Press release

Global Investment Banking Market Set to Grow $194.05 Billion by 2028 at 8.1% CAGR, Driven by Economic Growth

The new report published by The Business Research Company, titled "Investment Banking Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the investment banking market size has grown strongly in recent years. It will grow from $131.25 billion in 2023 to $142.16 billion in 2024 at a compound annual growth rate (CAGR) of 8.3%. The investment banking market size is expected to see strong growth in the next few years. It will grow to $194.05 billion in 2028 at a compound annual growth rate (CAGR) of 8.1%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=2896&type=smp

Global Economic Growth Boosting Investment Banking Market Growth

The global economic expansion is expected to propel the growth of the investment banking market. Economic expansion refers to a phase in the business cycle characterized by a sustained increase in economic activity, including factors such as rising gross domestic product (GDP), increasing employment rates, higher consumer spending, and improved business confidence. Economic prosperity drives demand for financial services like M&A, fundraising, and advisory work, benefiting investment banks at the core of these transactions. For instance, according to The World Bank, a US-based international financial institution, the world economy is anticipated to see growth of 1.7% in 2023 and a further increase of 2.7% in 2024. Therefore, the global economic expansion is driving the growth of the investment banking market going forward.

Technological Advancement To Better Serve Consumer-Centric Demand

Major companies operating in the investment banking market are introducing technologically advanced AI-driven platforms to meet the increasingly consumer-centric demands and extend their global reach in the market. An AI-driven investment banking platform is a software solution that utilizes artificial intelligence (AI) and machine learning to improve investment banking operations. For instance, in December 2022, Wells Fargo & Company, a US-based financial services company, launched Vantage, a digital banking platform to efficiently cater to its commercial, corporate, and investment banking clients. Portrayed as an all-in-one digital banking solution, Vantage consolidates Wells Fargo's diverse financial offerings into one unified platform. It's crafted to address the growing needs of corporate treasurers and small and medium-sized enterprises (SMEs) by leveraging the capabilities of artificial intelligence (AI) and machine learning (ML), ensuring they align with their consumer-centric demands.

The investment banking market covered in this report is segmented -

1) By Type: Mergers And Acquisitions Advisory, Financial Sponsor/Syndicated Loans, Equity Capital Markets Underwriting, Debt Capital Markets Underwriting

2) By Enterprise Size: Large Enterprises, Medium and Small Enterprises

3) By End-Use Industry: Financial Services, Retail And Wholesale, Information Technology, Manufacturing, Healthcare, Construction, Other End-Use Industries

Subsegments Covered: Mergers Advisory, Acquisitions Advisory, Underwritten Deal, Club Deal, Best-Efforts Syndication Deal

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=2896&type=discount

Major companies operating in the investment banking market report are JPMorgan Chase & Co., Bank of America Corporation, HSBC Holdings plc, Citigroup Inc., Wells Fargo & Company, Morgan Stanley, BNP Paribas SA, Goldman Sachs Group Inc., UBS Group AG, Barclays plc, Deutsche Bank AG, Credit Suisse Group AG, Mizuho Financial Group Inc., Raymond James Financial Inc., Nomura Holdings Inc., Jefferies Financial Group Inc., Stifel Financial Corp., Lazard Ltd., Evercore Inc., RBC Capital Markets, Houlihan Lokey Inc., Cowen Inc., Piper Sandler Companies, William Blair & Company LLC, PJT Partners Inc., Moelis & Company, Perella Weinberg Partners LP, Greenhill & Co. Inc., Centerview Partners LLC, Rothschild & Co.

Contents of the report:

1. Executive Summary

2. Investment Banking Market Report Structure

3. Investment Banking Market Trends And Strategies

4. Investment Banking Market - Macro Economic Scenario

5. Investment Banking Market Size And Growth

…..

