Press release

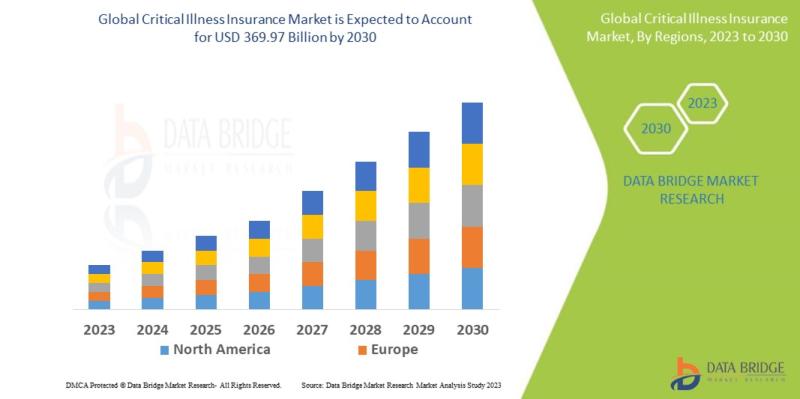

Critical Illness Insurance Market which was USD 216.5 Billion in 2022 is expected to reach USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period of 2030

Critical Illness Insurance Market which was USD 216.5 Billion in 2022 is expected to reach USD 369.97 Billion by 2030 and is expe

Amidst these trends, revenue analysis reveals a robust growth trajectory, with revenue forecasts suggesting continued expansion. The future scope of Critical Illness Insurance Market is promising, buoyed by technological advancements and the emergence of disruptive innovations. However, the market is not without challenges; fluctuating economic conditions and regulatory complexities pose hurdles for industry leaders and aspiring companies alike.

Data Bridge Market Research analyses that the Global Critical Illness Insurance Market which was USD 216.5 Billion in 2022 is expected to reach USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period of 2022 to 2030

Explore Further Details about This Research Critical Illness Insurance Market Share Report https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market

This Critical Illness Insurance Market report Segments Market growth rate, market shares, market size is also being highlighted in this report.

Global Critical Illness Insurance Market, By Product Type (Disease Insurance, Medical Insurance, and Income Protection Insurance), Application (Cancer, Heart Attack, and Stroke) - Industry Trends and Forecast to 2030

Prominent market player analysis-

Critical illness is mainly associated with any illness, disease, or health condition which is a potential or immediate threat to life and needs comprehensive care and continuous monitoring, often in intensive care. Critical illness insurance is an insurance product which helps to check if an insurer is contracted to typically make payments if the policyholder is diagnosed with any kind of specific illnesses on a predetermined list as part of an insurance policy.

Global Critical Illness Insurance Market Dynamics

Drivers

Increasing prevalence of critical illnesses

The rising incidence of critical illnesses such as cancer, heart disease, and stroke is a significant driver for the critical illness insurance market. As individuals become more aware of the financial burden associated with these illnesses, the demand for insurance coverage to mitigate the costs of treatment and recovery increases.

Growing healthcare expenditure

The escalating costs of medical treatments and healthcare services have fuelled the demand for critical illness insurance. Individuals seek coverage that can provide financial support for expensive medical procedures, hospitalizations, medications, and post-treatment care.

Advancements in medical technology and improved survival rates

Advances in medical technology and treatment protocols have led to improved survival rates for critical illnesses. As more individuals survive critical illnesses, the need for financial protection and support during recovery becomes crucial, driving the demand for critical illness insurance.

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Critical Illness Insurance Market report provides the information of the Major Key Players in the market their business strategy, financial situation etc.

