Press release

Specialty Insurance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033 |Berkshire Hathaway Specialty Insurance, Allianz Group, AXA SA, Assicurazioni Generali SpA, Zurich Insurance Group Ltd., Nationwide Mutual Insurance Company

As per the report, the specialty insurance market size has grown rapidly in recent years. It will grow from $89.87 billion in 2023 to $99.26 billion in 2024 at a compound annual growth rate (CAGR) of 10.5%. The specialty insurance market size is expected to see rapid growth in the next few years. It will grow to $147.67 billion in 2028 at a compound annual growth rate (CAGR) of 10.4%.Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=9198&type=smp

Specialty Insurance Market Thrives Amidst Escalating Natural Disasters

The rising natural disasters are expected to propel the growth of the specialty insurance market going forward. Natural disasters are catastrophic events with atmospheric, geological, and hydrological origins that can cause fatalities, property damage, and social environmental disruption. Specialty insurance provides tailored insurance to cover a wide range of damages caused by catastrophic events that include earthquakes, hurricanes, and others, and insurance covers covering real and personal property for captives, including business income and minimizes the financial risk. For instance, the National Centers For Environmental Information, a US-based agency for providing coastal, geophysical, and oceanic data, approximately 18 weather/climate crisis incidents that occurred in 2022 caused the United States to sustain losses of more than $1 billion apiece that claims the lives of 474 people and significantly damaged the local economy. Therefore, the rising natural disasters driving the growth of the specialty insurance market.

Digital Transformation And Technological Innovations Propel Specialty Insurance Market Growth

Technological advancements are a key trend gaining popularity in the specialty insurance market. Insurance businesses are leveraging innovative digital solutions to extend their operation and establish product lines based on niche client demand because of shifting business models, which contributes considerably to specialty insurance growth. For instance, in November 2022, Kingstone Insurance, a US-based insurance company, introduced Sure AI Assistant, an artificial intelligence-powered product to modernize the claims process. Sure AI Assistant uses a natural language model to optimize the insurance domain using data from real claims calls to guide policyholders through the claims process with ease. Additionally, Sure AI Assistant can be used in the case of a natural disaster when customers need to file their claims quickly and call volumes are the highest.

The specialty insurance market covered in this report is segmented -

1) By Type: Marine, Aviation And Transport (MAT), Political Risk And Credit Insurance, Entertainment Insurance, Art Insurance, Livestock And Aquaculture Insurance, Other Types

2) By Distribution Channel: Brokers, Non-Brokers

3) By End User: Business, Individuals

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=9198&type=discount

Major companies operating in the specialty insurance market report are Berkshire Hathaway Specialty Insurance, Allianz Group, AXA SA, Assicurazioni Generali SpA, Zurich Insurance Group Ltd., Nationwide Mutual Insurance Company, American International Group Inc., Chubb Corp, QBE Insurance Group Limited, The People's Insurance Company of China Limited, Manulife Reinsurance Limited, Everest Group Ltd., Markel Group Inc., Fidelity National Financial Inc., W.R. Berkley Corporation, Arch Capital Group Ltd., The Hanover Insurance Group Inc., AXIS Capital Holdings Limited, RenaissanceRe Holdings Ltd., Hiscox Ltd., Munich Reinsurance America Inc., Selective Insurance Group Inc., Tokio Marine HCC, Alleghany Corporation, Endurance Specialty Holdings Ltd., Argo Group International Holdings Ltd., Lancashire Holdings Limited, Validus Holdings Ltd., Cincinnati Financial Corporation, Aspen Insurance Holdings Limited, Fairfax Financial Holdings Limited, Catlin Group Limited, CNA Financial Corporation, Sompo International Holdings Ltd., AmTrust Financial Services Inc., Sirius International Insurance Group Ltd., RLI Corp

Contents of the report:

1. Executive Summary

2. Specialty Insurance Market Report Structure

3. Specialty Insurance Market Trends And Strategies

4. Specialty Insurance Market - Macro Economic Scenario

5. Specialty Insurance Market Size And Growth

…..

