Press release

Voice Banking Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033 | Hongkong and Shanghai Banking Corporation Limited, NatWest Group, U.S. Bank, Lloyds Bank plc, ICICI Bank, Ally Financial Inc., Emirates NBD Bank, NCR Corporatio

As per the report, the voice banking market size has grown rapidly in recent years. It will grow from $1.38 billion in 2023 to $1.61 billion in 2024 at a compound annual growth rate (CAGR) of 16.5%. The voice banking market size is expected to see rapid growth in the next few years. It will grow to $2.99 billion in 2028 at a compound annual growth rate (CAGR) of 16.8%.Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=16822&type=smp

Rising Demand For Voice Assistance Devices Drives Growth In Voice Banking Market

The rising demand for voice assistance-enabled devices is expected to propel the growth of the voice banking market going forward. Voice assistance-enabled devices are hardware devices equipped with voice recognition and processing capabilities, allowing users to interact with them using voice commands. Some common examples include smart speakers, smartphones with voice assistants, and smart home hubs. The demand for voice assistance-enabled devices is due to convenience, hands-free, compatibility with smart home systems, and benefit from improved voice recognition technology. Voice banking allows users to develop a custom digital voice profile for voice assistance-enabled devices, making interactions more personalized and enhancing the user experience. For instance, in July 2023, according to Statistics Canada, a Canada-based government agency for national statistics, the adoption of Internet-connected smart home devices has increased from 42% in 2020 to 47% in 2022, with smart speakers (30%) being the most favored device. Therefore, the rising demand for voice assistance-enabled devices is driving the growth of the voice banking market.

Voice Banking Innovations Enhance Accessibility For Cognitive Disabilities

Major companies operating in the voice banking market are focusing on developing advanced solutions, such as AI-powered voice-assisted solutions for banking, to enhance the user experience and provide more inclusive solutions for individuals with cognitive disabilities. AI-powered voice-assisted solutions for banking leverage artificial intelligence (AI) and voice recognition to provide customers with various banking services through voice commands. For instance, in April 2023, Glia, a US-based provider of customer interaction technology, launched a voice banking solution for the Glia Interaction Platform. The Glia Interaction Platform is a robust customer interaction solution designed to help businesses provide seamless and personalized customer experiences across multiple channels, especially within the financial services sector. The new feature extends the capabilities of Glia Virtual Assistants (GVAs), powered by AI, to include support for dial-in phone interactions. This enhancement offers a unified, native virtual assistant across both call center and digital channels, enabling the automation of voice and chat interactions. Glia's Voice GVAs ensure continuous 24/7 service, efficiently managing after-hours calls and high-demand periods by responding to customer inquiries and seamlessly transferring them to live support when necessary. They modernize phone support in financial institutions by replacing outdated touch-tone menu-based IVR and Phone Banking systems with advanced conversational AI technology.

The voice banking market covered in this report is segmented -

1) By Component: Solution, Services

2) By Technology: Machine Learning, Deep Learning, Natural Language Processing, Other Technologies

3) By Deployment Mode: On-Premise, Cloud

4) By Application: Banks, Non-Banking Financial Companies (NBFCs), Credit Unions, Other Applications

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=16822&type=discount

Major companies operating in the voice banking market are Hongkong and Shanghai Banking Corporation Limited, NatWest Group, U.S. Bank, Lloyds Bank plc, ICICI Bank, Ally Financial Inc., Emirates NBD Bank, NCR Corporation, IndusInd Bank, Axis Bank, Verbio Technologies S.L, DBS Bank India Limited, Uniphore, Central 1 Credit Union, SoundHound AI Inc., Acapela Group, kasisto, BankBuddy, Vibepay, United Bank of India

Contents of the report:

1. Executive Summary

2. Voice Banking Market Report Structure

3. Voice Banking Market Trends And Strategies

4. Voice Banking Market - Macro Economic Scenario

5. Voice Banking Market Size And Growth

…..

27. Voice Banking Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/voice-banking-global-market-report

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033 | Hongkong and Shanghai Banking Corporation Limited, NatWest Group, U.S. Bank, Lloyds Bank plc, ICICI Bank, Ally Financial Inc., Emirates NBD Bank, NCR Corporatio here

