Press release

Peer-to-Peer (P2P) Lending Market 2024 Report By Key Companies, Regional Analysis And Forecast 2033

The new report published by The Business Research Company, titled "Peer-to-Peer (P2P) Lending Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the peer-to-peer (p2p) lending market size has grown exponentially in recent years. It will grow from $143.54 billion in 2023 to $190.22 billion in 2024 at a compound annual growth rate (CAGR) of 32.5%. The peer-to-peer (p2p) lending market size is expected to see exponential growth in the next few years. It will grow to $559.73 billion in 2028 at a compound annual growth rate (CAGR) of 31.0%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=7466&type=smp

Digital Transformation In Banking Fuels P2P Lending Market Growth

Increasing digitization in the banking industry is expected to propel the growth of the peer to peer (P2P) lending market going forward. Digital innovation in the banking industry is transforming financial services such as mobile money, peer-to-peer (P2P), or marketplace lending. For instance, in January 2022, according to a report shared by European Banking Supervision, a regulatory body established to maintain financial stability throughout the European Union's (EU) banking industry, the number of digital users has climbed by 23% since the beginning of the pandemic. Therefore, the increasing digitization in the banking industry is driving the growth of the peer to peer (P2P) lending market.

Decentralized P2P Mobile Browsers Reshaping The Peer-To-Peer Lending Market

The emergence of decentralized P2P mobile browsers is a key trend gaining popularity in the peer-to-peer lending market. Major companies operating in the peer to peer (P2P) lending market are adopting decentralized P2P mobile browsers to increase their market share. For instance, in March 2022, eQualitie, a Canadian digital security organization, launched CENO, the world's first decentralized P2P mobile browser, built particularly to avoid the censoring techniques used today. It also permits access in areas where connectivity has been disrupted. Although using CENO is similar to using a conventional mobile browser, it runs more reliably than other browsers because it uses a peer-to-peer (P2P) network and the open-source Ouinet library and BitTorrent protocols. The online content cannot be forcibly deleted by outside agents because it is decentralized via peer-to-peer routing.

The peer-to-peer (p2p) lending market covered in this report is segmented -

1) By Loan Type: Consumer Credit Loans, Small Business Loans, Student Loans, Real Estate Loans

2) By Business Model: Traditional Lending, Alternate Marketplace Lending

3) By End User: Business, Personal

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=7466&type=discount

Major companies operating in the peer-to-peer (p2p) lending market report are Avant LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree LLC, OnDeck Capital Inc., Prosper Funding LLC, CircleBack Lending Inc., Social Finance Inc., Zopa Bank Limited, Upstart Network Inc., Commonbond Inc., Retail Money Market Ltd., Peerform, RateSetter, Max Crowdfund B. V., PYT FUNDS Inc., Rendity GmbH, ThinCats Limited, MoneyThing Capital Limited, ArchOver Limited, Landbay Partners Limited, Crowdstacker Holdings Ltd, Rebuilding Society. com Ltd., Assetz Capital Limited, Folk2Folk Limited, PeerStreet, 'EstateGuru. Co., Grupeer Ltd., Mintos marketplace AS

Contents of the report:

1. Executive Summary

2. Peer-to-Peer (P2P) Lending Market Report Structure

3. Peer-to-Peer (P2P) Lending Market Trends And Strategies

4. Peer-to-Peer (P2P) Lending Market - Macro Economic Scenario

5. Peer-to-Peer (P2P) Lending Market Size And Growth

…..

27. Peer-to-Peer (P2P) Lending Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/peer-to-peer-p2p-lending-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer (P2P) Lending Market 2024 Report By Key Companies, Regional Analysis And Forecast 2033 here

News-ID: 3609172 • Views: …

More Releases from The Business research company

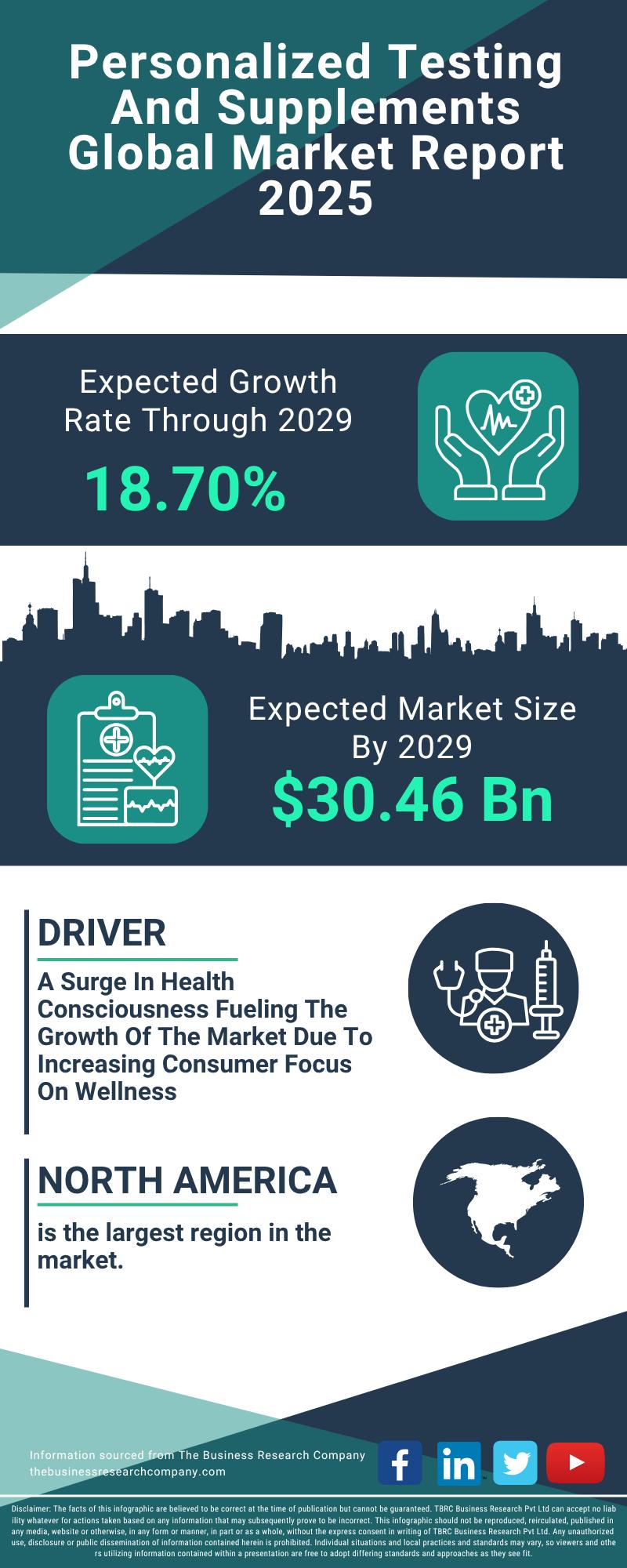

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…