Press release

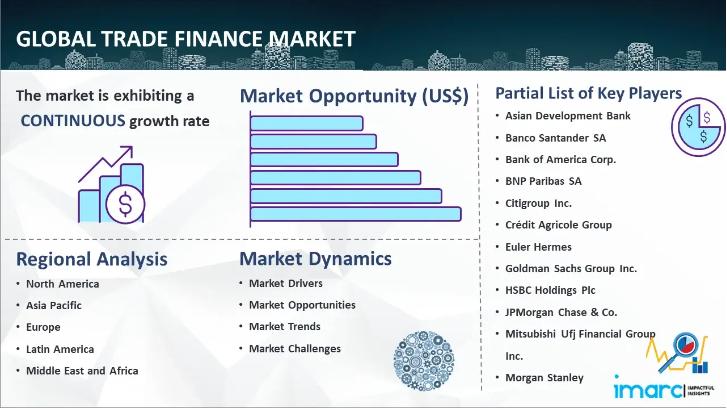

Trade Finance Market Size, Share, Sales Analysis, Growth Factors & Forecast Report 2024-2032

IMARC Group, a leading market research company, has recently released a report titled "Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End-User (Small and Medium Sized Enterprises (SMEs), Large Enterprises), and Region 2024-2032". The study provides a detailed analysis of the industry, including the trade finance market trends, size, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.The global trade finance market size reached US$ 51.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 82.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

Request to Get the Sample Report: https://www.imarcgroup.com/trade-finance-market/requestsample

Factors Affecting the Growth of the Trade Finance Industry:

Globalization of Trade:

As countries become more interconnected through trade agreements and economic partnerships, the volume of international trade continues to grow. Businesses are increasingly engaging in cross-border transactions to tap into new markets and expand their customer base. Trade finance facilitates these transactions by providing the necessary financial instruments, such as letters of credit, guarantees, and trade credit, to ensure that exporters receive payment and importers receive their goods as agreed. This financial support is crucial for businesses to manage the complexities and risks associated with international trade, such as currency fluctuations, different regulatory environments, and potential non-payment by trading partners, aiding the market growth.

Technological Advancements:

Innovations such as blockchain, artificial intelligence (AI), and digital platforms are transforming the way trade finance is conducted. Blockchain technology, for instance, offers enhanced transparency, security, and efficiency by enabling real-time tracking of transactions and reducing the risk of fraud. AI and machine learning (ML) algorithms can analyze vast amounts of data to assess creditworthiness, predict potential risks, and streamline compliance processes. Digital platforms facilitate the automation of trade finance processes, reducing the need for manual intervention and expediting transaction times. These technological advancements improve the efficiency and reliability of trade finance and make it more accessible to small and medium-sized enterprises (SMEs), which often face challenges in obtaining traditional trade finance services, bolstering the market demand.

Increasing Need for Risk Mitigation in International Transactions:

International trade involves numerous risks, including political instability, currency volatility, and the credit risk of trading partners. Trade finance instruments help mitigate these risks by assuring both exporters and importers. For example, letters of credit act as a guarantee that the exporter will receive payment upon fulfilling the terms of the contract, while trade credit insurance protects businesses against the risk of non-payment by buyers. Additionally, supply chain finance solutions enable companies to optimize their working capital and manage cash flow more effectively by allowing them to receive early payment for invoices. As global trade becomes more complex and the potential for disruptions increases, the demand for robust risk mitigation tools in the trade finance market continues to rise, contributing to the market expansion.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Trade Finance Market Report Segmentation:

By Finance Type:

• Structured Trade Finance

• Supply Chain Finance

• Traditional Trade Finance

Supply chain finance dominates the market because it optimizes cash flow and enhances working capital efficiency for businesses involved in global trade.

By Offerings:

• Letters of Credit

• Bill of Lading

• Export Factoring

• Insurance

• Others

Letter of credit represents the majority of shares as it provides crucial payment guarantees, reducing the risk for both importers and exporters in international transactions.

By Service Provider:

• Banks

• Trade Finance Houses

Banks hold the majority of shares due to their extensive resources and global networks, which make them the preferred providers of trade finance services.

