Press release

Takaful Insurance Market Set for Explosive Growth: 15.7% CAGR to Hit $ 133.45 Billion By 2032

𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐮𝐭𝐥𝐨𝐨𝐤:• 𝐓𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐭𝐚𝐤𝐚𝐟𝐮𝐥 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 𝐔𝐒𝐃 𝟑𝟔.𝟎𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟑.

• 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐞𝐱𝐩𝐚𝐧𝐝 𝐚𝐭 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟏𝟓.𝟕% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟒 𝐭𝐨 𝟐𝟎𝟑𝟐.

• 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐠𝐫𝐨𝐰 𝐭𝐨 𝐔𝐒𝐃 𝟏𝟑𝟑.𝟒𝟓 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟐.

𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

Takaful is a type of insurance in Islam where people come together to provide financial protection against risks and damages collectively. Takaful insurance follows sharia, or Islamic law, which dictates responsibilities for individuals to work together and protect one another. Typically, takaful policies offer protection for healthcare, life, and various insurance needs. Although the concept of a risk-sharing system is present, takaful insurance is predominantly utilized in Muslim countries. Moreover, takaful insurance is seen as the main form of insurance in countries with a Muslim majority.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐨𝐫 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐰𝐢𝐭𝐡 𝐀𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐋𝐨𝐨𝐤 𝐚𝐭 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐔𝐩𝐜𝐨𝐦𝐢𝐧𝐠 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬: https://www.polarismarketresearch.com/industry-analysis/takaful-insurance-market/request-for-sample

𝐆𝐫𝐨𝐰𝐭𝐡 𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

The rising Muslim population around the world drives the surge in the takaful insurance market. As Islamic finance grows in popularity, an increasing number of Muslims are seeking financial options that adhere to Sharia law, resulting in a greater need for takaful insurance. Moreover, the growing population of Muslims and improved comprehension of Islamic finance principles are also fueling the market expansion.

𝐊𝐞𝐲 𝐏𝐚𝐫𝐭𝐢𝐜𝐢𝐩𝐚𝐧𝐭𝐬:

Companies are allocating resources toward research and development activities, innovating new products, and broadening their range of products. These initiatives aim to offer that are affordable and reliable. Some of the major players participating in the market:

• Abu Dhabi National Takaful Co.

• AIG Prudential

• Allianz

• Aman Takaful Insurance Co.

• HSBC Insurance

• JamaPunji

• Prudential BSN Takaful Berhad

• Qatar Islamic Insurance

• SALAMA Islamic Arab Insurance Company

• Standard Chartered Bank

• Syarikat Takaful Brunei Darussalam

• Takaful Brunei Darussalam Berhad

• Takaful International

• Takaful Malaysia Berhad

• The Islamic Insurance Company

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐦𝐨𝐫𝐞 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐛𝐞𝐟𝐨𝐫𝐞 𝐩𝐮𝐫𝐜𝐡𝐚𝐬𝐞: https://www.polarismarketresearch.com/industry-analysis/takaful-insurance-market/inquire-before-buying

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬:

• In 2023, the general takaful segment accounted for a significant market share due to rise in demand for property takaful, motor takaful, and liability takaful.

• In 2023, the commercial segment accounted for a significant market share due to greater demand for property and liability coverage, business interruption, trade credit, and professional indemnity.

• In 2023, agents/brokers segment accounted for significant market share due to their localized expertise and cultural understanding, holistic customer engagement, and adaptation to local regulatory frameworks.

• In 2023, Middle East & Africa accounted for the largest revenue share due to strong presence of Islamic finance hubs, regulatory support and frameworks, and potential for micro-takaful.

𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐲:

The research report makes use of various standard methodologies to provide a comprehensive analysis of the market. It includes quantitative research to collect numerical information from primary and secondary data sources such as surveys, polls, and desk research. Also, it uses subjective measures, such as focus groups, to gain key insights into the market. Furthermore, the research study involves interviews with leading experts to uncover facts and opinions about the Takaful insurance Market Growth. All the information in the report goes through a multi-step verification method to provide an accurate and reliable market analysis.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/takaful-insurance-market

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

The takaful insurance market is mainly based on type, application, distribution channel, and region. Based on the type analysis, the general takaful segment dominated the market share in 2023. Offering safeguards for tangible possessions like structures, automobiles, and personal belongings, it also provides defines against liability exposures like third-party lawsuits and legal obligations. This form of Takaful offers flexibility and is suitable for both corporations and individuals. Furthermore, according to the application analysis, in 2023, a significant portion of the market was dominated by the commercial segment. Specially created for companies, commercial takaful insurance provides Sharia-compliant choices to fulfill various needs.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Smart Agriculture Market: https://www.polarismarketresearch.com/industry-analysis/smart-agriculture-market

