other hand, N-Propyl Acetate with 99.0% purity serves as a cost-effective alternative, appealing to price-sensitive segments of the market. This grade is suitable for applications where absolute purity is not as critical, such as in certain adhesive formulations and general industrial uses. While it does not command the same level of demand as the 99.5% variant, it still holds a substantial market share, particularly in regions or industries where cost considerations outweigh the need for higher purity.

Paint & Coating to hold the highest market share: By Application

Based on application, the global N-Propyl Acetate industry has been segmented as Paint & Coatings, Printing Ink, Cosmetic and Personal Care, Food and Beverages, Pharmaceuticals, and Others.

In the N-Propyl Acetate market, the paints and coatings application segment holds the highest market share, primarily due to its critical role in enhancing the performance and quality of various coating formulations. This solvent is highly recommended for automotive, industrial, and architectural coatings due to its exceptional solvency qualities, quick rate of evaporation, and capacity to produce a smooth, long-lasting finish. The demand for high-performance paints and coatings rises in tandem with the expansion of the automotive and construction industries, which are propelled by rising infrastructure development and consumer demand for automobiles. The market for N-Propyl Acetate in this market is further supported by strict environmental rules that favour low-VOC solvents, as manufacturers look for efficient and compliance solutions. The paints and coatings segment continues to be the leading force in the market, despite the expansion of other applications such as printing ink and cosmetics. This is due to the extensive use of the segment in many industries that are striving to improve quality and performance.

Regional Analysis

The regional dynamics of the N-propyl acetate market reflect varying growth patterns influenced by industrial activity, regulatory environments, and economic conditions.

North America is a significant market, characterized by stringent environmental regulations that encourage the use of safer solvents, including N-propyl acetate. Demand is driven by the existence of well-established end-use industries, especially in the coatings, adhesives, and inks sectors. To further spur market expansion, major players in the area are concentrating on sustainable development and innovative products.

Due to comparable legislative demands to reduce volatile organic compound emissions and promote ecologically acceptable alternatives, Europe also plays a significant role. The need for N-propyl acetate, particularly in paints and coatings, is sustained by the region's strong industrial sector, which includes the automobile and construction industries. Leading nations in the adoption of environmentally friendly solutions include France and Germany, which guarantees the market's competitiveness.

Despite having a smaller market share, the Middle East and Africa are steadily growing as a result of continuous industrial initiatives and infrastructure development. The demand for N-propyl acetate is anticipated to rise as nations in this region prioritise economic diversification and sustainability.

Overall, the regional analysis shows that Asia-Pacific is emerging as a key growth driver, capitalising on rapid industrial development and the demand for eco-friendly solvents, while North America and Europe continue to hold significant market shares due to established industries and regulatory frameworks.

Competitive analysis

Oxea

Dow

BASF

Eastman

Solvay

Showa Denko K.K.

Daicel

Sasol

Chang Chun Group

Shiny Chem

Handsome Chemical

Zhejiang Jianye

Nanjing Wujiang

Jiangsu Baichuan

Ningbo Yongshun

Jiangsu Ruijia

Yixing Kaixin

Other Key Players

The market for N-propyl acetate is highly volatile, with both local producers and multinational chemical companies competing for market dominance. The market is dominated by major firms including BASF SE, Dow Chemical, Eastman Chemical Company, and Oxea GmbH because of their extensive distribution networks, focus on innovation, and enormous production capacity. In response to growing regulatory pressure on VOC emissions and sustainability, these companies are actively investing in R&D to develop more effective, eco-friendly solvents.

The Global players leverage their scale to offer competitive pricing and maintain a diverse product portfolio, catering to various end-use industries such as coatings, adhesives, and cleaning products. They also engage in strategic mergers and acquisitions to expand their geographic presence and strengthen their market position.

Recent Developments

April 4th 2023, Solvay announced its strategic collaboration with Ginkgo Bio works in order to expand its research and Innovation in the United States. This acquisition is likely to provide Solvay access to new talents as well as establish sustainable growth in synthetic biology in the most important biotech hubs in the world there by accelerating the companies' biotech development plans.

