Press release

India Non-Life Insurance Market Industry Analysis, Share, Growth, Industry Segmentation, Analysis and Forecast 2030

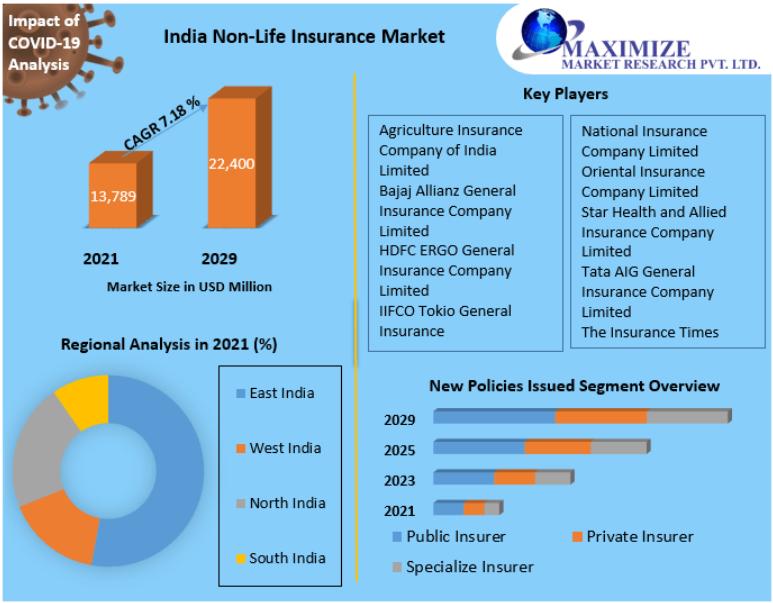

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐨𝐢𝐬𝐞𝐝 𝐟𝐨𝐫 𝐒𝐢𝐠𝐧𝐢𝐟𝐢𝐜𝐚𝐧𝐭 𝐆𝐫𝐨𝐰𝐭𝐡The 𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭, which was valued at approximately US$ 13,789 million in 2021, is on a trajectory to reach around US$ 22,400 million by 2029, with an expected compound annual growth rate (CAGR) of 7.18% during the forecast period.

India Non-Life Insurance Market Overview:

Non-life insurance, also referred to as general insurance, property insurance, or casualty insurance, encompasses policies that provide financial compensation for losses resulting from specific events, excluding life insurance. These policies typically cover medical emergencies, property damage, legal liabilities, and other non-life aspects. Unlike life insurance, which can be categorized into permanent and term life policies, non-life insurance offers various types of coverage with generally shorter policy durations, often lasting one year.

𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/42091/

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐬:

• Base Year: 2021

• Forecast Period: 2022-2029

• Historical Data: 2017 to 2021

• Market Size in 2021: US$ 13,789 Mn.

• Forecast Period 2022 to 2029

• CAGR: 7.18%

• Market Size in 2029: US$ 22,400 Mn.

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐨𝐦𝐢𝐧𝐚𝐧𝐜𝐞:

In 2021, motor insurance held the largest market share within the non-life insurance sector. This dominance is attributed to the mandatory nature of motor insurance in India, coupled with the rising demand for automobiles. Motor insurance policies provide comprehensive coverage against damages from natural disasters (floods, earthquakes), human actions (theft, strikes), and accidents, offering protection for the vehicle, driver, and passengers.

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬:

Several factors are driving the growth of the India Non-Life Insurance Market: The compulsory nature of motor insurance and the increasing demand for automobiles are significant growth drivers. Rising health awareness and a growing inclination towards preventive healthcare are boosting the health insurance segment. The expanding middle-class population with higher disposable incomes is fueling the demand for various non-life insurance products.

Despite the promising growth, the market faces several challenges: Issues such as capping broker incentives, data requirements, and operational complexities pose significant challenges. Lack of insurance penetration in rural areas remains a longstanding issue. The increasing threat of cyber-attacks and data breaches presents substantial risks to insurance companies.

