Press release

Banking Credit Analytics Market Hits New High | Major Giants FICO, Experian, Equifax, BNP Paribas, Wells Fargo

The latest research document on "Global Banking Credit Analytics Market Size, Share, Sales and Forecast 2024-2030" Published by HTF MI with 123+ pages. The Study is segmented by key a region that is accelerating the marketization. Banking Credit Analytics study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources.Major Key Players in This Report Include:

FICO (Fair Isaac Corporation) (United States), Experian (United Kingdom), TransUnion (United States), Equifax (United States), SAS (United States), Moody's Analytics (United States), Credit Suisse (Switzerland), BNP Paribas (France), S&P Global (United States), Wells Fargo (United States).

Download Sample Pages PDF (Including Full TOC, Table & Figures) 👉 https://www.htfmarketintelligence.com/sample-report/global-banking-credit-analytics-market?utm_source=Ganesh_OpenPR&utm_id=Ganesh

According to HTF Market Intelligence, the Global Banking Credit Analytics market grow with at a CAGR of 17.4% during forecast period of 2024-2030. It's crucial you stay up with the latest sectioned by Applications [Risk Management, Fraud Detection, Credit Analysis, Portfolio Management, Others], Product Types [On-premise, Cloud] and some significant parts of the business.

Definition:

Banking Credit Analytics are solutions which offer credit risk analytics, credit rating, ETL, EMI Calculations like Services. Emergence of Fintech Companies has made this process more digitised with use of artificial intelligence and machine learning. The Banking Credit Analysis enable firms to access deep insights into their credit management and identifies any potential risks associated with it. Although dynamic changes in Regulations by various national governments presents a challenge for the growth of the market of banking credit analytics. Geographically, North America is the biggest market although Asia Pacific is steadily rising behind it.

Market Trends:

• Adoption of Artificial Intelligence and Machine Learning by Banks for Credit Analytics

• Emergence of Fintech Companies

Market Drivers:

• Surge in Demand for Credit

• Growth of Banking Industry

Market Opportunities:

• Software Segment is expected to Boom over the coming years

Have a query? enquiry before purchase 👉 https://www.htfmarketintelligence.com/enquiry-before-buy/global-banking-credit-analytics-market?utm_source=Ganesh_OpenPR&utm_id=Ganesh

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Interpretative Tools in the Market: The report integrates the entirely examined and evaluated information of the prominent players and their position in the market by methods for various descriptive tools. The methodical tools including SWOT analysis, Porter's five forces analysis, and investment return examination were used while breaking down the development of the key players performing in the market.

Key Growths in the Market: This section of the report incorporates the essential enhancements of the marker that contains assertions, coordinated efforts, R&D, new item dispatch, joint ventures, and associations of leading participants working in the market.

Key Points in the Market: The key features of this Banking Credit Analytics market report includes production, production rate, revenue, price, cost, market share, capacity, capacity utilization rate, import/export, supply/demand, and gross margin. Key market dynamics plus market segments and sub-segments are covered.

Buy Now Latest Edition of Report 👉 https://www.htfmarketintelligence.com/buy-now?format=3&report=5170?utm_source=Ganesh_OpenPR&utm_id=Ganesh

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Ask for Discount 👉 https://www.htfmarketintelligence.com/request-discount/global-banking-credit-analytics-market?utm_source=Ganesh_OpenPR&utm_id=Ganesh

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, or Southeast Asia.

Contact Us:

Ganesh Zirpe (Senior Web Analyst)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Credit Analytics Market Hits New High | Major Giants FICO, Experian, Equifax, BNP Paribas, Wells Fargo here

News-ID: 3580903 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

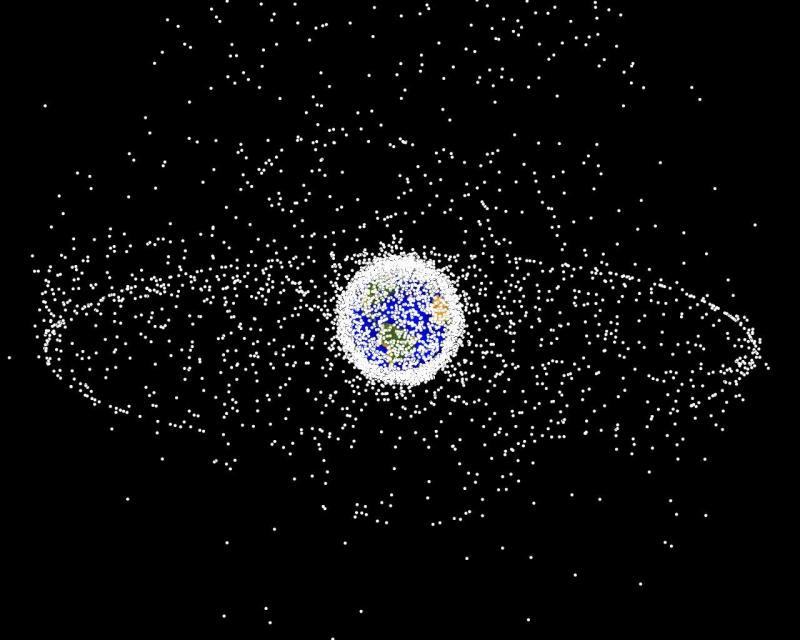

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…