September 18th 2023, Solvya sign strategic partnership agreement with market developments and Shengjian in order for technical exchange, with the market development and material supply. With this partnership the company aims to strengthen their business relations as well as expand into new market. "By reinforcing the strong bond between our companies, this agreement will also create a win-win situation for seizing new business opportunities and strengthening our ties with strategic end-customers." says Peter Browning, President of Solvay's Specialty Polymers Global Business Unit.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/260759/global-npropyl-acetate-market-2024-691

End Use industry Analysis

The N-propyl acetate market serves a variety of end-use industries, each contributing to the market's growth in distinct ways. .

The United States is one of the top pharma outsourcing destinations for pharma companies. The United States was one of the top outsourcing locations for pharmaceutical and biopharmaceutical research and manufacturing, according to Bioplan's 2022 Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production. This was because the nation was home to several contract manufacturers.

The R&D spending of European pharmaceutical businesses reached from EUR 42,533 million in 2021 to EUR 44,500 million in 2022, according to data from the European Federation of Pharmaceutical Industries and Associates as of June 2023. As a result, it is anticipated that pharmaceutical manufacturing businesses' rising R&D spending will boost industry activity, including production, and aid in market expansion.

The pharmaceutical industry in India is expected to reach $65 Bn by 2024 and to $130 Bn by 2030.

Industry Dynamics

Industry Trends

Increasing shift towards eco-friendly and low-VOC (volatile organic compounds) solvents

One of the significant trends in the N-propyl acetate market is the increasing shift towards eco-friendly and low-VOC (volatile organic compounds) solvents. Industries are looking for more environmentally friendly solvent substitutes as environmental laws become more stringent globally, as these solvents increase air pollution and health hazards. When compared to many common solvents, N-propyl acetate has lower VOC emissions and is less hazardous, making it a cleaner and greener choice. Since manufacturers are being pushed to lessen their environmental effect by regulations like the European Union's REACH standards and the United States EPA Clean Air Act, this trend is especially strong in industries like paints and coatings, adhesives, and printing inks. N-propyl acetate is being used more often by businesses in various industries to satisfy regulatory standards and preserve product attributes including strong solvency power and fast drying durations.

Furthermore, even in industrial applications, there is a growing need for eco-friendly products as consumer awareness of sustainability rises. This has further encouraged producers to spend money on R&D developing solvents like N-propyl acetate that have advantages for the environment and performance. The market for N-propyl acetate is anticipated to continue to be shaped by the push for sustainable manufacturing methods, especially in developed nations like North America and Europe and in the increasingly industrialising Asia-Pacific region where environmental restrictions are becoming more stringent.

Industry Drivers

Growing demand from the End Use industries

The expanding need for N-propyl acetate from the paint, coating, and adhesives industries-which is being propelled by a rise in global automobile production, infrastructure development, and construction-is a major market driver. High-quality coatings and adhesives are more important in residential, commercial, and industrial projects as urbanisation picks up speed, especially in developing regions like Asia-Pacific and Latin America. In these sectors, N-propyl acetate is frequently utilised to enhance product performance and fulfil particular application needs due to its outstanding solubility, short drying time, and low toxicity.

The need for paints and coatings-where N-propyl acetate plays a critical role as a solvent-has increased in the automobile industry due to the growing emphasis on vehicle aesthetics, customisations, and repairs. The use of solvents in coatings and adhesives has expanded as a direct result of the worldwide automobile market's expansion, especially in China, India, and Southeast Asia. Additionally, manufacturers in these sectors are turning to solvents like N-propyl acetate, which provide a balance between performance and regulatory compliance, as customers seek more low-VOC and ecologically friendly products. This development is especially noticeable in developed markets with strict environmental restrictions, such as those in North America and Europe, which further encourages the use of N-propyl acetate.

