Press release

Wealth Management Market Expected to Exceed $3.43 Trillion by 2021, Projected to Grow at 10.7% CAGR Through 2030

Allied Market Research published a report, titled, "Wealth Management Market By Business Model (Human Advisory, Robo Advisory, and Hybrid Advisory), Provider (FinTech Advisors, Banks, Traditional Wealth Managers, and Others), and End-user Type (Retail and High Net Worth Individuals (HNIs): Global Opportunity Analysis and Industry Forecast, 2021-2030." According to the report, the global wealth management industry was worth $1.25 trillion in 2020, and is expected to reach $3.43 trillion by 2030, manifesting a CAGR of 10.7% from 2021 to 2030.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐓𝐡𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.alliedmarketresearch.com/request-sample/13433

Rapid increase in need for alternative investments, emergence of FinTechs (Financial technology), and growing demand for wealth management products & services drive the growth of the global wealth management market. Wealth management provides wide range of offerings such as financial advice management, portfolio, accounting, trading management, performance management, risk & compliance management, reporting, and others. The demand for wealth management is growing exponentially due to several benefits such as helping in eliminating financial stress & creating financial plans primarily for high net worth individuals.

Prime Drivers of Growth

The rapid demand for alternative investments including private equity, commodities, hedge funds, real estate investment trusts (REITs), and intellectual property drives the growth of the global wealth management market. The emergence of FinTechs has disrupted the wealth management industry and benefits offered by wealth management such as reduced or eliminated financial stress & making financial plans, and digitization of offerings are contributing toward the market growth.

On the other hand, strict rules of the government for wealth management companies, lack of pricing transparency, and high fees are a few factors that limit the market growth. Technological advancements and untapped potential of emerging economies are opening doors of opportunities for the market.

Covid-19 Scenario

Owing to the economic slowdown, unpredictability in global financial sectors, and highly volatile economy, the wealth management market is impacted negatively. The demand for wealth management products is reduced.

The emergence of FinTechs is visible as wealth managers are increasingly investing in new technologies including robo-advisor, robotic process automation, artificial intelligence (AI), and digital identification (ID) technologies for boosting customer experience.

The Human Advisory Business Model will Maintain the Leading Position Throughout the Forecast Period

Based on business model, the human advisory segment held the highest market share in 2020, accounting for more than three-fourths of the global wealth management market, and is anticipated to lead throughout the forecast period. This lead is attributed to the fact that these advisors serve a changing client base in a variety of demographics and offer fluidity in the approach while managing wealth. However, the robo advisory segment is projected to manifest the highest CAGR of 26.4% from 2021 to 2030, owing to easy account setup, comprehensive education, robust goal planning, portfolio management, security features, account services, attentive customer service, and low fees.

The Traditional Wealth Managers Segment to Maintain the Leading Position during the Forecast Period

Based on provider, the traditional wealth manager segment accounted for the largest share in 2020, contributing to nearly two-thirds of the global wealth management market, and is anticipated to maintain its lead position throughout the forecast period. Traditional wealth manager offers convenience and reduces stress towards managing finances of the clients.

The core reason behind hiring a traditional wealth manager is clients' expectation that the investment may lead to an increase in the net returns. However, the fintech advisors segment is expected to portray the largest CAGR of 16.8% from 2021 to 2030, owing to the efforts of fintech advisors to create a solid business plan and market strategy, advice on regulatory compliance that meets state and federal standards, and help in building credible relationships with banks, customers, and investors.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/13433

North America to Maintain its Dominance by 2030

Based on region, North America held the highest market share in terms of revenue in 2020, accounting for more than half of the global wealth management market, and is expected to maintain its lead by 2030. This is due to the presence of a massive number of high net-worth individuals and increase in number of competitions among banks such as Morgan Stanley, UBS, and Bank of America Corporation to offer the maximum benefits to their clients. However, Asia-Pacific is projected to witness the fastest CAGR of 12.7% during the forecast period, owing to the several high net worth & ultra-high net worth individuals continuing to demand wealth management product lines in the region.