By End User:

• Small and Medium Sized Enterprises (SMEs)

• Large Enterprises

Large enterprises dominate the market due to their engagement in extensive cross-border trade and require comprehensive trade finance solutions to manage their complex operations.

Regional Insights:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

North America enjoys the leading position owing to the trade infrastructure and significant international trade volumes.

Global Trade Finance Market Trends:

The expansion of e-commerce and digital trade platforms, which facilitate cross-border transactions for businesses of all sizes, is strengthening the market growth. Concurrently, increasing regulatory support and government initiatives aimed at boosting international trade are supporting the market expansion. Besides this, the increasing diversification of global supply chains, which necessitates more complex financing solutions, is creating a positive outlook for market reach. Furthermore, the rise of emerging markets as significant trade players enhances the demand for tailored trade finance products to support new and evolving trading relationships, impelling the market growth.

Top Companies Operated in Trade Finance Industry:

• Asian Development Bank

• Banco Santander SA

• Bank of America Corp.

• BNP Paribas SA

• Citigroup Inc.

• Crédit Agricole Group

• Euler Hermes

• Goldman Sachs Group Inc.

• HSBC Holdings Plc

• JPMorgan Chase & Co.

• Mitsubishi Ufj Financial Group Inc.

• Morgan Stanley

• Royal Bank of Scotland

• Standard Chartered Bank

• Wells Fargo & Co.

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Size, Share, Sales Analysis, Growth Factors & Forecast Report 2024-2032 here

News-ID: 3570012 • Views: …

More Releases from IMARC Group

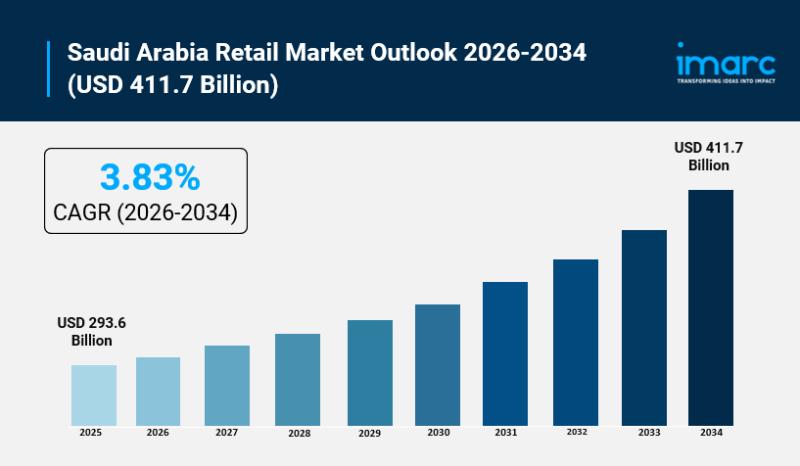

Saudi Arabia Retail Market Size to Surge to USD 411.7 Billion by 2034 | CAGR of …

Saudi Arabia Retail Market Overview

Market Size in 2025: USD 293.6 Billion

Market Size in 2034: USD 411.7 Billion

Market Growth Rate 2026-2034: 3.83%

According to IMARC Group's latest research publication, "Saudi Arabia Retail Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by 2034, exhibiting a…

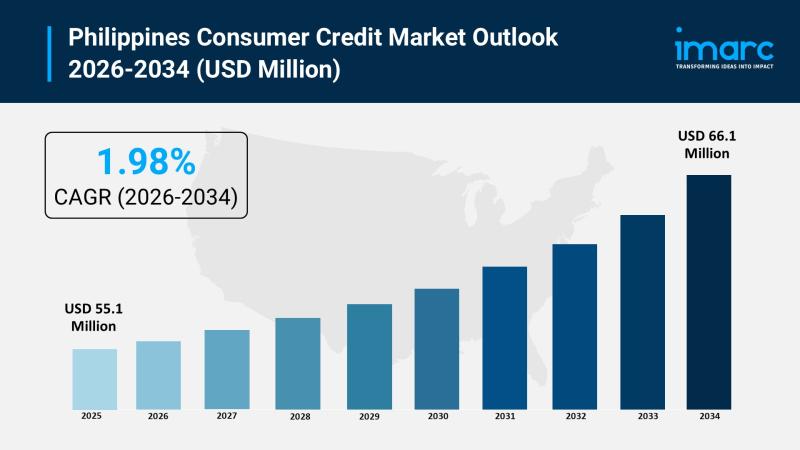

Philippines Consumer Credit Market 2026 | Worth USD 66.1 Million by 2034

Philippines Consumer Credit Market Overview:

