Press release

New Jersey Bankruptcy Attorney Daniel Straffi Releases Insightful Article on Bankruptcies and Background Checks

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/do-bankruptcies-show-up-on-background-checks/) of Straffi & Straffi Attorneys at Law has unveiled a comprehensive article titled "Do Bankruptcies Show Up On Background Checks?" This article sheds light on the implications of bankruptcy on background checks and offers valuable information for those concerned about how their financial history might affect their future employment prospects.New Jersey bankruptcy attorney Daniel Straffi emphasizes that bankruptcy is a legal tool designed to help individuals reconcile with creditors and start afresh. However, the presence of bankruptcy on a credit report can hinder future plans, such as securing a mortgage or achieving specific career goals. Straffi points out that while bankruptcy is often perceived negatively, it can also signal a proactive step toward financial improvement.

"Bankruptcy can indicate that someone has taken necessary steps to address their financial issues," says New Jersey bankruptcy attorney Daniel Straffi. "It's important to understand that bankruptcies over ten years old are not included in employee background checks, thanks to the Fair Credit Reporting Act (FCRA)."

In his article, New Jersey bankruptcy attorney Daniel Straffi explains how Chapter 7 and Chapter 13 bankruptcies are documented differently on credit reports. A Chapter 7 bankruptcy remains for up to ten years from the filing date, while a Chapter 13 bankruptcy is removed after seven years. Once these periods lapse, bankruptcies are automatically erased from credit reports.

Straffi also highlights federal protections against employment discrimination based on bankruptcy. Government employers at federal, state, and local levels cannot discriminate against job applicants solely due to a bankruptcy filing. However, private employers do not face the same restrictions and may consider bankruptcy when making hiring decisions.

The article delves into the types of background checks that reveal bankruptcies. Criminal background checks, academic verifications, and employment history checks typically do not disclose financial status. However, credit checks do, and bankruptcies will appear on these reports. Credit checks are particularly relevant for roles involving financial decision-making or access to sensitive financial information.

Employers must adhere to the FCRA when conducting credit checks, requiring written consent from the applicant. Daniel Straffi advises that being upfront about a past bankruptcy and providing context can be a strategic way to address potential concerns during the hiring process.

Federal laws, such as the FCRA and 11 U.S.C. 525(b), offer additional protections and regulations regarding background checks and employment decisions related to bankruptcy. While government employers cannot deny employment based on bankruptcy, private employers can consider it among other factors relevant to the job's duties.

Straffi's article also addresses the impact of bankruptcy on renting a home. Landlords may consider bankruptcy history when deciding whether to rent to an individual. Still, a strong financial record post-bankruptcy and the ability to demonstrate stable income and timely rent payments can mitigate concerns.

Bankruptcy can also affect employment status and future credit. Filing for bankruptcy does not automatically lead to job loss, as employers cannot use it as a reason for negative employment actions. However, legitimate reasons unrelated to bankruptcy, such as incompetence or dishonesty, can still result in termination. Employers might become aware of bankruptcy filings in specific circumstances, such as wage garnishment in Chapter 7 or automatic wage deductions in Chapter 13.

In terms of credit scores, Chapter 7 bankruptcy remains on a credit report for up to ten years and can significantly lower credit scores, especially for individuals with higher scores before filing. Chapter 13 bankruptcy, which involves a repayment plan, stays on a credit report for up to seven years and may be viewed more favorably by financial institutions due to the commitment to repay debts.

Daniel Straffi concludes that understanding the nuances of how bankruptcy affects background checks, employment, and credit is crucial for individuals considering or recovering from bankruptcy. Seeking professional legal guidance can help navigate these complex matters and protect one's financial future.

