Press release

Payday Loans Market Expected to Reach $48.68 Billion By 2030 | Lending Stream, Creditstar, Myjar, and Cashfloat

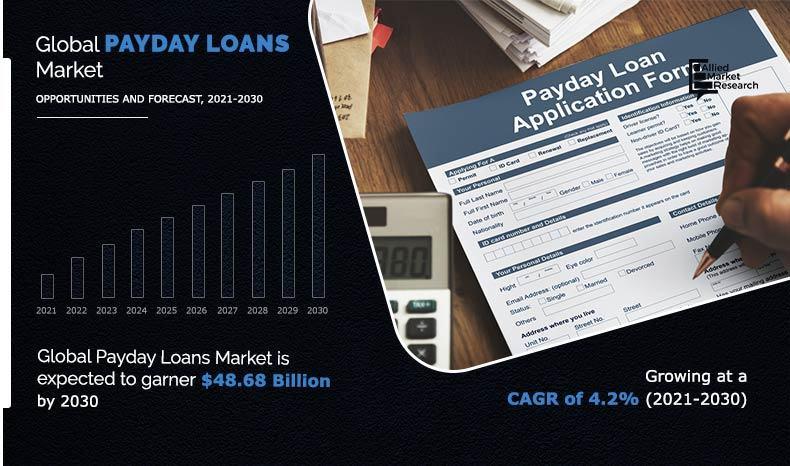

According to a recent report published by Allied Market Research, titled, "Payday Loans Market by Type, Marital Status and Customer Age: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payday loans market size was valued at $32.48 billion in 2020, and is projected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.►𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂

https://www.alliedmarketresearch.com/request-sample/A10012

Payday loan is a type of short-term cash loans that is provided to borrowers with high interest rate without any collateral provided by the borrowers. In addition, as payday loans continue to attract new users, more market participants are becoming aware of the need for straightforward tools designed to manage payday loans for borrowers of all skill levels which is driving the growth of the market.

Moreover, payday loan providers are typically small credit merchants who provide loans to the borrowers from physical platform as well as through online platform. In addition, payday loans help people in emergency need of cash without the need of any proof, which is driving the market. Furthermore, the key factor that drives the market includes growing awareness about the payday loan among the youth population and fast loan approval with no restriction on usage.

►𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A10012

In addition, presence of large number of payday lenders positively impacts the growth of the market. However, factors such high interest rates and negative impact of payday loans on credit score are expected to hamper the payday loans market growth. On the contrary, rise in adoption of advance technology among the payday lenders is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

Depending on marital status, single is expected to hold the largest global payday loans market as individuals are rapidly using payday loans for full filling their daily necessities. However, married is expected to witness significant growth rate during the forecast period, owing to growing need to repay the loan amount among the married people as well as to pay unexpected debt and medical bill provides lucrative opportunity for the market.

Region wise, the global payday loans market was dominated by North America, and is expected to retain its position during the forecast period. This is attributed to increase in adoption of advance technologies such as cloud technology, big data, artificial intelligence, and machine learning for automating the payday loan solutions and providing online payday solutions with high privacy. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rising payday loan awareness among the youth and growth in number of payday lenders in Asia-Pacific.

►𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 :

https://www.alliedmarketresearch.com/request-for-customization/A10012

COVID-19 Impact Analysis

The outbreak of COVID-19 is anticipated to have a positive impact on the growth of the global payday loans market trends. With the rise of COVID-19 pandemic, millions of people have lost their jobs and pay day loans have experienced a significant boost due to growing government support and favorable government schemes for the workers. In addition, many payday lenders wanted to repeat the same that has been repeating for the past two recessions that occurred in 1923 and 1926, i.e. to target the low earners to boost the market.

However, due to several COVID-19 relief schemes many unemployed and low earners have been saved and are able to protect themselves from the temptation of payday loans. In addition, even with the ongoing schemes, many youngsters are taking payday loans to keep continuing with their living style before pandemic and job loss. Furthermore, according to a study of consumer spending, it was found that majority of the people in the U.S. have reduced their spending and are instead trying to resolve their old debts as soon as possible. This change in behavior is however negatively impacting the growth of the market.

►𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/07eb909c67f0d4343313af1142b57646?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Key Findings Of The Study

Depending on type, the storefront payday loans accounted for the largest global payday loans market share in 2020.

Region wise, North America accounted highest revenue in 2020.

Depending on marital status, the single generated the highest revenue in 2020.

The key players profiled in the global payday loans market analysis are Speedy Cash, Titlemax, CashNetUSA, Silver Cloud Financial, Inc., TMG Loan Processing, THL Direct, Lending Stream, Creditstar, Myjar, and Cashfloat. These players have adopted various strategies to increase their market penetration and strengthen their position in the payday loans industry.

➡️𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞:

https://www.prnewswire.com/news-releases/cross-border-payments-market-to-reach-356-5-billion-globally-by-2032-at-7-3-cagr-allied-market-research-301997678.html

https://www.prnewswire.com/news-releases/autonomous-finance-market-to-reach-82-58-billion-globally-by-2032-at-18-2-cagr-allied-market-research-301992309.html

https://www.prnewswire.com/news-releases/atm-security-market-to-reach-32-4-billion-globally-by-2032-at-9-2-cagr-allied-market-research-301988850.html

https://www.prnewswire.com/news-releases/regtech-market-to-garner-28-33-bn-globally-by-2027-at-22-3-cagr-allied-market-research-301214736.html

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payday Loans Market Expected to Reach $48.68 Billion By 2030 | Lending Stream, Creditstar, Myjar, and Cashfloat here

News-ID: 3604334 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Payday

$500 Google Payday Review - Legit or Another Hype?

$500 Google Payday Review - Legit or Another Hype?

With so many online money-making systems launching every day, it's hard to separate real opportunities from overhyped products. One of the latest entries is "$500 Google Payday" by Glynn Kosky, a WarriorPlus product promising a plug-and-play system that leverages Google's algorithm to generate commissions without selling, ads, or tech skills. But does it really work, or is it just another rehashed system?…

Payday Loans Market Outlook 2023-2030

A payday credit is a transient unstable advance, frequently described by exorbitant loan costs. The expression "payday" in payday credit alludes to when a borrower composes a postdated check to the moneylender for the payday pay, yet gets some portion of that payday total in prompt money from the loan specialist. Likewise, payday loans have little credit limits, ordinarily up to $500, and don't need a credit check. Moreover, the…

Payday Loans Service Market Astonishing Growth with Top Influencing Key Players …

Report Description

The Payday Loans Service Market is expected to register a CAGR of around 4.1%, during the forecast period 2022 to 2027.

The Global Payday Loans Service Market Report provides Insightful information to the clients enhancing their basic leadership capacity identified with the global Payday Loans Service Market business, including market dynamics, segmentation, competition, and regional growth. The strategy of expansion has been adopted by key players who are increasing their…

Payday Loans Rise in Public interest

PaydayLoanSolutions believes that the personal payday loan is becoming a necessary element of the modern consumers way of life. The company offers insight with regard to the near cultural necessity of the payday loan for significant parts of the general population.

Location—PaydayLoanSolutions allows consumers to organise a quick and small sized loan based upon the stability and reliability of their employment history and that is paid back to the company automatically…

Enjoy Financial Freedom with Payday Loan Solutions

Payday Loan Solutions is an online lender of the loans for American citizens at any hour of the day. It is the most trustworthy site to get payday loan of any amount within few hours.

“Fast cash delivery and other exciting features that our website offers to loan seekers make us the best choice,” says a company spokesperson.

The website operates 365 days a year and 24 hours a day,…

Payday Loan Consolidation Company "Payday Freedom" Announces Lender Scam Still T …

There has been a massive increase of fraudulent payday loan debt collectors trying to collect fake payday loan debts. Most of the callers have very strong Indian accents from the client reports coming in. It's been ongoing for many months now with no end in sight.

Unfortunately, so many people are falling for this trap and the main problem is the operators of this scam are working out of the country.…