27. Investment Banking Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/investment-banking-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Investment Banking Market Set to Grow $194.05 Billion by 2028 at 8.1% CAGR, Driven by Economic Growth here

News-ID: 3579299 • Views: …

More Releases from The Business Research Company

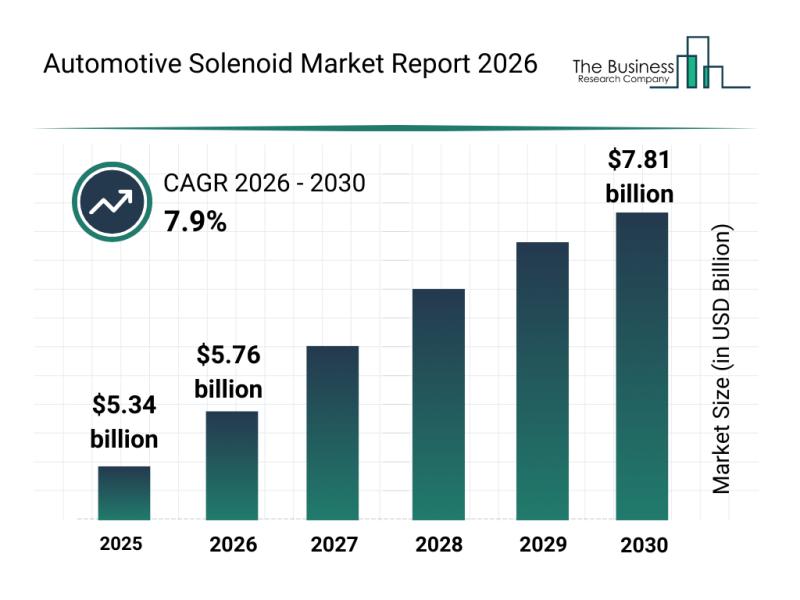

Leading Companies Fueling Growth and Innovation in the Automotive Solenoid Marke …

The automotive solenoid market is on the verge of significant expansion as advancements in technology and vehicle electrification continue to accelerate. Increasing integration of smart systems and the growing demand for efficient, eco-friendly automotive solutions are set to drive this market's development through the end of the decade.

Expected Growth Trajectory for the Automotive Solenoid Market by 2030

The automotive solenoid market is projected to reach a valuation of $7.81 billion…

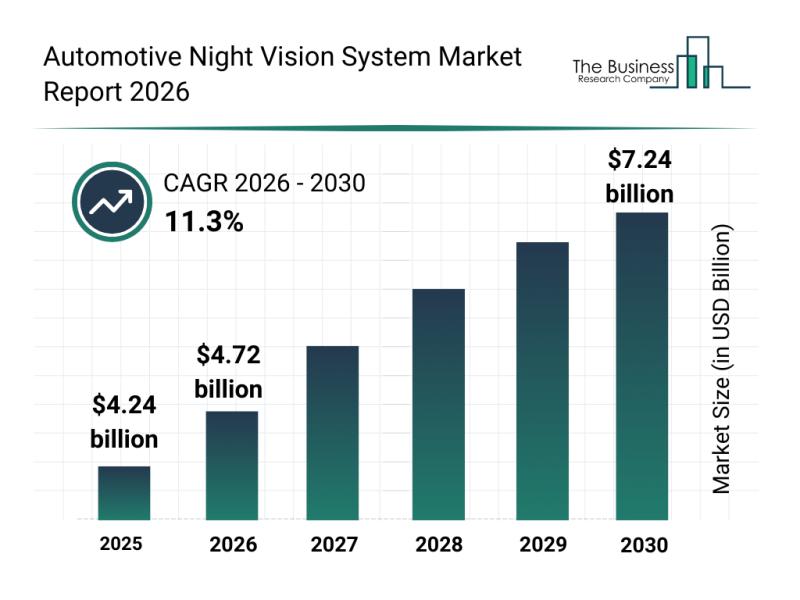

Automotive Night Vision System Market Analysis: Major Segments, Strategic Develo …

The automotive night vision system market is set to experience significant expansion over the coming years, driven by technological advancements and growing safety demands. As vehicle manufacturers continue to integrate more sophisticated safety features, this market shows promising potential for rapid growth and innovation through 2030.

