Press release

Rising Demand for Property Insurance Across the Globe to Boost the Growth of the Global Home Insurance Market by 2028

The global home insurance market is projected to observe substantial growth over the forecast period, owing to the rising demand for property insurance around the world. The North America region is predicted to observe striking growth during the analysis period.As per a report published by Research, the global home insurance market is predicted to register a revenue of $407,940.4 million by 2028, at a CAGR of 6.8% during the forecast period from 2021 to 2028.

Request Sample Report @https://www.researchdive.com/download-sample/8412

Market Dynamics

The rising demand for property insurance due to environmental damages from avalanches, floods, earthquakes, forest fires, lightning, hurricanes, tsunamis, tornadoes, and volcanic eruptions is expected to be a major factor driving the growth of the home insurance market over the forecast period. Additionally, the implementation of technological predictive analysis is projected to create significant growth opportunities for the home insurance market during the estimated period. However, a lack of awareness about home insurance services may hinder market growth in the coming years.

Impact of COVID-19 on the industry

The global outbreak of COVID-19 has adversely impacted the home insurance market. The decline in the home insurance market is primarily due to restrictions on construction activities, which led to a reduced need and demand for home insurance services during the pandemic. However, many companies in the home insurance industry are adopting strategies such as partnerships and acquisitions to recover from the challenges posed by the COVID-19 crisis.

Request Customization @ https://www.researchdive.com/request-for-customization/8412

Segments of the Market

The report has divided the home insurance market into different segments based on coverage, end user, and region.

Based on coverage, the comprehensive coverage sub-segment is predicted to garner a revenue of $225,160.3 million by 2028 and is estimated to hold the largest share in the home insurance market during the analysis period. This is mainly due to the increasing events of natural disasters, such as hurricanes, floods, tornadoes, earthquakes, volcanic eruptions, storms, tsunamis, and others.

Based on end user, the tenants sub-segment is expected to generate a revenue of $160,430.3 million by 2028 and is estimated to observe fastest growth during the analysis period. The significant growth of the sub-segment is mainly owing to the rising demand for affordable housing services due to the increasing rate of urbanization globally. In addition, the developing countries with large population such as India and China with high economic growth rate are envisioned to boost the growth of the tenants' sub-segment of the home insurance market.

Based on region, the North America home insurance market valued at $121,009.5 million in 2020 and is estimated to witness dominant growth during the analysis period. The increasing demand of insurance services in the economically developed countries such as Canada and the U.S, and the growing usage of technology such as AI and IoT for providing highly insightful & personalized customer experiences are the significant factors predicted to boost the regional market growth in the forecast period.

Purchase Enquiry @ https://www.researchdive.com/purchase-enquiry/8412

Prominent Market Players

Some of the top players of the global home insurance market are Allianz, American International Group, Inc., Admiral Group Plc, AXA, Chubb, Allstate Insurance Company, State Farm Mutual Automobile Insurance Company, Nationwide Mutual Insurance Company, Liberty Mutual Insurance, and The Travelers Indemnity Company. These players are implementing numerous strategies to gain a leading position in the global industry. The report presents several aspects of these major players such as business & financial performance, strategic moves by key players, latest developments, product portfolio, and SWOT analysis.

Latest Reports in BFSI Industry

Agriculture Insurance Market - https://www.researchdive.com/9177/agriculture-insurance-market

Logistics Insurance Market - https://www.researchdive.com/9156/logistics-insurance-market

On-Demand Insurance Market - https://www.researchdive.com/9153/on-demand-insurance-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York NY 10005

(P) +91-(788)-802-9103 (India)

Toll Free: 1-888-961-4454

E-mail: support@researchdive.com

Website: https://www.researchdive.com

𝐀𝐛𝐨𝐮𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐃𝐢𝐯𝐞:

Research Dive is a market research firm offering actionable insights and extensive analysis of various markets across different verticals. Maintaining the integrity and authenticity of the services, the firm provides services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, a team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive delivers the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Demand for Property Insurance Across the Globe to Boost the Growth of the Global Home Insurance Market by 2028 here

News-ID: 3594527 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

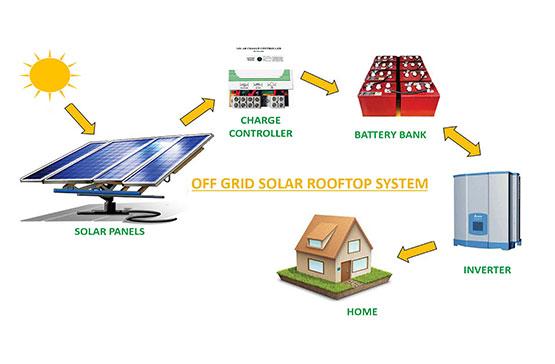

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…