Press release

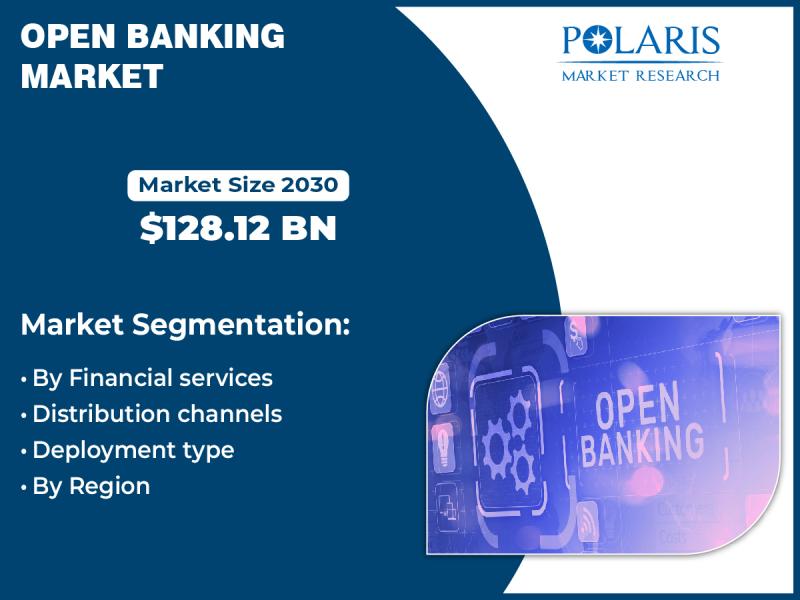

Open Banking Market Projections: Anticipated 26.8% CAGR to Expand Industry to USD 128.12 Billion By 2030

Open Banking Market Insights, Size Revenue, Outlook, Overview, and Analysis. The global open banking market was estimated to be worth USD 16.14 billion in 2021 and is predicted to expand to USD 128.12 billion by 2030, with a CAGR of 26.8% during the forecast period 2022-2030.This comprehensive study provides an accurate overview of the worldwide open banking market. Comprehensive analyses of sales volume, price, revenue, market share, and important companies are included. The market is further divided into segments by financial services, distribution channels, deployment type, and region in the study, which offers a comprehensive picture of the state of the market.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐨𝐫 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐰𝐢𝐭𝐡 𝐀𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐋𝐨𝐨𝐤 𝐚𝐭 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐔𝐩𝐜𝐨𝐦𝐢𝐧𝐠 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬: https://www.polarismarketresearch.com/industry-analysis/open-banking-market/request-for-sample

𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧:

Electronic financial information exchange is a feature of open banking, a financial service. Moreover, application programming interfaces (APIs) are used by open banking services to send financial data securely. Additionally, banks and other third-party service providers exchange financial data. An open API protects user privacy by allowing third-party service providers to gather transaction history and usage patterns. It makes publicly accessible data, such as a bank's product offerings, easily accessible. In order to improve the customer experience related to using financial services, sophisticated applications are developed using the financial data that has been acquired for a particular customer.

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐚𝐧𝐝 𝐓𝐫𝐞𝐧𝐝𝐬:

The key element driving the expansion of open banking is an increase in the number of people using cutting-edge applications and services.

An open banking platform has numerous benefits, including increased financial accessibility, service centralization, and improved client experience. Furthermore, increased client retention and customer-centric solutions are likely to drive market growth.

𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐓𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭: https://www.polarismarketresearch.com/buy/1457/2

𝐓𝐨𝐩 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬:

In this extremely competitive industry, major rivals constantly innovate and differentiate their products in an effort to take the lead in the market. Here are the top companies in the market:

• Banco Bibao Vizcaya Argentaria S.A.

• Barclays

• BBVA Open platform Inc.

• Capital One

• Clarity Group Inc.

• Citigroup

• Conduct Inc

• Credit Agricole

• DBS Bank

• DBS Bank

• Demystdata

• Figo GmbH

• Finastra

• Formfree

• HSBC Bank plc

• Jack Henry & Associate Inc

• Mambu GmbH

• MineralTree Inc. NCR Corporation

• Prista Corporation

• Quantros Inc.

• RL Datix

• Smart gate Solutions Ltd.

• Verge Health

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬

• With the development of an AI-based platform for online transactions and providing customer solutions, bank and capital segment is expected to drive product demand.

• The app segment accounted for the highest revenue share in 2021 and is expected to continue its dominance owing to the high performance of various online platforms used for transactions as the convenience of the consumer with just a click.

• The cloud segment is expected to witness faster growth over the forecast period as it is used to provide vast consumer data and offers customizable solutions to the consumer. Due to its real-time solutions, it is expected to drive the industry.

• Asia Pacific is expected to grow at a CAGR over the forecast period on account of several expansions and investments for digital payments projects mandated by the government across developing nations in the region, such as India and China.