27. Specialty Insurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/specialty-insurance-global-market-report

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Specialty Insurance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033 |Berkshire Hathaway Specialty Insurance, Allianz Group, AXA SA, Assicurazioni Generali SpA, Zurich Insurance Group Ltd., Nationwide Mutual Insurance Company here

News-ID: 3581470 • Views: …

More Releases from the business research company

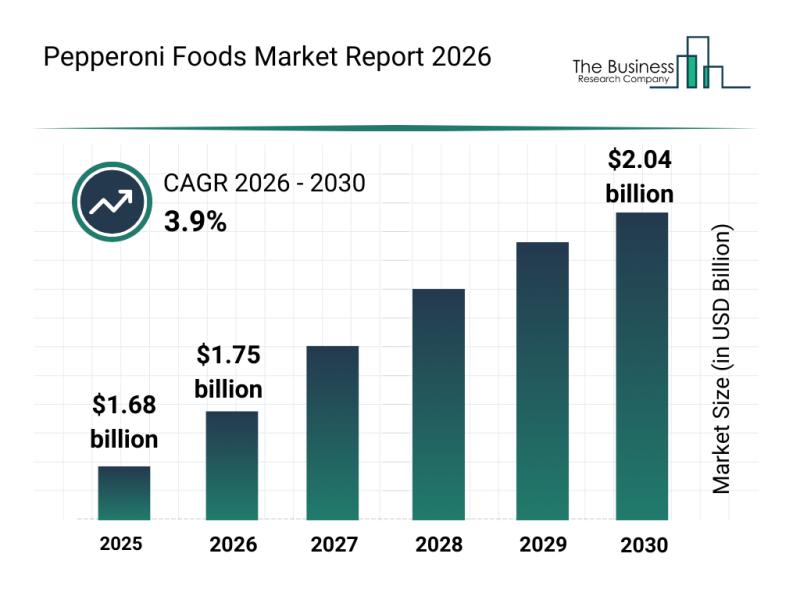

Future Perspectives: Key Trends Shaping the Pepperoni Foods Market Until 2030

The pepperoni foods market is on a steady growth path, driven by evolving consumer preferences and expanding product offerings. As demand rises for both traditional and innovative pepperoni varieties, this sector is set to experience notable developments through 2030. Let's explore the current market size, key players, influential trends, and segmentation details shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Pepperoni Foods Market

The pepperoni foods…

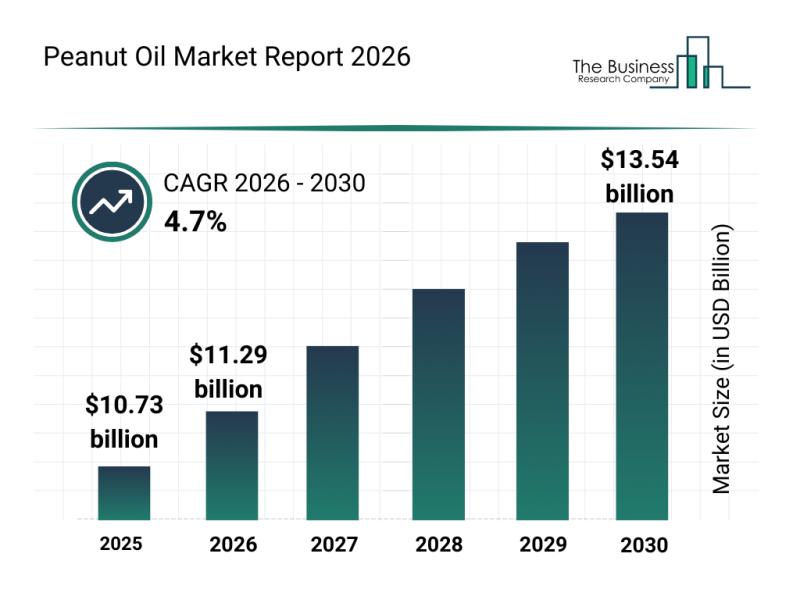

Peanut Oil Market Overview, Key Trends, and Insights on Top Players

The peanut oil industry is on track for consistent expansion over the coming years, driven by shifting consumer preferences and broader market trends. As awareness grows around health and sustainability, this sector is evolving to meet diverse demands across food, personal care, and other applications. Let's explore the market's value outlook, key players, emerging trends, and segmentation to understand where this industry is headed.

