Press release

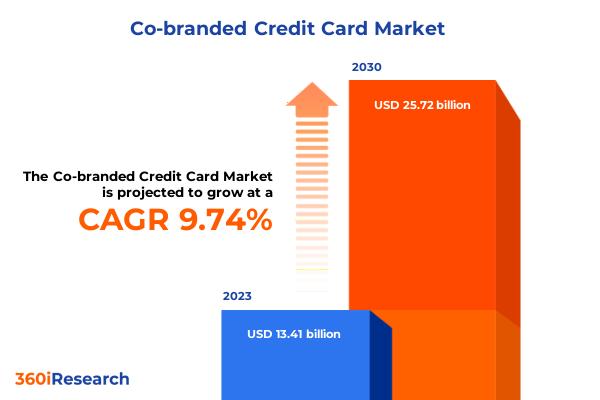

Co-branded Credit Card Market worth $25.72 billion by 2030, growing at a CAGR of 9.74% - Exclusive Report by 360iResearch

The "Co-branded Credit Card Market by Vendor Type (Card Issuer, Card Network, Retailer), Credit Card Type (Physical Credit Cards, Virtual Credit Cards), End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/co-branded-credit-card?utm_source=openpr&utm_medium=referral&utm_campaign=sample

A co-branded credit card, issued through a partnership between a credit card company and a retail or service brand, offers specialized rewards closely aligned with the co-brand's products or services, enhancing customer loyalty and brand recognition. These cards are necessary for fostering better customer engagement, incentivizing frequent purchases, and generating revenue streams for both partners through transaction fees and increased sales. They find application across various sectors, including retail, travel, and services, catering to different end-users such as consumers seeking tailored rewards, businesses aiming to build customer bases, and financial institutions looking to diversify their product portfolios. Key factors influencing market growth include rising consumer expenditure on travel, retail, and services, the integration of digital payment methods, and favorable economic conditions marked by increasing disposable income. Market opportunities exist in the personalization of reward programs through data analytics, the incorporation of artificial intelligence and machine learning for predictive benefits, and partnership expansions across sectors such as healthcare, entertainment, and technology. Limitations and challenges comprise economic downturns reducing consumer spending, stringent regulatory changes affecting profitability, and high competition leading to the dilution of reward program value. Innovation and research areas include blockchain technology for secure reward point transactions, the introduction of eco-friendly rewards, and using behavioral analytics to enhance program relevance and engagement. The market's dynamic and competitive nature necessitates constant innovation and adaptability to consumer preferences and technological advancements, making a strategic approach essential for capturing and sustaining growth.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/co-branded-credit-card?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Co-branded Credit Card Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Vendor Type, market is studied across Card Issuer, Card Network, and Retailer.

Based on Credit Card Type, market is studied across Physical Credit Cards and Virtual Credit Cards.

Based on End-User, market is studied across Education, Gaming, Hospitality, Petroleum, Retail, and Travel.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Georgia, Illinois, Kentucky, Michigan, Mississippi, New Jersey, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Co-branded Credit Card Market, highlighting leading vendors and their innovative profiles. These include American Express Company, AU Small Finance Bank Limited, Axis Bank Limited, Bank of America Corporation, Barclays PLC, BNP Paribas Group, Capital One Financial Corporation, Cardless, Inc., CIMB Group Holdings Berhad, Citigroup Inc., Commercial International Bank (Egypt) S.A.E., Concerto Card Company, CTBC Bank (Philippines) Corp., Despegar.com, Corp., First Abu Dhabi Bank, FPL Technologies Pvt. Ltd., HDFC Bank Limited, ICICI Bank Limited, IDBI Bank Ltd., JPMorgan Chase & Co., Marqeta, Inc., Mastercard International Incorporated, National Payments Corporation of India, Saigon Thuong Tin Commercial Joint Stock Bank, Scotiabank, Shinhan Bank Co., Ltd., Standard Chartered PLC, Synchrony Bank, The Bank of Baroda Ltd., The Goldman Sachs Group, Inc., U.S. Bancorp, Uniorbit Technologies Private Limited, Visa Inc., and Wells Fargo & Company.

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Co-branded Credit Card Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the Co-branded Credit Card Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it's a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Co-branded Credit Card Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/co-branded-credit-card?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Co-branded Credit Card Market, by Vendor Type

7. Co-branded Credit Card Market, by Credit Card Type

8. Co-branded Credit Card Market, by End-User

9. Americas Co-branded Credit Card Market

10. Asia-Pacific Co-branded Credit Card Market

11. Europe, Middle East & Africa Co-branded Credit Card Market

12. Competitive Landscape

13. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/co-branded-credit-card?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Co-branded Credit Card Market worth $25.72 billion by 2030, growing at a CAGR of 9.74% - Exclusive Report by 360iResearch here

News-ID: 3574060 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…