Press release

Credit Card Issuance Services Market Report 2024: Size, Share, Growth, Trends, Forecast 2033

"The new report published by The Business Research Company, titled Credit Card Issuance Services Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the credit card issuance services market size has grown strongly in recent years. It will grow from $478.09 billion in 2023 to $522.22 billion in 2024 at a compound annual growth rate (CAGR) of 9.2%. The credit card issuance services market size is expected to see strong growth in the next few years. It will grow to $717.7 billion in 2028 at a compound annual growth rate (CAGR) of 8.3%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=12484&type=smp

Surging Credit Card Demand Fuels Expansion Growth Trends In The Credit Card Issuance Services Market

The rise in credit card demand is expected to propel the growth of the credit card issuance services market going forward. A credit card refers to a credit product banks offer that enables users to take out loans up to a pre-approved credit limit. Credit card issuers play an essential role in processing card transactions, paying back previously approved purchases, and handling chargeback requests. For instance, in February 2023, according to the Federal Reserve Bank of New York, a US-based federal bank responsible for the second district of the Federal Reserve System, in the fourth quarter of 2022, credit card balances increased by $61 billion to $986 billion in the USA, exceeding the pre-pandemic peak of $927 billion. Therefore, the rise in credit card demand is driving the growth of the credit card issuance service market.

Technological Advancements Reshaping The Landscape Of Credit Card Issuance Services

Technological advancements are a key trend gaining popularity in the credit card issuance service market. Major companies operating in the credit card issuance service market are developing new technologies to sustain their position in the market. For instance, in February 2021, Marqeta Inc., a US-based modern card issuing platform, launched a new API-driven credit card issuing platform, providing innovators with the opportunity to launch next-generation credit card programs and enable customers to customize credit card goods in a fraction of the time with more adjustable restrictions and features. Depending on unique criteria, companies will have a modern credit record system that can alter account settings like rewards, APR (annual percentage rate), and credit lines in real-time. Marqeta's card-issuing platform and Deserve's digital card expertise will contribute to further innovation in the credit sector and improve consumer card experiences. Deserve Inc. is a US-based mobile-first credit card platform.

The credit card issuance services market covered in this report is segmented -

1) By Type: Consumer Credit Cards, Business Credit Cards

2) By Issuers: Banks, Credit Unions, Non-Banking Financial Companies

3) By End-User: Personal, Business

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=12484&type=discount

Major companies operating in the credit card issuance services market report are JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., American Express Company, HSBC Holdings plc., Toronto-Dominion Bank Group, Goldman Sachs Group Inc., Capital One Financial Corporation, Barclays Bank PLC, Visa Inc., U.S. Bancorp, Standard Chartered PLC, PNC Financial Corp., Mastercard Inc., Fiserv Inc., Synchrony Financial, Fidelity National Information Services Inc., Stripe Inc., Wells Fargo & Co., Fifth Third Bank NA, Navy Federal Credit Union, Huntington Bancshares Incorporated, Santander Bank N.A., Giesecke+Devrient GmbH, Synovus Financial Corp., Penfed Federal Credit Union, Marqeta Inc., Entrust Corporation, Comenity Bank, Nium Pte. Ltd.

Contents of the report:

1. Executive Summary

2. Credit Card Issuance Services Market Report Structure

3. Credit Card Issuance Services Market Trends And Strategies

4. Credit Card Issuance Services Market - Macro Economic Scenario

5. Credit Card Issuance Services Market Size And Growth

…..

27. Credit Card Issuance Services Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/credit-card-issuance-services-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Issuance Services Market Report 2024: Size, Share, Growth, Trends, Forecast 2033 here

