Press release

Critical Illness Insurance Global Market to Exhibit a Remarkable CAGR of 12.0% and is Expected to Reach $451.59 Billion By 2028 | Aviva PLC, Prudential PLC, Aflac Inc., MetLife Inc., Cigna Group

"The new report published by The Business Research Company, titled ""Critical Illness Insurance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033"", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the critical illness insurance market size has grown rapidly in recent years. It will grow from $249.05 billion in 2023 to $286.98 billion in 2024 at a compound annual growth rate (CAGR) of 15.2%. The critical illness insurance market size is expected to see rapidly grown in the next few years. It will grow to $451.59 billion in 2028 at a compound annual growth rate (CAGR) of 12.0%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=4004&type=smp

The Benefits Of Critical Illness Insurance For Patients And Providers

The increased prevalence of critical diseases is driving the global critical illness insurance market. Treatment for critical illnesses such as cancer incurs a huge amount, and therefore, having critical illness insurance can be beneficial to lower the burden of the treatment cost. The insurance service providers provide a lump-sum payment to the policyholder upon diagnosis of the critical disease. Some other common types of critical illnesses include heart attack, stroke, and coronary artery bypass. For instance, in October 2022, according to the Centers for Disease Control and Prevention, a US-based government organization, the weekly count of cancer deaths with COVID-19 increased from 28 to 1,055 between 2020 and 2022 to January 2022 (1,055) and January 2021 (953), respectively, were the greatest numbers for this month. . Therefore, the growing prevalence of critical illness is expected to drive the global critical illness insurance market.

The Impact Of New Diseases On The Critical Illness Insurance Market

An increase in the range of critical illnesses covered in critical illness insurance policies is a major trend shaping the critical insurance market. Major insurance companies are focusing on adding coverage for many new diseases such as Alzheimer's disease, multiple sclerosis, Parkinson's disease, and motor neuron diseases besides cancer, stroke, coronary artery bypass, and heart attack. For instance, according to the Parkinson's Foundation, 1 million people are suffering from the disease in the US, and it is expected to reach 1.2 million by 2030. This increase in the range of critical illnesses is responsible for the growing trend in insurance policies.

The critical illness insurance market covered in this report is segmented -

1) By Type: Individual Insurance, Family Insurance

2) By Premium Mode: Monthly, Quarterly, Half Yearly, Yearly

3) By Application: Cancer, Heart Attack, Stroke, Other Applications

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=4004&type=discount

Major companies operating in the critical illness insurance market include China Life Insurance Company Limited, Allianz SE, Ping An Insurance Company of China Ltd., Aviva plc, Legal and General Group plc, China Pacific Insurance Co. Ltd., Prudential plc, New China Life Insurance Co. Ltd., Aegon NV, AXA SA, American International Group Inc., Sun Life Financial Inc., Aflac Inc., Huaxia Life Insurance Co., Ltd., MetLife Inc., Zurich Insurance Group Ltd., Hospitals Contribution Fund of Australia Limited, Dai-ichi Life Insurance Company Limited, UnitedHealthcare Inc., Liberty Mutual Group, Bajaj Allianz General Insurance Company Limited, Cigna Group, Future Generali India Insurance Company Limited, Royal London Mutual Insurance Society Limited, United HealthCare Services Inc., Plum Benefits Private Limited, Tata AIG General Insurance Company Limited, AmMetLife Insurance Berhad, Star Union Dai-ichi Life Insurance Company Ltd., Manulife Financial Corporation, Great-West Lifeco Inc., Canada Life Assurance Company, Chubb Limited, Assurity Life Insurance Company, Colonial Life and Accident Insurance Company, Mutual of Omaha, New York Life Insurance Company

Contents of the report:

1. Executive Summary

2. Critical Illness Insurance Market Report Structure

3. Critical Illness Insurance Market Trends And Strategies

4. Critical Illness Insurance Market - Macro Economic Scenario

5. Critical Illness Insurance Market Size And Growth

…..

27. Critical Illness Insurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/critical-illness-insurance-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Global Market to Exhibit a Remarkable CAGR of 12.0% and is Expected to Reach $451.59 Billion By 2028 | Aviva PLC, Prudential PLC, Aflac Inc., MetLife Inc., Cigna Group here

News-ID: 3594129 • Views: …

More Releases from The Business research company

Analysis of Segments and Major Growth Areas in the Supermirrors Market

The supermirrors market is positioned for significant growth as advancements in various high-tech fields continue to drive demand. With increasing applications across industries such as quantum computing and medical imaging, the market is set to expand steadily over the next several years. Let's explore the market's projected valuation, key players, and major segment classifications to better understand the future outlook for supermirrors.