Industry Restraint

Volatile price of raw material and supply chain disruption

The market for N-propyl acetate is significantly constrained by supply chain interruptions and price volatility for raw materials. Propanol and acetic acid, both by-products of petrochemical feedstock, are combined to create N-propyl acetate. The costs of producing N-propyl acetate might become unstable due to changes in the pricing of crude oil and natural gas, which are the main raw materials used in petrochemical production. Geopolitical tensions, shifting trade regulations, and changes in the energy sector's market dynamics are frequently the causes of this volatility.

Further affecting the availability and cost of N-propyl acetate are supply chain disruptions, such as those brought on by the COVID-19 epidemic, logistical issues, or shortages of raw materials. The industries that depend on N-propyl acetate are affected in a cascading manner by these disruptions, particularly paints, coatings, and adhesives, where a steady supply is essential for ongoing production.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Types, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market's competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

Attributes

Details

Segments

By Type

N-Propyl Acetate 99.5%

N-Propyl Acetate 99.0%

By Application

Paints & Coatings

Printing Ink

Cosmetics and Personal Care

Food & Beverages

Pharmaceuticals

Others

Region Covered

Key Market Players

Report Coverage

Industry Trends

SWOT Analysis

PESTEL Analysis

Porter's Five Forces Analysis

Market Competition by Manufacturers

Key Companies Profiled

Marketing Channel, Distributors and Customers

Market Dynamics

Production and Supply Forecast

Demand Forecast

Research Findings and Conclusion

Chapter Outline

Chapter 1 mainly introduces the statistical scope of the report, market division standards, and market research methods.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the N-Propyl Acetate Market and its likely evolution in the short to mid-term, and long term.

Chapter 3 makes a detailed analysis of the Market's Competitive Landscape of the market and provides the market share, capacity, output, price, latest development plan, merger, and acquisition information of the main manufacturers in the market.

Chapter 4 is the analysis of the whole market industrial chain, including the upstream and downstream of the industry, as well as Porter's five forces analysis.

Chapter 5 introduces the latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 6 provides the analysis of various market segments according to product types, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 7 provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 8 provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 9 introduces the basic situation of the main companies in the market in detail, including product sales revenue, sales volume, price, gross profit margin, market share, product introduction, recent development, etc.

Chapter 10 provides a quantitative analysis of the market size and development potential of each region in the next five years.

Chapter 11 provides a quantitative analysis of the market size and development potential of each market segment (product type and application) in the next five years.

Chapter 12 is the main points and conclusions of the report.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/260759/global-npropyl-acetate-market-2024-691

Table of content

Table of Contents

1 Research Methodology and Statistical Scope

1.1 Market Definition and Statistical Scope of N-Propyl Acetate

1.2 Key Market Segments

1.2.1 N-Propyl Acetate Segment by Type

1.2.2 N-Propyl Acetate Segment by Application

1.3 Methodology & Sources of Information

1.3.1 Research Methodology

1.3.2 Research Process

1.3.3 Market Breakdown and Data Triangulation

1.3.4 Base Year

1.3.5 Report Assumptions & Caveats

2 N-Propyl Acetate Market Overview

2.1 Global Market Overview

2.1.1 Global N-Propyl Acetate Market Size (M USD) Estimates and Forecasts (2019-2030)

2.1.2 Global N-Propyl Acetate Sales Estimates and Forecasts (2019-2030)

2.2 Market Segment Executive Summary

2.3 Global Market Size by Region

3 N-Propyl Acetate Market Competitive Landscape

3.1 Global N-Propyl Acetate Sales by Manufacturers (2019-2024)

3.2 Global N-Propyl Acetate Revenue Market Share by Manufacturers (2019-2024)

3.3 N-Propyl Acetate Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.4 Global N-Propyl Acetate Average Price by Manufacturers (2019-2024)

