Press release

Wealth Management Market Anticipated to Generate a Revenue of $850.90 Billion and Grow at a CAGR of 7.1% During the Analysis Timeframe from 2021-2028

The global wealth management market is predicted to experience progressive growth during the forecast period owing to the technological advancements in the wealth management firms worldwide. The Asia-Pacific region is expected to dominate the market over the analysis period.According to a report published by Research Dive, the global wealth management market is anticipated to garner a revenue of $850.90 billion and rise at a CAGR of 7.1% during the forecast timeframe from 2021-2028.

Request Sample Report @ https://www.researchdive.com/download-sample/6119

Dynamics of the Market

The increasing expansion of wealth management firms with new technologies, such as chatbots, big data analytics, IoT, and AI is expected to fortify the growth of the market during the analysis period. Besides, the increasing investment in wealth management firms in offering digital and voice-enabled assistants for better user-friendly experience is further expected to bolster the growth of the wealth management market over the estimated period. Moreover, the growing focus on providing hybrid advisory to their clients worldwide by the wealth management organizations is expected to magnify the growth of the market during the forecast period. However, the lack of transparency in pricing and competitive fees may hinder the growth of the market during the analysis period.

COVID-19 Impact on the Market

The rise of the COVID-19 pandemic has shaken up the entire global economy and negatively impacted the wealth management market demand. This is mainly because of the economic recessions and instability in the global financial sectors worldwide. This further has affected the wealth management organizations and investors worldwide during the period of crisis. However, gradually, the increasing adoption of new technologies by organizations with larger customer bases has resulted in the demand for wealth management products and created some growth opportunities for the market.

Request Customization @ https://www.researchdive.com/request-for-customization/6119

Segments of the Market

The report has divided the wealth management market into segments based on advisory type, services, providers, and region.

Based on advisory type, the human advisory sub-segment is anticipated to generate a revenue of $516.67 billion during the forecast period. The increasing use of human advisory in wealth management firms for regular portfolio monitoring, flexibility, emotional sensitivity and providing customized services is expected to propel the growth of the wealth management market sub-segment during the analysis timeframe.

Based on services, the asset management sub-segment is projected to garner a revenue of $224.92 billion during the estimated period. The increasing investment by asset-intensive firms in advanced and creative solutions to tackle the difficulties associated in their management and to face the increasing competition in the market, is predicted to fuel the growth of the wealth management market sub-segment over the forecast period.

Based on providers, the banks sub-segment is expected to generate a revenue of $439.6 billion and is expected to continue a steady growth during the forecast period. This is mainly because banks are expected to play a major role in managing individuals' growing assets and wealth. In addition, the increasing utilization of wealth management software in providing client-centric strategy is expected to fortify the growth of the wealth management market sub-segment during the analysis timeframe.

Based on region, the Asia-Pacific wealth management market is expected to generate a revenue of $289.22 billion and grow at a CAGR of 8.4% during the forecast period. This is mainly due to the increased adoption of digital platforms in this region for private wealth management. Moreover, the growing wealth management software companies in the developing economies of this region is predicted to drive the regional growth of the market over the estimated timeframe.

Purchase Enquiry @ https://www.researchdive.com/purchase-enquiry/6119

Key Players of the Market

The major players of the wealth management market include, CREDIT SUISSE GROUP AG, JPMorgan Chase & Co., Charles Schwab & Co., Inc., Goldman Sachs, Citigroup Inc., Julius Baer Group, BNP Paribas, Morgan Stanley, Bank of America Corporation, UBS and many more. These players are working on the development of new business strategies such as product development, mergers and acquisitions, partnerships and collaborations, and many more to acquire leading positions in the global industry.

The report also summarizes other vital aspects including product portfolio, SWOT analysis, the financial performance of the key players, and the latest strategic developments.

Latest Reports in BFSI Industry

Reverse Factoring Market - https://www.researchdive.com/8987/reverse-factoring-market

Finance and Accounting Business Process Outsourcing Market - https://www.researchdive.com/9037/finance-and-accounting-business-process-outsourcing-market

Alternative Financing Market - https://www.researchdive.com/8862/alternative-financing-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York NY 10005

(P) +91-(788)-802-9103 (India)

Toll Free: 1-888-961-4454

E-mail: support@researchdive.com

Website: https://www.researchdive.com

𝐀𝐛𝐨𝐮𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐃𝐢𝐯𝐞:

Research Dive is a market research firm offering actionable insights and extensive analysis of various markets across different verticals. Maintaining the integrity and authenticity of the services, the firm provides services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, a team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive delivers the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Market Anticipated to Generate a Revenue of $850.90 Billion and Grow at a CAGR of 7.1% During the Analysis Timeframe from 2021-2028 here

News-ID: 3596623 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

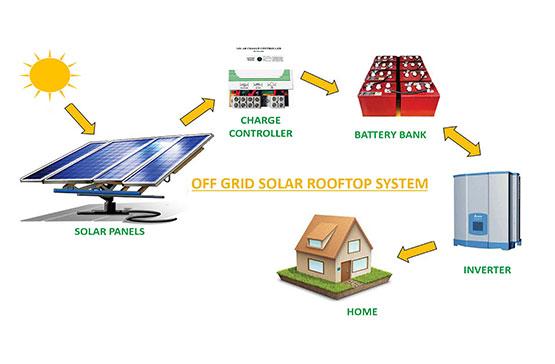

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…