Press release

Bancassurance Market Key Players, Market Analysis, Share, Trends And Forecast To 2033

"The new report published by The Business Research Company, titled Bancassurance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the bancassurance market size has grown strongly in recent years. It will grow from $1,290.19 billion in 2023 to $1,382.35 billion in 2024 at a compound annual growth rate (CAGR) of 7.1%. The bancassurance market size is expected to see strong growth in the next few years. It will grow to $1,830.09 billion in 2028 at a compound annual growth rate (CAGR) of 7.3%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=16354&type=smp

Growing Demand For Insurance Fuels Bancassurance Market Expansion

The increasing need for insurance is expected to propel the growth of the bancassurance market going forward. Insurance is a financial arrangement in which an individual or entity (the insured) pays premiums to an insurance company (the insurer) in exchange for protection against financial losses from specified risks. The growing need for insurance is driven by rising uncertainties and risks in modern life, including health issues, natural disasters, economic instability, and the growing value of personal and business assets. Bancassurance effectively addresses the increasing need for insurance by leveraging banks' extensive customer networks and trust to provide convenient access to tailored insurance products. For instance, in February 2024, according to LIMRA Inc., a US-based insurance and financial services trade association, in 2023, the total U.S. life insurance new annualized premium rose by 1% year-over-year, reaching $15.6 billion. Additionally, the overall policy count saw a 4% increase, with term policy counts also up by 4%. Notably, the number of indexed universal life policies sold surged by 20% compared to the previous year. Therefore, the increasing need for insurance will drive the growth of the bancassurance market.

Revolutionary Digital Insurance Portal Redefining User Independence And Convenience

Major companies operating in the bancassurance market are working on technological advancements, such as digital insurance platforms, to enhance the customer experience, streamline operations, and offer more personalized and accessible insurance solutions. A digital insurance platform is an online system that leverages technology to simplify and automate buying, managing, and claiming insurance policies. For instance, in October 2023, NCBA Bancassurance Intermediary LTD, a Kenya-based company specializing in offering a wide range of insurance products and services, launched a digital insurance portal that simplifies insurance management. The platform provides secure, self-service features, including quote comparisons, instant portfolio access, real-time claim submission and tracking, and easy premium payments.

The bancassurance market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Non-Life Insurance

2) By Model Type: Pure Distributor Model, Strategic Alliance Model, Joint Venture Model, Financial Holding, Other Model Types

3) By End User: Personal, Business

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=16354&type=discount

Major companies operating in the bancassurance market are Allianz SE, AXA Group (AXA SA), Wells Fargo & Company, HSBC Holdings plc, Citigroup Inc., MetLife Inc., Assicurazioni Generali S.p.A., Prudential Financial Inc., American Express Company, BNP Paribas SA, ING Groep N.V., Mitsubishi UFJ Financial Group Inc. (MUFG), Crédit Mutuel, Barclays PLC, Crédit Agricole SA, Intesa Sanpaolo S.p.A., Banco Bradesco S.A., Standard Chartered PLC, Nordea Bank Abp, Australia and New Zealand Banking Group Limited (ANZ), CNA Financial Corporation, Lloyds Banking Group plc, Bank of Nova Scotia (Scotiabank), ABN AMRO Group N.V., Yes Bank Ltd.

Contents of the report:

1. Executive Summary

2. Bancassurance Market Report Structure

3. Bancassurance Market Trends And Strategies

4. Bancassurance Market - Macro Economic Scenario

5. Bancassurance Market Size And Growth

…..

27. Bancassurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/bancassurance-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Key Players, Market Analysis, Share, Trends And Forecast To 2033 here

