Press release

Insurance Brokerage Market Predicted to Garner $5,70,765.4 Million by 2031, Growing at a Healthy CAGR of 7.0%

According to Research Dive's newly published report, the global insurance brokerage market is predicted to grow at a stable CAGR of 7.0%, thereby garnering a revenue of $5,70,765.4 million by 2031.The global insurance brokerage market is expected to grow tremendously by 2031, primarily due to advancements in digital technology. The North America region is expected to grow significantly in the 2022-2031 timeframe.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐧𝐨𝐰 @ https://www.researchdive.com/download-sample/8405

𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

Drivers: In the last few years, there have been massive advancements in digital technology which are expected to be the primary growth driver of the insurance brokerage market in the forecast period. Along with this, government initiatives to boost insurance coverage are predicted to push the market forward.

Opportunities: Increasing awareness about the need for insurance policies is predicted to offer numerous growth and investment opportunities to the market in the forecast period. Moreover, integration of IT & analytic solutions and the provision of professional solutions and services is anticipated to help the market grow substantially in the analysis period.

Restraints: Direct purchases of insurance by clients, however, might be a hindrance in the insurance brokerage market's growth trajectory.

𝐈𝐦𝐩𝐚𝐜𝐭 𝐨𝐟 𝐂𝐎𝐕𝐈𝐃-𝟏𝟗 𝐨𝐧 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

The coronavirus pandemic negatively impacted numerous manufacturing and service industries and caused disruptions in global supply chains. The insurance brokerage market, too, was affected greatly due to the pandemic. The lockdowns and travel restrictions led to shutting down of various insurance companies in developing countries. Also, many shareholders withdrew their contributions to the insurance companies during this period which ultimately brought down the growth rate of the market.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

The report has divided the insurance brokerage market into certain segments based on insurance type, brokerage type, and region.

Based on insurance type, the property & casualty insurance sub-segment is predicted to be one of the most lucrative by 2031. Changing risk landscape, changing customer expectations, and the entry of new players is predicted to boost the growth of this sub-segment.

Based on brokerage type, the retail brokerage sub-segment is predicted to be highly profitable in the forecast timeframe by 2031. Growing implementation of technologies in existing products and service lines is predicted to augment the growth rate of this sub-segment in the analysis timeframe.

Based on region, the North America insurance brokerage market is projected to become the most dominant sub-segment by 2031. Increased awareness of the advantages of insurance coverage is predicted to be the main growth driver of the market in this region in the forecast period.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 @ https://www.researchdive.com/request-for-customization/8405

𝐏𝐫𝐨𝐦𝐢𝐧𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

Some prominent market players of the insurance brokerage market are Marsh & McLennan, Hub International, Acrisure LLC, AON PLC, Lockton, Alliant Insurance Services, Willis Towers Watson PLC, Truist Insurance Holdings, Brown & Brown, and Arthur J. Gallagher, among others. These companies are coming up with various innovations using different business strategies like acquisitions, mergers, and collaborations to gain a prominent position in the market.

Finally, this report published by Research Dive also summarizes many crucial aspects of the insurance brokerage market including the latest strategic developments, SWOT analysis, financial performance of the key players, and product portfolio.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

𝐌𝐫. 𝐀𝐛𝐡𝐢𝐬𝐡𝐞𝐤 𝐏𝐚𝐥𝐢𝐰𝐚𝐥

𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐃𝐢𝐯𝐞

𝟑𝟎 𝐖𝐚𝐥𝐥 𝐒𝐭. 𝟖𝐭𝐡 𝐅𝐥𝐨𝐨𝐫, 𝐍𝐞𝐰 𝐘𝐨𝐫𝐤 𝐍𝐘 𝟏𝟎𝟎𝟎𝟓

(𝐏) +𝟗𝟏-(𝟕𝟖𝟖)-𝟖𝟎𝟐-𝟗𝟏𝟎𝟑 (𝐈𝐧𝐝𝐢𝐚)

𝐓𝐨𝐥𝐥 𝐅𝐫𝐞𝐞: 𝟏-𝟖𝟖𝟖-𝟗𝟔𝟏-𝟒𝟒𝟓𝟒

𝐄-𝐦𝐚𝐢𝐥: support@researchdive.com

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.researchdive.com

𝐀𝐛𝐨𝐮𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐃𝐢𝐯𝐞:

Research Dive maintaining the integrity and authenticity of the services, the firm provides services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, a team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable.

Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive delivers the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market Predicted to Garner $5,70,765.4 Million by 2031, Growing at a Healthy CAGR of 7.0% here

News-ID: 3639035 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

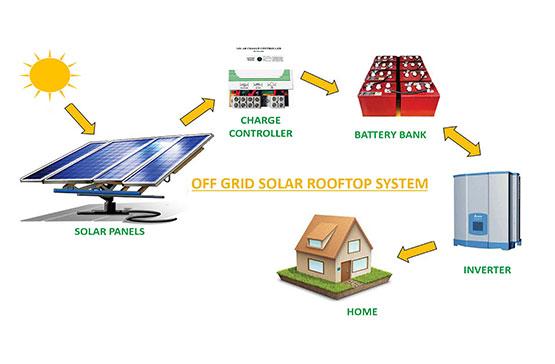

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…