Press release

New York City 1031 Exchange Lawyer Natalia Sishodia Releases Insightful Article on the Benefits of a 1031 Exchange Delaware Statutory Trust

New York City 1031 exchange lawyer Natalia Sishodia (https://sishodia.com/benefits-of-a-1031-exchange-delaware-statutory-trust-dst/) of Sishodia PLLC has recently published an enlightening article titled "Benefits of a 1031 Exchange Delaware Statutory Trust (DST) - 1031 Lawyer." This comprehensive piece aims to inform real estate investors about the advantages of utilizing 1031 exchanges and Delaware Statutory Trusts (DSTs) to mitigate tax liabilities while enhancing their investment portfolios.New York City 1031 exchange lawyer Natalia Sishodia explains that real estate investment in New York offers a multitude of opportunities, each with unique oversight requirements and tax implications. Investors often seek methods to limit their tax liabilities, and 1031 exchanges provide a viable solution. "Many investors are unaware of the potential tax deferral advantages offered by 1031 exchanges. Our goal is to educate and guide them through this complex process," says Sishodia.

The article by New York City 1031 exchange lawyer Natalia Sishodia discusses the mechanics of a 1031 exchange, which allows investors to swap properties held for business or investment purposes without immediately incurring capital gains taxes. According to IRS code section 1031, this process can be repeated multiple times, offering significant tax advantages. However, compliance with IRS requirements can be challenging, prompting many investors to consider DSTs for their 1031 exchanges.

A DST is a legal entity established for business activities and recognized as a trust. Despite its name, a DST can operate in any state, functioning as an "Unincorporated Business Trust." These trusts have gained popularity in real estate investments, particularly for 1031 exchanges, due to their ability to own multiple high-value properties. "DSTs provide a streamlined pathway for investors to defer taxes while acquiring fractional interests in high-quality properties without the hassles of direct property management," notes Sishodia.

The article further highlights the IRS ruling (Rev Rul 2004-86) that a taxpayer may exchange real property for a DST interest without recognizing gain or loss under 1031, provided other requirements are met. This ruling underscores the qualification of DSTs as replacement properties in 1031 exchanges, making them an attractive option for investors seeking to defer capital gains taxes.

For those dealing with international properties, the rules of 1031 exchanges are equally detailed. Properties within the United States can only be exchanged with other domestic properties, and the same applies to foreign properties. This stipulation requires thorough understanding and compliance with both domestic and international tax laws.

Sishodia's article also outlines the benefits of investing in DSTs, which include potential capital gains tax savings, higher income potential, and access to institutional-grade properties with minimal landlord responsibilities. DSTs offer passive property management, risk diversification, and tax savings for estate beneficiaries. Additionally, they present a low risk of exchange failure and can be closed quickly, often within three to five days.

However, investing in DSTs is not without risks. Potential disadvantages include the possibility of loss of principal, lack of return, liquidity issues, interest rate risks, and dependency on tenant rent payments. "Investors must carefully assess their individual goals and the inherent risks associated with DSTs. It's crucial to make informed decisions," advises Sishodia.

DSTs provide individual investors a unique opportunity to access a diverse range of commercial real estate that would typically be financially inaccessible. By pooling resources, investors can acquire shares in a trust that holds large-scale properties, from multifamily complexes to industrial warehouses. This investment strategy not only diversifies portfolios but also offers competitive income streams and potential appreciation.

For those looking to turn their 1031 exchange properties into DSTs, the process involves selling the original property and acquiring an interest in a DST, thus becoming a fractional investor. This transition alleviates the responsibilities of property management while providing a diversified, income-producing portfolio that continues to defer capital gains taxes.

Natalia Sishodia emphasizes the importance of consulting with a knowledgeable legal professional when navigating the complex aspects of 1031 exchanges and DSTs. "Understanding IRS regulations can be daunting. Engaging a New York real estate lawyer can simplify the process and help avoid potential pitfalls," she advises.

Investors are encouraged to read the full article by Natalia Sishodia to gain deeper insights into the benefits and intricacies of 1031 exchanges and DSTs. For personalized legal guidance tailored to specific investment needs and goals, consider reaching out to Sishodia PLLC.

