Press release

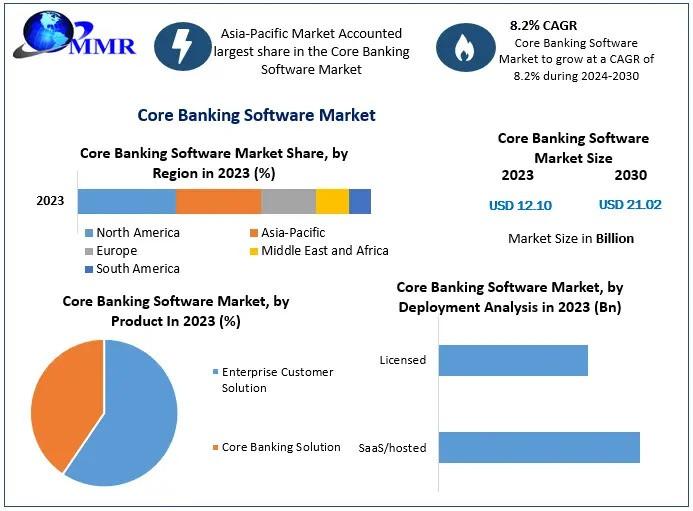

Global Core Banking Software Market Projected to Reach USD 21.02 Billion by 2030, Growing at a CAGR of 8.2 Percentage

Forecast Increase in Revenue:In 2030, the Core Banking Software Market was valued at USD 21.02 billion and is anticipated to experience significant growth, with projections indicating a compound annual growth rate (CAGR) of 8.2% throughout the forecast period. This expansion is driven by the increasing need for banks and financial institutions to enhance operational efficiency, improve customer service, and integrate advanced technological solutions. The growing adoption of digital banking and the rising demand for real-time transaction processing are also contributing to the market's growth. As institutions seek to modernize their core systems to remain competitive and meet evolving customer expectations, core banking software continues to play a crucial role in shaping the future of the financial services industry.

Core Banking Software Market Overview:

The Core Banking Software Market is evolving rapidly as financial institutions worldwide seek to modernize their operations and enhance customer experiences. This software, essential for managing day-to-day banking functions, facilitates real-time processing of transactions, account management, and regulatory compliance. The market's growth is driven by increasing digital transformation efforts, which aim to streamline operations and integrate advanced technologies like artificial intelligence and blockchain. Institutions are investing in core banking solutions to improve efficiency, reduce operational costs, and offer innovative services to meet the demands of a digitally-savvy customer base. As financial services continue to advance, core banking software is becoming a cornerstone of modern banking infrastructure, enabling institutions to stay competitive and responsive in a rapidly changing industry.

𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐬 𝐉𝐮𝐬𝐭 𝐚 𝐂𝐥𝐢𝐜𝐤 𝐀𝐰𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/148072/

Drivers in the Core Banking Software Market:

The Core Banking Software Market is being driven by several key factors. One major driver is the increasing demand for digital transformation within financial institutions, which seeks to enhance operational efficiency and provide seamless, real-time banking experiences. The rise of online and mobile banking has further accelerated the need for robust core banking systems that can support diverse digital channels and streamline transaction processing. Additionally, regulatory compliance requirements are pushing institutions to adopt advanced software solutions to ensure accurate and secure management of financial data. Technological advancements, including cloud computing and artificial intelligence, are also contributing to market growth by offering scalable, flexible, and innovative solutions. As banks and financial institutions continue to prioritize customer experience and operational agility, core banking software becomes increasingly essential for maintaining competitive advantage.

Core Banking Software Market Trends:

The Core Banking Software Market is witnessing several transformative trends that are reshaping the industry. One prominent trend is the increasing adoption of cloud-based core banking solutions, which offer scalability, flexibility, and cost-efficiency compared to traditional on-premises systems. Another significant trend is the integration of artificial intelligence and machine learning technologies, which enhance data analytics, fraud detection, and personalized customer interactions. Additionally, there is a growing emphasis on open banking APIs, enabling financial institutions to offer more seamless and innovative services by integrating with third-party applications. The shift towards omnichannel banking, where customers can interact through various digital and physical channels, is also driving the demand for advanced core banking systems. These trends highlight the industry's move towards more agile, data-driven, and customer-centric banking solutions.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/148072/

What is Core Banking Software Market Regional Insight?

