Press release

Health (Well-Being) Insurance Market Players Gaining Attractive Investments

The Latest Released Health (Well-Being) Insurance market study has evaluated the future growth potential of Health (Well-Being) Insurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the Health (Well-Being) Insurance market. The study includes market share analysis and profiles of players such as Ping An Insurance (Group) Company of China, Ltd, Prudential plc, AIA Group Limited, Manulife, AXA, Aetna Inc, China Life Insurance Company, Aon plc, Aviva plc, Prudential Financial, Inc., People's Insurance Company of China Group (PICC)According to HTF Market Intelligence, the Health (Well-Being) Insurance market size is estimated to increase by USD Million at a CAGR of 4.46% from 2023 to 2030. Currently, the market value is pegged at USD 97 Million

This article will assist you in understanding the pattern with Impacting Trends if you are a Health (Well-Being) Insurance manufacturer and would like to check or comprehend the policy and regulatory ideas, designing clear explanations of the stakes, prospective winners and losers, and choices for improvement. Click To get SAMPLE PDF (Including Full TOC, Table & Figures) https://www.htfmarketintelligence.com/sample-report/china-health-well-being-insurance-market?utm_source=Sweety_Openpr&utm_id=Sweety

Health (Well-Being) Insurance Market Overview

Health (Well-Being) Insurance is a type of insurance coverage that pays for medical, surgical, and sometimes dental expenses incurred by the insured. It can either reimburse the insured for expenses incurred from illness or injury or pay the care provider directly.

Market Drivers

Medical services are getting more costly when the population expands as individuals get older and live more. The expansion in medical care spending comes from increased expenses for administrations, particularly inpatient hospital care. The two next highest elements with regard to expanded medical care spending are populace growth and populace aging. People from China spend an enormous measure of cash on medical services every year. Although high insurance premiums, variable deductions, and service charges may restrain a portion of the expenses related to wellbeing and health in the country. While the mounting sickness trouble, expanding geriatric populace, and rise in educated and engaged customers will prompt the development of health care insurance in the coming years. Regardless of the development, numerous families are presented with medical care-related financial risks as social health insurance system (SHI) policies have restricted inclusion for therapy and solutions, co-installments, deductibles, and restricted reimbursement.

Market Opportunities:

The COVID-19 pandemic has incited a widespread reprioritization of tech activities and will rush the organization of digital solutions across the world. Asian countries specifically will be at the cutting edge of development, with advanced platforms in the district solidifying their position and broadening further into financial administrations. These platforms create easier encounters, synchronizing arrangements that are typically autonomous and distinct to offer clients a comprehensive experience. Digital platforms approach the number of consumers, offering insurers a course to expand protection entrance. Insurers can plug into existing stages to associate with consumers who are now acquainted with it and who might be underinsured. Insurers that plugin right on time to a platform will probably be in a more grounded position to adjust to its advancement as it grows.

Market Restraints:

Medical inflation is rising twice as quickly as feature swelling, and treatment costs, particularly for medicines with present-day innovation, are just rising. The new rules oblige the insurer to normalize the prohibitions and to cover techniques and medicines as per specialized advancement. The costs for health insurance depend on the protection inclusion and the rundown of infections included. Since backup plans don't have adequate authentic information for the sicknesses that were recently barred, the superior rates are additionally founded on case insight. Health care insurance charging is unpredictable and regularly befuddling and subsequently may get bills for administrations that ought to have been covered by protection or that were thought were at that point paid for. Every well-being plan has diverse co-installment, deductibles, maximum amounts, and prohibitions. With such countless various plans, it is hard to tell what costs one is answerable for and what expenses are covered by an arrangement.

Major Highlights of the Health (Well-Being) Insurance Market report released by HTF MI

The Health (Well-Being) Insurance Market is segmented by China Health (Well-Being) Insurance Market Breakdown by Application (Individual, Group) and by Type (Health Insurance, Life Insurance).

Revenue and Sales Estimation - Historical Revenue and sales volume are presented and further data is triangulated with top-down and bottom-up approaches to forecast complete market size and to estimate forecast numbers for key regions covered in the report along with classified and well-recognized Types and end-use industry.

SWOT Analysis on Health (Well-Being) Insurance Players

In addition to Market Share analysis of players, in-depth profiling, product/service, and business overview, the study also concentrates on BCG matrix, heat map analysis, FPNV positioning along with SWOT analysis to better correlate market competitiveness.