Wireless Mesh Network Market: https://www.polarismarketresearch.com/industry-analysis/wireless-mesh-network-market

Voice And Speech Recognition Market:

https://www.polarismarketresearch.com/industry-analysis/voice-recognition-market

Parking Management Systems Market: https://www.polarismarketresearch.com/industry-analysis/parking-management-systems-market

Professional Service Automation Market: https://www.polarismarketresearch.com/industry-analysis/professional-service-automation-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

𝐀𝐛𝐨𝐮𝐭 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 & 𝐂𝐨𝐧𝐬𝐮𝐥𝐭𝐢𝐧𝐠, 𝐈𝐧𝐜:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market Set for Explosive Growth: 15.7% CAGR to Hit $ 133.45 Billion By 2032 here

News-ID: 3662440 • Views: …

More Releases from Polaris Market Research & Consulting

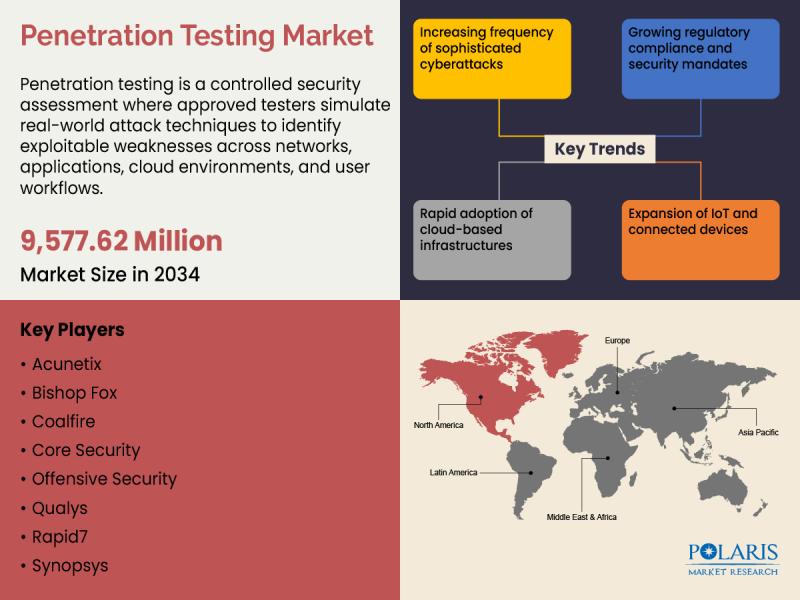

Global Penetration Testing Market Projected to Hit USD 9,577.62 Million by 2034 …

Polaris Market Research recently introduced the latest update on Penetration Testing Market that provides an extensive outlook of the market, analyzing key growth opportunities, challenges, risk factors, and emerging trends across diverse geographic regions. The report offers a definitive and meticulous analysis of the Penetration Testing Market size, share, demand, key growth factors, segmentation, country-level overview, and forecast.

The report helps businesses get a thorough understanding of the industry landscape…

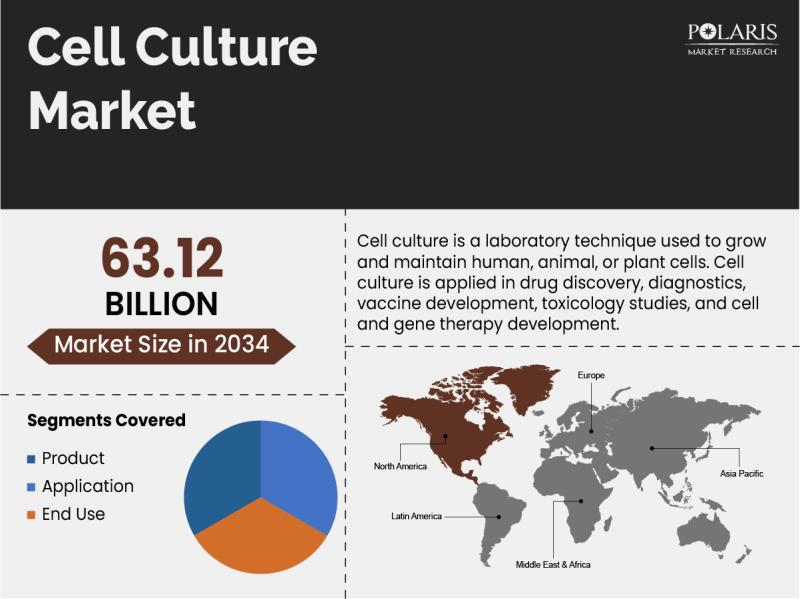

Cell Culture Market to Reach USD 63.12 Billion by 2034, Expanding at a CAGR of 1 …

