Press release

Connected Cars Insurance Market May See Big Move | Major Giants AXA, Mapfre, General Motors Insurance

The latest research study released by HTF MI on Connected Cars Insurance Market with 123+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, sales, drivers, opportunities, market viewpoint and status. The market Study is segmented by key a region that is accelerating the marketization. Connected Cars Insurance study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources.Key Players in This Report Include:

Allstate Corporation (United States), Progressive Corporation (United States), State Farm Mutual Automobile Insurance Company (United States), General Motors Insurance (United States), AXA SA (France), Liberty Mutual Group (United States), Ping An Insurance Group (China), The Hartford Financial Services Group, Inc. (United States), UnipolSai Assicurazioni S.p.A. (Italy), Zurich Insurance Group Ltd. (Switzerland), Mapfre S.A. (Spain), Metromile (United States)

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.htfmarketintelligence.com/sample-report/global-connected-cars-insurance-market

"According to HTF Market Intelligence, the Connected Cars Insurance market size is estimated to reach by USD 257.2 Billion at a CAGR of 16.2% by 2030. The report includes historic market data from 2019 to 2023. The Current market value is pegged at USD 93.4 Billion."

Definition:

The Connected Cars Insurance market refers to the segment of the insurance industry that offers policies specifically tailored to vehicles equipped with connected car technology. Connected cars are vehicles that are equipped with internet connectivity and various sensors and technologies that enable them to communicate with other devices, networks, and services. In the context of insurance, connected cars provide a wealth of real-time data and insights that insurers can leverage to offer more personalized and usage-based insurance policies. This data includes information about driving behavior, vehicle health, location, and environmental conditions.

Market Trends:

• The adoption of Usage-Based Insurance models, where premiums are determined by driving behaviour and vehicle data collected from connected cars, is on the rise.

• Insurance providers are offering more customized insurance solutions tailored to individual driving habits and risk profiles, enabled by the data collected from connected cars.

• Insurers are forming partnerships with automotive manufacturers, technology companies, and telematics service providers to enhance their connected car insurance offerings and expand their market reach.

Market Drivers:

• Continued advancements in telematics technology and the availability of connected car features drive the growth of the connected car insurance market by enabling more accurate data collection and analysis.

• Increasing consumer demand for personalized insurance solutions and transparent pricing models is a key driver for the adoption of connected car insurance.

• Intense competition among insurance providers and the need to differentiate offerings drive innovation in connected car insurance products and services, leading to market growth and expansion.

Market Opportunities:

• Connected Cars Insurance offers the opportunity for insurers to develop personalized pricing models based on actual driving behavior, potentially leading to increased customer satisfaction and loyalty.

• The wealth of data collected from connected cars provides insurers with valuable insights into driver behavior, risk patterns, and accident trends, which can be used to refine underwriting processes and mitigate risks effectively.

• The growing demand for connected car insurance presents opportunities for insurers to expand their market presence and attract new customer segments, including younger drivers and urban dwellers.

Market Challenges:

• The collection and use of personal driving data raise concerns about data privacy and security. Insurers must address these concerns and ensure compliance with data protection regulations.

• Integrating connected car data into insurance processes and systems can be complex and requires collaboration between insurance companies, automakers, and technology providers.

• Insurance regulations and requirements vary across regions, posing challenges for insurers operating in multiple jurisdictions to ensure compliance with regulatory standards.

Market Restraints:

• The cost of integrating connected car technology and developing the infrastructure to support data analytics and UBI programs can be prohibitive for some insurance companies, particularly smaller firms.

• Despite the benefits of connected car insurance, consumer adoption rates may vary due to factors such as concerns about privacy, resistance to change, and the availability of alternative insurance options.

Major Highlights of the Connected Cars Insurance Market report released by HTF MI

Global Connected Cars Insurance Market Breakdown by Application (Individual Car Owners, Fleet Management Companies, Automotive Rental and Leasing Companies, Others) by Type (Liability Coverage, Comprehensive Coverage, Personal Injury Protection, Others) by Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles, Luxury Vehicles, Others) by Service Provider (Insurance Companies, Automotive Manufacturers, Technology Companies, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Global Connected Cars Insurance market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to help the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Buy Complete Assessment of Connected Cars Insurance market now @ https://www.htfmarketintelligence.com/buy-now?format=3&report=3432

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• To carefully analyse and forecast the size of the Connected Cars Insurance market by value and volume.

