Press release

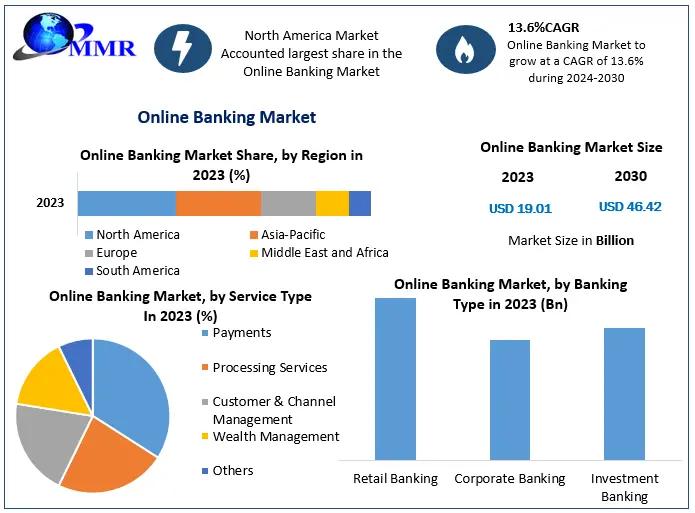

Online Banking Market Valued at US$ 19.01 Billion in 2023; Expected to Reach US$ 46.42 Billion by 2030

Forecast Increase in Revenue:Online Banking Market was valued at US$ 19.01 Bn. in 2023 and is expected to reach US$ 46.42 Bn. by 2030, at a CAGR of 13.6% during a forecast period.

Online Banking Market Overview:

The Online Banking Market, valued at approximately USD 19.01 billion in 2023, encompasses a range of financial transactions conducted over the Internet, including deposits, transfers, and bill payments. Online banking, also known as Internet or web banking, offers users the convenience of managing their finances from virtually anywhere, 24/7. This accessibility enables consumers to perform tasks such as account management and fraud detection more efficiently, ultimately enhancing security and ease of use. The sector has experienced significant growth due to its ability to provide time-saving, user-friendly financial solutions, despite facing some disruptions from the COVID-19 pandemic.

𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐬 𝐉𝐮𝐬𝐭 𝐚 𝐂𝐥𝐢𝐜𝐤 𝐀𝐰𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/84177/

Drivers in the Online Banking Market:

The primary driver of the Online Banking Market is the convenience it provides, allowing users to perform financial transactions from home or other locations with internet access. The rapid expansion of e-commerce and online payment services has further fueled this growth, as increased internet usage globally supports the demand for digital financial solutions. Additionally, evolving consumer preferences for greater transparency and flexibility in banking operations contribute to the market's advancement. However, the industry also contends with challenges such as rising cybersecurity threats, which can impact user confidence and adoption rates.

Online Banking Market Trends:

Current trends in the Online Banking Market include a heightened focus on real-time payment solutions and the integration of advanced technologies like artificial intelligence and blockchain. As more consumers embrace digital financial services, banks are responding with innovative features that enhance user experience, such as mobile banking apps and personalized financial tools. There is also a growing emphasis on improving cybersecurity measures to address the increasing frequency of cyber-attacks, which threatens to undermine consumer trust in online banking platforms.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/84177/

Online Banking Market Opportunities:

The Online Banking Market presents several opportunities for growth, particularly in emerging regions where digital adoption is accelerating. Governments and financial institutions are investing in digital infrastructure and regulatory frameworks to support online banking expansion. Additionally, the development of new financial technologies and alternative payment methods creates opportunities for banks to differentiate themselves and attract new customers. Innovations such as biometric authentication and automated financial management tools offer the potential to enhance security and convenience, driving further market expansion.

What is Online Banking Market Regional Insight?

Regionally, North America holds the largest market share in online banking, driven by high technological adoption and advancements in IT infrastructure. This region benefits from a robust consumer base willing to embrace digital financial services. The Asia-Pacific region follows as a significant player, with growth fueled by government initiatives like Digital India and increasing internet accessibility. European countries, particularly in the Nordics, Germany, and Austria, are also experiencing a shift away from cash transactions, which is positively influencing the online banking market. The diverse regional dynamics reflect varying stages of digital adoption and infrastructure development across the globe.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐭𝐨 𝐩𝐞𝐞𝐤 𝐢𝐧𝐬𝐢𝐝𝐞? 𝐆𝐫𝐚𝐛 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/84177/

Segmentation Analysis of the Online Banking Market:

by Software Type

Customized software

Standard software

by Service Type

Payments

Processing Services

Customer & Channel Management

Wealth Management

Others

by Banking Type

Retail Banking

Corporate Banking

Investment Banking

Who is the largest manufacturers of Online Banking Market worldwide?

