Press release

Companies Return To Reliable And Available Financing As SPAC's Fall From Grace

Over the years, we've covered numerous small-cap companies and highlighted what truly fuels their growth beyond ambition-money. However, we rarely take a deep dive into the companies that help them raise that capital. Considering these financial firms are the pistons in the engine of growth, it's essential to recognize their value. Moreover, they offer investors an opportunity to capitalize on a well-known strategy: follow the money.Aegis Capital is an excellent example. By underwriting IPOs, follow-on offerings, and private placements, Aegis and similar firms ensure that small and mid-cap companies can access the funds necessary for innovation and expansion. This process, which often comes with multiple doses, not only strengthens individual companies but also significantly contributes to global economic growth, as these small-cap companies often drive industry shifts and introduce disruptive technologies.

Fueling Smallcap Missions

One recent beneficiary of Aegis Capital's network is SMX (Security Matters) Public Limited Company (NASDAQ: SMX), a trailblazer in digitizing physical objects for a circular economy. SMX recently entered into definitive agreements with institutional investors to raise approximately $5.35 million through the sale of Ordinary Shares and pre-funded and investor warrants. This capital will likely fuel SMX's mission to serve major brand owners like PepsiCo (NYSE: PEP), Unilever (NYSE: UL), and Colgate-Palmolive (NYSE: CL), which have acknowledged their failure to meet [https://packagingeurope.com/comment/what-lessons-can-be-learned-from-brands-missing-their-packaging-sustainability-targets/11676.article?utm_medium=email&utm_campaign=Packaging%20Connections%20-%20080824&utm_content=Packaging%20Connections%20-%20080824+CID_40bb0721c20c35dcda27368bb7144425&utm_source=News%20letters&utm_term=Read%20the%20full%20article] sustainable packaging objectives.

By facilitating this deal, Aegis has helped bring together cutting-edge technology with the urgent need to overcome the forecasted challenges [https://www.biztechreports.com/news-archive/2021/12/9/gartner-predicts-90-of-public-sustainable-packaging-commitments-wont-be-met-by-2025] in reaching ambitious environmental goals. SMX, with its embedded invisible marker technology, offers the ability to track the origin and recycling of virtually any liquid, metal, or fabric. This transparency across product lifecycles enables companies to efficiently monitor and verify materials from production to post-consumer recycling.

SMX is just one of the many potentially game-changing companies Aegis has supported in 2024. The firm has helped finance companies across various sectors, from clean energy to biotechnology. Notable deals include ParaZero Technologies' (NASDAQ: PRZO) $7.8 million IPO, Super League Gaming's (NASDAQ: SLE) $2.2 million offering, Clearmind Medicine's (NASDAQ: CMND) $2.25 million offering, and Volcon, Inc.'s (NASDAQ: VLCN) $9 million public offering. Aegis also played a key role in securing a $2.2 million convertible note offering for Interactive Strength (NASDAQ: TRNR) to support its growth and expansion.

The Importance Of Financing Partners

Why is this important? Two reasons. First, through public offerings, private placements, and strategic advisory services, Aegis and similar companies connect small-cap companies with investors who see their potential and are willing to invest to fund research and development, product advancement, and market expansion. The SPAC bust [https://www.forbes.com/sites/ilonalimonta-volkova/2022/12/20/whatever-happened-to-spacs/] heightened this need. Second, these deals can expose investment opportunities by providing a follow the money opportunity for investors.

While market volatility is inevitable, companies that secure financing-like the ones mentioned-are often better positioned to unlock intrinsic value and growth potential. Not every company will succeed, as capital is only one of the many factors determining success. Aegis has facilitated funding for both winners and those that ultimately faltered. There are no guarantees in investing. However, for small and mid-cap companies, working with firms like Aegis can help check an essential box in the investor's due diligence process by enhancing a company's financial viability-a critical advantage that adds immediate value.

That said, while following the money is a proven strategy in many cases, it's just one factor to consider before making an investment. Investors should research company filings, understand their missions, and look for disconnects between current valuations and potential. While Aegis Capital and firms like it provide a head start in identifying value-driven opportunities, the road to success in small and mid-cap investments is often long. So, it's okay to be selective, even when the company's coffers are full.