Projected Market Valuation and Growth Factors in the Supermirrors…

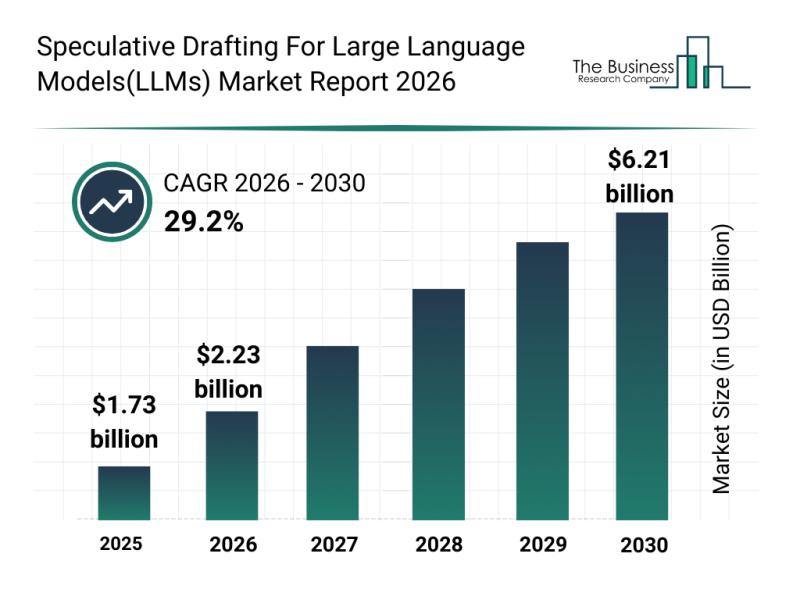

Emerging Growth Factors Fueling the Expansion of the Speculative Drafting Market …

The speculative drafting market for large language models (LLMs) is rapidly evolving and poised for remarkable growth in the coming years. With businesses increasingly adopting AI-driven solutions, this sector is set to transform how organizations approach automated drafting tasks. Let's explore the market's projected size, key players, principal segments, and emerging trends shaping its future.

Projected Market Growth and Size of the Speculative Drafting for Large Language Models Market

The…

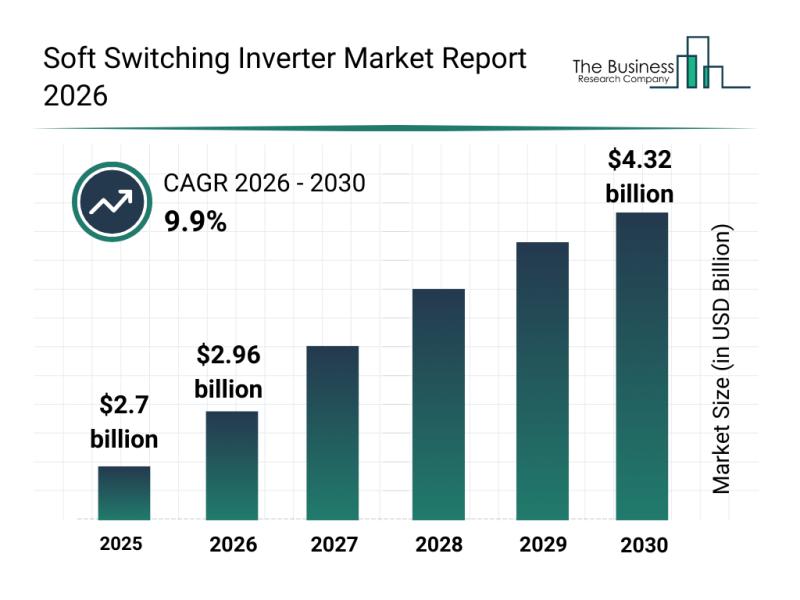

Emerging Sub-Segments Transforming the Soft Switching Inverter Market Landscape

The soft switching inverter market is on the brink of significant expansion as technological advancements and increasing demand across various sectors drive its growth. This market is becoming more crucial, especially with the rising adoption of electric vehicles and renewable energy systems. Let's explore the current market size, key players, emerging trends, and detailed segmentation shaping the future of the soft switching inverter industry.

Projected Market Growth and Size of the…

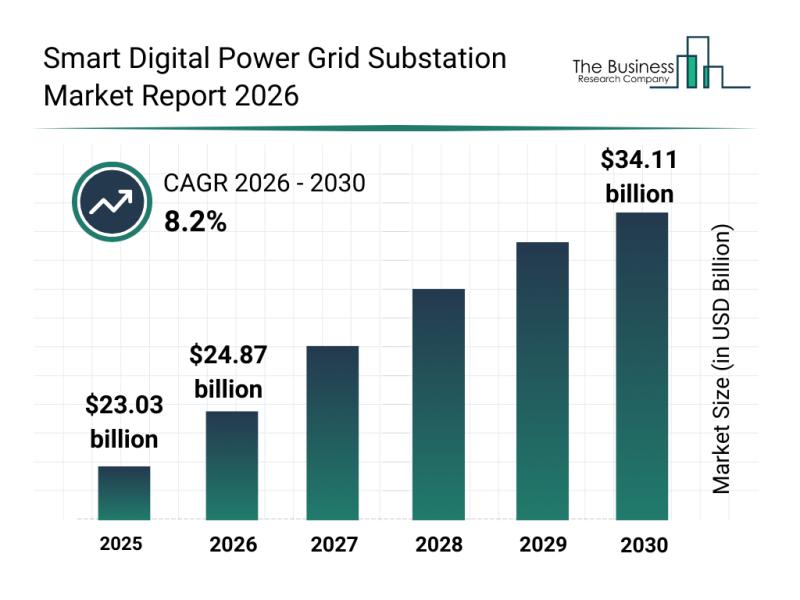

Key Players and Competitive Overview in the Smart Digital Power Grid Substation …

The smart digital power grid substation market is rapidly evolving as utilities and industries embrace advanced technologies to improve grid efficiency, reliability, and sustainability. With increasing integration of renewable energy sources and greater demand for smarter infrastructure, this market is set to experience substantial growth. Let's explore the market size projections, major players, key trends, and segment insights that define the future of this sector.

Projected Market Size and Growth for…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…