The insurance industry is witnessing a rapid integration of technology, with companies leveraging artificial intelligence to enhance efficiency and automate processes. However, maintaining high levels of insurance technology incurs significant costs and intensifies competition. Insurers are continuously seeking innovative ways to incorporate technology into their growth strategies to meet evolving customer needs and improve core functions.

𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The market report provides an in-depth analysis of the India Non-Life Insurance Market, exploring historical data from 2017 to 2020 and offering insights into current trends and future projections. It includes a detailed examination of market drivers, restraints, opportunities, and barriers, along with recommendations for investors.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐕𝐢𝐬𝐮𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐍𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/42091/

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

♦ 𝐁𝐲 𝐏𝐫𝐨𝐝𝐮𝐜𝐭

• Motor insurance

• Health insurance

• Fire insurance

• Marine insurance

• Others

♦ 𝐁𝐲 𝐍𝐞𝐰 𝐏𝐨𝐥𝐢𝐜𝐢𝐞𝐬 𝐈𝐬𝐬𝐮𝐞𝐝

• Public insurer

• Private insurer

• Specialize insurer

♦ 𝐁𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥

• Individual agents

• Corporate agents - banks

• Corporate agents - others

• Brokers

• Direct business

• Others

𝐀𝐜𝐜𝐨𝐫𝐝𝐢𝐧𝐠 𝐭𝐨 𝐭𝐡𝐞 𝐏𝐫𝐨𝐝𝐮𝐜𝐭, In 2021, auto insurance had the biggest market share. A notable increase in the need for cars and the requirement for auto insurance throughout India. The study offers a thorough segment analysis of the non-life insurance industry in India, offering insightful information at both the macro and micro levels. The coverage includes damage and destruction to the vehicle caused by typhoons, earthquakes, floods, and other natural disasters. It also includes coverage for harm and destruction to the car brought on by riots, strikes, burglaries, and theft. When traveling, the cover provides security for both co-passengers and the vehicle's owner/driver. In addition, damage and destruction sustained when mounting or removing from the car are covered.

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

• Agriculture Insurance Company of India Limited

• Bajaj Allianz General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• IFFCO Tokio General Insurance

• National Insurance Company Limited

• Oriental Insurance Company Limited

• Star Health and Allied Insurance Company Limited

• Tata AIG General Insurance Company Limited

• The New India Assurance Company Limited

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐮𝐭𝐮𝐫𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤:

The India Non-Life Insurance Market is set to experience robust growth driven by the expanding automobile and healthcare sectors, increasing middle-class purchasing power, and technological advancements. However, addressing regulatory challenges, improving rural penetration, and enhancing cybersecurity measures will be crucial for sustaining long-term growth.

The report offers a clear and comprehensive view of the market dynamics, providing stakeholders with valuable insights to navigate the competitive landscape and make informed decisions.

𝐈𝐧𝐝𝐢𝐚 𝐍𝐨𝐧-𝐋𝐢𝐟𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧:

With a promising growth trajectory, the India Non-Life Insurance Market is positioned to become a significant segment within the insurance industry. Continuous innovation, strategic investments, and addressing existing challenges will be key to unlocking the market's full potential and ensuring sustained growth in the coming years.

𝐒𝐭𝐚𝐲 𝐀𝐡𝐞𝐚𝐝 𝐢𝐧 𝐚 𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

𝐓𝐚𝐛𝐥𝐞 𝐨𝐟 𝐂𝐨𝐧𝐭𝐞𝐧𝐭𝐬:

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 01: Overview

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 02: Report Scope for the India Non-Life Insurance Market

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 03: Landscape of the India Non-Life Insurance Market

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 04: Size of the India Non-Life Insurance Market

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 05: Types of India Non-Life Insurance Market Segmentation

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 06: Analysis of Competitive Forces

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 07: Profile of Customers

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 08: Geographic Analysis

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 09: Decision-Making Framework

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 10: Factors Driving and Hindering Growth

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 11: Current Market Developments

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 12: Assessment of Market Participants

𝐒𝐞𝐜𝐭𝐢𝐨𝐧 13: Detailed Analysis of Vendors

𝐊𝐞𝐲 𝐢𝐧𝐪𝐮𝐢𝐫𝐢𝐞𝐬 𝐚𝐝𝐝𝐫𝐞𝐬𝐬𝐞𝐝 𝐢𝐧 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:

• What defines India Non-Life Insurance?

