Press release

Banking-as-a-Service (BaaS) Market 2024 Analysis with Top Business Strategy and Key Players Decided to Invest | Solaris SE, Currencycloud, Prime Treasury Services, Green Dot

"Banking-as-a-Service (BaaS) Market is anticipated to expand at a 24.4% compound annual growth rate (CAGR) and reach a size of $ 23.4 Billion by 2030, up from its current value of $ 14.3 Billion in 2023."The worldwide "Banking-as-a-Service (BaaS) Market" 2024 Research Report presents a professional and complete analysis of the Global Banking-as-a-Service (BaaS) Market in the current situation. This report includes development plans and policies along with Banking-as-a-Service (BaaS) manufacturing processes and price structures. the reports 2024 research report offers an analytical view of the industry by studying different factors like Banking-as-a-Service (BaaS) Market growth, consumption volume, Market Size, Revenue, Market Share, Market Trends, and Banking-as-a-Service (BaaS) industry cost structures during the forecast period from 2024 to 2030. It encloses in-depth Research of the Banking-as-a-Service (BaaS) Market state and the competitive landscape globally. This report analyzes the potential of the Banking-as-a-Service (BaaS) Market in the present and future prospects from various angles in detail.

The global Banking-as-a-Service (BaaS) market report is provided for the international markets as well as development trends, competitive landscape analysis, and key region's development status. Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report additionally states import/export consumption, supply and demand Figures, cost, price, revenue, and gross margins. The Global Banking-as-a-Service (BaaS) market 2024 research provides a basic overview of the industry including definitions, classifications, applications, and industry chain structure.

Get Free Sample Copy of the Report at: https://www.forinsightsconsultancy.com/reports/request-sample-banking-as-a-service-baas-market/

Scope of the Banking-as-a-Service (BaaS) Market:

The Global Banking-as-a-Service (BaaS) market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2030. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

The report also gives a 360-degree overview of the competitive landscape of the industries that are:

Green Dot Corporation

MatchMove Pay Pte Ltd

PayPal Holdings, Inc.

Sopra Banking Software

Treezor

Twilio Inc.

Solaris SE

Currencycloud

By Enterprise:

Large Enterprise

Small & Medium Enterprise

By End-Use Industry:

Banks

NBFC

Government

Request Sample Copy of this Report at: https://www.forinsightsconsultancy.com/reports/request-sample-banking-as-a-service-baas-market/

𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐫𝐢𝐯𝐞𝐫𝐬: A few important variables, including the rising consumer demand for the product, effective marketing tactics in new markets, and significant financial investments in product development, are the primary drivers of Banking-as-a-Service (BaaS).

𝐌𝐚𝐫𝐤𝐞𝐭 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬: Easy availability to rivals is one of the challenges in the market for Banking-as-a-Service (BaaS). Another barrier in the market is the low cost of alternatives. However, firms intend to overcome this obstacle by using cutting-edge technology and managing prices, which will subsequently boost product demand. Moreover, in order for market participants to prevent risks, alter their plans, and carry on with operations, researchers have also highlighted major hurdles for them. By doing this, producers will be able to properly manage their resources without sacrificing product quality or timely market delivery.

𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬: businesses can take advantage of them by putting the proper plans in place. The prospects described in the report assist the stakeholders and report buyers in properly planning their investments and obtaining the most return on investment.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬: The market sees a few developments that assist businesses in developing more successful tactics. The report with the most recent data discusses the current trends. Customers can obtain an idea of the upcoming offerings on the market, and businesses can plan on producing greatly improved solutions with the use of this information.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

➳ North America (United States, Canada, Mexico)

➳ Europe (Germany, UK, France, Italy, Spain, Others)

➳ Asia-Pacific (China, Japan, India, South Korea, Southeast Asia, Others)

➳ The Middle East and Africa (Saudi Arabia, UAE, South Africa, Others)

➳ South America (Brazil, Others)

Global Banking-as-a-Service (BaaS) Market Development Strategy Pre and Post COVID-19, by Corporate Strategy Analysis, Landscape, Type, Application, and Leading 20 Countries covers and analyzes the potential of the global Banking-as-a-Service (BaaS) industry.

Have any query on this report? Click here at: https://www.forinsightsconsultancy.com/contact-us/

Valuable Points from Banking-as-a-Service (BaaS) Market Research Report 2024-2030:

➼ Significant changes in Market dynamics.

➼ Reporting and assessment of recent industry developments.

➼ A complete background analysis, which includes a valuation of the parental Banking-as-a-Service (BaaS) Market.

➼ Current, Historical, and projected size of the Banking-as-a-Service (BaaS) Market from the viewpoint of both value and volume.

➼ Banking-as-a-Service (BaaS) Market segmentation according to Top Regions.

➼ Banking-as-a-Service (BaaS) Market shares and strategies of key Manufacturers.

➼ Emerging Specific segments and regions for Banking-as-a-Service (BaaS) Market.

➼ An objective valuation of the trajectory of the Market.

➼ Recommendations to Top Companies for reinforcement of their foothold in the market.

FAQ's:

[1] Who are the global manufacturers of Banking-as-a-Service (BaaS), what are their share, price, volume, competitive landscape, SWOT analysis, and future growth plans?

[2] What are the key drivers, growth/restraining factors, and challenges of Banking-as-a-Service (BaaS)?

[3] How is the Banking-as-a-Service (BaaS) industry expected to grow in the projected period?

[4] How has COVID-19 affected the Banking-as-a-Service (BaaS) industry and is there any change in the regulatory policy framework?

[5] What are the key areas of applications and product types of the Banking-as-a-Service (BaaS) industry that can expect huge demand during the forecast period?