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐖𝐢𝐬𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

According to regional research, Asia Pacific is the greatest region for online payment implementation and expansion. It is predicted to develop quicker over the forecast period due to the region's high level of digital penetration and understanding of the benefits of open banking. Also, Europe has led the open banking market. It is projected to continue to do so as a result of consumers' increased demand for security in online transactions and government mandates requiring banks to establish APIs. Industry players in this region could boost revenue development.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/open-banking-market

𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐡𝐚𝐬 𝐬𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐭𝐡𝐞 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐩𝐨𝐫𝐭 𝐛𝐚𝐬𝐞𝐝 𝐨𝐧 𝐫𝐚𝐰 𝐦𝐚𝐭𝐞𝐫𝐢𝐚𝐥, 𝐭𝐲𝐩𝐞, 𝐭𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲, 𝐚𝐧𝐝 𝐞𝐧𝐝-𝐮𝐬𝐞:

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠, 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 (𝐑𝐞𝐯𝐞𝐧𝐮𝐞 - 𝐔𝐒𝐃 𝐁𝐢𝐥𝐥𝐢𝐨𝐧, 𝟐𝟎𝟏𝟖 - 𝟐𝟎𝟑𝟎)

• Bank and capital

• Payments

• Digital currencies

• Value added services

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠, 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐜𝐡𝐚𝐧𝐧𝐞𝐥𝐬 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 (𝐑𝐞𝐯𝐞𝐧𝐮𝐞 - 𝐔𝐒𝐃 𝐁𝐢𝐥𝐥𝐢𝐨𝐧, 𝟐𝟎𝟏𝟖 - 𝟐𝟎𝟑𝟎)

• Bank channels

• App markets

• Distributors

• Aggregators

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠, 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐭𝐲𝐩𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 (𝐑𝐞𝐯𝐞𝐧𝐮𝐞 - 𝐔𝐒𝐃 𝐁𝐢𝐥𝐥𝐢𝐨𝐧, 𝟐𝟎𝟏𝟖 - 𝟐𝟎𝟑𝟎)

• Cloud

• On-premise

• Hybrid

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Optical Sorter Market: https://www.polarismarketresearch.com/industry-analysis/optical-sorter-market

Non-fungible Tokens Market: https://www.polarismarketresearch.com/industry-analysis/non-fungible-tokens-market

Management Decision Market: https://www.polarismarketresearch.com/industry-analysis/management-decision-market

Bot Security Market: https://www.polarismarketresearch.com/industry-analysis/bot-security-market

Smart Water Management Market: https://www.polarismarketresearch.com/industry-analysis/smart-water-management-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Projections: Anticipated 26.8% CAGR to Expand Industry to USD 128.12 Billion By 2030 here

News-ID: 3601232 • Views: …

More Releases from Polaris Market Research & Consulting

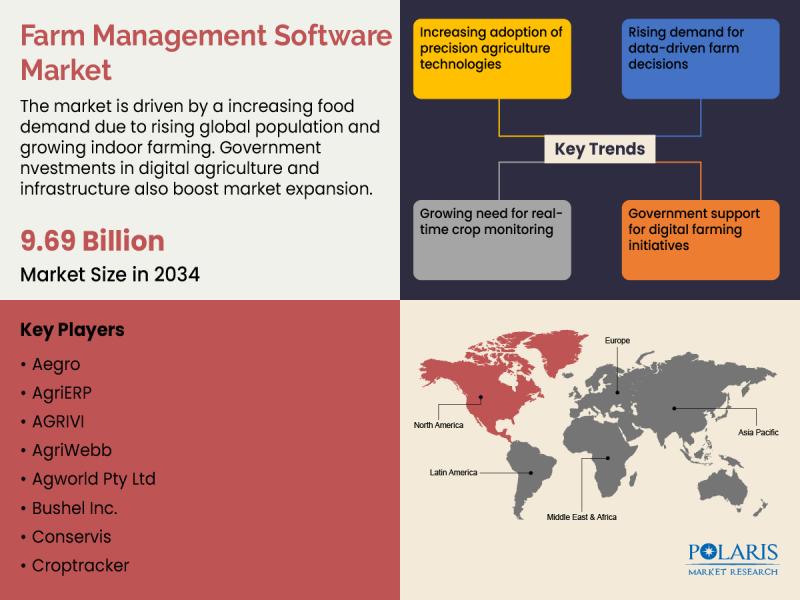

Farm Management Software Market Forecast 2026-2034: Growth Dynamics and Competit …

The quantitative market research report published by Polaris Market Research on Farm Management Software Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Farm Management Software market size, financial data, and projected future growth. All the…