3.5 Manufacturers N-Propyl Acetate Sales Sites, Area Served, Product Type

3.6 N-Propyl Acetate Market Competitive Situation and Trends

3.6.1 N-Propyl Acetate Market Concentration Rate

3.6.2 Global 5 and 10 Largest N-Propyl Acetate Players Market Share by Revenue

3.6.3 Mergers & Acquisitions, Expansion

4 N-Propyl Acetate Industry Chain Analysis

4.1 N-Propyl Acetate Industry Chain Analysis

4.2 Market Overview of Key Raw Materials

4.3 Midstream M

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, India 411014

International: +1(332) 2424 294

Asia: +91 9169162030

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, India 411014

International: +1(332) 2424 294

Asia: +91 9169162030

Our Prime focus is to provide bespoke industry intelligence, equity research reports and business consulting services on chemical sector across the globe.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global N-Propyl Acetate Market Research Report 2024 here

News-ID: 3675171 • Views: …

More Releases from 24chemicalresearch

Molded Fiber Pulp Packaging for Food market 2026-2034: Pathways to Innovation & …

Global Molded Fiber Pulp Packaging for Food market demonstrates robust expansion, valued at USD 2.25 billionin 2026 with projections indicating growth to USD 3.80 billion by 2034, reflecting a 6.0% CAGR. This sustainable packaging solution gains traction as food manufacturers and retailers prioritize eco-friendly alternatives to plastic, driven by regulatory pressures and shifting consumer preferences.

Molded fiber pulp packaging, manufactured from recycled paperboard or agricultural byproducts, offers superior biodegradability and cushioning…

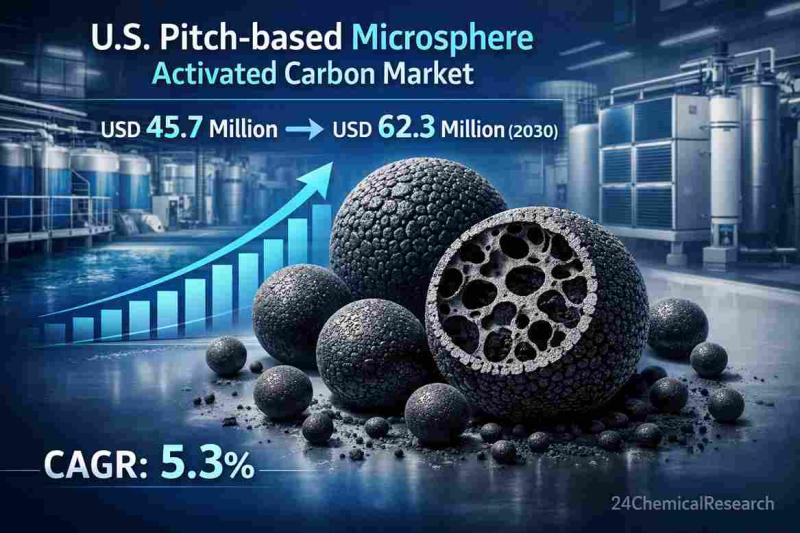

Is the global Pitch-based Microsphere Activated Carbon market growing rapidly an …

The United States Pitch-based Microsphere Activated Carbon market was valued at USD 45.7million in 2026 and is projected to reach USD 62.3 million by 2032, growing at a CAGR of 5.3 % during the forecast period. This specialized adsorbent material - featuring spherical particles with controlled pore structures - continues gaining traction across high-performance purification applications where standard granular activated carbon falls short.