Projected Market Value and Key Growth Factors…

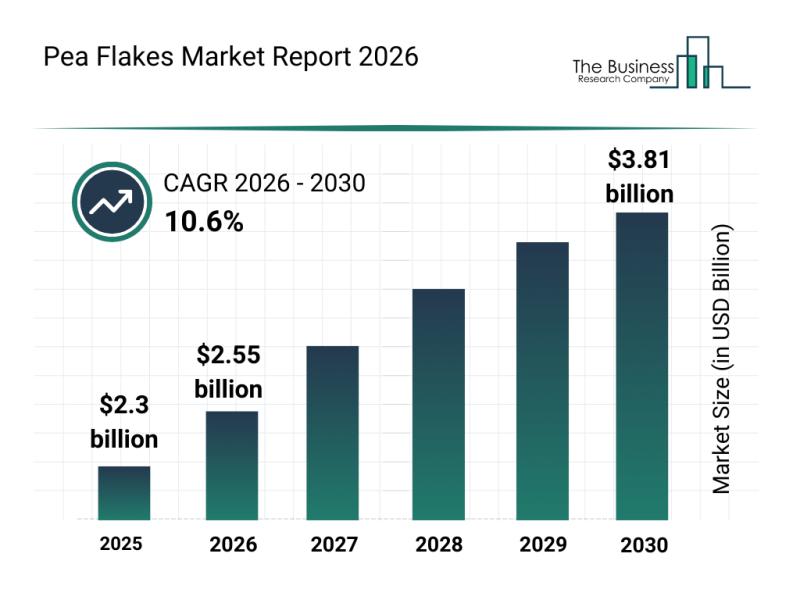

Segmentation, Major Trends, and Competitive Overview of the Pea Flakes Market

The pea flakes market is on the brink of significant expansion as demand for plant-based and sustainable food ingredients continues to rise globally. This report delves into key market details, including projected sizes, major players, emerging trends, and the segmentation that defines this fast-growing industry.

Expected Growth and Market Size of the Pea Flakes Industry by 2030

The pea flakes market is projected to grow substantially, reaching a market value…

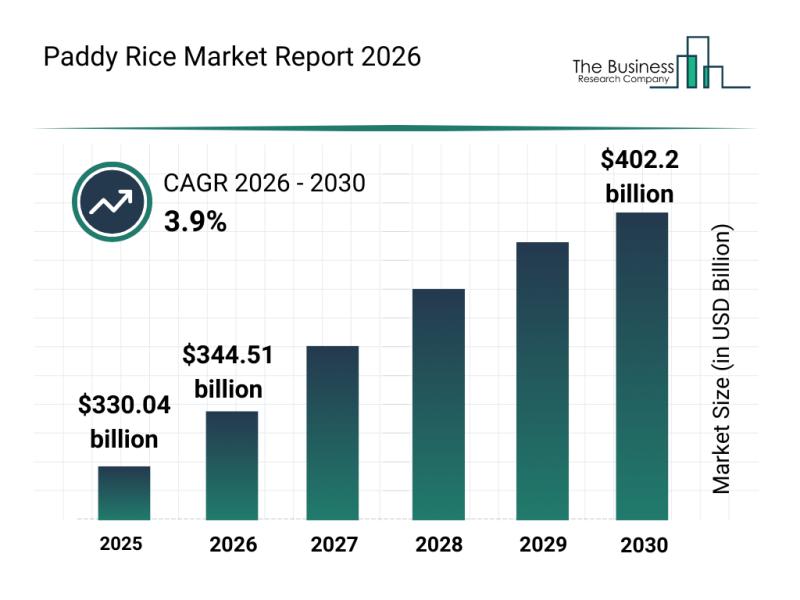

Leading Companies Reinforcing Their Presence in the Paddy Rice Market

The paddy rice sector is set for notable expansion in the coming years, driven by advancements in farming techniques and growing consumer demand. As the market evolves, several key factors and trends are shaping its trajectory and opening up new opportunities for producers and exporters alike.

Projected Market Size and Growth Path for the Paddy Rice Industry

The paddy rice market is anticipated to steadily increase, reaching a valuation of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…