• What was the size of the India Non-Life Insurance market in 2023?

• What is the growth rate anticipated for the India Non-Life Insurance Market?

• Who are the leading companies and what are their offerings in the India Non-Life Insurance Market?

• Which region is experiencing the most rapid growth in the India Non-Life Insurance market?

• What are the various segments within the India Non-Life Insurance Market?

• Which segments are encompassed in the India Non-Life Insurance Market?

• Who are the key players in the India Non-Life Insurance market?

• What factors are expected to propel growth in the India Non-Life Insurance market?

• What is the projected CAGR for the ## market during the forecast period?

• What upcoming opportunities and trends are emerging in the India Non-Life Insurance Market?

• What recent industry trends could be implemented to enhance revenue streams?

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

• Historical Market Size and Competitive Overview (2018-2022)

• Historical Pricing Trends and Regional Price Analysis (2018-2022)

• Market Size, Share, and Forecast for Different Segments (2024-2030)

• Market Dynamics: Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Market Segmentation: In-depth Analysis by Segment and Sub-segment, Across Regions

• Competitive Landscape: Profiles of Key Players from a Strategic Perspective, Across Regions

• Competitive Analysis: Market Leaders, Followers, and Regional Players

• Comparative Evaluation of Key Players Across Regions

• PESTLE Analysis

• PORTER's Analysis

• Value Chain and Supply Chain Analysis

• Legal Considerations for Business Operations by Region

• Identification of Lucrative Business Opportunities through SWOT Analysis

• Strategic Recommendations

𝐀𝐜𝐜𝐞𝐬𝐬 𝐌𝐨𝐫𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

1. Ip Phone Market https://www.maximizemarketresearch.com/market-report/global-ip-phone-market/55506/

2. Kraft Paper Market https://www.maximizemarketresearch.com/market-report/global-kraft-paper-market/54469/

3. Lime Market https://www.maximizemarketresearch.com/market-report/global-lime-market/113336/

4. Luxury Watches Market https://www.maximizemarketresearch.com/market-report/global-luxury-watches-market/69252/

5. Music Publishing Market https://www.maximizemarketresearch.com/market-report/global-music-publishing-market/105765/

6. Next Generation Oss And Bss Market https://www.maximizemarketresearch.com/market-report/global-next-generation-oss-and-bss-market/105336/

7. Pre Engineered Buildings Market https://www.maximizemarketresearch.com/market-report/global-pre-engineered-buildings-market/30843/

8. Racing Drone Market https://www.maximizemarketresearch.com/market-report/global-racing-drone-market/116649/

9. Swimwear Market Market https://www.maximizemarketresearch.com/market-report/global-swimwear-market-market/20975/

10. Wood Chips Market https://www.maximizemarketresearch.com/market-report/global-wood-chips-market/115358/

𝐎𝐮𝐫 𝐀𝐝𝐝𝐫𝐞𝐬𝐬:

𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐯𝐭. 𝐋𝐭𝐝.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐑𝐞𝐠𝐚𝐫𝐝𝐢𝐧𝐠 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Non-Life Insurance Market Industry Analysis, Share, Growth, Industry Segmentation, Analysis and Forecast 2030 here

News-ID: 3582597 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

Headwear Market to Reach US$ 34.97 Billion by 2032

Headwear Market was valued at US$ 22.84 billion in 2024 and is expected to reach US$ 34.97 billion by 2032, expanding at a compound annual growth rate (CAGR) of 5.47% during the forecast period.