1. ACI Worldwide, Inc.

2. Capital Banking Solution

3. CGI Inc.

4. COR Financial Solutions Limited

5. EdgeVerve Systems Limited

6. Fiserv, Inc.

7. Microsoft

8. Oracle

9. Tata Consultancy Services Limited

10. Temenos Headquarters SA

11. Financial Network services

12. Corillian

13. I-flex Solutions

14. Canopus Software Laboratory

15. First Source Bank

16. Rockall Technologies.

17. Appway AG

18. CREALOGIX AG

19. ebankIT

20. Etronika

21. Fidor Solutions AG

22. Finastra

23. Halcom.com

24. Infosys Limited

25. Intellect Design Arena Limited

26. SAP SE

27. Sopra Steria

𝐆𝐞𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐎𝐧 𝐓𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

Key Offerings:

Past Market Size and Competitive Landscape

Online Banking Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Online Banking Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ Global Incident Response Market: https://www.maximizemarketresearch.com/market-report/global-incident-response-market/11644/

♦ Global Healthcare Chatbot Market: https://www.maximizemarketresearch.com/market-report/global-healthcare-chatbots-market/240/

♦ Global Voice Assistant Application Market: https://www.maximizemarketresearch.com/market-report/global-voice-assistant-application-market/29742/

♦ Global Online On-Demand Home Services Market: https://www.maximizemarketresearch.com/market-report/global-online-on-demand-home-services-market/39167/

♦ Carbon Management Software Market: https://www.maximizemarketresearch.com/market-report/global-carbon-management-software-market/108489/

♦ Global Industrial Vending Machine Market: https://www.maximizemarketresearch.com/market-report/global-industrial-vending-machine-market/31293/

♦ Crypto Asset Management Market: https://www.maximizemarketresearch.com/market-report/global-crypto-asset-management-market/27361/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market Valued at US$ 19.01 Billion in 2023; Expected to Reach US$ 46.42 Billion by 2030 here

News-ID: 3617347 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

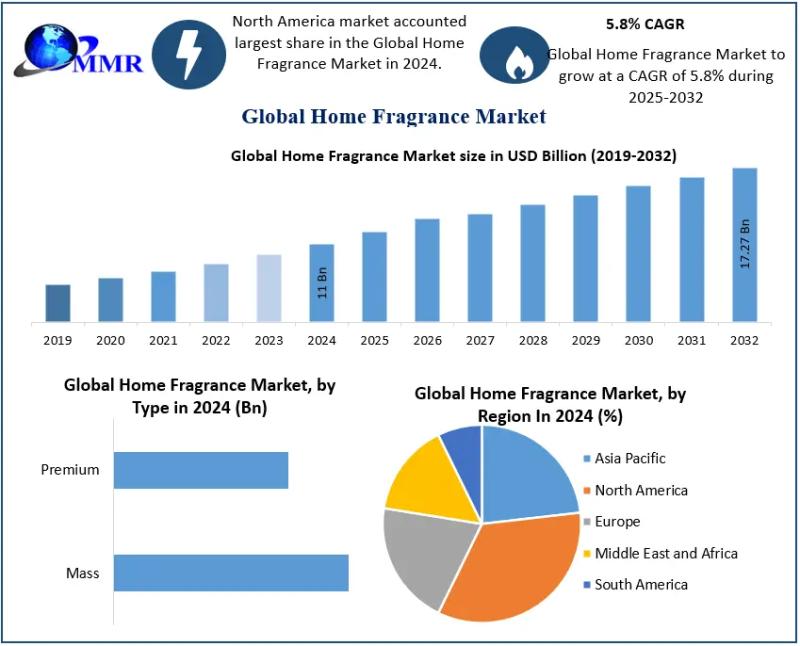

Home Fragrance Market Poised to Reach USD 17.27 Billion by 2032; CAGR 5.8% - Dri …

The Global Home Fragrance Market was valued at USD 11 Billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2032, reaching approximately USD 17.27 Billion by 2032.

Market Overview

The Home Fragrance Market is experiencing sustained global demand driven by increased consumer interest in indoor ambience enhancement, stress-relief attributes of scents, and home décor trends. Products such as scented candles, essential oil diffusers, sprays, and…

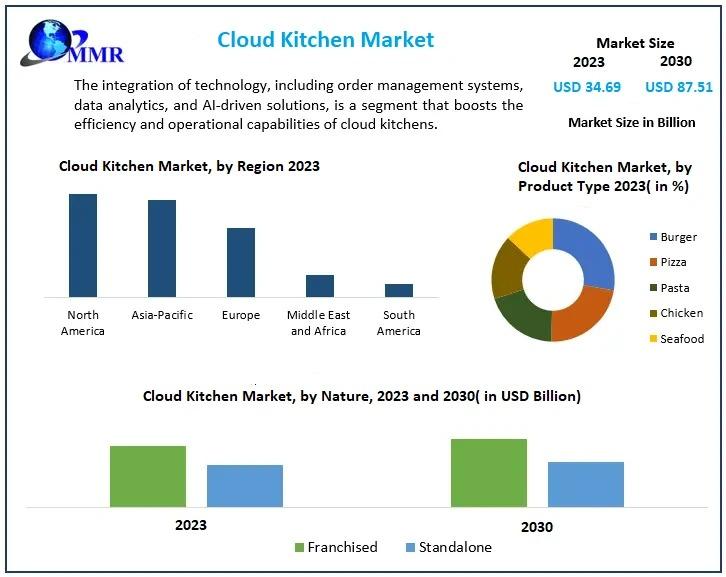

Cloud Kitchen Market Trends 2024-2030 Driven by Online Food Platforms and Cost-E …