For those concerned about how a bankruptcy might impact their background check or future employment, Straffi & Straffi Attorneys at Law can offer knowledgeable and compassionate legal assistance. Their team is dedicated to helping clients understand their rights and options, helping ensure they can move forward with confidence.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a reputable law firm based in New Jersey. Led by Daniel Straffi, the firm can provide legal representation in matters of bankruptcy, family law, and more. The team is committed to helping clients navigate the legal landscape and achieve favorable outcomes.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=Ppe3CFIxzEc

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-releases-insightful-article-on-bankruptcies-and-background-checks]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Releases Insightful Article on Bankruptcies and Background Checks here

News-ID: 3602698 • Views: …

More Releases from ABNewswire

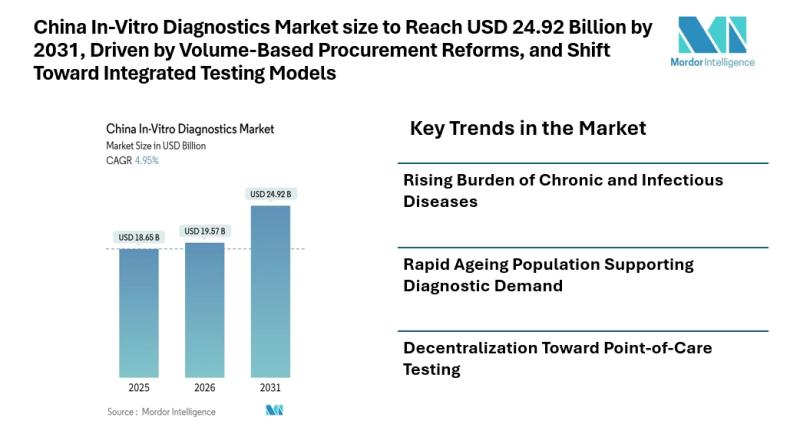

China In-Vitro Diagnostics Market size to Reach USD 24.92 Billion by 2031, Drive …

Mordor Intelligence has published a new report on the china in-vitro diagnostics market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the china in-vitro diagnostics market size [https://www.mordorintelligence.com/industry-reports/china-in-vitro-diagnostics-market?utm_source=abnewswire] is projected to reach USD 24.92 billion by 2031, growing from USD 19.57 billion in 2026 at a CAGR of 4.95% during the forecast period. The china in-vitro diagnostics market size reflects steady expansion supported by…

Hyaluronic Acid Market Size to Reach USD 4.07 Billion by 2030 - Mordor Intellige …

Mordor Intelligence has released an in-depth analysis of the hyaluronic acid market, outlining expanding cosmetic, orthopedic, and pharmaceutical applications driving global demand.

Hyaluronic Acid Market Overview

According to Mordor Intelligence, the global hyaluronic acid market size [https://www.mordorintelligence.com/industry-reports/hyaluronic-acid-market?utm_source=abnewswire] reached USD 2.84 billion in 2025 and is projected to grow to USD 4.07 billion by 2030, registering a CAGR of 7.46% during the forecast period.

The strong hyaluronic acid market growth is supported by:

* Increasing…

Scott Bryant Unveils Moon Valley's "Best Value" Listing in Hillcrest East; Signa …

Bryant Real Estate Leverages Data-Driven Performance Metrics to Position New Hillcrest East Property as the Region's Premier Investment Opportunity

PHOENIX, AZ - Scott Bryant, Founder and Team Leader of Bryant Real Estate and a top-performing agent with Keller Williams, has announced the debut of a landmark listing in the Hillcrest East subdivision of Moon Valley. Positioned as "Moon Valley's Best Deal," the property is being introduced at a strategic price point…

Jennifer Rollin Named Best Individual Therapist in Best of Bethesda Awards

Bethesda, MD, USA - Jennifer Rollin, LCSW-C, eating disorder therapist and founder of The Eating Disorder Center, has been named Best Individual Therapist in the 2025 Best of Bethesda Awards. She was selected from among therapists across Montgomery County, Maryland and Upper Northwest Washington, D.C., an honor that reflects both community support and her longstanding commitment to helping individuals recover from eating disorders.

Jennifer Rollin provides eating disorder therapy [https://www.theeatingdisordercenter.com/eatingdisordertherapyrockvilleservices.html] in…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…