AEGON Life Insurance Company Ltd( Netherlands), AXA Hong Kong(Hong Kong), Legal & General Group plc(U.K.), Generali China Life Insurance Co. Ltd.(China), Prudential Hong Kong Limited(Hong Kong), Bajaj Allianz General Insurance Co. Ltd.(India), Tata AIG General Insurance Company Limited(India), United Healthcare Services Inc.(U.S.), Zurich American Insurance Company(U.S.) , AmMetLife Insurance Berhad (Malaysia), Star Union Dai-ichi Life Insurance Company Limited(India) , Sun Life Assurance Company of Canada.(Canada) , AFLAC INCORPORATED(U.S.) , Liberty General Insurance Ltd.(India) , HCF(Australia) , Star Union Dai-ichi Life Insurance Company Limited.(India) , Future Generali India Insurance Company Ltd.(India) , Religare Health Insurance Company Limited(India), Cigna(U.S.). Manulife Financial Corporation (Canada), Prudential Financial, Inc. (United States)

Answers That the Report Acknowledges:

Market size and growth rate during forecast period

Key factors driving the Critical Illness Insurance Market

Key market trends cracking up the growth of the Critical Illness Insurance Market.

Challenges to market growth

Key vendors of Critical Illness Insurance Market

Opportunities and threats faces by the existing vendors in Global Critical Illness Insurance Market

Trending factors influencing the market in the geographical regions

Strategic initiatives focusing the leading vendors

PEST analysis of the market in the five major regions

Browse Related Reports:

https://strategicmarketresearch12.blogspot.com/2024/07/memory-foam-mattress-market-industry.html

https://strategicmarketresearch12.blogspot.com/2024/07/steel-fiber-market-overview-outlook.html

https://strategicmarketresearch12.blogspot.com/2024/07/breast-ultrasound-market-revenue.html

https://strategicmarketresearch12.blogspot.com/2024/07/sustained-release-drugs-market-growth.html

"

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market which was USD 216.5 Billion in 2022 is expected to reach USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period of 2030 here

News-ID: 3589087 • Views: …

More Releases from Data Bridge Market Research Private Ltd

Self-Leveling Concrete Market which was USD 6032.2 Million in 2022 is expected t …

"Self-Leveling Concrete Market Size And Forecast by 2030

Data Bridge Market Research analyses that the Global Self-Leveling Concrete Market which was USD 6032.2 Million in 2022 is expected to reach USD 9542.09 Million by 2030 and is expected to undergo a CAGR of 5.90% during the forecast period of 2022 to 2030

The Self-Leveling Concrete Market research report offers valuable insights into industry statistics, including market size, share, and revenue performance. It…

gaskets and seals market, which was USD 69.88 billion in 2023, is expected to re …

"Gaskets and Seals Market Size And Forecast by 2031

Data Bridge Market Research analyses that the global gaskets and seals market, which was USD 69.88 billion in 2023, is expected to reach USD 110.55 billion by 2031, growing at a CAGR of 5.9% during the forecast period of 2024 to 2031.

The growth trajectory of the Gaskets and Seals Market is shaped by various drivers, including technological advancements, favorable regulatory frameworks, and…

Nucleotide Premixes market size was valued at USD 208.40 million in 2023 and is …

"Global Nucleotide Premixes Market Segmentation, By Form (Liquid Nucleotide Premixes, Powder Nucleotide Premixes), Ingredients (Vitamins, Minerals, Nucleotides, Others), Type (Purine Nucleotides, Pyrimidine Nucleotides), Industry (Animal Nutrition, Human Nutrition, Pharmaceuticals) - Industry Trends and Forecast to 2031.

Global Nucleotide Premixes market size was valued at USD 208.40 million in 2023 and is projected to reach USD 322.26 million by 2031, with a CAGR of 5.60% during the forecast period of 2024 to…

Electronic Specialty Gas Market which was USD 6.1 Million in 2023

"Global Electronic Specialty Gas Market, By Type (Inert Gases, Silane and Silicon Gases, Halogen gases, Ammonia, Carbon gases, Hydrogen Sulfide and Others), Application (Semiconductors and Microelectronics, Flat Panel Displays, Photovoltaic Cells, LEDs), End-Use Industry (Electronics, Energy, Healthcare and Industrial) - Industry Trends and Forecast to 2031.

Data Bridge Market Research analyses that the Global Electronic Specialty Gas Market which was USD 6.1 Million in 2023 is expected to reach USD 14.68…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…