News-ID: 3619296 • Views: …

More Releases from The Business Research Company

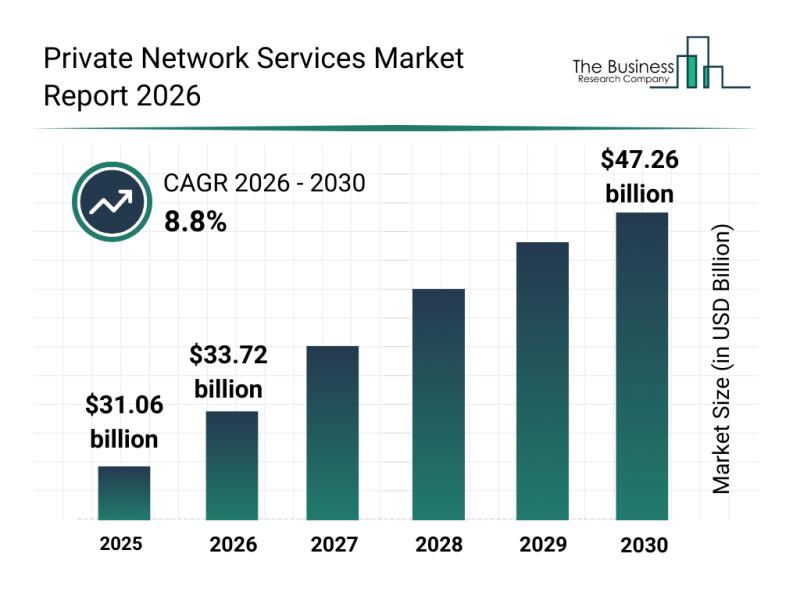

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

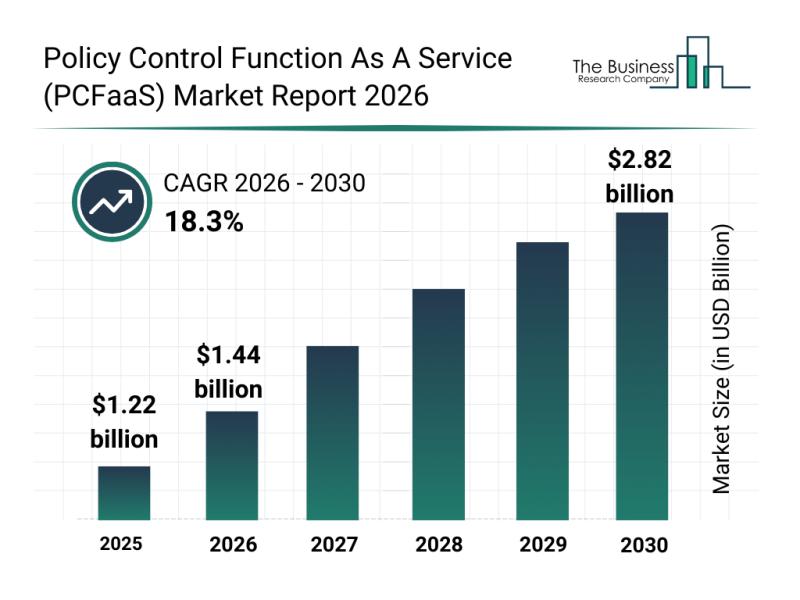

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

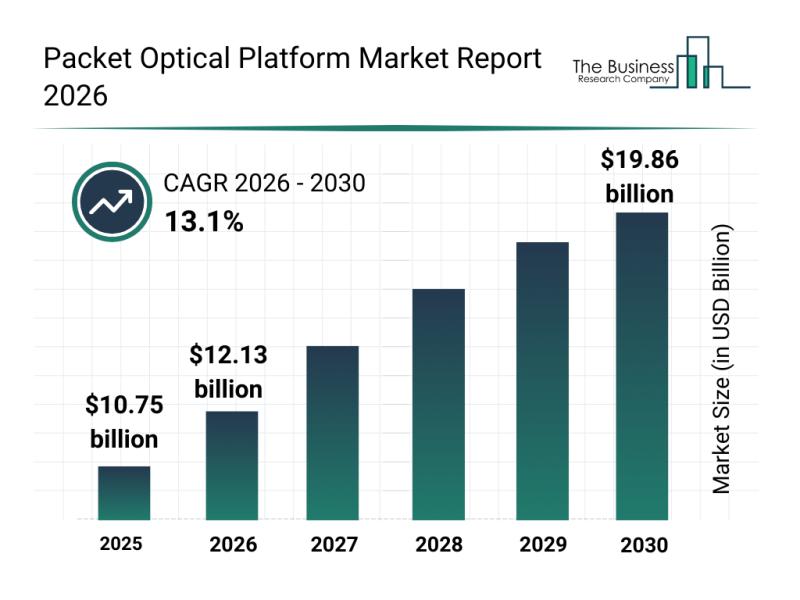

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

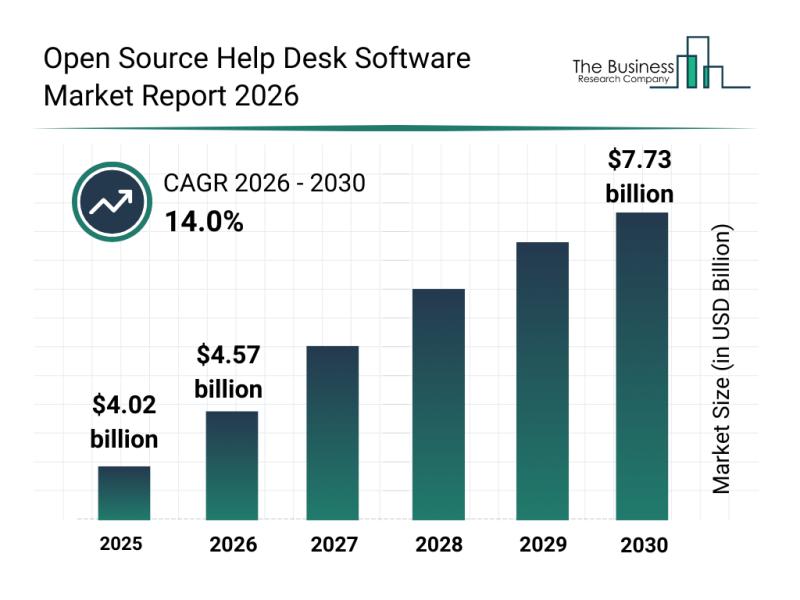

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Bancassurance

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

Bancassurance Products Market 2025: A Decade of Phenomenal Growth Ahead

The Bancassurance Products Market 2025-2033 report provides a comprehensive analysis of Types (Life Insurance, Non-life Insurance), Application (Aldult, Child, Others), Analysis of Industry Trends, Growth, and Opportunities, R&D landscape, Data security and privacy concerns Risk Analysis, Pipeline Products, Assumptions, Research Timelines, Secondary Research and Primary Research, Key Insights from Industry Experts, Regional Outlook and Forecast, 2025-2033.

Major Players of Bancassurance Products Market are:

ABN AMRO Bank, ANZ, Banco Bradesco, American Express, Banco Santander,…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…