The market growth is driven by increasing fashion consciousness, rising sports participation, growing demand for branded and designer headwear, and expanding e-commerce penetration worldwide. Additionally, changing lifestyle trends and the growing influence of social media and celebrity…

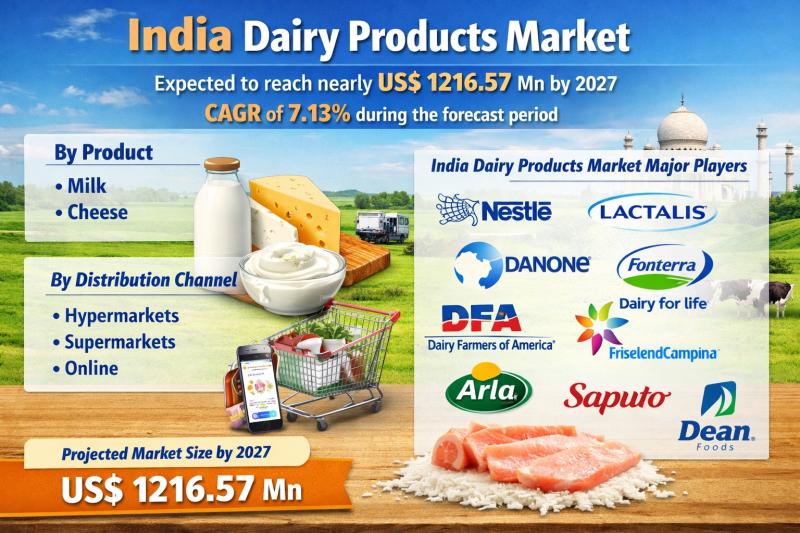

India Dairy Products Market to Reach US$ 1216.57 Mn by 2027, Expanding at a CAGR …

India Dairy Products Market size is expected to reach nearly US$ 1216.57 Mn by 2027, expanding at a CAGR of 7.13% during the forecast period. The market growth is driven by increasing dairy consumption, rising health awareness, expansion of organized retail, and growing demand for value-added dairy products across urban and semi-urban regions.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/india-dairy-products-market/92594/

Key Market Highlights

Market Size & CAGR:

The India Dairy Products…

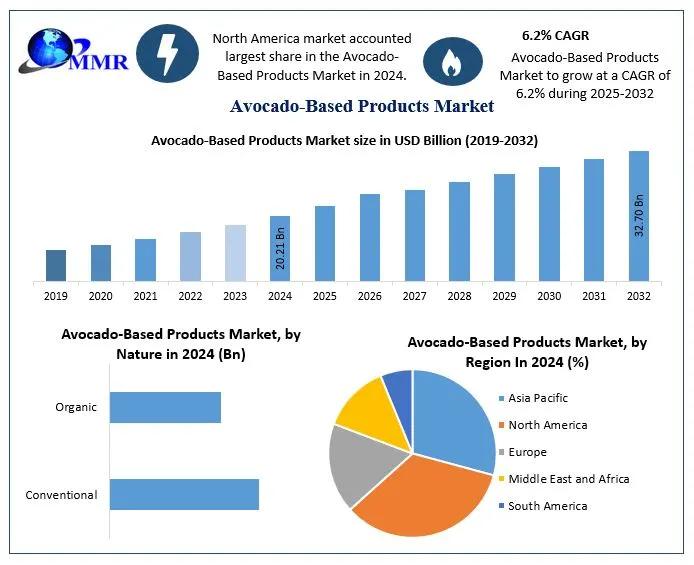

Avocado-Based Products Market Set for Strong Growth Through 2032 Driven by Healt …

The global Avocado-Based Products Market is projected to reach a market value of USD 32.70 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2032, according to a new research report.

Avocado-Based Products Market Overview:

The global Avocado-Based Products Market is experiencing significant traction as consumers increasingly embrace nutrient-rich and plant-based options. With avocados recognized for their natural healthy fats, vitamins, and fiber, demand across…

Waste Paper Recycling Market to Reach USD 63.32 Billion by 2030, Growing at a CA …

Waste Paper Recycling Market reached a value of USD 45.60 Bn. in 2023. The global market is expected to grow at a CAGR of 4.8% during the forecast period, reaching nearly USD 63.32 Bn. by 2030. The market growth is driven by increasing environmental awareness, rising demand for sustainable packaging solutions, and stringent government regulations promoting recycling and waste reduction practices.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/global-waste-paper-recycling-market/84320/

Key…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…