About Sishodia PLLC:

Sishodia PLLC, a New York-based law firm, can provide comprehensive legal services in real estate matters. The firm is dedicated to helping clients navigate the complex aspects of real estate transactions, including 1031 exchanges, contract negotiations, due diligence, and compliance. With a commitment to personalized service and strategic solutions, Sishodia PLLC strives to protect the interests of its clients and achieve their investment goals.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=S2QDZOB-VVQ

GMB: https://www.google.com/maps?cid=12450537318741950980

Email and website

Email: natalia@sishodialaw.com

Website: https://sishodia.com/

Media Contact

Company Name: Sishodia PLLC

Contact Person: Natalia A. Sishodia

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-york-city-1031-exchange-lawyer-natalia-sishodia-releases-insightful-article-on-the-benefits-of-a-1031-exchange-delaware-statutory-trust]

Phone: (833) 616-4646

Address:600 Third Avenue 2nd Floor, 600 3rd Ave Second Floor

City: New York

State: New York 10016

Country: United States

Website: https://sishodia.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New York City 1031 Exchange Lawyer Natalia Sishodia Releases Insightful Article on the Benefits of a 1031 Exchange Delaware Statutory Trust here

News-ID: 3616365 • Views: …

More Releases from ABNewswire

Cyber-physical Systems Security Market Growth Drivers, New Trends, Opportunities …

Cyber-physical Systems (CPS) Security Market by Solution (Network Security, Data Security, IAM, SIEM), Service (Incident Response), Application (Medical Device Security, Industrial Automation Security, Smart Grid Security) - Global Forecast to 2030.

The cyber-physical systems (CPS) security market [https://www.marketsandmarkets.com/Market-Reports/cyber-physical-system-cps-security-market-247212119.html?utm_campaign=cyberphysicalsystemcpssecuritymarket&utm_source=abnewswire.com&utm_medium=referral] is projected to expand at a compound annual growth rate (CAGR) of 16.5% from USD 16.07 billion in 2025 to USD 34.44 billion by 2030. The growing use of Industry 4.0, smart manufacturing,…

Exhaust Aftertreatment System Market worth $40.93 billion by 2032

Exhaust Aftertreatment System Market by Product Type (DOC, DPF, LNT, SCR, GPF, Sensors), Fuel (Gasoline, Diesel), Vehicle Type (Passenger Cars, LCVs, HCVs), Sales Channel (OE-Fitted, Aftermarket), and Region - Global Forecast to 2032

The Exhaust Aftertreatment System Market [https://www.marketsandmarkets.com/Market-Reports/exhaust-aftertreatment-system-market-160495914.html?utm_source=prnewswire.com&utm_medium=referral&utm_campaign=exhaust-aftertreatment-system-market] is projected to grow from USD 32.77 billion in 2025 and to reach USD 40.93 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period.

Technical advancements…

DRaaS Market 2032: In-depth Insights, Business Opportunities, Leading Companies, …

DRaaS Market by Service Type (Backup & Restore, Real-time Replication, Data Protection, and Professional Services), Deployment Mode (Public Cloud and Private Cloud), Organization Size, Vertical, and Region - Global Forecast to 2032

The disaster recovery as a service (DRaaS) market [https://www.marketsandmarkets.com/Market-Reports/recovery-as-a-service-market-962.html?utm_campaign=recoveryasaservicemarket&utm_source=abnewswire.com&utm_medium=referral] is estimated to grow at a compound annual growth rate (CAGR) of 16.2%, from approximately USD 16,112.2 million in 2025 to USD 46,089.9 million by 2032. The market for Disaster…