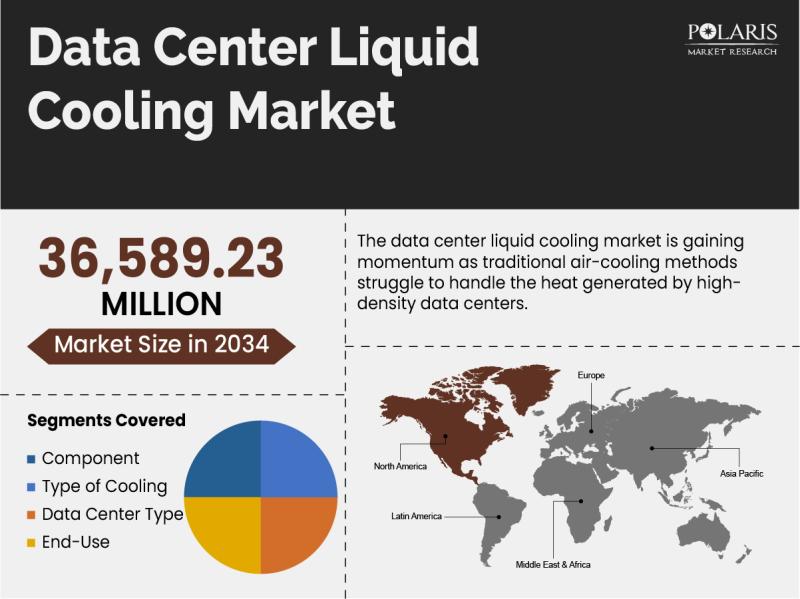

Future of the Data Center Liquid Cooling Market: Emerging Opportunities, Market …

The quantitative market research report published by Polaris Market Research on Data Center Liquid Cooling Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Data Center Liquid Cooling market size, financial data, and projected future growth.…

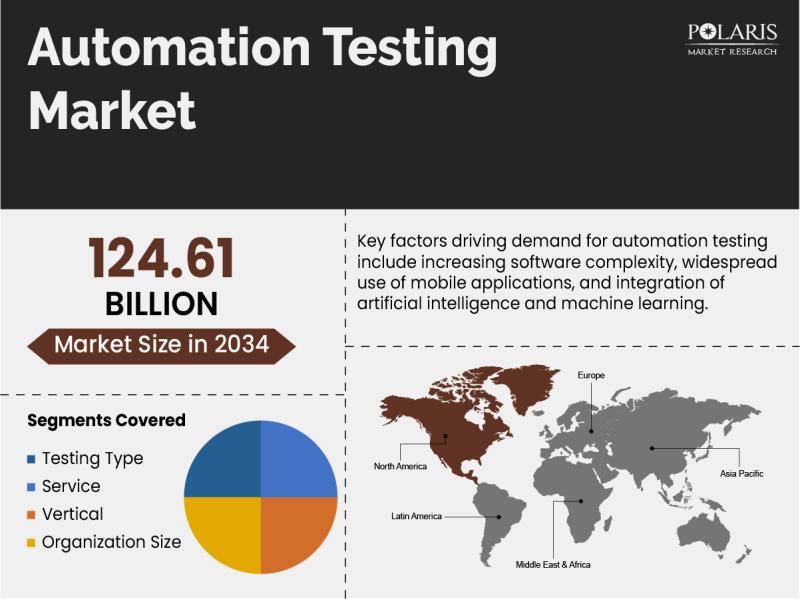

Automation Testing Market Growing Trends and Demands Analysis Forecast 2026 to 2 …

Market Size and Share:

Global Automation Testing Market is currently valued at USD 36.44 Billion in 2025 and is anticipated to generate an estimated revenue of USD 124.61 Billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 14.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market research…

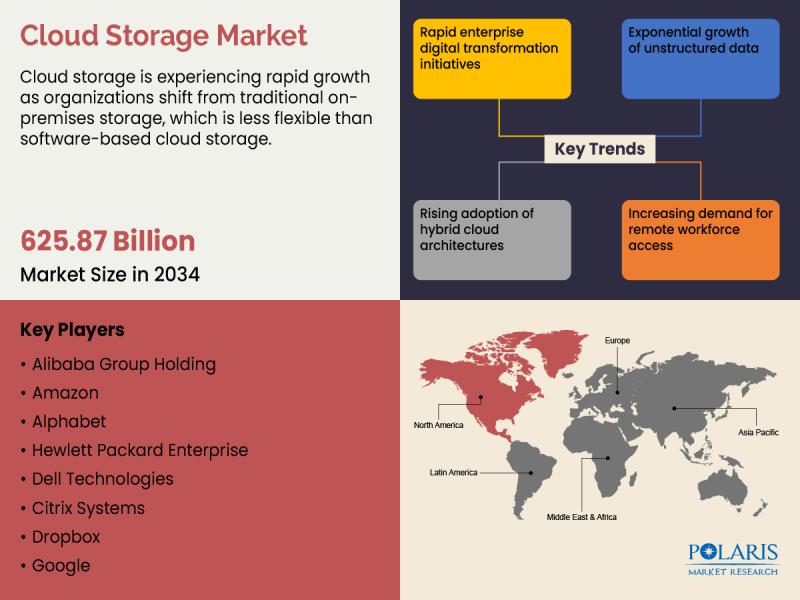

Global Cloud Storage Market Expected to Hit USD 625.87 Billion by 2034 with 18.5 …

The quantitative market research report published by Polaris Market Research on Cloud Storage Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Cloud Storage Market size, financial data, and projected future growth. All the information presented…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…