• To estimate the market shares of major segments of the Connected Cars Insurance

• To showcase the development of the Connected Cars Insurance market in different parts of the world.

• To analyse and study micro-markets in terms of their contributions to the Connected Cars Insurance market, their prospects, and individual growth trends.

• To offer precise and useful details about factors affecting the growth of the Connected Cars Insurance

• To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Connected Cars Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Have a query? Market an enquiry before purchase @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-connected-cars-insurance-market

Points Covered in Table of Content of Global Connected Cars Insurance Market:

Connected Cars Insurance Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Connected Cars Insurance market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Connected Cars Insurance Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Connected Cars Insurance Market Production by Region Connected Cars Insurance Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

• Key Points Covered in Connected Cars Insurance Market Report:

• Connected Cars Insurance Overview, Definition and Classification Market drivers and barriers

• Connected Cars Insurance Market Competition by Manufacturers

• Connected Cars Insurance Capacity, Production, Revenue (Value) by Region (2024-2030)

• Connected Cars Insurance Supply (Production), Consumption, Export, Import by Region (2024-2030)

• Connected Cars Insurance Production, Revenue (Value), Price Trend by Type {Review Management, Identity Monitoring, Search Engine Suppression, Internet Removal}

• Connected Cars Insurance Market Analysis by Application {SMEs, Large Enterprises}

• Connected Cars Insurance Manufacturers Profiles/Analysis Connected Cars Insurance Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Get Discount (10-15%) on immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-connected-cars-insurance-market

Key questions answered

• How feasible is Connected Cars Insurance market for long-term investment?

• What are influencing factors driving the demand for Connected Cars Insurance near future?

• What is the impact analysis of various factors in the Global Connected Cars Insurance market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, MINT, BRICS, G7, Western / Eastern Europe, or Southeast Asia. Also, we can serve you with customized research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Connected Cars Insurance Market May See Big Move | Major Giants AXA, Mapfre, General Motors Insurance here

News-ID: 3572934 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

International Travel Shopping Industry Market Is Booming Worldwide |, Ever Rich …

HTF MI just released the Global International Travel Shopping Industry Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key players in this industry include Avolta AG (formerly…

Digital City Solutions Market Is Booming Worldwide | Major Giants Hitachi Ltd., …

HTF MI just released the Global Digital City Solutions Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Prominent players in the digital city solutions market include IBM…

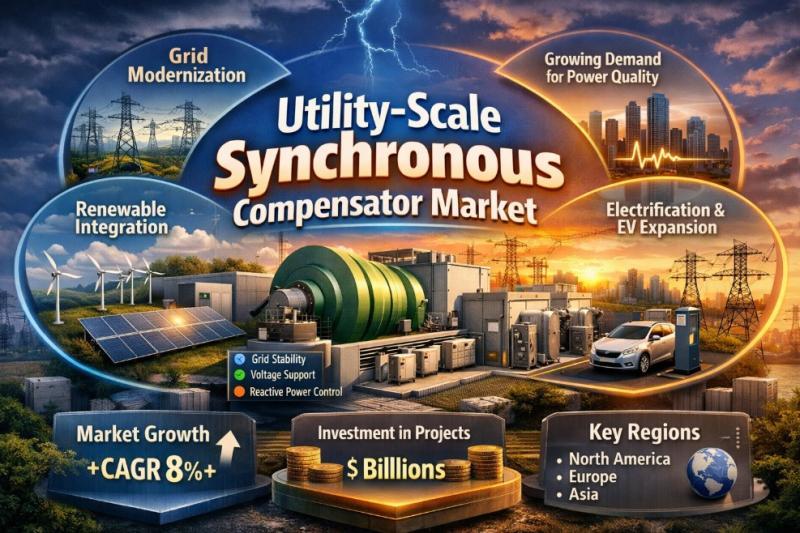

Utility-Scale Synchronous Compensator Market Is Booming Worldwide | Major Giants …

HTF MI just released the Global Utility-Scale Synchronous Compensator Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies operating in this market include Siemens Energy, Hitachi…

Denim Outerwear Market Is Booming Worldwide | Major Giants G-Star RAW, Mavi Jean …

HTF MI just released the Global Denim Outerwear Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key players in the denim outerwear market include Levi Strauss &…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…