Demand from top-notch companies and government agencies is expected to rise as they seek more information on the latest scenario. Check the Demand Determinants section for more information.

Regulation Analysis

• Local System and Other Regulation: Regional variations in Laws for the use of Health (Well-Being) Insurance

• Regulation and its Implications

• Other Compliances

Have Any Query? Ask Our Expert @: https://www.htfmarketintelligence.com/enquiry-before-buy/china-health-well-being-insurance-market?utm_source=Sweety_Openpr&utm_id=Sweety

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Book Latest Edition of Health (Well-Being) Insurance Market Study @ https://www.htfmarketintelligence.com/buy-now?format=1&report=1897?utm_source=Sweety_Openpr&utm_id=Sweety

Heat map Analysis, 3-Year Financial and Detailed Company Profiles of Key & Emerging Players: Ping An Insurance (Group) Company of China, Ltd, Prudential plc, AIA Group Limited, Manulife, AXA, Aetna Inc, China Life Insurance Company, Aon plc, Aviva plc, Prudential Financial, Inc., People's Insurance Company of China Group (PICC)

Geographically, the following regions together with the listed national/local markets are fully investigated:

• APAC (Japan, China, South Korea, Australia, India, and the Rest of APAC; the Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Check it Out Complete Details of Report @ https://www.htfmarketintelligence.com/report/china-health-well-being-insurance-market

- Overview of Health (Well-Being) Insurance Market

- Market dynamics

Growth Drivers, Market Trends, Opportunities and Challenges

- Five Forces Analysis

Bargaining power of buyers, bargaining power of suppliers, Threat of new entrants, Threat of substitutes, Threat of rivalry

- Health (Well-Being) Insurance Size (USD & Sales Volume) Comparison by Type (2019- 2030)

- Health (Well-Being) Insurance Size (USD & Consumption) and Market Share Comparison by Application (2019- 2030)

- Health (Well-Being) Insurance Size (Value & Volume) Comparison by Region (2019- 2030)

- Market Capacity, Production, Export-Import by Region (2019-2023E)

- Health (Well-Being) Insurance Market Sales, Revenue and Growth Rate (2019- 2030)

- Competitive Situation and Trends

- Market Positioning and Share Analysis (2020-2023E)

- Suppliers High-Performance Operational Base Distribution

- Analyse competitors, Profiles, Sales Area, Product Category

- Health (Well-Being) Insurance Cost Analysis

- Marketing Strategy Analysis

- Research Conclusions

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

Thanks for reading this article; HTF MI also offers Custom Research services providing focused, comprehensive, and tailored research according to clientele objectives. Thanks for reading this article; you can also get individual chapter-wise sections or region-wise reports like Balkan, China-based, Japanese, German, North American, Europe, or Southeast Asia.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Health (Well-Being) Insurance Market Players Gaining Attractive Investments here

News-ID: 3659512 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

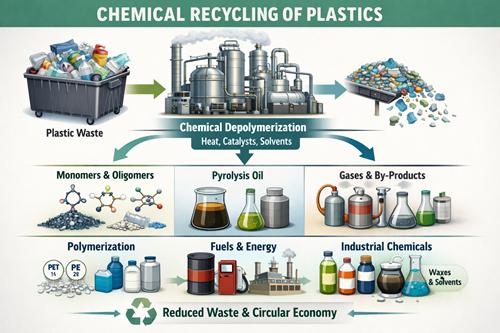

Chemical Recycling Of Plastics Market is Going to Boom | Major Giants Agilyx, Ca …

HTF MI just released the Global Chemical Recycling Of Plastics Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: BASF, SABIC, Indorama Ventures, Eastman…

Single-Crystal Diamond Wafers Market is set to Fly High Growth in Years to Come

The latest analysis of the worldwide Single-Crystal Diamond Wafers market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Single-Crystal Diamond Wafers market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Element Six…

Smart Cookware Market Hits New High | Major Giants T-fal, Instant Brands, Xiaomi …

The latest study released on the Global Smart Cookware Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Smart Cookware study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Fantasy Sports Apps Market Hits New High | Major Giants DraftKings, FanDuel, Dre …

The latest study released on the Global Fantasy Sports Apps Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fantasy Sports Apps study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…