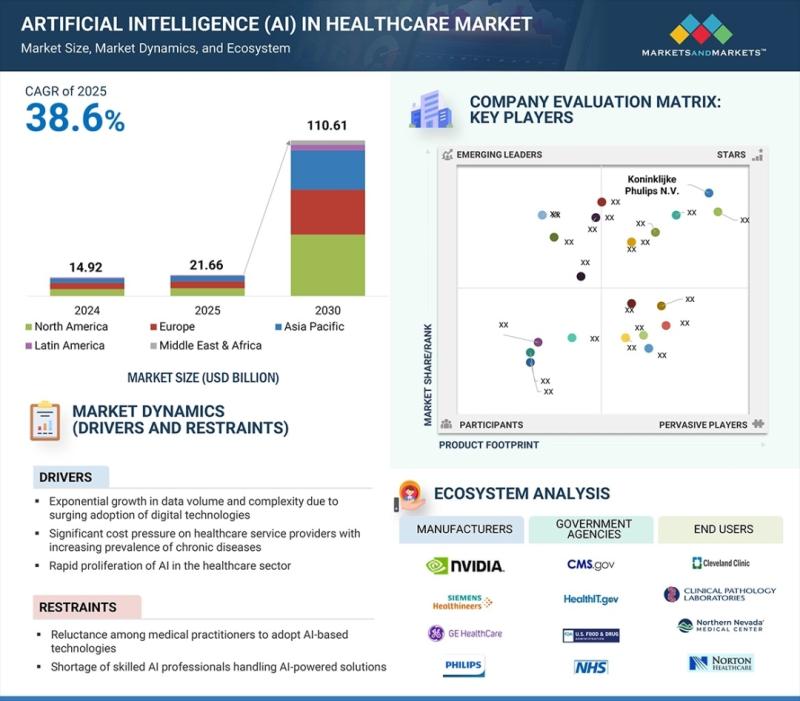

Global AI in Healthcare Market Projected to Reach $110.61 Billion by 2030

Enterprise healthcare leaders face unprecedented pressure to optimize diagnostics, treatment, and operations-AI solutions now offer a decisive competitive advantage

The global artificial intelligence in healthcare market is experiencing explosive growth, valued at $21.66 billion in 2025 and accelerating toward $110.61 billion by 2030, representing a compound annual growth rate (CAGR) of 38.6%, according to new market analysis. This expansion reflects a fundamental shift in how healthcare organizations are addressing chronic disease…

More Releases for Sishodia

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

Manhattan Deed Transfer Lawyer Natalia A. Sishodia Clarifies New York Transfer T …

Transferring real estate in New York requires careful attention to legal and tax obligations that can have long-term consequences. Natalia A. Sishodia (https://sishodia.com/do-i-need-to-pay-transfer-taxes-when-transferring-title/), a Manhattan deed transfer lawyer at Sishodia PLLC, outlines key considerations property owners should understand when changing a property's title through sale, inheritance, gift, or restructuring. In New York, real estate transfers typically involve the payment of transfer taxes, which can significantly affect the cost and timeline…

NYC Condo Attorney Natalia Sishodia Provides Insights on Manhattan Real Estate T …

NYC condo attorney [https://sishodia.com/manhattan-condo-real-estate-attorney/] Natalia Sishodia discusses key aspects of Manhattan real estate transactions, helping buyers and sellers navigate purchasing or selling a condominium in the city. With the competitive nature of the real estate market, having an understanding of legal requirements and potential challenges is essential. Sishodia PLLC provides guidance on contract negotiations, due diligence, and closing processes for those involved in condo transactions.

As an NYC condo attorney, Natalia…

Manhattan Deed Transfer Lawyer Natalia Sishodia Releases Insightful Article on P …

Manhattan deed transfer lawyer Natalia Sishodia (https://sishodia.com/manhattan-deed-transfer-lawyer/), of Sishodia PLLC, highlights the essential role of deed transfers in real estate transactions. A deed, which serves as the official document transferring property ownership from one party to another, is foundational in establishing clear and lawful property rights. Handling these transfers properly is critical to avoiding costly disputes or legal challenges.

A deed transfer is not just about signing paperwork. As Manhattan deed…

New York Estate Probate Lawyer Natalia Sishodia Explains the Probate Sale Proces …

Probate sales play an important role in settling estates after the death of a loved one. According to New York estate probate lawyer Natalia Sishodia (https://sishodia.com/what-is-a-probate-sale/) of Sishodia PLLC, a probate sale involves selling property under court supervision to meet the financial obligations of the deceased, such as debts and taxes, before distributing any remaining assets to beneficiaries. This legal process ensures that everything is conducted fairly, especially when real…