Polaris Market Research recently introduced the latest update on Cell Culture Market that provides an extensive outlook of the market, analyzing key growth opportunities, challenges, risk factors, and emerging trends across diverse geographic regions. The report offers a definitive and meticulous analysis of the Cell Culture Market size, share, demand, key growth factors, segmentation, country-level overview, and forecast.

The report helps businesses get a thorough understanding of the industry landscape…

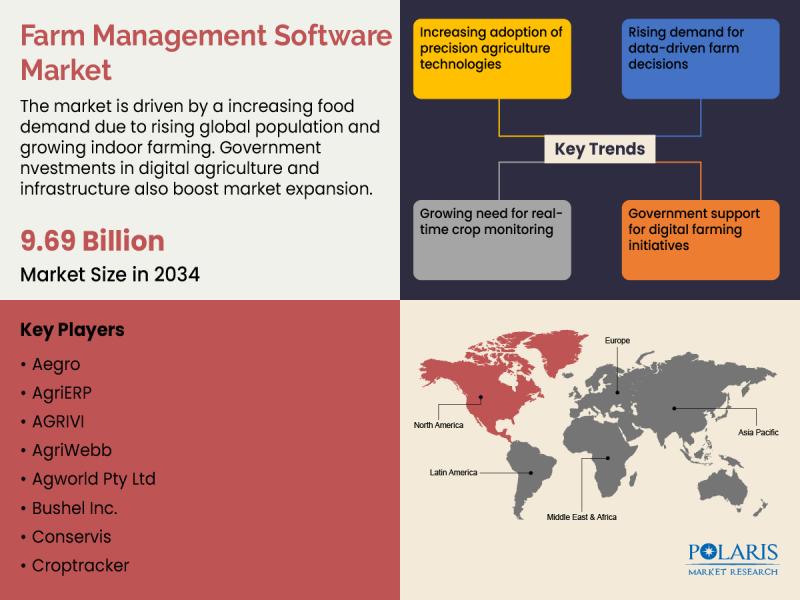

Farm Management Software Market Forecast 2026-2034: Growth Dynamics and Competit …

The quantitative market research report published by Polaris Market Research on Farm Management Software Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Farm Management Software market size, financial data, and projected future growth. All the…

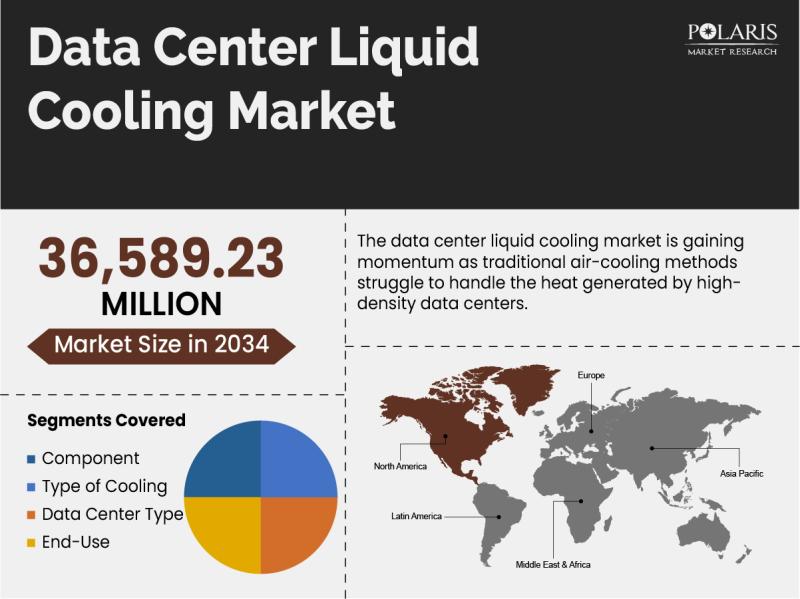

Future of the Data Center Liquid Cooling Market: Emerging Opportunities, Market …

The quantitative market research report published by Polaris Market Research on Data Center Liquid Cooling Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Data Center Liquid Cooling market size, financial data, and projected future growth.…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…