Cloud Kitchen Market size was valued at USD 34.69 Bn in 2023 and Cloud Kitchen Market revenue is expected to reach USD 87.51 Bn by 2030, at a CAGR of 14.13% over the forecast period. Market Expected to Witness Strong Growth Through 2030, Driven by Urban Demand and Digital Food Ordering

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/109430/

The Cloud Kitchen Market is undergoing rapid transformation…

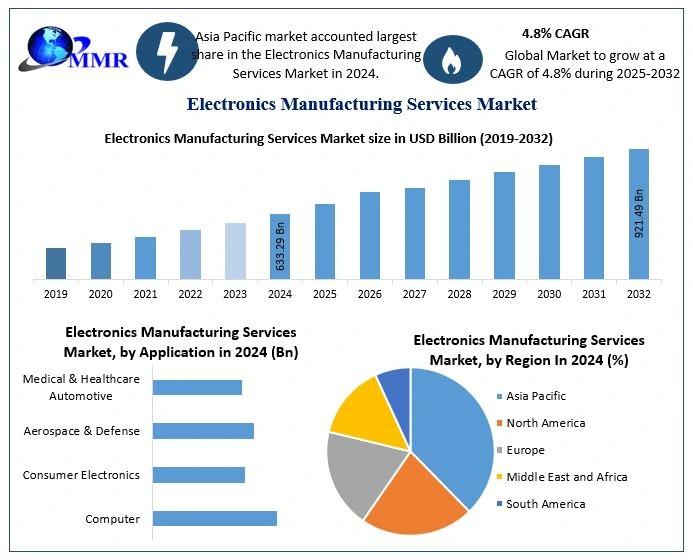

Electronics Manufacturing Services Market Poised to Hit USD 921.49 Billion by 20 …

The Global Electronics Manufacturing Services Market was valued at approximately USD 633.29 Billion in 2024 and is projected to grow at a CAGR of 4.8% through 2032, reaching USD 921.49 Billion by 2032.

Market Overview

The Global Electronics Manufacturing Services Market encompasses full-spectrum services - from PCB fabrication and product assembly to testing, logistics, and aftermarket support - that enable original equipment manufacturers to streamline production and focus on innovation. Electronics Manufacturing…

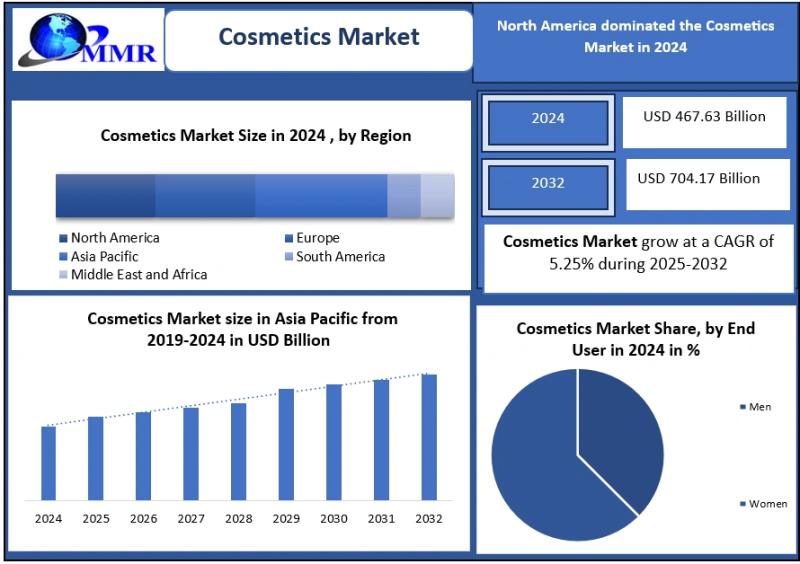

Cosmetics Market Size to Reach USD 704.17 Billion by 2032: Rising Clean Beauty, …

The Global Cosmetics Market was valued at USD 467.63 Billion in 2024 and is projected to reach USD 704.17 Billion by 2032, exhibiting a CAGR of 5.25% from 2025 to 2032.

Market Overview

The Global Cosmetics Market continues to grow rapidly, driven by heightened beauty consciousness, strong demand for advanced skincare, digital transformation in e-commerce, and rising preference for clean and sustainable beauty products. Market dynamics show innovation originating from major beauty…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…