Disclaimers and Disclosures : Hawk Point Media Group, Llc. holds ZERO shares of any company stock mentioned. This content is not an endorsement for any company mentioned and HPM has not been compensated to produce and syndicate this content. The information in this article is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Data was accurate at the time of production. Contributors are under no obligation to accept revisions when not factually supported.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=companies-return-to-reliable-and-available-financing-as-spacs-fall-from-grace]

Country: United States

Website: https://hawkpointmedia.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Companies Return To Reliable And Available Financing As SPAC's Fall From Grace here

News-ID: 3654919 • Views: …

More Releases from ABNewswire

Living Forever - AI Selected for Startup Grind Global Conference 2026 - Named Am …

AI-powered platform preserving living people's personalities, voices, and stories earns exhibition and pitch slot at premier Silicon Valley startup event

ATLANTA, GA - February 26, 2026 - Living Forever - AI [https://livingforeverai.com], an Atlanta-based startup building fully interactive video AI digital twins that preserve the personalities, voices, and life stories of living people for future generations, today announced its acceptance into the Startup Grind Global Conference 2026. The company was selected…

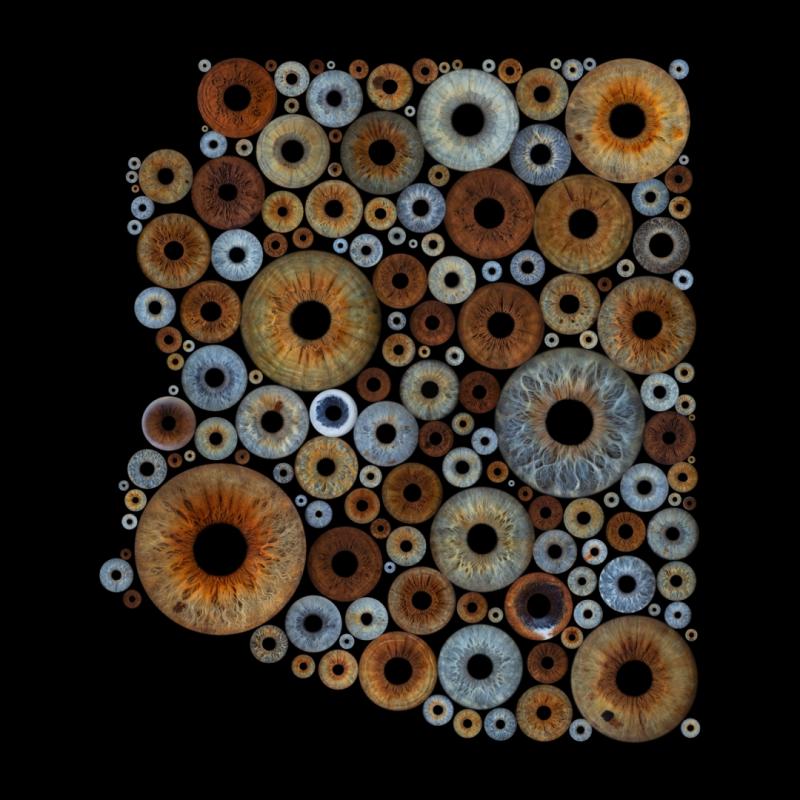

Mesa Studio Blends Iris Photography with the Art of Becoming Through the Iris Wi …

Sol Iris Photography founder Saskia Soliz draws on a background in autism support and personal growth to create a creative experience rooted in self-discovery.

MESA, AZ - February 26, 2026 - Sol Iris Photography, a Mesa-based studio specializing in high-resolution iris photography, is quietly building something beyond photography. Through the Iris Wisdom Project, clients are invited to share a brief piece of wisdom alongside their iris portrait - a thought, truth,…

Power Couple Combines Army Structure and Insurance Expertise to Launch Family-Ow …

Red Rover Roofing, a family-owned roofing company in Williamson County, Tennessee, brings Xactimate-certified insurance claim expertise and CertainTeed Master Shingle Applicator credentials to Middle Tennessee homeowners navigating storm damage roof replacement and insurance disputes across Franklin, Brentwood, Spring Hill, Nashville, and Murfreesboro.