[6] What are the key offerings and new strategies adopted by Banking-as-a-Service (BaaS) players?

Reason to Buy:

✔ Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the global Banking-as-a-Service (BaaS) Market.

✔ Highlights key business priorities in order to guide the companies to reform their business strategies and establish themselves in the wide geography.

✔ The key findings and recommendations highlight crucial progressive industry trends in the Banking-as-a-Service (BaaS) Market, thereby allowing players to develop effective long-term strategies in order to garner their market revenue.

✔ Develop/modify business expansion plans by using substantial growth offerings in developed and emerging markets.

✔ Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those restraining the growth to a certain extent.

✔ Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

**(Today OFFER )- Buy this report and Get Up to 20% Discount At: https://www.forinsightsconsultancy.com/buy-now-banking-as-a-service-baas-market/

📚 ☎ Contact Us:

Dipti Desai (PR & Marketing Manager)

For Insights Consultancy

sales@forinsightsconsultancy.com

View Site- https://www.forinsightsconsultancy.com/reports/workplace-health-promotion-consultancy-market/

📚 About Author:

For Insights Consultancy delivers unique market research solutions to its customers and help them to get equipped with refined information and market insights derived from reports. We are committed to providing best business services and easy processes to get the same. For Insights Consultancy considers themselves as strategic partners of their customers and always shows the keen level of interest to deliver quality.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking-as-a-Service (BaaS) Market 2024 Analysis with Top Business Strategy and Key Players Decided to Invest | Solaris SE, Currencycloud, Prime Treasury Services, Green Dot here

News-ID: 3592138 • Views: …

More Releases from For Insights Consultancy

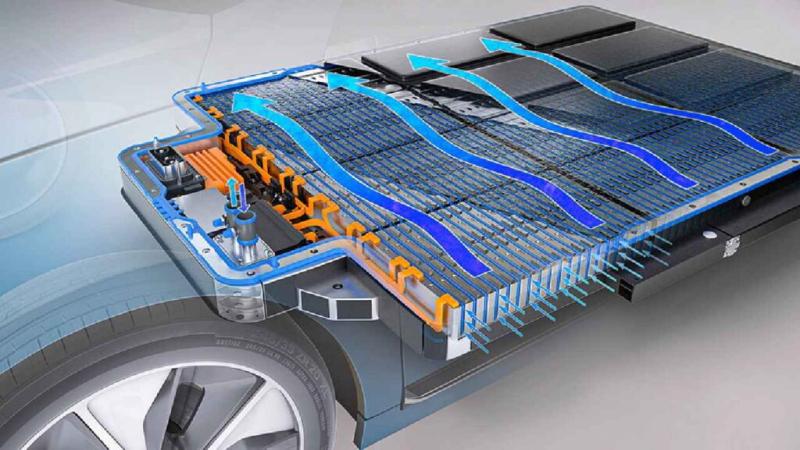

Electric Vehicle Battery Cooling System Market Research Report: In-Depth Qualita …

"Electric Vehicle Battery Cooling System Market is growing at a High CAGR during the forecast period 2034. The increasing interest of the individuals in this Market is that the major reason for the expansion of this market".

Electric Vehicle Battery Cooling System Market is expected to expand from $ 1.4 Billion in 2025 to $ 5.8 Billion in 2034, with a compound annual growth rate of 18.4%.

"Electric Vehicle Battery Cooling…

Inside the Future of the Luxury Footwear Market: Forecasts, Growth Outlook, and …

"Luxury Footwear Market is growing at a High CAGR during the forecast period 2034. The increasing interest of the individuals in this Market is that the major reason for the expansion of this market".

Luxury Footwear Market is expected to expand from $ 32.89 Billion in 2025 to $ 54.78 Billion in 2034, with a compound annual growth rate of 7.3%.

"Luxury Footwear Market Forecast to 2034" a detailed analysis report…

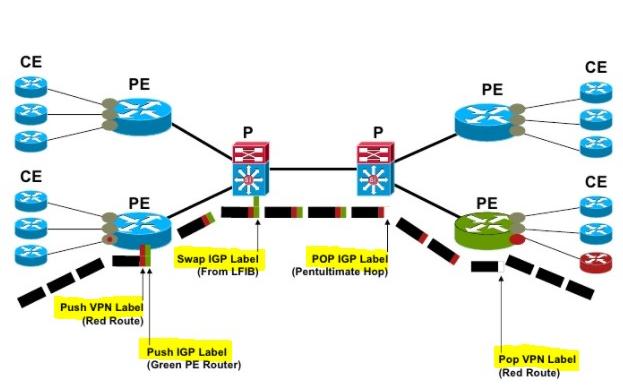

IP-MPLS VPN Services Market Future Prospects 2030 | AT&T, BT Global Services, Ci …

"IP-MPLS VPN Services Market is growing at a High CAGR during the forecast period 2030. The increasing interest of the individuals in this Market is that the major reason for the expansion of this market".

IP-MPLS VPN Services Market is expected to expand from $ 51,790.6 million in 2023 to $ 121,456.8 million in 2030, with a compound annual growth rate of 8.78%.

"IP-MPLS VPN Services Market Forecast to 2030" a…

United States Maintenance, Repair, and Operations (MRO) Market to Show Strong Gr …

"United States Maintenance, Repair, and Operations (MRO) Market is growing at a High CAGR during the forecast period 2030. The increasing interest of the individuals in this Market is that the major reason for the expansion of this market".

United States Maintenance, Repair, and Operations (MRO) Market is expected to expand from $ 89.50 Billion in 2023 to $ 99.78 Billion in 2030, with a compound annual growth rate of 1.56%.…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…