Projected Expansion of the Automotive Night Vision System Market Size Through 2030

The market size for automotive night vision systems is anticipated to reach $7.24…

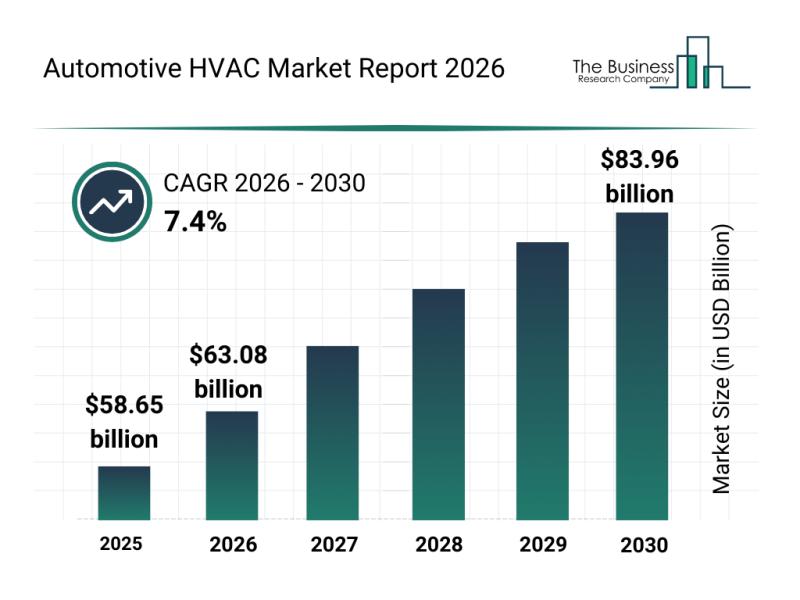

Segment Analysis and Major Growth Areas in the Automotive HVAC Market

The automotive HVAC market is on a trajectory of significant growth as vehicle climate control systems evolve with advanced technologies. Innovations aimed at improving energy efficiency and passenger comfort are driving the sector forward, setting the stage for substantial expansion through 2030. Let's explore the current market size, key players, influential trends, and detailed segment insights shaping this dynamic industry.

Automotive HVAC Market Size and Growth Outlook Through 2030

The automotive…

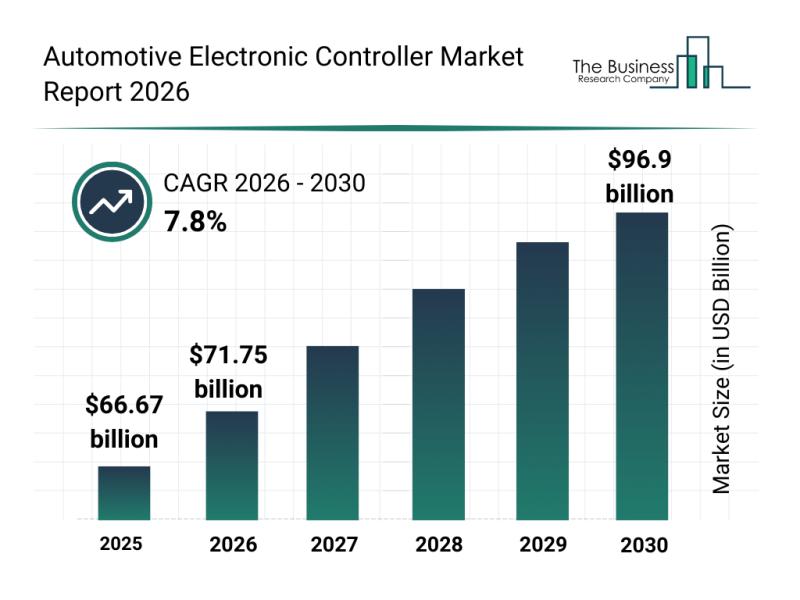

Key Strategic Developments and Emerging Changes Shaping the Automotive Electroni …

The automotive electronic controller market is on track for impressive expansion as technology continues to transform the automotive sector. With the industry embracing smarter and more connected vehicle systems, the demand for advanced controllers that manage and optimize vehicle functions is rapidly increasing. Below, we explore the market's projected growth, key players, notable trends, and the main segments shaping this dynamic field.

Projected Market Size and Growth of the Automotive Electronic…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…