Pitch-based microsphere activated carbon demonstrates superior performance in…

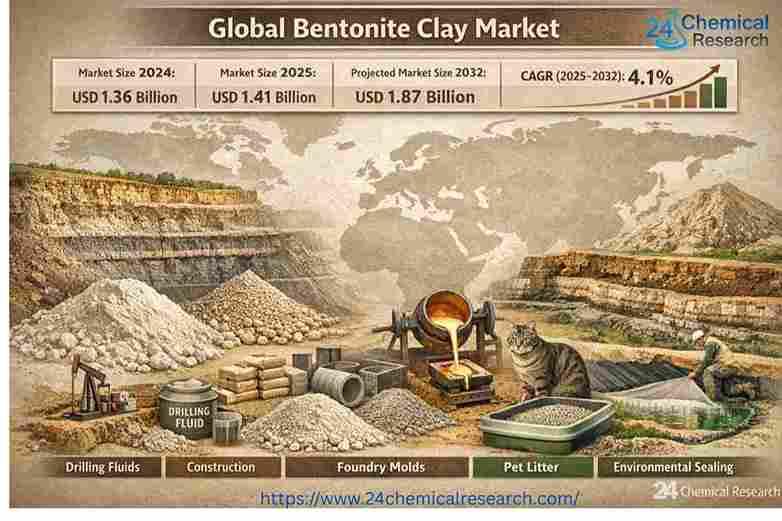

Global Bentonite Clay Market Poised for Steady Growth, Projected to Reach USD 1. …

Driven by construction boom and environmental applications, the versatile mineral market exhibits resilience and innovation amid challenges.

Global bentonite clay market, valued at USD 1.36 billion in 2024, is on a trajectory of consistent expansion, according to the latest comprehensive analysis by 24chemicalresearch. The market is projected to grow at aCAGR of 4.1%, reaching an estimated USD 1.41 billion in 2025 and USD 1.87 billion by 2032.

This growth underscores the enduring…

Global Ammonium Bicarbonate Market Report 2025-2032: Industry Size, Share & Stra …

Global Ammonium Bicarbonate Market continues to demonstrate stable demand across multiple industries, with its valuation reaching USD 1.23 billion in 2023. According to the latest industry analysis, the market is projected to decline to USD 800 million by 2029, exhibiting a CAGR of -6.90% during the forecast period. This contraction is attributed to regulatory shifts in Western markets, while Asia-Pacific continues to dominate consumption due to strong agricultural and food…

More Releases for Acetate

Global Sodium Acetate Trihydrate And Sodium Acetate Anhydrous Market Size by App …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to Market Research Intellect, the global Sodium Acetate Trihydrate And Sodium Acetate Anhydrous market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The sodium acetate trihydrate and sodium acetate anhydrous market is experiencing steady growth, driven by their wide-ranging applications in industries…

Ethylene Vinyl Acetate Market Report 2024 - Ethylene Vinyl Acetate Market Growth …

"The Business Research Company recently released a comprehensive report on the Global Ethylene Vinyl Acetate Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Cellulose Esters Market (Cellulose Acetate, Cellulose Acetate Butyrate, Cellulos …

The cellulose esters market is projected to grow from 9.27 billion in 2018 to USD 12.43 billion by 2023,at a CAGR of 6.0% from 2018 to 2023. The growing use of cellulose esters in various applications, increasing demand for cellulose esters from the Asia Pacific region, and ongoing technological advancements in various applications are leading to the growth of the cellulose esters market across the globe.

Get Free Market Updates…

Sodium Acetate Trihydrate and Sodium Acetate Anhydrous Market Current Trends and …

An uptick in the demand for sodium acetate trihydrate and sodium acetate anhydrous market will lead to moderately healthy growth in both these markets to 2020, says a latest study published by Transparency Market Research. The report, “Sodium Acetate Trihydrate and Sodium Acetate Anhydrous Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020,” is composed of sharp insights and an array of informative tables and charts. The…

Sodium Acetate Trihydrate and Sodium Acetate Anhydrous Market Latest Trends, Dem …

An uptick in the demand for sodium acetate trihydrate and sodium acetate anhydrous market will lead to moderately healthy growth in both these markets to 2020, says a latest study published by Transparency Market Research. The report, “Sodium Acetate Trihydrate and Sodium Acetate Anhydrous Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020,” is composed of sharp insights and an array of informative tables and charts. The…

Neuropeptide Y Acetate Market

Neuropeptide Y (NPY), a peptide with 36-amino acids, acts as a neurotransmitter in the autonomic nervous system (ANS). It is one of the most abundant neuropeptides in the central and peripheral nervous system. In the periphery, NPY is widely distributed in the adrenal medulla, in the sympathetic nerves, platelets, and various cell types within white adipose tissue. NPY in the central nervous systems is found in highest concentration within the…