SPRING HILL, TN - February 26, 2026 - When retired U.S. Army Captain Courtney Hostetler came home from deployment in Kuwait, she and her husband Alex knew they wanted…

Primary Biliary Cholangitis Market: Rapid Increment Driven by Innovation by 2034 …

The Key Primary Biliary Cholangitis Companies in the market include - CymaBay Therapeutics, Inc., Zydus Therapeutics Inc., Gannex Pharma Co., Ltd., Nanjing Chia-tai Tianqing Pharma, Intercept Pharmaceuticals, Enanta Pharmaceuticals, COUR Pharmaceutical, Novartis, Merck, Mirum Pharmaceuticals, Inc., Genfit, CymaBay Therapeutics, Inc., Calliditas Therapeutics, HighTide Biopharma Pty Ltd, Albireo, Curome Biosciences, Biotie Therapies Corp., and others.

DelveInsight's "Primary Biliary Cholangitis Market Insights, Epidemiology, and Market Forecast-2034 report offers an in-depth understanding of the…

More Releases for Aegis

AEGIS Cybersecurity Systems Inc. Announces $10 Million Investment

Image: https://www.globalnewslines.com/uploads/2025/01/44e034a93cd0e9f41bd9bf4a073998db.jpg

McLean, Virginia - AEGIS Cybersecurity Systems Inc., a leader in technology innovation, announces the successful completion of its target $10 million investment fundraising initiative to support accelerating commercial roll-out, including marketing and sales and key recruiting initiatives. This milestone marks a significant step forward in the company's mission: "To provide innovative, comprehensive solutions against all cyber threats targeting data and digital assets", said Dr. Mohamed Reda, CEO of AEGIS.

Additionally,…

Aegis Services: Leading the Way in Comprehensive Business Solutions

When the competition is this high only the best can be trusted for the most effective solutions.

One of the top providers of total solutions in Qatar, Aegis Services L.L.C., has a straightforward, no-nonsense approach to ISO certification. When a client chooses them, they provide consultation, and in return, the client gets certified. Since its founding in November 2012, it has worked with a wide range of clients, from small, one-person…

Aegis Services L.L.C: Providing Standard ISO Certification Services

Aegis Services L.L.C, a client-centric ISO certification management company, provides effective ISO certification solutions.

With adequate tools and resources, businesses can improve their services. By also acquiring certifications that prove their dedication to excellence, they can make their customers trust their services more. Aegis Service L.L.C is a top ISO certification management and consultation service provider in Qatar. The ISO certification management and consultation service have been in the industry since…

Aegis Services L.L.C: Providing Exceptional ISO Certification Management Service …

Aegis Services L.L.C, a leading ISO certification consultation company, provides standard ISO certification solutions.

Through reliable solutions from experts, organizations can scale up their operations and serve their clients effectively. ISO certifications can help businesses with this as well, as it proves their commitment to offering quality services. In Qatar, Aegis Services L.L.C is a leading ISO certification management and consultation service provider. The client-focused ISO certification company is dedicated to…

Aegis Services L.L.C.: Providing Standard ISO Certification Management Services

Aegis Services L.L.C, a reputable ISO certification consultation company, provides trusted ISO certification management services and solutions.

Companies seek ISO certifications to validate their service standards to attract more customers and boost productivity. Aegis Services L.L.C, based in Qatar, is a leading ISO certification management and consultation services provider. Focusing on client needs, they assist startups, brands, and corporations of all sizes to excel in the competitive market. With years of…

Aegis Softtech adds Dynamic Snowflake Development Services for its Customers

"We continue to invest in Snowflake to help our customers to access the next generation of analytics for data. Adding value to our services is a commitment for data as evidence for a better approach to IT solutions."

Aegis Team, India

Aegis Softtech is in the business of improving customer experience through its wide range of IT services across 15 countries. On the forefront of adding dynamic clout to secure IT…