News-ID: 3593601 • Views: …

More Releases from The Business research company

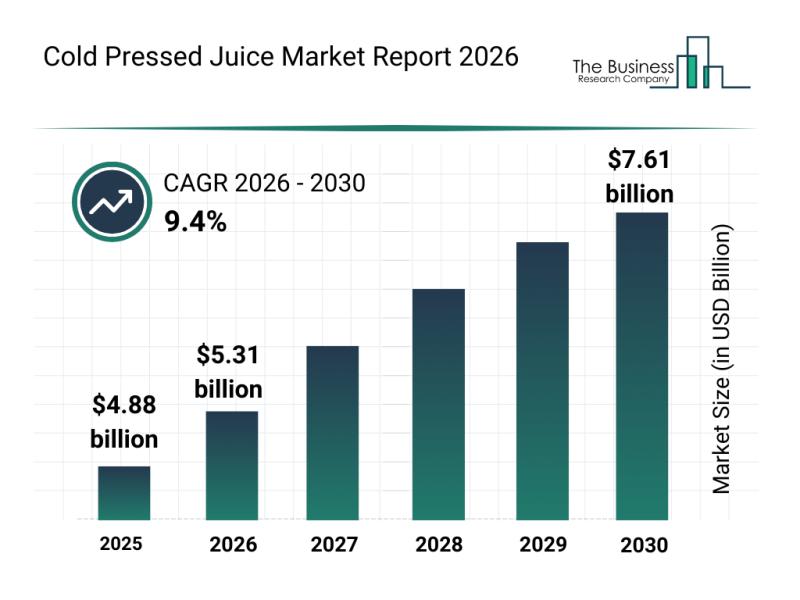

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

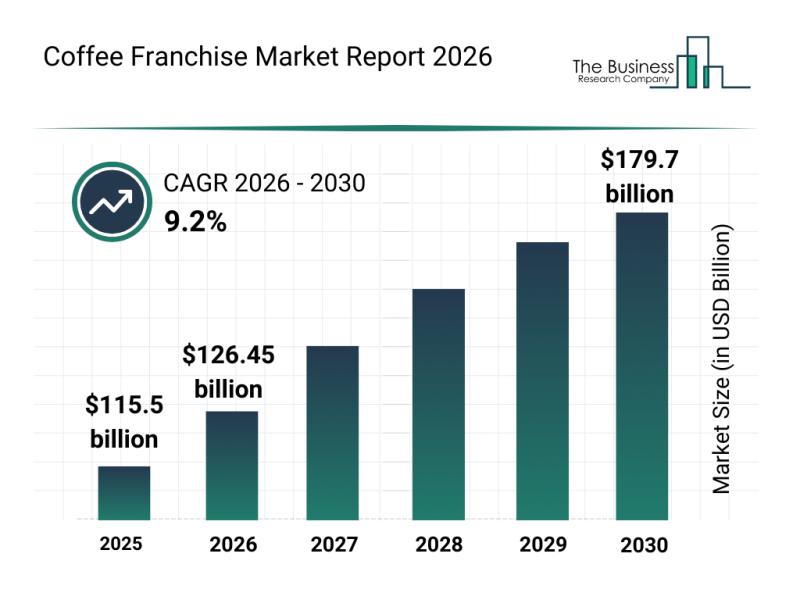

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

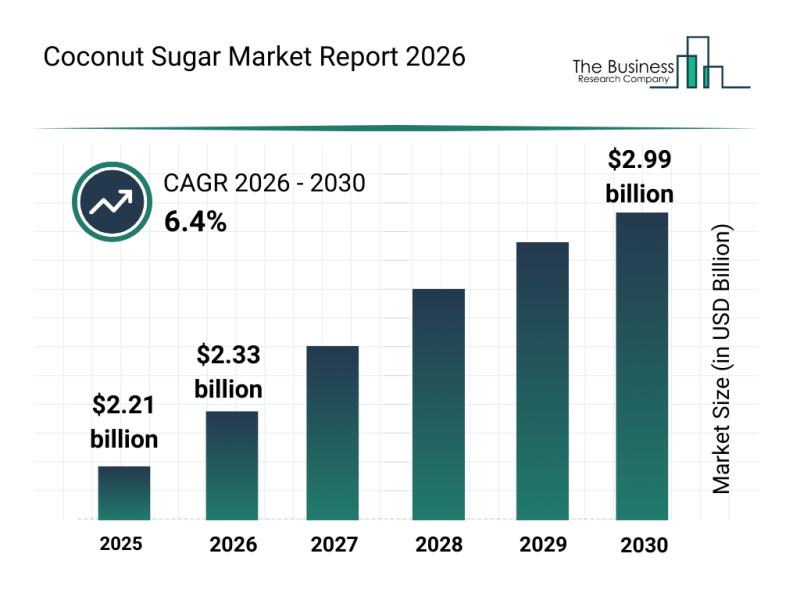

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

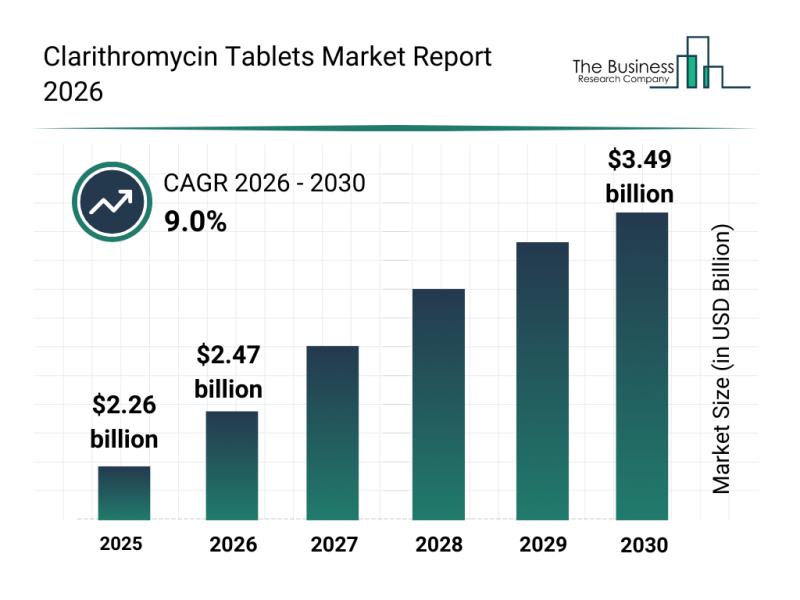

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…