𝑰𝒇 𝒚𝒐𝒖 𝒉𝒂𝒗𝒆 𝒂𝒏𝒚 𝒔𝒑𝒆𝒄𝒊𝒂𝒍 𝒓𝒆𝒒𝒖𝒊𝒓𝒆𝒎𝒆𝒏𝒕𝒔, 𝒂𝒔𝒌 𝒇𝒐𝒓 𝒄𝒖𝒔𝒕𝒐𝒎𝒊𝒛𝒂𝒕𝒊𝒐𝒏𝒔: https://www.alliedmarketresearch.com/request-for-customization/13433?reqfor=covid

Leading Market Players

Bank of America Corporation,

BNP Paribas,

Charles Schwab & Co., Inc.,

Citigroup Inc.,

CREDIT SUISSE GROUP AG,

Goldman Sachs,

JPMorgan Chase & Co.,

Julius Baer Group,

Morgan Stanley,

UBS

𝘽𝙪𝙮 𝙉𝙤𝙬@ https://www.alliedmarketresearch.com/checkout-final/75cd5505e34d1beaab78bfb5b8dbe265

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐢𝐧 𝗕𝗙𝗦𝗜 𝐃𝐨𝐦𝐚𝐢𝐧 -

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

Financial Services Software Market https://www.alliedmarketresearch.com/financial-services-software-market-A14931

AI in Fintech Market https://www.alliedmarketresearch.com/ai-in-fintech-market-A16644

Crypto Payment Gateway Market https://www.alliedmarketresearch.com/crypto-payment-gateway-market-A31799

Data Analytics in Banking Market https://www.alliedmarketresearch.com/data-analytics-in-banking-market-A16647

Auto Finance Market https://www.alliedmarketresearch.com/auto-finance-market-A10390

Europe Open Banking Market https://www.alliedmarketresearch.com/europe-open-banking-market-A16019

South Korea Car Finance Market https://www.alliedmarketresearch.com/south-korea-car-finance-market-A15933

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Market Expected to Exceed $3.43 Trillion by 2021, Projected to Grow at 10.7% CAGR Through 2030 here

News-ID: 3621576 • Views: …

More Releases from Allied Market Research

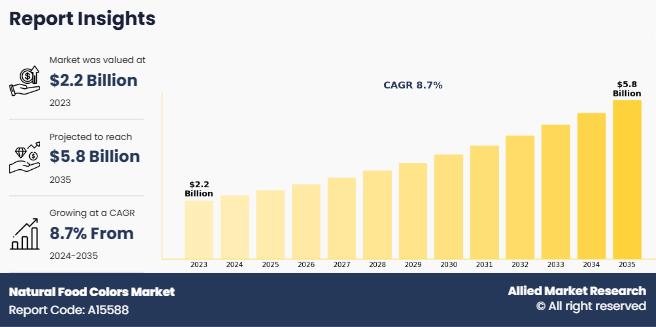

Natural Food Colors Market Size Worth USD 5.58 Billion By 2035 | Growth Rate (CA …

The natural food colors market was valued at $2.2 billion in 2023, and is estimated to reach $5.8 billion by 2035, growing at a CAGR of 8.7% from 2024 to 2035.

The rising demand for functional and nutraceutical foods is significantly driving the natural food colors, as consumers increasingly seek products that offer both health benefits and visual appeal. Natural colors derived from ingredients like turmeric, beetroot, spirulina, and blueberry not…

Combat Self-Defense Management Systems Market Rapidly Growing Dynamics with Indu …

Combat management system is a computer system which integrates the ship sensors, radars, weapons, data links, and other equipment into a single system. The combat management system provides situational awareness & intelligence to the crew and enables them to perform combat missions effectively. A combat management system comprises the central command & decision-making element of vessel combat system. The combat management system is used in combat missions for several purposes…

Ice Cream Coating Market Research Overview, Share, Size, Analysis, and Forecast …

Ice cream is a sweetened frozen product with either an artificial sweetener or natural sugar. Ice cream is eaten as a desert or snack. Increase in consumption of ice cream is highest in summer. Ice cream coating is made from coconut, cashew, almond milk, dairy milk or cream, soy, and is flavored with sugar. Ice cream coating contains thin layers that are manufactured from inexpensive fats such as hydrogenated palm…

Aviation Crew Management System Market Size Worth $5.61 Billion by 2032 With CAG …

According to the report, the global aviation crew management system market size was valued at $2.61 billion in 2022 and is projected to reach $5.61 billion by 2032, registering a CAGR of 8.16% from 2023 to 2032.

The growing demand for sophisticated software designed to improve crew operations across a range of aviation industries will experience significant growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/A177928

The global aviation crew management system market is driven by factors…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…