The Philippines consumer credit market size reached USD 55.1 Million in 2025. The market is projected to reach USD 66.1 Million by 2034, exhibiting a growth rate (CAGR) of 1.98% during 2026-2034. The market is expanding steadily as rising financial inclusion, mobile-first lending platforms, and Buy Now Pay Later adoption bring formal credit to previously underserved Filipinos. Fintech innovation, neobank growth, and supportive BSP regulatory frameworks…

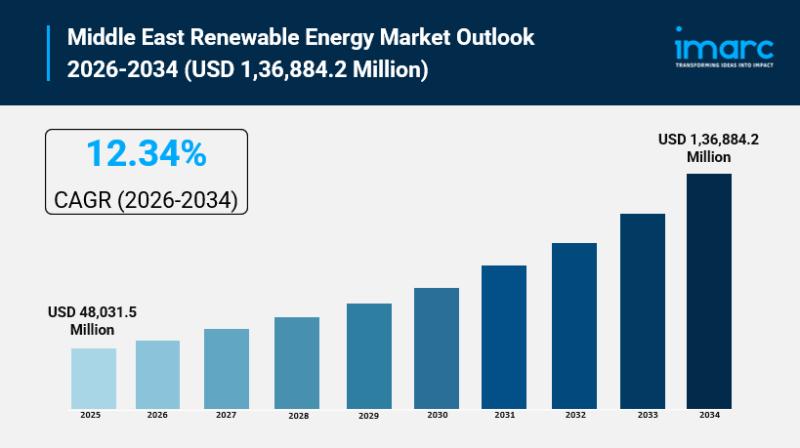

Middle East Renewable Energy Market Size to Hit USD 1,36,884.2 Million by 2034 | …

Middle East Renewable Energy Market Overview

Market Size in 2025: USD 48,031.5 Million

Market Size in 2034: USD 1,36,884.2 Million

Market Growth Rate 2026-2034: 12.34%

According to IMARC Group's latest research publication, "Middle East Renewable Energy Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East renewable energy market size was valued at USD 48,031.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,36,884.2 Million by…

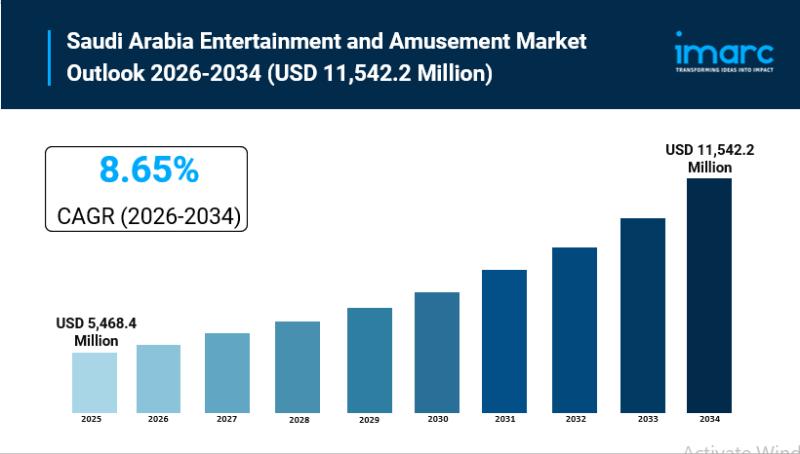

Saudi Arabia Entertainment and Amusement Market Size to Reach USD 11,542.2 Milli …

Saudi Arabia Entertainment and Amusement Market Overview

Market Size in 2025: USD 5,468.4 Million

Market Size in 2034: USD 11,542.2 Million

Market Growth Rate 2026-2034: 8.65%

According to IMARC Group's latest research publication, "Saudi Arabia Entertainment and Amusement Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Saudi Arabia entertainment and amusement market size reached USD 5,468.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,542.2 Million…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…