Press release

New Jersey Bankruptcy Attorney Daniel Straffi Provides Insight on Life After Filing Chapter 7

Straffi & Straffi Attorneys at Law, led by New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-can-you-not-do-after-filing-chapter-7/), offers clear guidance for individuals navigating life after filing for Chapter 7 bankruptcy. In a recent article, Daniel Straffi outlines the critical financial actions to avoid during the post-bankruptcy period to ensure a smooth and successful financial recovery.Filing for Chapter 7, often referred to as "liquidation" bankruptcy, provides a fresh start for those overwhelmed by debt. However, as New Jersey bankruptcy attorney Daniel Straffi emphasizes, certain restrictions and obligations come with this legal process. He warns that failing to follow these rules can jeopardize the benefits of the bankruptcy and, in some cases, lead to further financial difficulties.

Daniel Straffi, a respected New Jersey bankruptcy attorney, explains that Chapter 7 is designed to help individuals discharge most unsecured debts, such as credit card balances, medical bills, and personal loans. "The purpose of Chapter 7 is to provide relief from crushing debt," Straffi explains, "but it also comes with responsibilities that must be adhered to for a successful discharge." Once a debtor files for Chapter 7, an automatic stay is put into place, temporarily halting most collection activities. This includes stopping creditors from garnishing wages, foreclosing on homes, or repossessing property.

However, according to New Jersey bankruptcy attorney Daniel Straffi, post-bankruptcy life requires careful financial management. Straffi highlights several key financial actions that individuals should avoid after filing for Chapter 7 to protect their financial recovery.

One critical mistake to avoid, as noted by Straffi, is accumulating new debt after filing. "Any debt accrued post-filing is not included in the bankruptcy," Straffi says. "This means the individual is fully responsible for repaying it. Taking on substantial new debt right after filing could even be viewed as fraudulent, which can result in serious legal consequences, including the denial of the bankruptcy discharge."

Another pitfall discussed by New Jersey bankruptcy attorney Daniel Straffi is making large purchases on credit during or immediately after filing for Chapter 7. Purchases made within 90 days prior to the bankruptcy filing are closely scrutinized by the court, and creditors can object to discharging these debts. "Making large purchases right before or after filing can give the appearance of attempting to game the system," Straffi warns. "If the court or creditors perceive this as an abuse of the bankruptcy process, it could lead to further legal challenges."

Daniel Straffi also advises against selling or transferring assets after filing for bankruptcy. "Once the Chapter 7 process begins, all of the debtor's assets become part of the bankruptcy estate," he explains. "Selling or transferring property without court approval can result in serious legal penalties, including the potential for the asset to be reclaimed by the bankruptcy trustee." Straffi adds that individuals should always consult their bankruptcy attorney before making significant financial decisions after filing to avoid any unintentional violations of bankruptcy rules.

In addition to these financial guidelines, New Jersey bankruptcy attorney Daniel Straffi stresses the importance of understanding how changes in employment or income may affect a Chapter 7 case. While filing for bankruptcy should not directly impact current employment, a significant increase in income after filing can lead to complications. "If an individual's financial situation improves dramatically after filing but before the case is discharged, the trustee may revisit the case to determine whether any part of the debt can now be repaid," says Straffi.

Straffi also points out that self-employed individuals face unique challenges when filing for Chapter 7 bankruptcy. In these cases, business assets may be included in the bankruptcy estate. The trustee will review the business's financial status to determine if assets such as inventory, tools, or accounts receivable can be liquidated to repay creditors.

For those considering or already navigating Chapter 7 bankruptcy, Daniel Straffi recommends working closely with a New Jersey bankruptcy attorney to ensure compliance with all legal obligations and to maximize the chances of a successful discharge. "Filing for bankruptcy is a significant step toward financial recovery," Straffi explains. "But it's important to follow the necessary rules and avoid actions that could lead to further complications."

Straffi & Straffi Attorneys at Law provides tailored guidance for individuals facing financial difficulties in New Jersey. The firm's goal is to offer practical advice that enables clients to move forward with confidence and clarity in their financial decisions. Straffi encourages individuals to consult with a bankruptcy attorney before making any major financial decisions post-bankruptcy, as even well-intentioned actions can lead to unintended consequences in the legal process.

For those who have filed or are considering filing for Chapter 7 bankruptcy, Daniel Straffi and his team at Straffi & Straffi Attorneys at Law are dedicated to helping clients regain control of their financial futures. By adhering to the guidelines outlined by Straffi and avoiding risky financial behaviors, individuals can take proactive steps toward rebuilding their financial stability.