The Core Banking Software Market exhibits varied regional dynamics, reflecting differing levels of adoption and technological advancements. In North America and Europe, the market is highly developed, driven by the need for modernization and regulatory compliance within mature financial systems. These regions are characterized by significant investments in advanced core banking solutions, including cloud-based and AI-driven technologies. In Asia-Pacific, rapid economic growth and a surge in digital banking are propelling the market, with countries like China and India leading in the adoption of innovative core banking technologies. Meanwhile, Latin America and the Middle East are experiencing gradual but steady growth as financial institutions in these regions begin to invest in upgrading their core systems to enhance operational efficiency and customer service. These regional insights underscore the global nature of the core banking software market and its varying developmental stages across different regions.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐭𝐨 𝐩𝐞𝐞𝐤 𝐢𝐧𝐬𝐢𝐝𝐞? 𝐆𝐫𝐚𝐛 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/148072/

Segmentation Analysis of the Core Banking Software Market:

by Product

Enterprise Customer Solution

Core Banking Solution

by Deployment

analysis SaaS/hosted

Licensed

Who is the largest manufacturers of Core Banking Software Market worldwide?

1.Capgemini

2. Finastra

3. FIS

4. Fiserv, Inc.

5. L Technologies Limited

6. Infosys Limited

7. Jack Henry & Associates, Inc.

8. Oracle Corporation

9. Temenos Group

10. UnisysSAP SE

11. TATA Consultancy Services

12. Capital Banking Solutions

13. EdgeVerve System Limited

14. Fidelity National Information Services

15. Mambu GmbH

16. Backbase

17. Forbis

18. Securepaymentz

19. nCino

20. Bricknode

21. Wipro Core Banking Service

22. C-Edge Technologies

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/core-banking-software-market/148072/

Key Offerings:

• Past Market Size and Competitive Landscape

• Core Banking Software Market Size, Share, Size & Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Core Banking Software Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Explore our top-performing reports on the latest trends:

♦ Multi-fuel Dispenser Market https://www.maximizemarketresearch.com/market-report/multi-fuel-dispenser-market/73721/

♦ Global Mobile Phone Loudspeaker Market https://www.maximizemarketresearch.com/market-report/global-mobile-phone-loudspeaker-market/64237/

♦ Chip Crusher Market https://www.maximizemarketresearch.com/market-report/global-chip-crusher-market/70938/

♦ Global MV Protection Relay Market https://www.maximizemarketresearch.com/market-report/global-mv-protection-relay-market/25376/

♦ Global Motor Soft Starter Market https://www.maximizemarketresearch.com/market-report/global-motor-soft-starter-market/50346/

♦ Global Natural Gas Generator Market https://www.maximizemarketresearch.com/market-report/global-natural-gas-generator-market/117375/

♦ Global Zero Liquid Discharge (ZLD) System Market https://www.maximizemarketresearch.com/market-report/global-zero-liquid-discharge-zld-system-market/30911/

♦ Dental Bone Graft Substitutes Market https://www.maximizemarketresearch.com/market-report/global-dental-bone-graft-substitutes-market/13027/

♦ Global Virtual Reality in Gaming Market https://www.maximizemarketresearch.com/market-report/global-virtual-reality-in-gaming-market/55076/

♦ Global Specialty Polystyrene Resin Market https://www.maximizemarketresearch.com/market-report/global-specialty-polystyrene-resin-market/26312/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Core Banking Software Market Projected to Reach USD 21.02 Billion by 2030, Growing at a CAGR of 8.2 Percentage here

News-ID: 3629640 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…