News-ID: 3631471 • Views: …

More Releases from the business research company

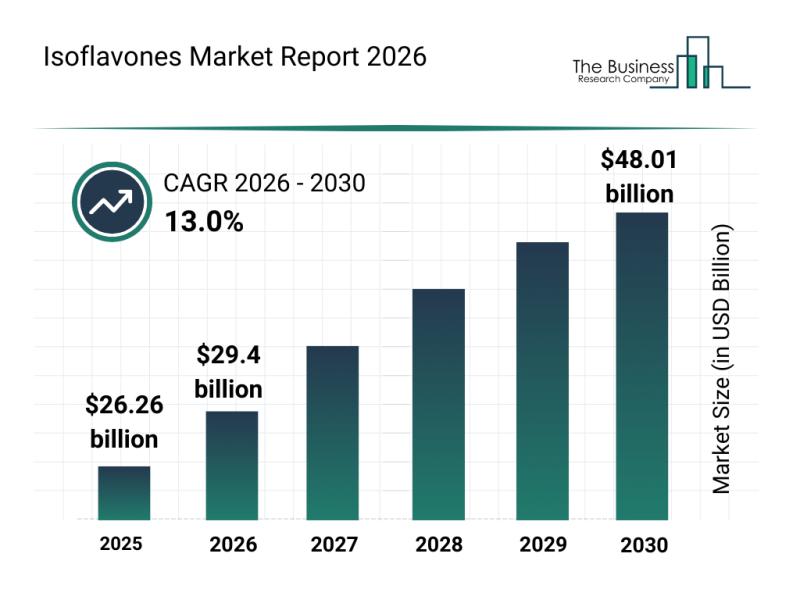

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

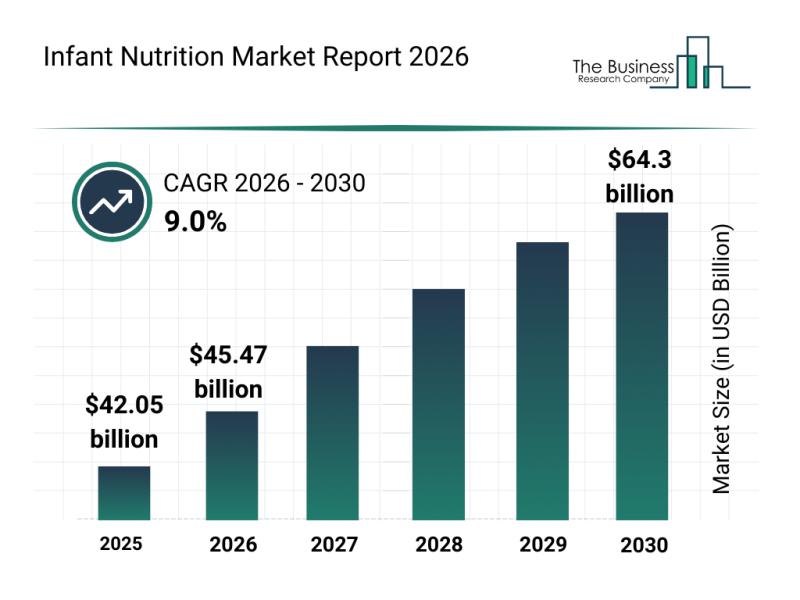

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

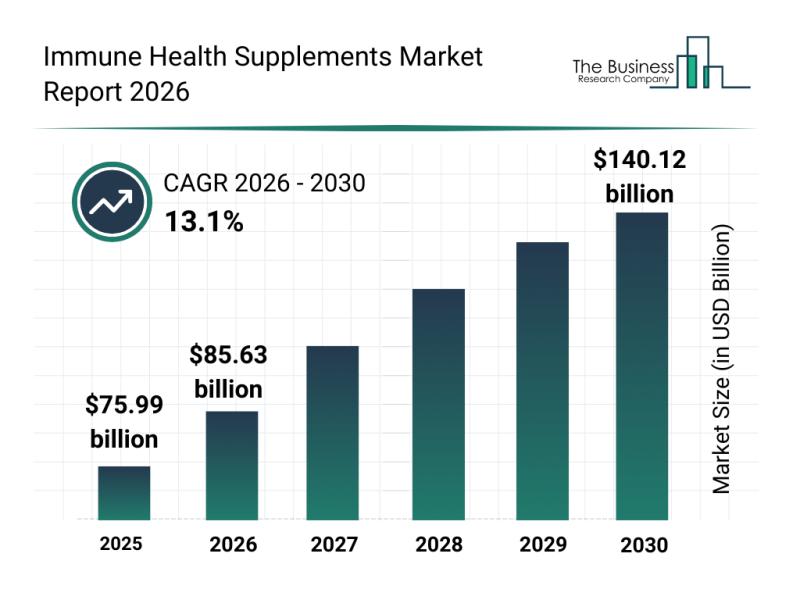

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

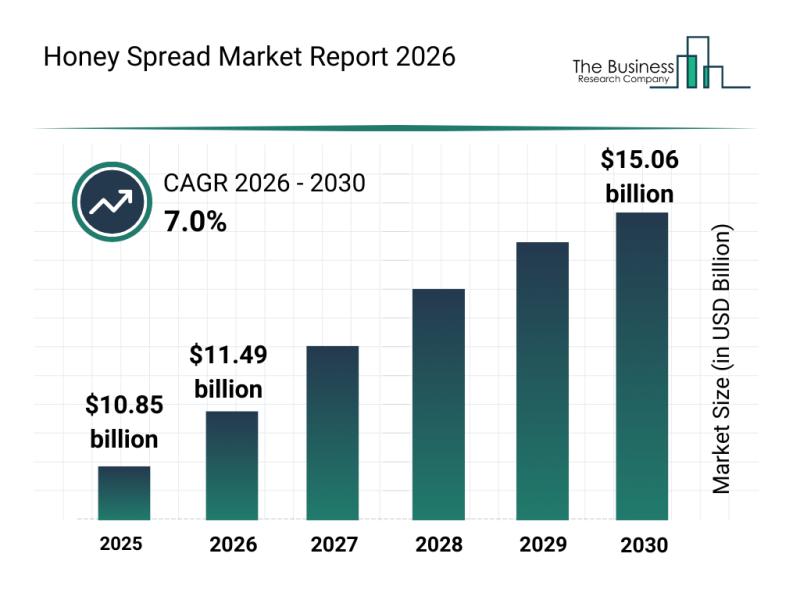

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…