A positive outcome after Chapter 7 bankruptcy requires careful attention to legal and financial rules. Daniel Straffi and his team are available to provide support, offering personalized advice to help clients manage the challenges of life after bankruptcy. Those in need of guidance on their post-bankruptcy journey are encouraged to connect with Straffi & Straffi Attorneys at Law for informed advice on their financial recovery.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a leading law firm based in New Jersey, providing comprehensive legal services in bankruptcy law. Led by Daniel Straffi, the firm is committed to offering personalized and clear legal guidance to individuals seeking debt relief. With years of experience in handling Chapter 7 bankruptcy cases, Straffi & Straffi Attorneys at Law is dedicated to helping clients achieve financial stability.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=2VsYKDqsdkk

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-provides-insight-on-life-after-filing-chapter-7]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Provides Insight on Life After Filing Chapter 7 here

News-ID: 3662936 • Views: …

More Releases from ABNewswire

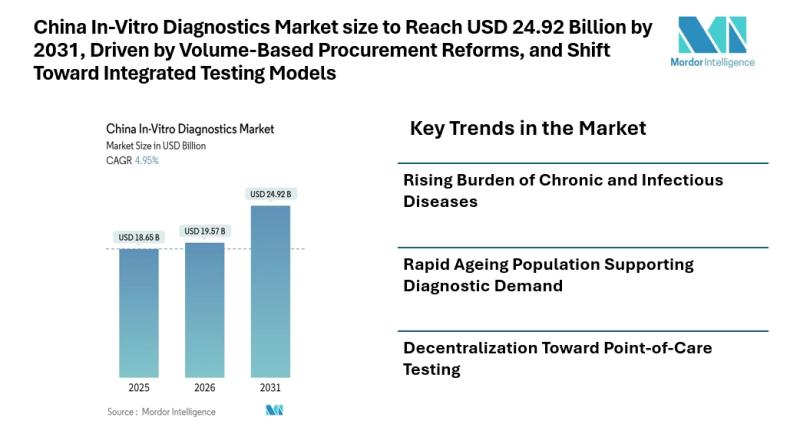

China In-Vitro Diagnostics Market size to Reach USD 24.92 Billion by 2031, Drive …

Mordor Intelligence has published a new report on the china in-vitro diagnostics market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the china in-vitro diagnostics market size [https://www.mordorintelligence.com/industry-reports/china-in-vitro-diagnostics-market?utm_source=abnewswire] is projected to reach USD 24.92 billion by 2031, growing from USD 19.57 billion in 2026 at a CAGR of 4.95% during the forecast period. The china in-vitro diagnostics market size reflects steady expansion supported by…

Hyaluronic Acid Market Size to Reach USD 4.07 Billion by 2030 - Mordor Intellige …

Mordor Intelligence has released an in-depth analysis of the hyaluronic acid market, outlining expanding cosmetic, orthopedic, and pharmaceutical applications driving global demand.

Hyaluronic Acid Market Overview

According to Mordor Intelligence, the global hyaluronic acid market size [https://www.mordorintelligence.com/industry-reports/hyaluronic-acid-market?utm_source=abnewswire] reached USD 2.84 billion in 2025 and is projected to grow to USD 4.07 billion by 2030, registering a CAGR of 7.46% during the forecast period.

The strong hyaluronic acid market growth is supported by:

* Increasing…

Scott Bryant Unveils Moon Valley's "Best Value" Listing in Hillcrest East; Signa …

Bryant Real Estate Leverages Data-Driven Performance Metrics to Position New Hillcrest East Property as the Region's Premier Investment Opportunity

PHOENIX, AZ - Scott Bryant, Founder and Team Leader of Bryant Real Estate and a top-performing agent with Keller Williams, has announced the debut of a landmark listing in the Hillcrest East subdivision of Moon Valley. Positioned as "Moon Valley's Best Deal," the property is being introduced at a strategic price point…

Jennifer Rollin Named Best Individual Therapist in Best of Bethesda Awards

Bethesda, MD, USA - Jennifer Rollin, LCSW-C, eating disorder therapist and founder of The Eating Disorder Center, has been named Best Individual Therapist in the 2025 Best of Bethesda Awards. She was selected from among therapists across Montgomery County, Maryland and Upper Northwest Washington, D.C., an honor that reflects both community support and her longstanding commitment to helping individuals recover from eating disorders.

Jennifer Rollin provides eating disorder therapy [https://www.theeatingdisordercenter.com/eatingdisordertherapyrockvilleservices.html] in…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…